The field of climate finance has come a long way in recent years, but questions remain about the market for investment in climate mitigation, adaptation, and resilience—even as demand for capital continues to grow.

To find out about the state of the market today, BCG and The Rockefeller Foundation surveyed more than 100 climate finance leaders. These included representatives of private equity, venture capital, multibillion-dollar asset owners, banks, philanthropic organizations, multilateral development banks (MDBs), development finance institutions, and government bodies. To deepen our insights, we also conducted extensive one-on-one interviews with additional practitioners. (See “About Our Research.”)

About Our Research

A total of 132 individuals responded to the survey. They included 47 fund managers (from pre-seed to later-stage private equity and other types of fund managers), 16 asset managers, 7 asset owners, 11 banks, 5 corporate investment teams, 13 multilateral development banks and development finance institutions, 14 philanthropies and foundations, 6 government entities, and 13 others who sat across these categories. Of this group, 55% were resident in North America, 20% in Europe and 12% in Asia, but their investment activities were well distributed across geographies. We conducted interviews with a number of respondents to supplement the survey results and gather additional detail and insight.

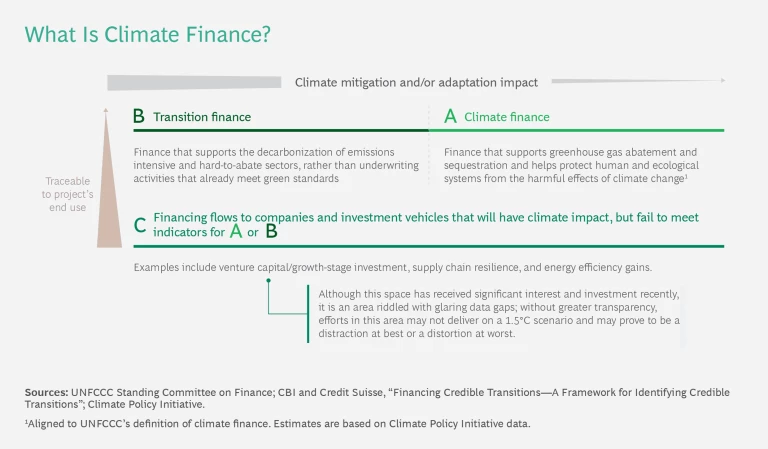

In this article, we use the term “climate finance” to encompass all three areas of climate-related finance. To build our sub-theme deep-dive, we consulted industry and proprietary taxonomies. However, because sub-themes can fall into multiple categories, we recognize there may be some overlap among them. (See the exhibit.)

Overall, what we learned is encouraging. Investors from across the public and private sectors believe climate finance opportunities exist across every major theme and market. They believe those opportunities cut across regions. And, notably, despite market fluctuations, they believe the investment pipeline is growing. However, our research also showed that long-standing deployment challenges continue. These issues, combined with recent macroeconomic headwinds that have increased project risk, are making some investors wary.

To find out about the state of the market today, BCG and The Rockefeller Foundation surveyed more than 100 climate finance leaders.

Fortunately, new solutions are emerging. We see heightened interest in collaboration among commercial and concessionary investors. Today, the challenge is how to mobilize most effectively at scale.

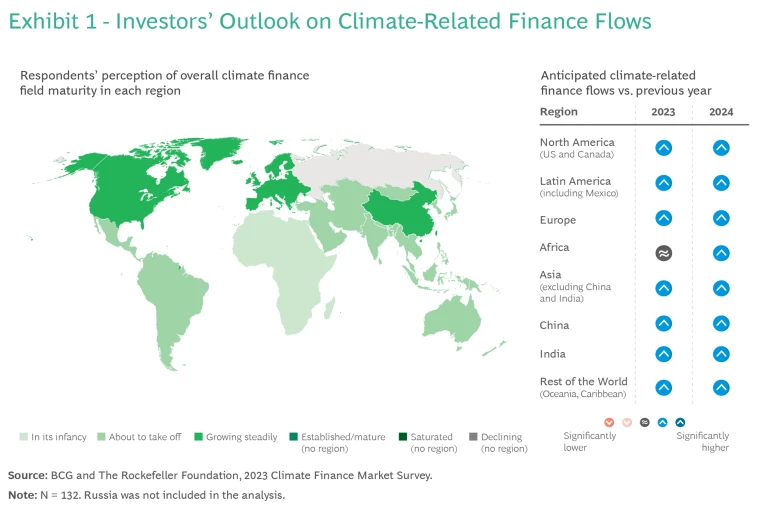

Investors Predict Growth for Climate Finance, Especially in Latin America and Asia

