This content was developed in collaboration with Oxford Global Projects.

The green transformation of the energy sector is catalyzing the creation of a multitrillion-dollar investment pool. Investors are targeting the development of major capital projects, particularly in renewables and associated technologies. A standout among the technologies is power-to-X (PtX), which converts renewable electricity into hydrogen, ammonia, or other molecules as well as sustainable aviation fuel. Integrated PtX solutions could replace many of the carbon-intensive chemicals and liquid fuels used today.

To capture the emerging PtX opportunities, developers will need to overcome challenges posed by complex interdependencies, nascent technologies, new regulations, and uncertain market conditions. The challenges are evident in the schedule estimates for PtX projects, which range from seven to nine years from initial feasibility studies to beneficial operations. These protracted timelines increase the financial and scheduling risks, creating greater uncertainty in the market.

Leveraging BCG’s experience supporting dozens of PtX projects globally and data from Oxford Global Projects, we have developed a new approach for these large capital projects. Encompassing five strategies, our approach will help accelerate completion time for PtX projects while increasing their value. Mastering this innovative approach requires radical changes in project capabilities and governance—but companies that succeed will gain a significant competitive edge, potentially becoming major players in this emerging sector.

Strong Momentum, but Significant Challenges

The PtX sector is experiencing strong momentum, driven by climate policies and net zero ambitions as well as profitability improvements stemming from continuous technological advancements. The sector’s growth is also supported by green stimulus packages, such as the NextGen EU plan in Europe and the Infrastructure and Investment Jobs Act in the US. As the sector matures, companies will be able to explore synergies and hedging opportunities across power generation and molecule production.

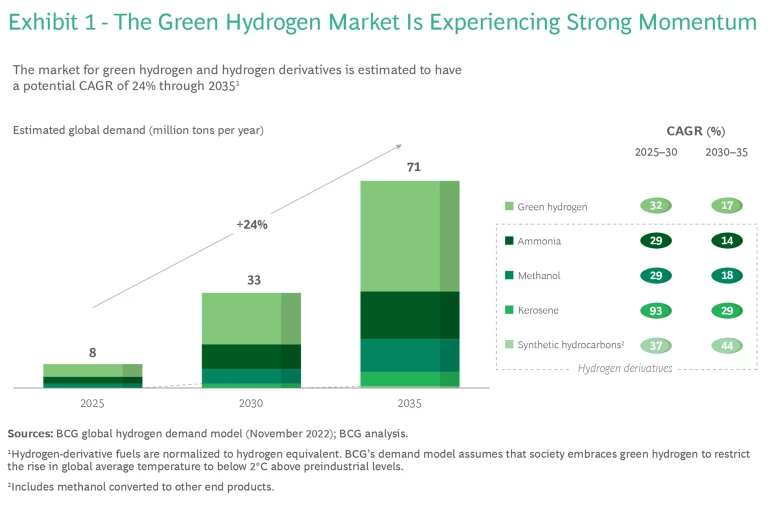

These tailwinds are promoting significant growth. A BCG analysis estimates a potential CAGR of 24% for the green hydrogen and hydrogen derivatives market, for example. This projection assumes that society embraces green hydrogen as part of its effort to restrict the rise in global average temperature to below 2°C above preindustrial levels. (See Exhibit 1.)

Historically, even in mature industries, large capital projects have been plagued by cost overruns, schedule delays, and deviations from expected benefits. On average, the cost overruns across asset classes surpass 50%. Energy projects often experience cost overruns of more than 100%, but with wide variances: oil and gas projects can experience up to 120% in cost overruns, while new nuclear power projects might witness up to a staggering 400% in overruns. Conversely, renewable energy projects tend to be on the more favorable end of the spectrum—average cost overruns for wind and solar projects are 54% and 30%,

In terms of schedule, the average delay across energy projects exceeds 30%. Projects in oil and gas and nuclear tend to underperform, with delays of 57% and 65%, respectively. In contrast, renewable projects perform better, with solar projects being almost always delivered on time.

The challenges confronting large capital projects can be broadly categorized into three primary complexities: structural, sociopolitical, and

Three Types of Complexity

- Structural. Internal project complexity arising from the intrinsic characteristics of the project and/or industry—for example, the number of KPIs, lack of clarity on scope, the existing knowledge to execute the project, novel and complex supply chains, and increased number of uncertain interdependencies.

