Companies have long optimized their global sourcing strategies around cost efficiency and rapid delivery, building intricate procurement networks that utilize low-cost production in China, Eastern Europe, and other regions. These carefully structured supply chains have achieved remarkable efficiencies and competitive pricing, enabling them to serve the global market effectively.

Today, however, established sourcing models face profound disruptions. Shifting geopolitical realities, driven by new US trade policies, evolving EU regulations, and China’s strategic localization push, have exposed critical vulnerabilities in traditional procurement approaches.

Recognizing these challenges, companies are fundamentally rethinking their global sourcing strategies. Cost control remains essential, but it must now be balanced with resilience, regulatory compliance, and sustainability. Achieving this balance requires strategic clarity and actionable frameworks that allow companies to adapt quickly, manage risks proactively, and seize growth opportunities in promising markets, such as India, Southeast Asia, and the Middle East.

To help companies meet these emerging needs, we build on work described in a previous article by providing executives with an enhanced framework to assess and respond to evolving geopolitical complexities and regulatory demands. By applying the tools we recommend, leaders can proactively identify vulnerabilities, leverage their unique market strengths, and position their procurement strategies for sustained competitive advantage and growth.

Stay ahead with BCG insights on operations

The Evolving Landscape of Global Sourcing

Recent geopolitical shifts are significantly affecting sourcing dynamics, prompting companies to rethink their supply chains, particularly in high-tech sectors such as semiconductors.

In the US, new trade and export regulations restrict sourcing options for key technologies, including specific hardware and software components used in connected vehicles. Simultaneously, heightened tariffs on critical imports—such as semiconductors, steel, and aluminum—are pushing US companies to reconsider their sourcing strategies, encouraging greater domestic production and reshoring.

Meanwhile, China is transforming itself from primarily a low-cost manufacturing center into a leader in technological innovation and self-reliance. Through ambitious initiatives like Made in China 2025, the government aims to significantly expand domestic capabilities, particularly in sectors such as semiconductors, electric vehicles, and renewable energy. These policies actively encourage local sourcing, reducing dependence on foreign suppliers. At the same time, multinational corporations that have traditionally depended on China's manufacturing capabilities are now exploring alternative production hubs in countries such as Vietnam, India, and Malaysia to enhance resilience and flexibility.

These shifts in the US and China have significant implications for companies in other Asian countries and in Europe, which find themselves positioned between geopolitical forces. Economically intertwined with US technology and Chinese manufacturing—and heavily reliant on revenue streams from both markets—these companies must balance competing pressures arising from policy shifts in each country. At the same time, intensifying pressures, including energy crises, increasingly stringent regulations, and growing sustainability expectations, further complicate procurement decisions.

To transform these challenges into opportunities, companies need sourcing strategies that are agile enough to effectively navigate geopolitical volatility, regulatory complexity, and evolving sustainability demands, while preserving crucial competitive advantages, such as cost savings, speed, and innovation.

Enhancing the Framework for Sourcing Decisions

In our earlier publication, we introduced a practical framework that enables companies to identify viable alternatives to traditional sourcing strategies. By means of a category-specific analysis, it enabled firms to assess both the necessity and the ease of shifting from traditional sourcing models. However, to navigate today’s increasingly complex landscape, companies need a more in-depth framework to balance cost and resilience in the context of regulatory and geopolitical developments, sustainability considerations, digital enablement, and collaborative opportunities.

To provide the clarity and actionable insights companies now require, we have expanded our sourcing framework to include two interconnected tools: the multidimensional global sourcing matrix and the four-pillar advanced sourcing strategy. Originally developed for European firms navigating complex supply chains closely tied to both the US and China, these new tools offer valuable strategic guidance to companies worldwide facing similar geopolitical and regulatory challenges.