Climate, transition, and other related finance

While the upward trend is encouraging, the survey suggests growth will come in steps rather than leaps, with investors saying they expect finance flows to be only “slightly higher” than today’s levels, and not “significantly higher.” That tempered rise could be a problem, given the Climate Policy Initiative estimates that suggest flows will need to increase at least five-fold by 2030 to generate the $6 trillion to $12 trillion in finance needed each

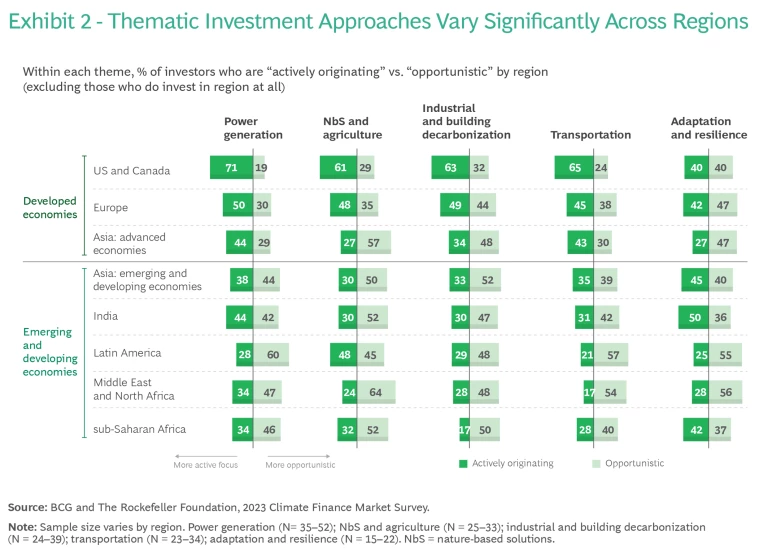

Power Generation Leads, but All Mitigation Themes Have Strong Investor Support

Investors are pursuing all climate mitigation themes. (See Exhibit 2.) Power generation has particularly strong investor support. More respondents said they were actively originating (defined as seeking investment opportunities) in power generation than in any other theme. In terms of specific technologies, solar stands out, with 72% of power-focused respondents looking to originate in this area. Smart grid technologies and utility-scale storage came second and third (60% and 57%, respectively).

Industrial and building decarbonization and transportation are also gaining widespread interest, particularly in advanced economies. North America leads the way in each of these sectors (more than 60% of respondents who invest in this theme are actively originating in these themes in the US and Canada), with Europe close behind. At the sub-theme level, we see the highest levels of active origination in building efficiency, heating and cooling and in the circular economy. In transportation, electric vehicles and charging infrastructure predominate.