- Sociopolitical. The complexity associated with the project’s environment and management of internal and external stakeholders—for example, project sponsorship, relations with regulators, licensing, permitting, reliance on subsidies, or a weak policy environment.

- Emergent. The industry’s maturity level and the associated uncertainty about the expected evolution of key market dynamics—for example, volumes, prices, technology, and competitive landscape in an emerging sector.

Structurally, most PtX projects announced in the past few years are the first to use the required technologies at an industrial scale. It is not a surprise, then, that some of these technologies, such as electrolyzers used for green hydrogen production, have a cost-overrun potential exceeding 500%, according to reference-class forecasts. This represents a significant increase from the more established energy sectors. Moreover, with supply chains under pressure, critical equipment is currently difficult to source. The Hydrogen Council anticipates a 40-gigawatt cumulative deficit in electrolyzers’ manufacturing capacity over the next three to five years, indicating that schedule overruns are likely for all but the first movers in the PtX space.

Sociopolitically, complex decision making holds back PtX projects. From an internal perspective, the projects do not fit well into the standard investment frameworks. Weighted average cost of capital rates do not align with benchmarks because projects span the utility and chemicals industries; the finance arrangements are more complex; and the risks are poorly understood by decision makers. From an external perspective, the situation is even more complex, owing to the lengthy processes required for permitting and environmental approvals as well as local communities and other stakeholders not fully understanding the project’s implications.

Finally, projects are complicated by the nuances typical of an emerging industry. The development of the commercial landscape for green molecules is still uncertain. The ambiguity stems from the absence of historical references, high uncertainty regarding future market prices, and a lack of established contract terms in the industry. Given the importance of these projects to the energy transition, governments are trying to develop regulatory frameworks and incentives to stimulate the industry. However, these frameworks and incentives are continuously shifting in the ongoing development process, further increasing uncertainty. Competing technologies also complicate the landscape and stall decision making as investors try to ensure that they do not back the wrong segment.

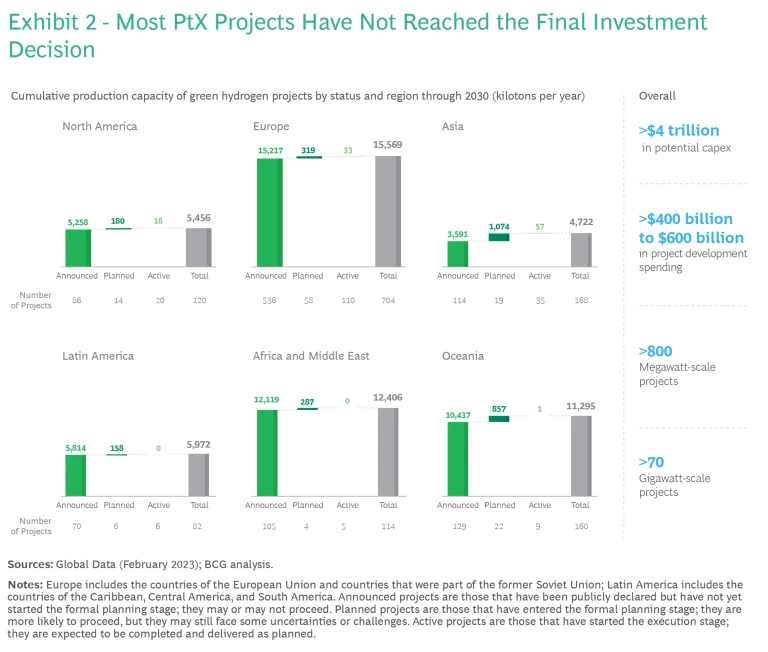

We have seen the impact of these complexities, as numerous projects stall even before reaching the final investment decision (FID). (See Exhibit 2.) Client discussions and industry roundtables point to funding delays, lengthy permitting processes, and the absence of off-take commitments as key obstacles to advancing projects through the FID. In such situations, cost estimates start to surge and the initial timelines become difficult to meet, jeopardizing the collective goal of a low-carbon future.

Society can ill afford the risks associated with protracted timelines for implementing low-carbon technologies. These delays might culminate in a logjam of new capacity that does not enter the market until after 2030, stalling the development of critical technology and pushing back the arrival of the hydrogen economy by several decades. Clearly, companies that learn how to expedite their projects will secure a considerable advantage. There is an additional benefit: ecosystems develop around the first projects to reach the market, fostering a sustained advantage.

