The past five years have been an extraordinary period in business, marked by inflation, a global pandemic, supply-chain disruptions, and geopolitical conflict. Yet B2B distributors were able to adapt, largely due to structural advantages, and have been able to deliver strong returns. The largest publicly listed distribution companies increased their collective market cap from $350 billion to $560 billion (+60%) in this period, generating a median annual total shareholder return (TSR) of 10%, slightly outperforming the median for all industries.

Looking even further back, our analysis (based on data for publicly held companies along with BCG’s deep experience with private distribution companies, many backed by financial sponsors) reveals several strategies that have helped a subset of B2B distributors consistently outperform the pack over the past two decades.

The starting point is achieving both local and national scale. Companies that have national scale can invest in five major capabilities that build strategic moats to protect and grow their business: build digital self-service tools for customers; improve margins through pricing; offer private-label products; expand into value-added services; and design circularity into offerings. These capabilities offer a playbook for leadership teams at B2B distributors—and for investors looking to capitalize on the industry.

Sales Growth and Scale Are the Keys to Value Creation

Distributors play a critical role in the economy, and this role was elevated during recent unpredictable demand fueled by COVID and the subsequent supply-chain disruptions. Established players took advantage of this period of instability by ensuring that products were available; rolling up smaller, distressed players; and implementing best-in-class pricing tactics. Top performers also pivoted from traditional sales models—with large teams of reps contacting clients in person—to hybrid models based on high-quality virtual interactions, reducing costs, and making better use of digital technology to grow sales based on analytics.

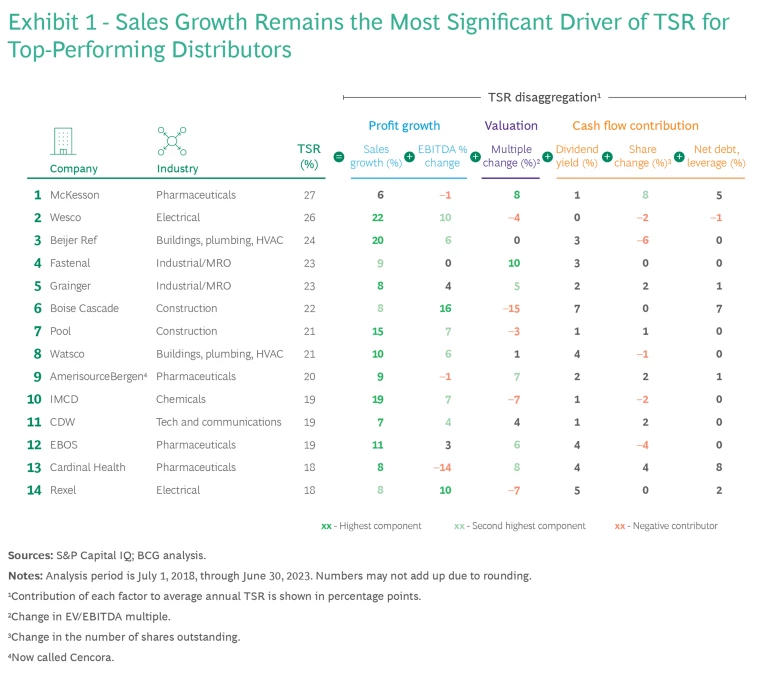

Within the sector, however, our analysis shows a wide range of performance, with five-year TSR varying from an average annual rate of

–24% to 27%. (See “The Components of TSR.”) As Exhibit 1 shows, the top performers in our sample tend to be the larger, faster-growing companies, and the largest contributor to TSR was sales growth.