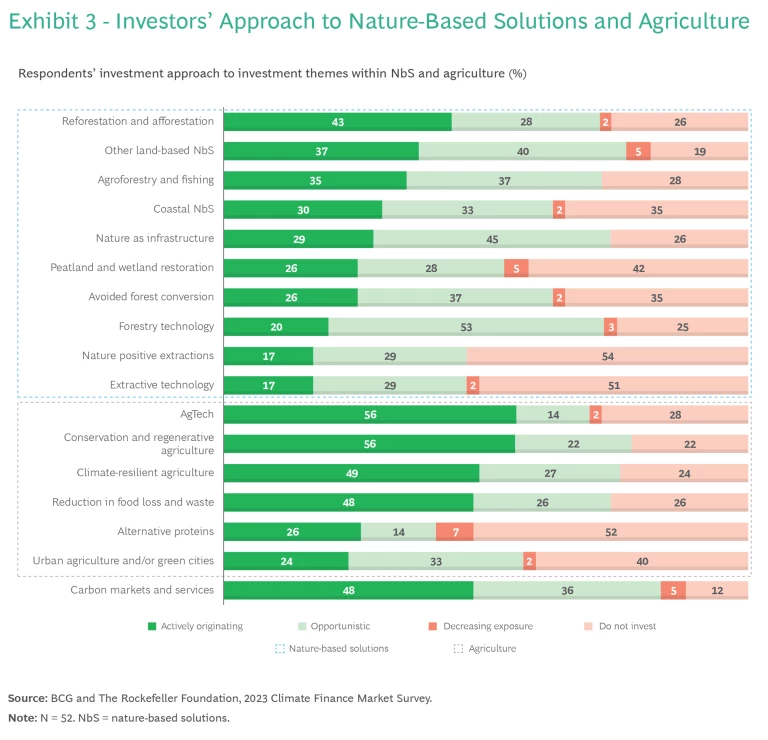

Nature-Based Solutions May Be Breaking Through Commercial Viability Concerns

Nature-based solutions (NbS) play a fundamental role in addressing climate change and other environmental crises but have suffered from lingering concerns over their commercial viability, owing in part to a lack of confidence in carbon markets. Our survey suggests these mindsets are shifting, and we see interest across regions. Over 60% of those surveyed who focus on NbS said they are actively originating in North America and nearly half (48%) are doing so in Europe and in Latin America.

Looking ahead, the fact that COP30 will be held in Brazil in 2025 could spur continued interest in NbS both globally and in Latin America. One senior asset manager said that “COP30 will be groundbreaking, especially for land restoration and reforestation as well as for carbon markets.”

Among the most active areas for origination are those at the intersection of NbS and agriculture, specifically conservation and regenerative agriculture (56% of interested investors), carbon markets and services (48%), and climate-resilient agriculture (49%). (See Exhibit 3.) In addition to tailwinds from their carbon and biodiversity benefits, these themes generate new revenue streams and gain lift from corporate commitments for regenerative supply chains. Agriculture technology has gained traction, given its parallels to other areas of climate tech. It is high growth, asset light, and fits into the investment scope of many VC investors. Over 40% of interested investors say they are originating in reforestation (the restoration of existing forests) and afforestation (the planting of new forests).

Adaptation and Resilience Is Gaining Momentum, but More Growth Is Needed

Although the overall A&R funding gap is still significant, some developing economies lead the way in attracting the interest of A&R-focused investors. For example, 50% of respondents focused on this theme are actively originating in India, 45% are doing so in the developing economies of Asia, and 42% in sub-Saharan Africa. However, Europe and North America are seeing comparable levels of active origination (42% and 40%, respectively). This suggests that adaptation and resilience is no longer just a developing economy story, and that safeguarding critical assets and enabling supply chain resilience are universal needs.

That said, some key regions continue to lag. Only 25% of the investors focused on adaptation and resilience are actively originating in Latin America and just 28% are doing so in the Middle East and North Africa. This low degree of engagement is concerning. As we reported last year in What Gets Measured Gets Financed, the Middle East and Africa and the Americas have the largest adaptation and resilience financing gaps of any region globally, with shortfalls in the range of $100 billion or more annually.