This situation poses a fundamental question for industry participants: How do players successfully navigate these projects without putting billions of dollars at risk?

A New Approach in Five Dimensions

Our new paradigm for large-capital PtX projects addresses the underlying drivers of poor performance to help companies dramatically streamline project development, reduce time-to-market, and significantly increase project value. This innovative approach ensures that the design solution is not only more robust but also empowers the project team to respond to changes quickly and effectively.

1. Reimagine decision-making processes and use new reference metrics. The standard stage-gate process for project development works well for established markets and technologies. For innovative projects such as PtX, however, such processes are too linear and siloed, while the metrics neither support the required analyses nor enable effective decision making.

Standard processes also do not support test-and-trial approaches. As a result, teams often develop a hypothesis for the solution under consideration (for example, the project configuration) and refine it based on standard requirements, only to discover that the solution is not viable. Instead, teams should rapidly generate multiple competing ideas (such as for the plant’s storage and operating concepts), test them quickly by leveraging advanced analytics tools and generative AI, and then integrate the insights and iterate. This process can become even more efficient if the supply chain is engaged early—something easier said than done given the cumbersome procurement processes in most companies.

In addition, companies need to change the metrics they use for decision making in stage-gate processes. Metrics such as levelized cost of energy (LCOE) or levelized cost of ammonia (LCOA) are more straightforward and insightful during front-end development than the internal rate of return (IRR) or hurdle rates. Indeed, LCOx metrics allow project teams to estimate at the prefeasibility stage whether a project will be viable and globally competitive. They can also be used in benchmarking efforts to identify levers for project optimization.

Companies need to change the metrics they use for decision making in stage-gate processes.

Organizations need to agree on the methodology and assumptions for calculating LCOx in order to ensure that the metric is comparable to other benchmarks. For example, they must agree on how to account for the intermittency of energy production, whether to use standard definitions (such as those established by the UK’s Department for Business, Energy & Industrial Strategy), and whether to make estimates in nominal or real terms.

Beyond LCOx, metrics such as the expected value of perfect information (EVPI) provide deeper insights than classic sensitivity analyses. Moreover, quantitative and probabilistic risk models are far better than standard risk matrices. Indeed, risk matrices offer little value when the key risks are poorly understood, and teams are prone to an availability bias. At worst, risk matrices can divert an organization’s focus to incorrect risks, resulting in delays, heightened risks, and missed opportunities.

A frequently observed pain point is preparing the documentation required to pass through a stage gate. Project managers should view the issues from the gatekeeper’s perspective. By solely addressing the gatekeeper’s most pressing questions, managers can significantly streamline the required deliverables. In short, the objective should shift from seeking certainty to determining where diminished uncertainty is sufficient for advancing to subsequent phases. (See “Rethinking Stage-Gate Processes.”)

Rethinking Stage-Gate Processes

Consider cost estimates. Many teams excel at creating detailed cost projections in the initial stages. The stage process might require a Class 5 estimate, which means it could be as much as 50% below or 100% above the actual costs. Although teams often strive for greater precision in the estimate, they neglect developing other options or fail to fully understand the range of uncertainty. Consequently, they might prove that a solution is prohibitively expensive rather than identifying viable alternatives. They also might assume that their cost estimate is fairly precise while overlooking the risk that the actual costs could be twice as high.

“

Once uncertainty is sufficiently reduced, the developer can decide whether the project should be implemented.

In nascent industries, such as PtX, this is especially relevant. In contrast to oil and gas projects, where options are well-defined with limited alternatives (for example, the cost of a subsea tie-back), PtX teams grapple with a vast array of choices. This includes decisions about project size, technology selection, grid connectivity, product off-takes, optimal timelines, and engagement with the broader ecosystem, to name a few.

A similar concern arises with metrics. For instance, a finance team might ask if a project achieves a specific IRR or meets a hurdle rate. However, the uncertainty surrounding PtX projects transforms IRR into a probability distribution, prompting the question: Which IRR—the median, mode, or average? In addition, a company needs to decide which metrics will ultimately guide its decision to proceed. A more useful metric might be the economic value of perfect information, which assesses the value of gaining further insights about the project.

Once uncertainty is sufficiently reduced, the developer can decide whether the project should either be stopped or implemented. Even if the average IRR falls short of company benchmarks, proceeding might still be justifiable if high uncertainty is offset by the substantial strategic advantage of early market entry—a scenario that is almost always the case in PtX projects.