The Multidimensional Global Sourcing Matrix

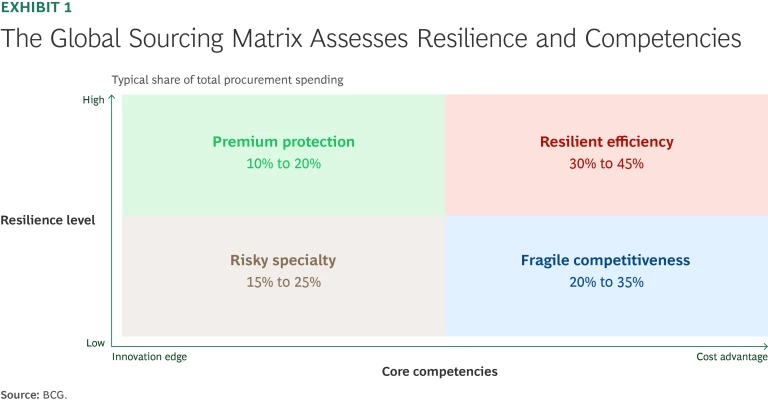

This matrix categorizes procurement strategies according to two criteria: core competencies and resilience level. (See Exhibit 1.) Core competencies represent the primary competitive advantage of the sourced goods and services, be it a cost advantage or an innovation edge. Resilience assesses how effectively the supply chain for these products can withstand disruptions. These two criteria are the axes of the matrix.

Together, the quadrants of the matrix give companies a clear view of their sourcing landscape, enabling them to align strategies precisely with their specific risk profiles and competitive goals. We characterize the four procurement strategies as follows:

- Premium Protection. The upper-left quadrant includes items sourced through onshoring or near-shoring strategies and whose technological innovation protects profitability. Companies accept higher costs to secure superior quality, security, and regulatory compliance. Examples include premium automotive systems and critical defense electronics produced domestically. Here, the primary strategy for mitigating risk involves sustained investments in innovation.

- Resilient Efficiency. The upper-right quadrant contains items for which the strategy focuses on achieving low cost while maintaining resilience through diversified supplier bases. Typical examples include basic components, such as standard industrial fasteners sourced from multiple suppliers across Asia. Although this strategy provides flexibility and cost efficiency, effective risk management requires continuous monitoring of suppliers’ compliance with evolving regulatory and sustainability standards.

- Risky Specialty. The lower-left quadrant comprises specialized, high-tech products characterized by limited sourcing options due to high entry barriers and proprietary technology. Examples include advanced semiconductors and proprietary aerospace components, which often depend on a single supplier and thus are particularly vulnerable to disruption. Companies sourcing products in this quadrant must actively mitigate risk by building long-term—ideally exclusive—partnerships, positioning themselves as preferred customers to secure priority access during disruptions.

- Fragile Competitiveness. The lower-right quadrant includes items sourced primarily for their low cost, typically with minimal backup sources. These products, such as generic consumer electronics and basic packaging materials sourced exclusively from a single, low-cost region, are highly susceptible to geopolitical instability and supply disruptions. Risk mitigation here requires identifying and developing alternative suppliers in different low-cost regions to diversify sourcing options and enhance supply chain resilience.

Companies must also factor in two critical second-order effects: regulatory and geopolitical alignment and sustainability considerations. These factors can amplify risks and potentially shift a sourcing category’s exposure, thereby requiring a deeper strategic analysis. A product that might initially seem to fall within the resilient efficiency quadrant could, for instance, shift toward fragile competitiveness if its supply base is concentrated in regions exposed to geopolitical tensions or tightening environmental regulations.

For example, an industrial solvent may be sourced at low cost from multiple suppliers across Southeast Asia, placing it in the resilient efficiency quadrant. But if those suppliers rely on high-emission production processes, this product will face increasing scrutiny under the EU’s Carbon Border Adjustment Mechanism. As regulatory costs rise, what once looked like a resilient and efficient procurement strategy may prove vulnerable to disruption.

Manufacturing and technology companies typically allocate their total procurement spending to the four categories as follows: roughly 10% to 20% to premium protection, 30% to 45% to resilient efficiency, 15% to 25% to risky specialty, and 20% to 30% to fragile competitiveness, with precise proportions varying by industry and product mix. Although only a relatively small share of spending—in the premium protection quadrant—may be mission-critical, the substantial portion in the resilient efficiency and fragile competitiveness categories demands careful consideration of cost-versus-resilience tradeoffs. Implementing the global sourcing matrix early allows procurement leaders to determine where to deploy their improvement efforts most effectively.