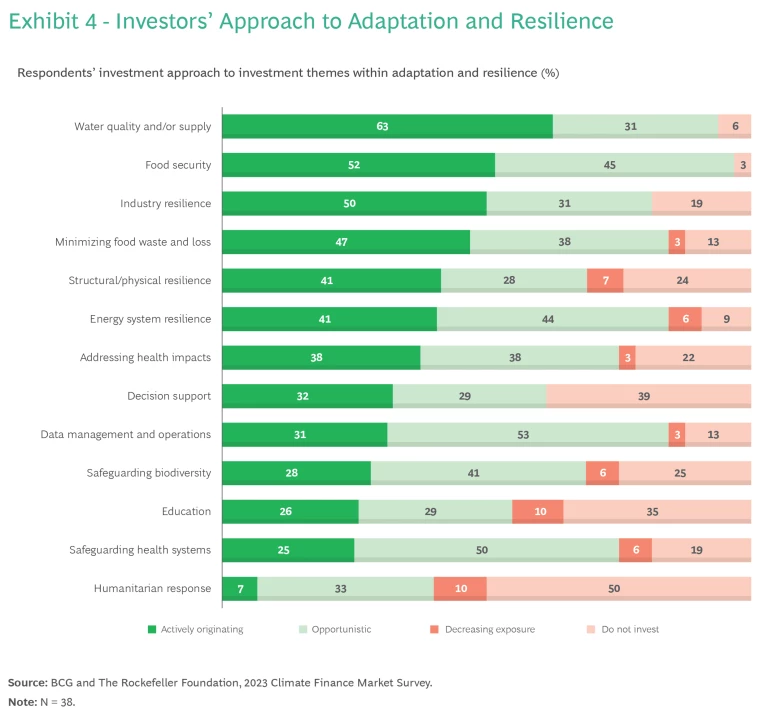

Globally within adaptation and resilience, water quality and supply, food security, and industry resilience are key focal areas. Other categories, such as data management and operations, safeguarding health systems, and safeguarding biodiversity have higher levels of opportunistic investing. (See Exhibit 4.)

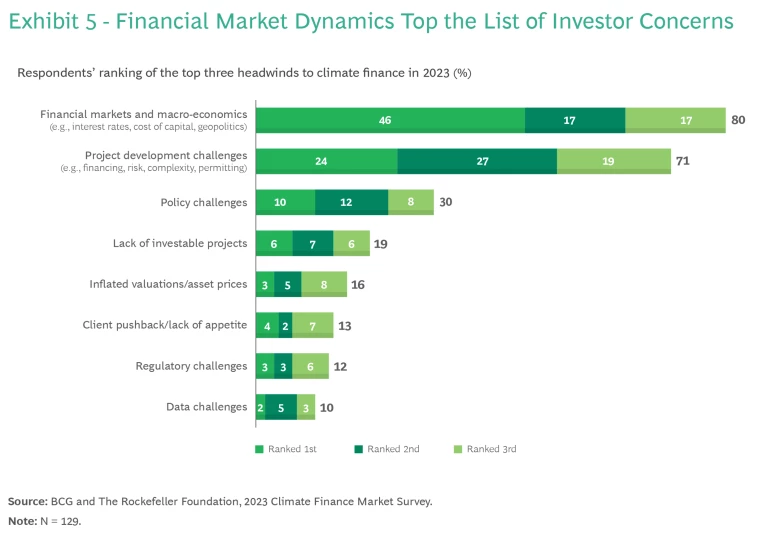

Challenging Market Dynamics Could Temper Investor Optimism and Put Projects at Risk

Rising interest rates, currency volatility, and macroeconomic uncertainty are creating a vicious cycle. These financial market dynamics are driving up the cost of capital and making investors wary. Respondents almost universally said that financial market dynamics pose the greatest risk to future climate finance flows. (See Exhibit 5.) These factors in turn are exacerbating project development challenges and heightening off-taking and permitting risks. Many decarbonization initiatives are capital intensive. And projects that looked attractive when central bank rates were at 1.5% look decidedly less attractive with rates at 5% or higher.

These headwinds are already buffeting some investments. Challenges in offshore wind farms have been well publicized in recent months, with some projects cancelled due to factors such as inflation and interest rates, combined with supply chain challenges.

Foreign exchange risk is another consistent worry. The US dollar has grown stronger in recent years, and this can make it harder for climate initiatives based in other countries—particularly in developing economies—to secure

Recognizing and addressing implementation roadblocks like these will become imperative. With financial and economic volatility likely to remain persistent, measures that can allay the high cost of capital and enable deployment can shore up investor confidence.

