To what degree are private equity firms aiding in the process of reducing greenhouse gas emissions? That is one of the most critical questions that the ESG Data Convergence Initiative is looking to address.

And the answer is becoming clearer. We now have an additional year’s worth of data on progress at portfolio companies, data submission rates of close to 70% for both Scope 1 and Scope 2 emissions, and nearly double the number of portfolio companies participating in the initiative. This year, three insights stand out:

- Scope 1 and Scope 2 greenhouse gas emissions intensity varies significantly across industries.

- PE firms have been more successful in driving decarbonization at larger portfolio companies (ahead of their public peers) than at smaller ones.

- PE firms that successfully reduce carbon emissions are doing so by extending their investment playbooks to include decarbonization, scanning their portfolios to find ROI-positive opportunities, and establishing strong governance processes involving portfolio companies’ senior leadership.

A closer examination of the results shows the important role that the PE industry can play in the fight against climate change—and in building stronger businesses at the same time.

Sector Matters

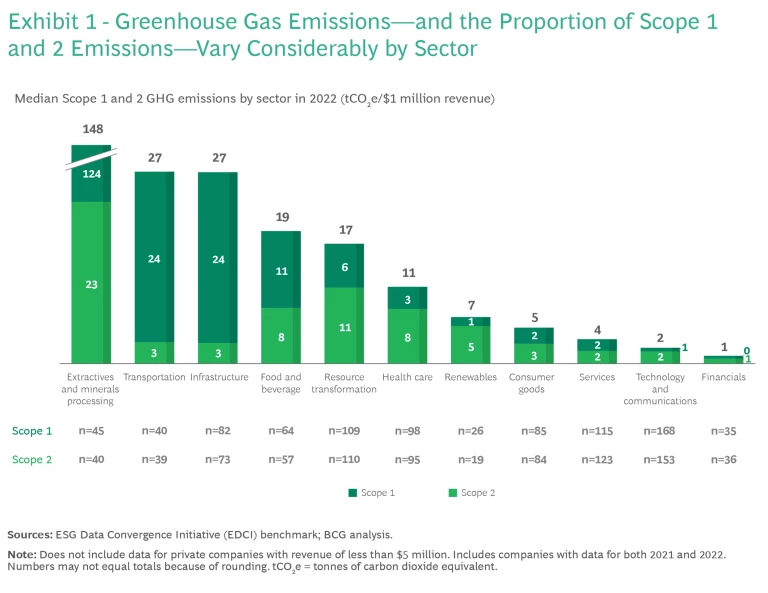

Emissions levels at private companies differ significantly by sector. Scope 1 and 2 emissions intensity, combined, ranges from an average of 148 tons per $1 million in revenue for private extractives and mineral processing (E&M) businesses down to 1 ton per $1 million for financial firms. (See Exhibit 1.)

The relative proportion of Scope 1 and Scope 2 emissions also varies considerably by sector, owing to differences in sector business models. E&M companies produce more than five times as many Scope 1 as Scope 2 emissions because of the GHGs produced by the extraction and processing of commodities, their core business. But in sectors like health care and technology, the reverse is true: their emissions come largely from the purchase of energy to run their operations. (Significantly lower data submission rates prohibit us from including Scope 3 emissions in this analysis; see “Measuring Scope 3 Emissions.”)

Measuring Scope 3 Emissions

Measuring Scope 3 Emissions

EDCI members have made progress in collecting Scope 3 data, with submission rates increasing from 26% in 2021 to 34% in 2022. But the data set is still too small and the data too preliminary for us to draw significant insights. As the level of sophistication in measurement rises, we hope to be able to provide results from this increasingly important metric in the future.

