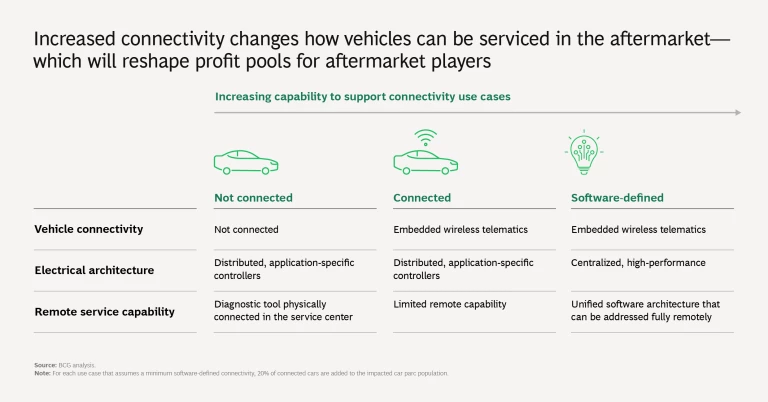

The automotive industry is rapidly accelerating to a future of software-defined vehicles, which include advanced connectivity and high-performance computing. This shift is generating tremendous excitement over the new technologies and innovative features that are transforming the ownership experience. Among other things, software in these vehicles will enable remote diagnostics, with repairs and maintenance coordinated in advance or taking place remotely, completely outside the shop.

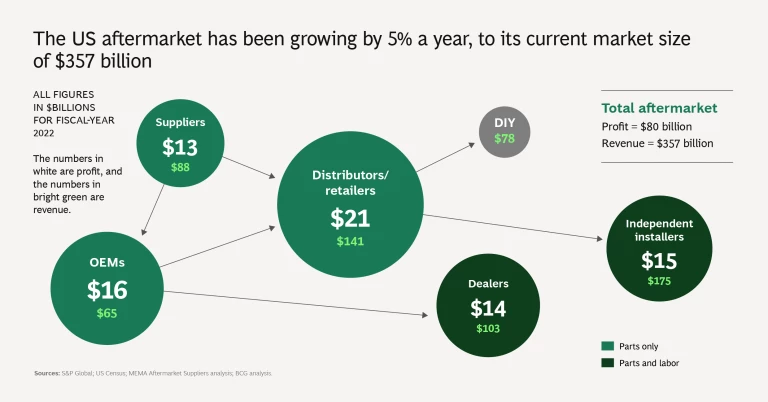

But as these vehicles of the future gradually take over the roads, will they be a boon or a burden for the vast aftermarket industry—worth $357 billion in the US alone in 2022? And how should all players in the value chain that supports software-defined cars prepare?