The Four-Pillar Advanced Sourcing Strategy

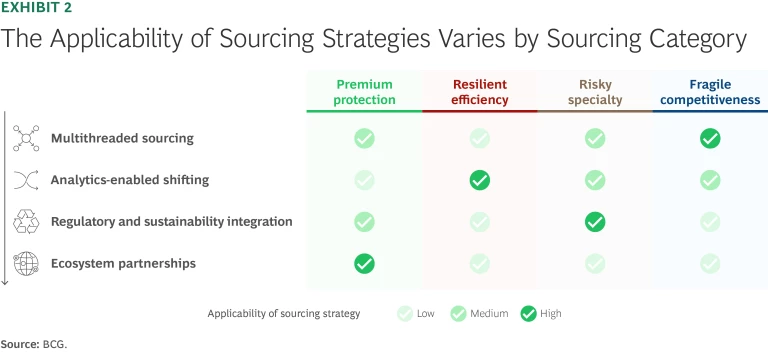

After using the multidimensional global sourcing matrix to categorize spending and associated procurement strategies, the next step is to take targeted actions to address at-risk categories. The four-pillar advanced sourcing strategy provides a structured set of tools and tactics to manage risk and ensure sustained competitiveness in an increasingly volatile environment.

- Multithreaded Sourcing. The first pillar addresses the vulnerabilities inherent in relying on just one or two suppliers. By adopting tri- or quad-sourcing strategies, companies spread their procurement risk more effectively and establish essential backup options. Key actions include gaining deeper visibility into tier two and tier three suppliers and developing regionally diverse backup facilities. The outcome is significantly reduced dependency on individual suppliers, allowing for faster recovery from disruptions.

- Analytics-Enabled Shifting. This pillar emphasizes the need for agility and proactive decision making in rapidly changing markets. In volatile environments, businesses must rely on real-time data to make swift, informed adjustments to their supply chains. By leveraging advanced analytics and AI-driven scenario planning, companies can continuously monitor supplier performance and market trends. The benefit is accelerated, data-driven decision making, enabling organizations to respond proactively to emerging risks.

- Regulatory and Sustainability Integration. The third pillar highlights the growing importance of compliance and sustainability in global sourcing decisions. As regulatory frameworks and sustainability standards become increasingly stringent, companies must embed these considerations into their sourcing and supply chain decisions. Essential actions include integrating regulatory-cost modeling into sourcing evaluations, developing supplier sustainability scorecards for selection decisions, and conducting regular sustainability audits. These practices help future-proof the supply chain against regulatory penalties and improve the company’s overall sustainability profile.

- Ecosystem Partnerships. The final pillar acknowledges that no business can effectively navigate the complexities of today’s sourcing landscape in isolation. Strategic alliances with suppliers, industry peers, and government agencies are increasingly vital for resilience. Companies must forge long-term collaborative relationships, engage in joint product development programs, and invest in local workforce-training initiatives. Such partnerships cultivate a collaborative sourcing network that enhances supply chain resilience and opens new market opportunities.

As shown in Exhibit 2, the applicability of each sourcing strategy varies depending on the specific characteristics and risks associated with each of the four sourcing categories. Items in the premium protection quadrant benefit most from ecosystem partnerships to sustain innovation. For products in the resilient efficiency category, companies must prioritize analytics-enabled shifting to maintain flexibility and cost advantages while actively monitoring supplier performance. For risky specialty products, multithreaded sourcing and integration of regulatory compliance and sustainability factors are crucial owing to limited sourcing options and high exposure to geopolitical risks. Finally, products in the fragile competitiveness quadrant rely heavily on multithreaded sourcing and real-time analytics to diversify sourcing locations, manage disruptions, and safeguard cost efficiency.

The Framework in Action

To illustrate how companies might apply the enhanced sourcing framework, consider a company called Autotech Solutions—a fictional European tier one automotive supplier with a substantial market presence in China and significant sales in the US. Autotech has relied heavily on Asian semiconductor foundries for cost efficiency in its automotive chipsets. But recent geopolitical tensions, such as intensified US export controls and China's push for semiconductor localization, have made the company’s single-source reliance highly vulnerable.