2. Develop new skills for high-performance teams and organizations. Companies aiming to develop PtX projects need a new approach to structuring project teams, as well as new work models that promote creativity and speed. PtX requires specific, dynamic capabilities to enable rapid and effective responses to unexpected events and to handle the complexity associated with such projects. These include capabilities to quickly test-and-trial ideas, balance innovative thinking and decisive action, and develop specific solutions.

To gain these capabilities, companies must not only build competencies but also establish a new organizational context to drive the right behaviors within project teams. They must find individuals who possess strong capabilities across the different areas of expertise needed for a PtX project (for example, renewables and process plants) and can perform well amid high levels of ambiguity and uncertainty. Only a handful of companies currently have people with the required capabilities in their organization. The others are increasingly concerned about finding the necessary talent. In many cases, they will need to reskill their onsite workers.

Here are three actions that can promote high performance:

- Seek both technical expertise and soft skills. Too often, we see companies default to their existing teams instead of actively reskilling their workforce and seeking more suitable talent. Possessing the right skills, capabilities, knowledge, and experience to handle the uncertainty and ambiguity of PtX projects may require external hiring. For example, developers need technical expertise in electrolysis, ammonia, or downstream solutions as well as in real estate development and project management systems. Moreover, given the unique demands of PtX projects, hiring decisions should consider not only technical capabilities but also innate problem-solving abilities and other soft skills.

- Build a cohesive team, not a collection of star players. It is unlikely that every individual, including those in leadership roles, embodies all the essential traits needed to create a well-rounded team. Companies need to consider whether the project sponsor, senior leadership, and operational team possess the capabilities needed to navigate a project’s uncertainties. (Assembling an Olympic national team provides a fitting analogy: A country aiming for the top spot on the Olympic medal chart cannot rely solely on a few exceptional athletes, regardless of their individual medal hauls. To surpass competitors, an Olympic delegation requires a varied assortment of teams spanning different sports and a diverse array of athletes within each sport.) Once a cohesive team is in place, leaders must ensure that members focus on developing optimal solutions rather than getting bogged down by a misguided emphasis on precision.

- Assess how well your processes encourage innovation. Rigid adherence to outdated processes and benchmarks is a near-certain recipe for failure. A recent BCG survey on the performance of large capital projects found that strict adherence to benchmarks was the variable most strongly correlated with subpar project outcomes. We often see companies strictly adhering to processes that, while ensuring compliance with internal policies, yield suboptimal solutions. A laser focus on compliance does not equate to excellence or innovation. Although a current process might suffice in proven scenarios, it could be a surefire path to failure in an environment of heightened uncertainty. Outdated processes KPIs or improperly designed organizational structures can foster detrimental behaviors, culminating in poor performance. To ensure innovation, companies need to structurally embed the practice. For example, one client scheduled brainstorming sessions to allow teams to focus on innovative thinking and then rapidly specify a set of ideas to be refined further. The additional solutions promoted an approximate 20% reduction in the effective LCOA for a PtX plant.

3. Utilize probabilistic models and AI-driven optimization. Although standard deterministic models are valuable for building a basic understanding of what promotes project success, they fall short in areas with high uncertainty. Project teams that focus on specific numbers when making estimates or setting targets often spend more time debating assumptions than discerning potential outcomes. The precise development trajectory of PtX markets or technologies is neither clear-cut nor reducible to a handful of discrete scenarios. Even so, very few companies use probabilistic modeling for decision making. Most continue to rely on simplistic risk models, which are effective only in well-understood circumstances.

For example, PtX projects face considerable uncertainty relating to the electrolyzer’s performance and cost and the final product's price. Instead of speculating on a single scenario for performance, cost, and price, developers can model these factors using probabilistic distributions, allowing the mathematics to produce unbiased outputs.

To evaluate the scenarios they use, companies can consider the following question: Are the scenarios merely a set of assumptions and discrete points, or do they form an integrated model that accounts for a broad spectrum of uncertainty and interdependencies?

Rapid advances in analytic techniques and AI have vastly simplified the development of the required estimation models and enhanced their capabilities, allowing companies to execute a significantly higher number of simulations in less time. Such models markedly improve the project team's capacity to evaluate and navigate risks associated with internal economic drivers, external economic incentives, market trends, and schedules.