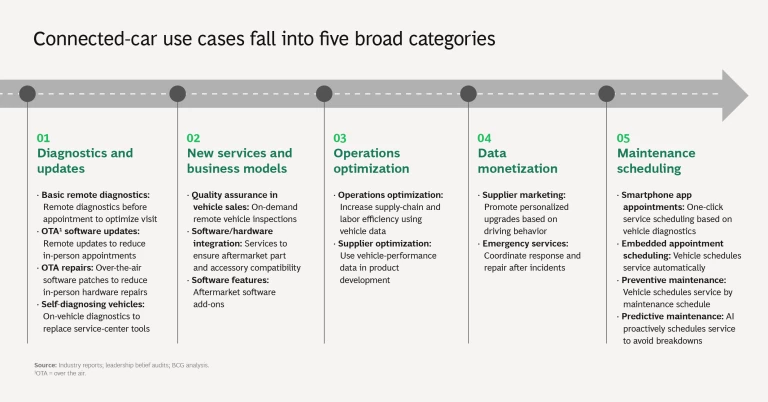

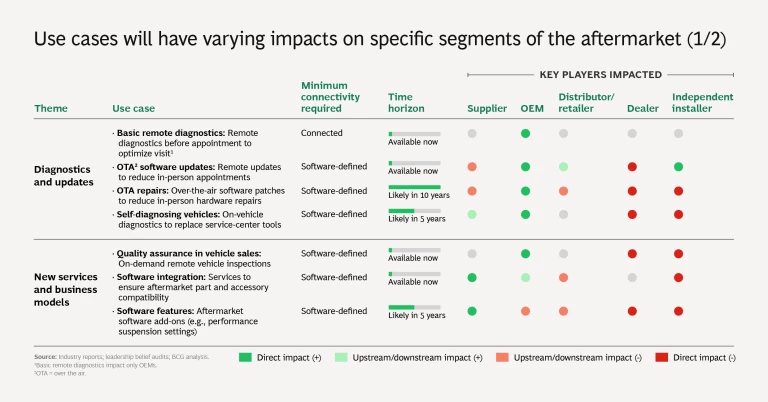

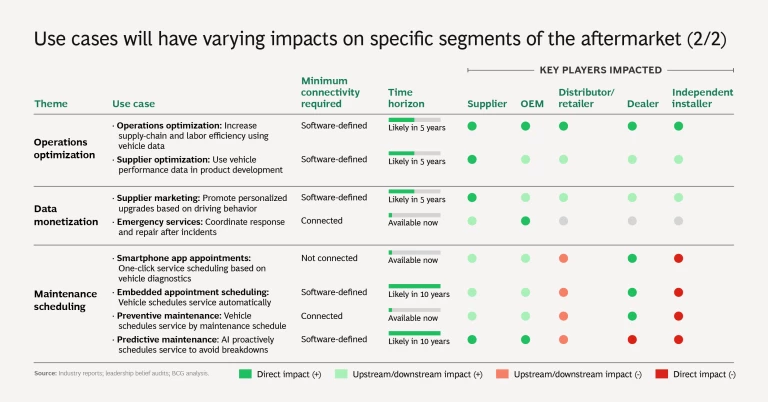

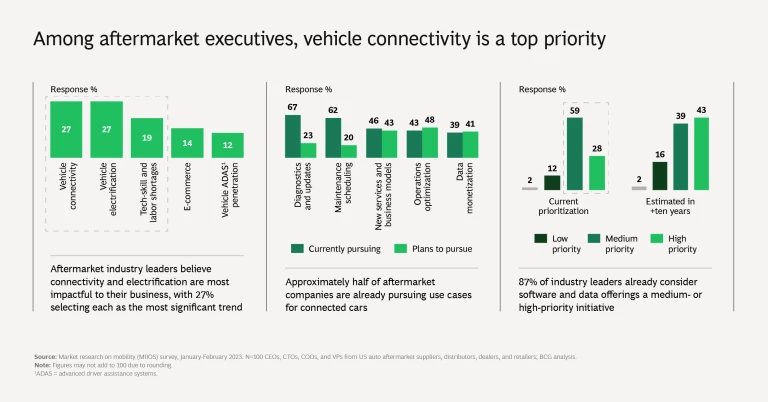

For answers, BCG collaborated with the MEMA Aftermarket Suppliers to study the implications of software-defined cars on the major segments of the US automotive aftermarket—parts suppliers, original equipment manufacturers (OEMs), distributors and retailers, independent installers, and dealerships. For each, we assessed five categories of opportunities: diagnostics and updates, new services and business models, operations optimization, data monetization, and maintenance scheduling. With a rigorous and thoughtful approach to building the new capabilities required to tackle these use cases, aftermarket players have a once-in-a-generation opportunity to capture these profit pools. An overview of our findings is included in this slideshow:

Challenges and Opportunities for Aftermarket Players

Here are some key findings from the study:

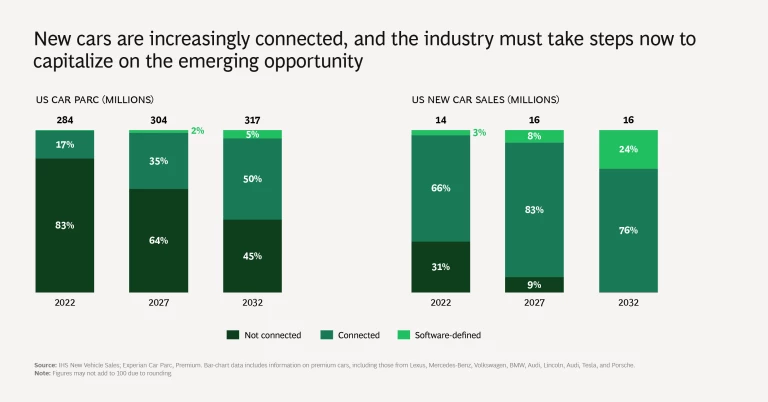

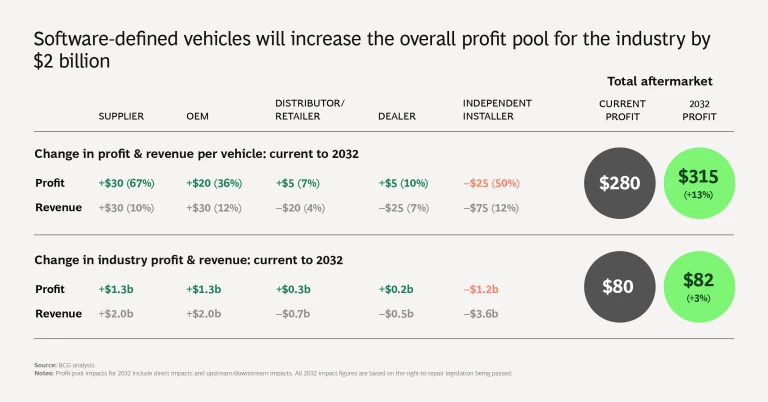

- The shift toward software-defined vehicles will moderately decrease aftermarket revenue but increase the profit pool. The average amount that US owners spend maintaining or improving their vehicles will drop by around 8%, to $1,150, in 2032, largely because electric vehicles will become more common and have fewer moving parts to fix or replace. But because such services and solutions as advanced driver assistance and in-vehicle infotainment will generate high margins, profit per vehicle is projected to grow by around 13% over that period, to $315 annually. In the aggregate, aftermarket revenue will dip slightly by 2030, but the total profit pool for the industry will increase by approximately $2 billion.

- As much as $4 billion in profit shifts along the value chain will be up for grabs by 2032. But the growth opportunities won’t be evenly distributed across the aftermarket value chain. Automotive OEMs and their suppliers will be best positioned to capture value because connectivity will give them greater direct access to customers—especially if regulators fail to enact “right to repair” laws that open systems to outside app developers and service providers. Brick-and-mortar dealerships face the most risk of lost business.

- There will be even greater shifts within profit pools as leading players realize value from emerging use cases, and erode the share of players that focus only on established aftermarket offerings.

- Although it will still be around a decade before connected cars comprise half of light vehicles on US roads, aftermarket providers must rev up now. The technical capabilities and infrastructure needed to compete will take an average of eight or more years to build.

Keys to Success in the Aftermarket of the Future

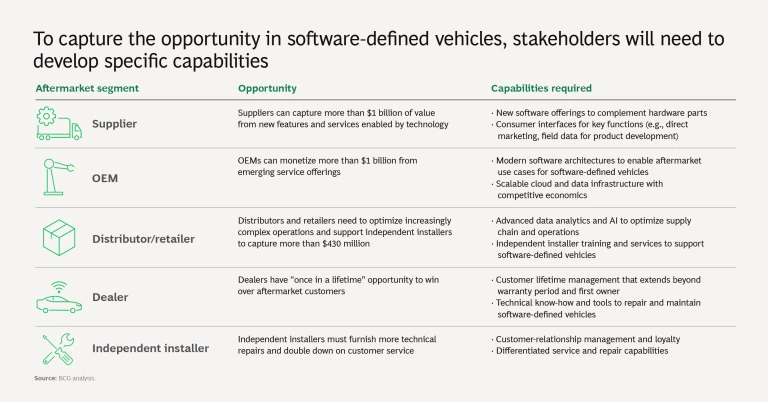

The evolving automotive aftermarket offers major opportunities for companies in each segment of the value chain. But there will be one overarching requirement for all players: they must improve their customers’ experience by reducing the frequency of agonizing, time-wasting visits to repair centers. This will mean shifting to a model of seamless, remote service. Capturing the opportunities and emerging as a winner require the following capabilities:

Suppliers can capture more than $1 billion in value from new features and services enabled by technology. They should develop solutions that complement physical components and interfaces, helping customers easily navigate key functions (for example, direct marketing, and field data for product development).

OEMs can also monetize more than $1 billion from emerging service offerings. To do so, they will need to develop modern software architectures and scalable cloud and data infrastructure, along with agile product-development methods that enable them to launch and improve digital offerings quickly.

Distributors and retailers will have opportunities to compete on leveraging data from vehicles to optimize their operations to capture more than $430 million in value. They will need to accommodate more complex operations through advanced data analytics and artificial intelligence capabilities. Additionally, they are well positioned to provide installers and technicians with the knowledge and expertise needed to service software-defined vehicles.

Dealers have a golden opportunity to win the loyalty of aftermarket customers—if they seize the initiative. Since newly introduced software-defined vehicles under warranty will likely go to dealers for service first, dealers can extend their customer relationships beyond warranty periods and the first owners if they capitalize on the opportunity to provide an outstanding customer experience.

Independent installers have opportunities to furnish more technical repairs and compete on better customer service. They must be able to differentiate themselves based on service and advanced repair capabilities as the car parc mix shifts to software-defined vehicles.

Stay ahead with BCG insights on the automotive industry

Although software-defined vehicles will only gradually become common sights on US roads, the technological trends and development paths of leading OEMs are set—and adoption by consumers is accelerating rapidly. Aftermarket providers must begin the transition to the software-defined future now.