Using the multidimensional global sourcing matrix, Autotech identifies its semiconductor sourcing strategy as falling into the risky specialty quadrant, characterized by specialized products with limited supplier options and substantial exposure to regulatory risk. Applying the four-pillar advanced sourcing strategy, the company implements several targeted actions to address its vulnerabilities:

- Diversifying the Supplier Base. The company engages its integrated-device manufacturer to qualify alternative semiconductor fabrication partners, tapping into European capacity and establishing partnerships with US-based foundries as backups for its current East Asian facility. It also partners with local players in China to serve a growing local-to-local supply base. To mitigate short-term supply disruptions, it builds buffer stocks of critical semiconductors. For essential components where swift change is required, Autotech maintains two distinct bills of materials (BOM)—one using subcomponents sourced locally within Europe and another using Asian-sourced subcomponents—to maximize flexibility and quickly adapt sourcing strategies in response to evolving tariffs and trade policies.

- Deploying AI-Supported Tools and Integrating Data. The company deploys AI-driven dashboards and scenario simulations to continuously track global market trends, tariffs, and supplier performance. This facilitates rapid, data-driven decision making in response to emerging risks. It also establishes an integrated data foundation, linking procurement spending databases directly to the R&D department’s BOM repository. For example, rising tariffs that increase category costs automatically trigger targeted redesign projects in R&D, with the aim of minimizing or eliminating the risk exposure and dependency.

- Factoring in Regulations and Sustainability. Autotech incorporates compliance and sustainability considerations into sourcing decisions. It factors potential tariff impacts directly into cost models and regularly evaluates suppliers against sustainability criteria.

Autotech also reviews its sourcing approach for noncritical components such as molded electromechanical parts, plastics, and rubber belts, traditionally procured from a single, low-cost supplier in China. Although economically advantageous, its single-source dependency posed increased risks from potential tariff hikes and shipping disruptions, placing these products in the fragile competitiveness quadrant. To mitigate these vulnerabilities, Autotech shifts some procurement volumes to Eastern Europe and qualifies additional suppliers in Vietnam and Malaysia.

Elevating Procurement’s Strategic Importance

The evolution of global sourcing strategies has far-reaching implications for procurement functions. Successfully navigating this new environment will require significant shifts in organizational structure, skill sets, digital capabilities, and partnership strategies.

Establish a strong local procurement presence. To achieve greater agility and responsiveness, many companies are moving toward procurement models built around regional hubs—a strategy known as “follow the supply.” By placing category managers closer to key sourcing regions like Southeast Asia, Eastern Europe, or North Africa, companies can closely monitor local supplier conditions and regulatory changes, enabling faster and more informed decision making.

Adopt new skills and roles. Procurement professionals must evolve into supply chain strategists, with expertise in multitier supply chain analysis, risk assessment, and sustainability compliance. New roles, such as “geopolitical risk lead,” are emerging to continuously monitor policy shifts and supplier vulnerabilities. To support this shift, organizations must prioritize training in advanced analytics and digital tools to help procurement professionals manage complex global supply networks.

Pursue digital transformation. AI-driven analytics, real-time dashboards, and digital control towers empower procurement teams to monitor global supply conditions, simulate various scenarios, and adjust strategies rapidly. This transformation not only enhances risk management but also improves cross-functional collaboration among procurement, R&D, finance, and logistics teams.

Build collaborative ecosystems. To create resilient, diversified supply chains, procurement functions must build long-term relationships with suppliers, industry peers, and government agencies. Public–private initiatives, joint ventures, and supplier codevelopment programs help secure a stable supply and foster innovation.

The rapidly changing geopolitical environment compels companies to fundamentally rethink their global sourcing strategies. Traditional cost-driven approaches no longer suffice amid rising geopolitical tensions, stringent regulatory demands, and increasing sustainability expectations. By proactively embracing resilient, agile, and compliance-focused procurement models, companies can build future-ready sourcing networks that unlock long-term growth. Companies that act decisively now will not only safeguard their supply chains but also position themselves to become the market leaders of the future. In an increasingly fragmented global market, procurement will be the strategic function that differentiates companies and drives their sustained competitive advantage.