Investors Want Closer Collaboration but Haven’t Yet Enabled It

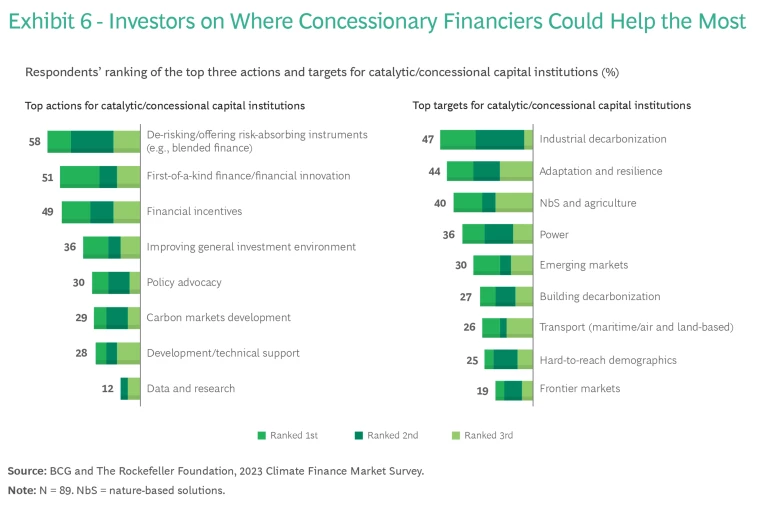

Blended finance, first-of-its-kind finance, and related financial incentives top the list of actions that private investors hope concessional capital institutions will take. (See Exhibit 6.) But adapting them to the needs of key stakeholders will require collective resolve. Commercial and concessionary investors move at different speeds, have different blended finance capabilities, and focus on different sectors.

Despite calling out for more catalytic investment, uptake of existing blended finance opportunities has been somewhat muted, with only about 38% of commercial investors participating in these transactions. Convergence’s State of Blended Finance report found that deal volume fell by 55% between 2012 and 2022, taking the number to a ten-year low in 2022.

When we asked why, a leading European asset manager told us, “Blended finance is far too limited and slow to deploy.” The head of strategic initiatives at a North American investment manager added, “We need to build capability to interact and engage with concessionary capital, and we need concessionary finance players to move with the speed of the market.” And a senior leader from a large global pension plan said that “concessional finance is not prevalent enough, and nor is blended finance.”

Commercial investors want concessionary finance to focus most on industrial decarbonization, adaptation and resilience, and NbS and agriculture. According to the latest data from the Climate Policy Initiative, these finance flows are limited, with the majority of public funding going toward energy, transport, building decarbonization, and infrastructure. A senior leader at an Asian MDB told us, “There is a desire for concessional investors to de-risk what commercial investors are doing. But this is not where we should be using our concessional finance. We should use it to supplement those initiatives where there isn’t yet enough money to get something going.”

Commercial investors also want to see a wider variety of risk-absorbing plays. The head of climate strategy referenced earlier said, “There are high upfront costs for clean products like solar panels or electric vehicles, so funding at the consumer level rather than at the fund level would be more impactful for us.”

But the challenges are not one-sided. Leaders of some MDBs and other concessionary institutions are reliant on capital flows from donors, many of them nation states, but these flows have been shrinking as governments address an increasing number of geopolitical priorities.

There is reason to be optimistic though. Many MDBs are aware of these challenges and the need to reframe how they operate. As one leading MDB executive said, “We have completely flipped [our] mandate. We are still a development institution, but we look at everything through a climate lens and a private sector lens. That’s the shift that every MDB needs to go through.”

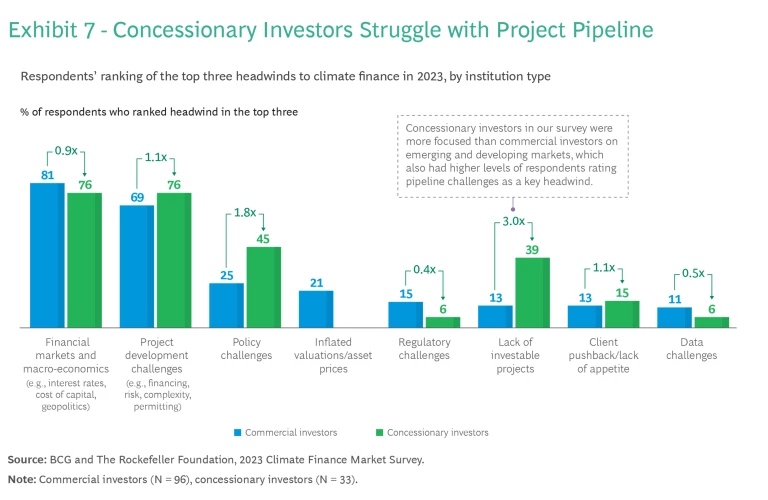

Concessionary Investors Are Three Times More Likely Than Commercial Investors to Say Pipeline Is a Challenge

Lack of available pipeline for climate finance initiatives used to be a common complaint among private investors. But things have changed. Only 13% of respondents said that sourcing was a top-three challenge. (See Exhibit 7.)