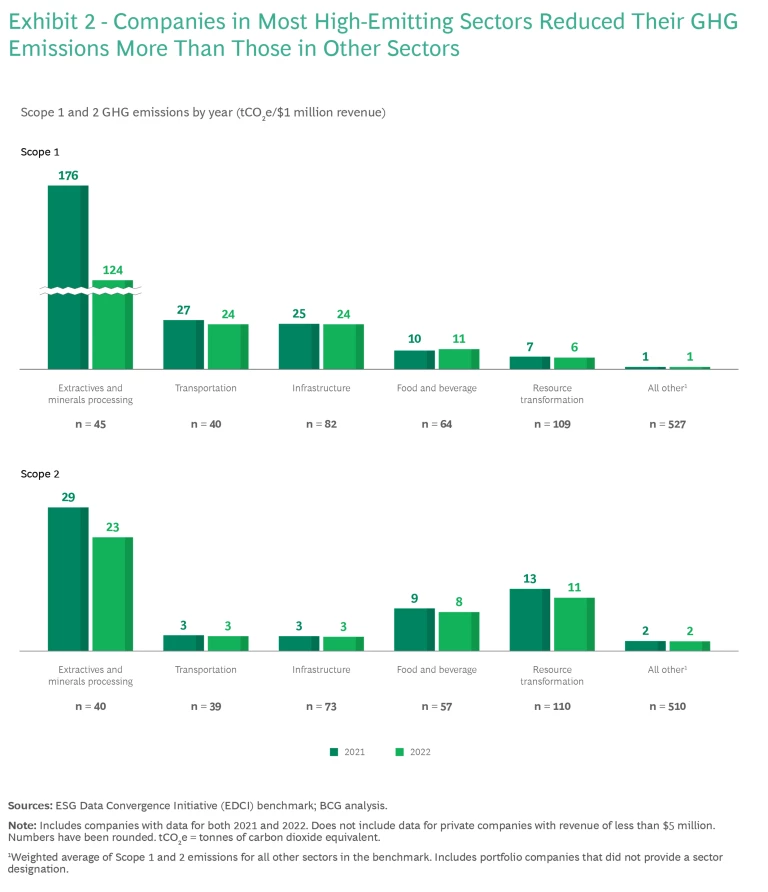

Many EDCI portfolio companies have been collecting consistent emissions data since 2021, and this allows us to understand how emissions have been evolving in different sectors. Overall, the picture is mixed, with some sectors seeing drops in emissions intensity and others seeing slight increases. In general, the high-emitting sectors—notably, E&M and resource transformation—have seen larger reductions than the lower-emitting sectors, likely reflecting their greater urgency in cutting emissions. Of the five highest-emitting sectors, four (E&M, transportation, infrastructure, and resource transformation) saw decreases across Scope 1 and 2 emissions intensity, while Scope 1 emissions intensity rose at companies in the food and beverage sector. (See Exhibit 2.)

Results also varied when comparing changes in emissions intensity levels among private companies with those of public companies in the same sectors. In some sectors, private companies are driving decarbonization faster than the public companies, while other sectors are seeing the opposite.

Size Matters

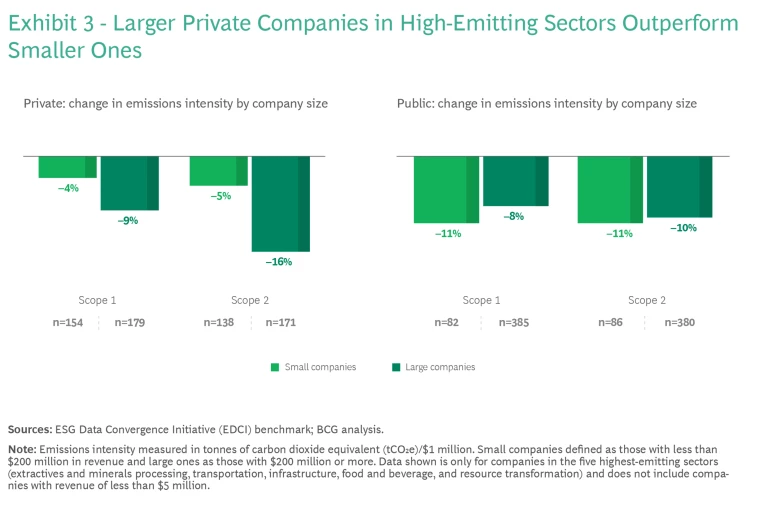

The picture changes when looking at companies by size. Decarbonization rates are relatively consistent across both larger and smaller public companies in the highest-emitting sectors. But for those same sectors, larger private companies (those with revenue of $200 million or more) have been reducing their carbon footprint across both Scope 1 and Scope 2 emissions significantly faster than smaller private companies. At the same time, larger private companies have been decarbonizing more quickly than their public peers, while smaller private companies have been lagging. (See Exhibit 3.)

This likely reflects the fact that, compared with their counterparts in the public markets (which are subject to sustainability disclosure requirements), many of these smaller private firms have not historically focused on decarbonization and have instead concentrated more on pursuing a wide array of growth opportunities. As a result, they are still at an early stage of maturity in this regard and are just now starting to zero in on measuring and understanding their emissions baseline. In contrast, larger private businesses in these sectors tend to be more mature—already implementing decarbonization plans, making ROI-positive investments in reducing their carbon footprint, and driving progress.

When PE firms prioritize climate action at their larger portfolio companies, they can excel at decarbonizing. We expect that, going forward, PE owners of smaller companies, too, will improve the decarbonization performance of these businesses as they develop their carbon reduction plans.

A Recipe for Success

How are PE firms approaching the challenge of helping their portfolio companies to decarbonize—and creating value as they do so? Essentially, they are using the same playbook that already makes them effective company owners to drive decarbonization as well. In the process, they are reducing costs, lowering risks, and finding opportunities to increase revenue. And many are building repeatable models that allow them to act at scale across their portfolios. (See “Creating Business Value Through Decarbonization.”)

