For private equity (PE) firms and institutional investors in Europe, one of the most compelling segments is growth equity: companies that are past the initial venture capital (VC) stage and growing rapidly but aren’t established enough to be considered by the main funds of leading European investors. (In Europe, the term “growth equity” doesn’t just refer to funds investing capital into a business on the path to an IPO but more broadly refers to both minority and majority investments into fast-growing companies with revenue growth of 20% per year or more.)

Some investors may not be aware of the increasing opportunity in growth equity, and even those that know about it often struggle to make sense of the landscape. The market is extremely fragmented in terms of deal volume (with roughly 1,500 transactions per year) and concentrated among investment firms (just 30 fund managers account for 80% of the raised capital).

Some investors may not be aware of the increasing opportunity in growth equity, and even those that know about it often struggle to make sense of the landscape.

We recently analyzed more than 10,000 deals in a proprietary BCG database to map the growth equity landscape in Europe for software and technology companies—the biggest segment of the market. Our goal was to identify the most attractive segments, giving PE firms and institutional investors a clear way to capitalize on the potential in growth equity companies.

Growth Equity Is (Mostly) Growing

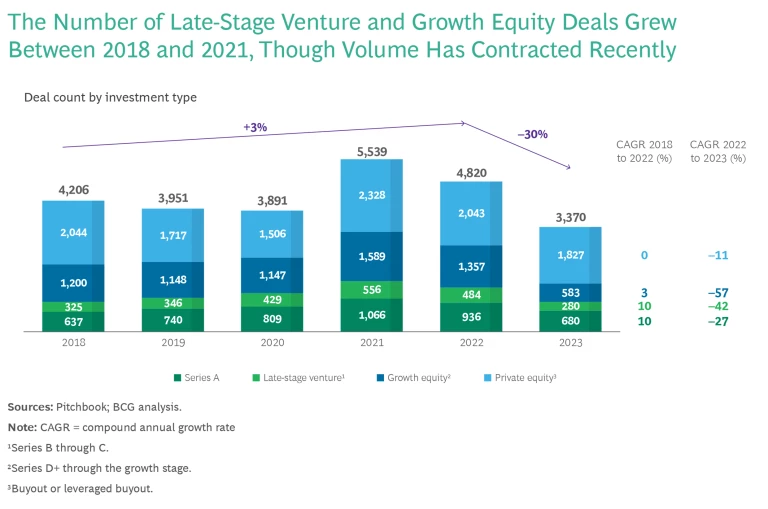

Over the past five years, investors have raised more than $100 billion with a mandate to invest in European companies in the growth equity stage. Between 2018 and the first half of 2021, the number of growth equity deals in Europe grew from 1,200 to nearly 1,600, even factoring in a dip during the pandemic. Late-stage venture deals—defined here as series B and C investments—have grown nearly as fast, suggesting a strong pipeline of future growth equity opportunities. The majority of those deals (81%) have been concentrated in software, technology, and life sciences.

Starting in the second half of 2022, deal volume for the growth equity and VC segments has contracted significantly due to high interest rates and a reduced appetite among investors for companies that are growing fast but may not have reached profitability. (See the exhibit.) In particular, funds were more interested in safer segments such as software and less interested in riskier categories such as metaverse technologies.

The market is highly fragmented. Over the entire five-year period of our analysis, roughly 6,800 growth equity deals have closed, along with another 3,300 in late-stage venture deals. At the same time, the market has become increasingly competitive. The top ten fund managers accounted for 45% of raised capital, and the top 30 accounted for 80%.

Some fund managers (including General Atlantic, Vitruvian, and PSG Equity) are focused primarily on the growth equity segment. But new entrants are joining from both sides of the pipeline. Traditional PE and buyout fund managers (including KKR, Permira, and EQT) are moving to invest in growth equity as well. And VC-focused managers such as Inflexion are expanding their focus to include post-venture companies.

These factors—fragmentation, market concentration, and new competitors—can make the growth equity market challenging and complex to analyze and invest in.

A Differentiated Approach to the Market

Based on our analysis, we believe institutional investors should adopt a differentiated approach. This requires understanding the market dynamics for different technology and software subsegments based on their level of maturity and overall market dynamics.

Institutional investors should adopt a differentiated approach that considers the market dynamics for different technology and software subsegments.

Specifically, we looked at how verticals are moving through the various phases of funding, tracking subsegments that are shifting from late-stage venture into the growth equity stage and also from growth equity into the PE buyout stage. We also tried to identify promising investment targets by looking at whether verticals are increasing their employee count.

Our research points to several clear strategies for investors.

Look upstream at companies that will soon grow beyond the venture stage. The first strategy is to build a pipeline of future opportunities. Our analysis identified sectors that experienced strong or exceptionally strong growth in VC funding—as well as in growth equity funding—in 2022 compared with 2019 levels, indicating that companies in these areas have been able to scale up and attract larger investments. The sectors include biopharma, analytics, financial technology, and payment providers. But firms can also expand their perspective to consider sectors that are still in earlier stages of expansion, with historically strong VC funding that has only recently started to translate into growth equity investments. This second group includes sustainability technology companies (ESG software, clean technology, and climate technology providers), along with supply chain software and solutions to help digitally lagging sectors, such as supply chain, construction, and real estate, to catch up.

Pick off any remaining opportunities among more mature verticals. The second approach is to focus on companies and verticals that are already seeing VC funding slow yet are still registering strong levels of growth equity investment. Because they are at this stage in their maturity—advancing through growth equity and into the PE buyout phase—these entities offer fewer opportunities overall, but firms that are selective and tactical can still find potential winners. In our analysis, the most promising sectors for this approach are e-commerce software and technology, marketing technology, and customer relationship management.

Take a speculative approach to consider less mature sectors. Third, investors can consider sectors that are not yet mature enough for growth: those with a large volume of VC deals but limited traction in growth equity funding, indicating a limited ability to achieve scale. This is a more speculative strategy, and it requires more thorough due diligence to make sense of companies’ business models and prospects. But if growth equity investors can spot strong performers early on—with strong business models in place—they can essentially jump the line and invest further upstream than they typically would. The most attractive sectors for this approach have historically included virtual and augmented reality (although those sectors have experienced a significant slowdown in the last 12 to 18 months). Advanced manufacturing is another interesting segment that showed significant deal volume.

For institutional investors, growth equity represents the sweet spot between venture capital and private equity. The challenge is that the growth equity segment is highly fragmented and increasingly competitive. Our analysis helps investors overcome these obstacles, giving them a strategic way to capitalize on an attractive segment of the market.