Probabilistic models markedly improve the ability to evaluate risks associated with internal economic drivers, external economic incentives, market trends, and schedules.

By implementing such models, companies can turn uncertainty and risk to their advantage. In addition, jointly optimizing technical and economic variables can reduce capex while enhancing value through better allocation of expenditures and a proper tradeoff between mitigating risks and maximizing returns.

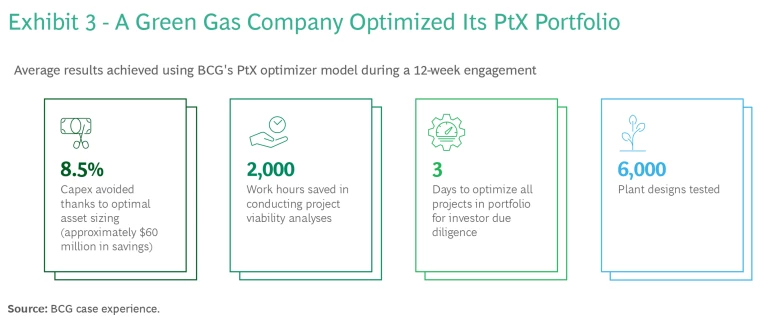

An AI-based optimizer toolkit can support making economic tradeoffs across the value chain, with the potential to enhance project value significantly. A green gas company recently applied BCG’s PtX optimizer model to improve net present value by 25%. It achieved this impact through more intelligent sizing of each plant asset, an evaluation of optimal investment phasing based on different future scenarios, and a more accurate prediction of intermittent operations. (See Exhibit 3.)

4. Adopt new contracting mechanisms. The engineering, procurement, construction, and management models prevalent in today's market are inadequate for PtX projects. They lack the necessary flexibility to manage the inherent complexity and uncertainty of these emerging megaprojects. This inadequacy is exacerbated by the concentration of the market and the inability of contractors to bear the risks of PtX projects on their balance sheets. This is especially true given not only the scale of PtX projects but also the broader surge in large capital projects.

To solve these challenges, project owners and developers will need to adopt new engagement models with suppliers and contractors along the value chain. This entails cultivating long-term relationships and instituting risk-reward mechanisms that incentivize all participating parties to adopt behaviors that promote the project’s success.

Other industries have shown that “alliance contracting” can be an effective mechanism to foster collaboration among contractors and accommodate the unforeseen scheduling changes commonly required in PtX projects.

In the late 1990s, Project Andrew in the North Sea pioneered the use of alliance contracting to maximize productivity and minimize costs in the development of a new oil field. The alliance established contractual arrangements that eliminated role redundancy, streamlined communications, aligned incentives via a risk- and gain-sharing mechanism, and adopted a life-cycle design approach. This also facilitated the adoption of new technologies. As a result, the project was delivered seven months ahead of schedule and achieved savings of more than 20% compared to the initially estimated capex at the FID stage.

Alliance contracting can be an effective mechanism to foster collaboration and accommodate the unforeseen scheduling changes commonly required in PtX projects.

Alliance contracting could be particularly effective for developing the project packages on the critical path to PtX—from the integration of new technologies and processes to the scaling of new technologies not yet validated at an industrial scale.

To use alliance contracting, companies need to expand their capabilities. They can no longer solely depend on open tenders to determine the best price or solicit optimal designs. Instead, they increasingly need to gain insights into the expected costs (“should cost”) and anticipated timelines (“should schedule”) to engage in constructive discussions and effectively select alliance partners.

5. Partner with green finance to de-risk early-stage investments. Ensuring the availability of funds throughout the project’s lifespan is crucial for accelerating progress. The initial phases of a PtX project are characterized by limited visibility on key assumptions, leading to risk profiles that traditional commercial banks might find unattractive. This necessitates seeking alternative financing sources, such as development finance institutions and dedicated green funds, in some instances even as codevelopers.

In addition, engaging early on with green funders can even be beneficial for projects that possess sufficient internal resources to cover the prefeasibility or feasibility stages. Indeed, onboarding funders at the outset is critical to mitigate risks in later phases. Acquiring funding could be a time-consuming process, so starting early ensures that the funds will be available when needed.

PtX projects have a pivotal role in the energy transition. To bring these projects to fruition, companies must deploy innovative strategies. By reducing projects’ costs and timelines, the synergistic deployment of the five levers outlined above will not only significantly enhance returns for project developers but also support the much-needed acceleration of the energy transition.