It’s a different story for concessionary investors. Nearly 40% of those surveyed said that they struggle to find suitable projects to finance. One possible explanation is that concessionary investors are more focused on the overall challenge of mitigating and adapting to climate change and perceive a shortage of investable projects across a broader context than their specific pipeline. Another is that many concessionary financiers focus on emerging markets, which typically have more challenging project environments and result in slower-moving pipelines. Our data reflects this, with respondents from concessionary capital providers more likely to be focused on investing in emerging and developing markets than commercial players.

There is a disconnect between what concessional players are offering and what commercial investors are asking for. Adapting their offerings and finding better ways to collaborate could help commercial and concessionary investors expand their pipeline and lay the groundwork for a more diverse array of partnerships with the private sector.

Subsidies and Incentives Provide Clear Tailwinds, but Implementation Drags

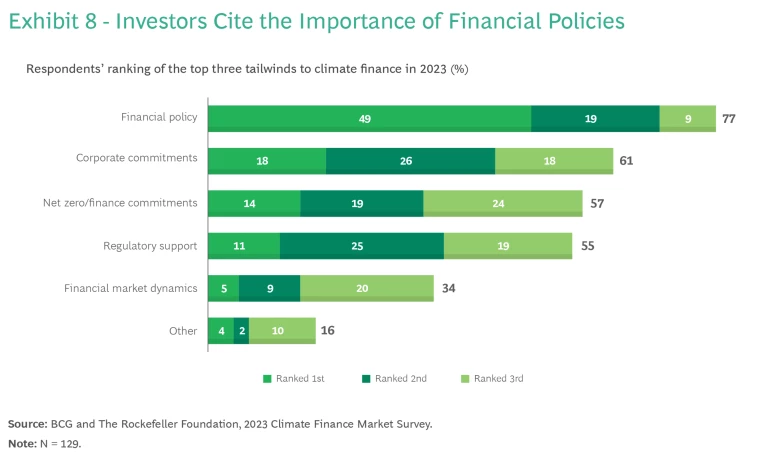

A proliferation of new laws and policy initiatives are creating unprecedented momentum. They include the Inflation Reduction Act (IRA) and Infrastructure Investment and Jobs Act in the US and the Green Deal in the European Union. They also include subsidies, tax credits, and funding programs in other regions. Almost half (49%) of investors said that these measures play a larger role in mobilizing climate finance than any other lever. And 77% ranked it in their top three most powerful growth enabler. (See Exhibit 8.)

But it’s one thing to enact these policies and another to implement them, and despite the enthusiasm, many investors are concerned that the pace of implementation is too slow. According to respondents, deal flow has grown by one to two times across most themes as a result of favorable policies, which is less than most had hoped for. (The notable exception is transport, which respondents say has seen flow rise by three or four times.) As one investor we spoke to said, “Implementation of the IRA has been slower and more complicated than anticipated.”

Bottlenecks include delayed implementation as governments scale up their administrative operations to execute these policies, complex rules and tax codes that require additional guidance, lengthy review processes, and multiple approval stages.

The climate finance leaders surveyed made clear that they believe the economic business case for investment exists.

Additionally, there are fears that the policies enacted by advanced economies are not allowing the energy transition to happen equitably and could be siphoning flows away from other markets that lack similarly muscular fiscal incentives—leaving climate finance projects in developing economies particularly vulnerable. A senior leader in one development finance institution told us, “In the midst of global macroeconomic concerns and rising costs, these schemes have resulted in investor retrenchment. Financiers would rather concentrate in markets where these subsidy programs exist than continuing investing in EMDEs.”

The field of climate finance has come a long way. While climate finance is far from mature, respondents of our survey made clear that they believe the economic business case for investment exists, that opportunities are growing across markets, and span multiple themes. This is exciting, but we are still at the proverbial tip of the iceberg. To close the climate finance gap, public and private sector investors will need to find ever-more innovative and collaborative ways to fund vital measures. Our research suggests that the opportunity is there. It is now time to enable it.

This article was developed in partnership with The Rockefeller Foundation.