Creating Business Value Through Decarbonization

Creating Business Value Through Decarbonization

BCG and PESMIT recently published a paper that provides guidance on how PE investors can effectively

As part of this study, we spoke to sustainability leaders at two major PE firms: New York–based Apollo Global Management, a diversified alternative asset manager, and Cinven, a European PE fund headquartered in London. Apollo and Cinven have quite different investment strategies, but both are effectively integrating decarbonization into their portfolio engagement models in ways that draw on their distinctive capabilities.

Apollo Global Management

Apollo’s PE franchise takes a hands-on investment approach to supporting management teams, enabling business transformation, and helping to drive growth at portfolio companies across a wide variety of industries. As with many of its management initiatives, Apollo has developed a 300-page internal environmental, social, and governance (ESG) value creation playbook to guide decarbonization, which serves as a resource that aids company management and deal teams in identifying ROI-positive decarbonization opportunities. The playbook provides detailed sector-specific information and operational details to help support active decarbonization in portfolio companies at scale.

Even with this robust internal resource, Apollo still experiences challenges. This is hard work and some portfolio companies’ operations teams have limited resources or expertise in implementing decarbonization plans. To address these issues, Apollo leverages its network of experienced third parties with the requisite experts and capacity to assist companies in successfully executing these projects.

For example, Apollo worked closely with one of its portfolio companies, Novolex, a supplier of plastic, paper, and bio-based packaging products, to help the business pilot a number of new capabilities introduced to support its decarbonization goal. While the company had decarbonization commitments before it was acquired by Apollo-managed funds, the strategy was not strongly tied to long-term value creation. Carletta Ooton, the head of ESG for PE and operating partner at Apollo, says the firm engaged the Novolex management team by “actively collaborating with them to identify high-level ROI-positive levers that could help take the company around 40% of the way toward net zero on top of where they already were.”

Apollo also worked with Novolex to assist the company in outlining project-level capital and operating expenditures and prioritizing which projects to pursue over the near, medium, and long term. As part of this process, Novolex engaged third-party consultants who conducted on-the-ground assessments of the company’s operations to support its detailed decarbonization planning and deployed a carbon-accounting system to track progress.

Cinven

Cinven’s approach to decarbonization at its portfolio companies focuses first on establishing a common baseline of carbon footprints, decarbonization targets, plans, and governance structures across all businesses within its newer funds (Fund 7 onward). Then it prioritizes companies with outsize growth potential from effective decarbonization and provides more hands-on support in pursuit of these opportunities.

The firm has deployed this approach with success for portfolio companies from a wide array of sectors. For example, Cinven worked with management at Arxada, a specialty chemicals company, to identify opportunities to develop green products that would allow the company to capitalize on potential demand from beauty and skin care customers looking to decarbonize their supply chains. When working with TK Elevator, a manufacturer of elevators and escalators, Cinven pushed the company to focus on developing more resource-efficient products that help reduce the carbon footprint of their customers’ buildings.

As part of its strategy, Cinven consistently elevates decarbonization to the C-suite and board levels at its portfolio companies, integrating it into their overall strategy deliberations. Decarbonization initiatives, says Allegra Day, the ESG director at Cinven, “must be owned at a senior level within a company, including board support. Otherwise, sustainability becomes viewed as something outside the core business, and that is rarely the case.”

This was put into practice when Partner in Pet Food (PPF) was considering ways to reduce the carbon emissions of its products and realized some options would require reformulating the products’ protein composition. It was clear that this could not be evaluated in isolation but instead must be aligned with how the business thinks about its future growth strategy. So Cinven helped the company to establish a sustainability steering committee, which consisted of the CEO, CFO, COO, and CHRO in addition to its sustainability lead. Including senior leadership on this committee not only helped ensure that sustainability considerations were fully integrated into the company’s strategy, but also helped secure support for this work among the key decision makers.

All PE funds should examine their particular investment strategies and portfolios to understand where they have opportunities for value creation through decarbonization.

As we have seen, PE firms can have a considerable impact on their portfolio companies’ efforts to decarbonize their operations and create value in the process. This is especially true at the larger companies in their portfolios, but the impact can be felt across the board.

The evidence also shows, however, that there is considerably more work to be done. All PE funds should examine their particular investment strategies and portfolios to gain a clear understanding of where they have opportunities for value creation through decarbonization and to leverage the same capabilities that make them such effective owners of companies.

In support of this ongoing effort, the EDCI will incorporate a portfolio company net zero metric into its data-gathering efforts next year. This will cover three aspects of a company’s decarbonization journey: whether the business has an established decarbonization plan, whether it has a near-term emissions reduction target, and whether it has a long-term net zero ambition. We believe this new metric is effectively designed to meet the needs of PE-backed companies and enable them to engage on this important topic. We look forward to sharing insights from our analysis in next year’s report.

Sustainability in Private Equity, 2023

Hundreds of PE firms have reported data detailing the progress that their portfolio companies are making on social and climate-related issues. The results are encouraging.