The Components of TSR

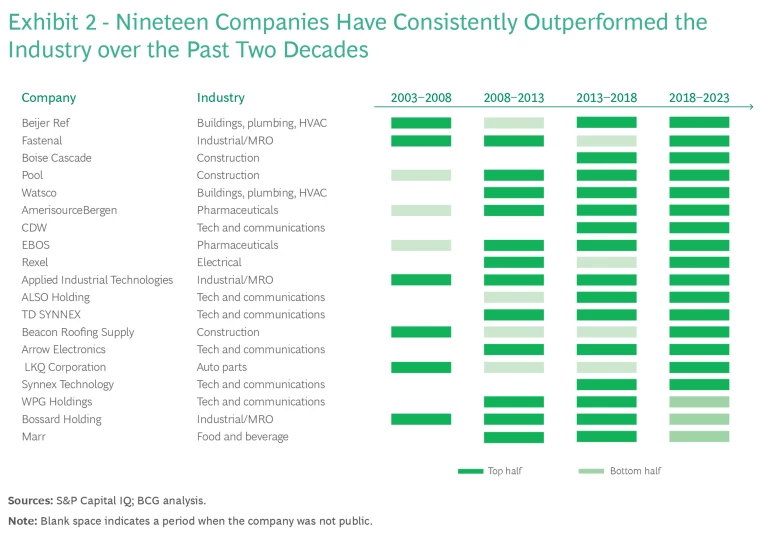

We also looked at a longer period to determine the foundational elements that set top companies apart. Specifically, we analyzed TSR performance over the last four consecutive five-year periods, starting in mid-2003, and identified the companies with TSRs in the top half of the ranking in a majority of those periods—19 in all. (See Exhibit 2). As a group, they increased their stock price by more than 1,000% since 2003, more than three times the returns of the benchmark MSCI World Index. What do these companies do differently?

Achieving scale at the local and national level, typically in that order and through the right kind of M&A activity, is table-stakes for distributors. The former helps companies understand the needs of a local market and provides increased service levels and reduced cost-to-serve (through route density), among other advantages. The latter allows for scale in procurement and better inventory management closer to customers. It also gives companies the means to invest in more advanced capabilities to build moats such as digital technology, pricing, and circularity.

Achieving scale at the local and national level, typically in that order and through the right kind of M&A activity, is table-stakes for distributors.

M&A is a key means of achieving scale. The 19 winners conducted a total of 136 M&A deals in the past five years (a median of six each), amounting to $19 billion, or $290 million in median deal value. Although the worst performers carried out deals as well, they closed fewer transactions at lower valuations (89 deals total, with a median of three each, averaging $80 million each).

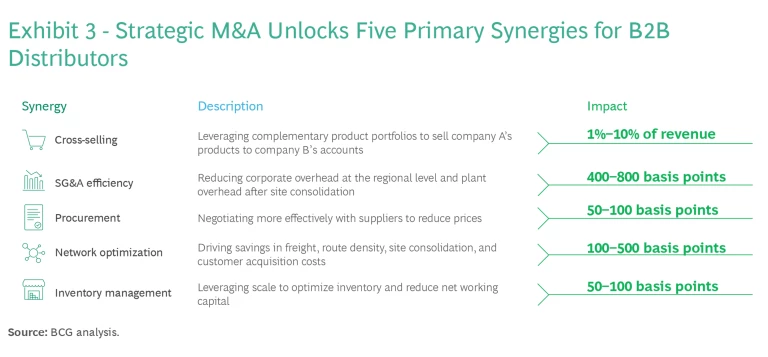

While there are many different rationales for a deal, distributors typically benefit more from synergistic M&A, which provides scale benefits and enables a company to dominate its market. A deal between two organizations with overlapping capabilities or geographic markets creates greater synergies via reduced overhead, denser delivery routes, and opportunities to cross-sell across a wider base of customers, ultimately boosting the deal’s impact on the bottom line. (See Exhibit 3.)

CDW, a US distributor of tech products, is a good example. It acquired six companies since 2020, including Sirius, a leading US IT solutions integrator. The Sirius acquisition expanded CDW’s service and solutions capabilities in key growth areas like security, digital and data innovation, and cloud services in customer segments markets that CDW already served, including health care and government.

Five Capabilities to Grow Shareholder Returns

Once distributors generate scale, they can invest in additional capabilities to create strategic moats, increase sales, and reinforce their market share—resulting in superior shareholder returns. We have identified five major capabilities through our work with dozens of distributors in recent years.

Build digital self-service tools for customers. Digital self-service enables customers to handle many interactions on their own, including checking pricing, placing orders, checking order status, updating delivery schedules, and paying invoices. Digital tools lower sales and administrative costs and free sales teams to focus on more value-adding tasks. Early wins in digital often creates a flywheel effect of momentum to boost innovation and reinforce competitive advantages.

Early wins in digital self-service tools can create a flywheel effect to boost innovation and reinforce competitive advantages.

Rexel, a European distributor of electrical supplies, launched a large transformation in 2017 aimed at boosting digital commerce. It developed tools that made processes easier for customers, including an AI-enabled solution that makes cross-selling and upselling suggestions and a portal, used by 25% of its key suppliers, that shares data to help Rexel assess and improve performance over time. Since that point, the company has increased its digital sales from 14% to 28%—and it aims to increase that number to 50% by 2027. This digital transformation has allowed Rexel to serve customers more efficiently, retain customers, and grow its market position further. Its prominence in the market enabled it to make these kinds of digital investments, whereas a smaller player would have a tougher time allocating capital to such a large program.

Improve margins through pricing. Although margins are affected by many factors, the biggest opportunity for most distributors is pricing. In many companies, pricing gets overlooked (typically bundled into the sales function but without sufficient resources or expertise). Best-in-class distributors use advanced algorithms to gauge customers’ willingness to pay, enabling them to price far more effectively. Leading organizations also use detailed playbooks for sales teams to understand and adhere to pricing structures, including incentives. Based on our experience across more than 100 pricing projects, we find that pricing initiatives can help distributors increase their EBIT margins by 100 to 300 basis points in the initial phase, with the potential for greater impact later.

In 2013, Rexel launched a program to improve pricing, initially in France and later covering the rest of its operating markets. The initiative included using AI to optimize list prices and rebates, establish strict pricing processes, and implement price performance monitoring—all without hurting market share or customer loyalty. Rexel has steadily improved gross margin by a total of 100 to 150 basis points in the last five years, due in part to these pricing measures. Again, the company’s strong market position enabled it to invest in a dedicated pricing function that could extract additional value from its customer base.

Offer private-label products. Economic downturns have historically driven private-label growth, and recent trends suggest that the spike in private-label sales due to COVID is likely to stick. Inflation and supply chain issues that curtailed availability have allowed private-label offerings an opportunity to demonstrate their value to customers. Leading distributors have learned from B2C retailers and have actively sought out categories where such products could be successful. This trend has led distribution companies to hire leaders with stronger capabilities in merchandising, rather than the traditional focus on operations.

Leading distributors have learned from B2C retailers and have actively sought out categories where private-label products could be successful.

Private-label business has several clear advantages. Gross margins are typically 10% to 15% higher than for other products in distributors’ portfolios. Customers tend to be more loyal (though it’s initially harder to get them to switch).

There is clear room for growth. In consumer retail categories, private-label products now account for about 20% of products, versus less than 5% in distribution. However, distributors need to be selective about their product segments when building a private-label business to avoid upsetting their supplier base.

GME Supply, a North American distributor of safety equipment, leveraged its national scale and trusted brand to develop a private-label line with WestFall Pro (an equipment manufacturer). Over the last seven years, GME’s private-label business has grown roughly 35% per year and posted gross margins of roughly 45%.

Expand into value-added services. In addition to baseline distribution, companies can offer additional services such as vendor-managed inventory, packaging, and product formulations (for example, to support chemical or pharmaceutical suppliers). Such value-added services can give distributors a greater share of wallet from customers and differentiate them from the competition.

For example, Fastenal, the largest distributor of fasteners in North America, offers vendor-managed inventory replenishment programs that show customers detailed usage data, lowering consumption and reducing the need for safety stock. This allows Fastenal to stand out from other distributors and deepens its ties to its customers. Dedicated personnel embed directly with customers, using proprietary technologies installed in customers’ facilities to digitally monitor, track, and control a vast range of products. The company invests roughly $55 million a year in such technologies, which allows it to create resilient revenue streams with customers.

Design circularity into offerings. As sustainability issues become more prominent, circularity solutions are an increasingly attractive opportunity, especially for distributors. For example, distributors can adjust their product mix to meet growing customer demand in green categories such as electric vehicles, organic food, and others. More importantly, they are uniquely positioned to offer circularity solutions like reverse logistics services, managing end-of-life products for existing customers and tapping into a new customer base of recyclers. Distributors can also track and report data that helps customers analyze their supply chain performance. Watsco, a US distributor of HVAC equipment, now collects end-of-life systems from its customers, including services like the proper disposal of refrigerants and coolants.

As our analysis shows, there is a clear playbook for how distributors can win. They must build scale—through both organic growth and M&A—and then capitalize on that scale by investing to defend and grow their market share. In a complex and increasingly competitive business environment, understanding how and when to implement some of these strategies is key to creating a winning formula for long-term success.

The authors would like to thank Greg Hamilton and Martin Link for their contributions to this article.