Every year, 2 million women in the US enter menopause, each one experiencing hormonal changes that can affect the brain, heart, bones, and mental well-being. However, only 60% of women with significant menopause symptoms seek medical attention, and of those, only 25% are treated.

Women going through menopause are increasingly well informed and vocal about their needs, creating unprecedented demand for high-quality midlife care. Failing to deliver adequate treatment isn’t just a critical care gap—it’s a missed business opportunity. If all women with moderate to severe menopause symptoms received sufficient treatment, the annual market for US menopause health care could grow eightfold, to almost $40 billion, by 2030.

Failing to deliver adequate treatment isn’t just a critical care gap—it’s a missed business opportunity.

Momentum to improve care for women at midlife is already starting, signaling that a system-wide transformation is underway. First movers in the midlife health sector that deliver swift, impactful solutions to close care gaps will be rewarded. For that to happen, changes are needed to earn the allegiance of women underserved by the current system.

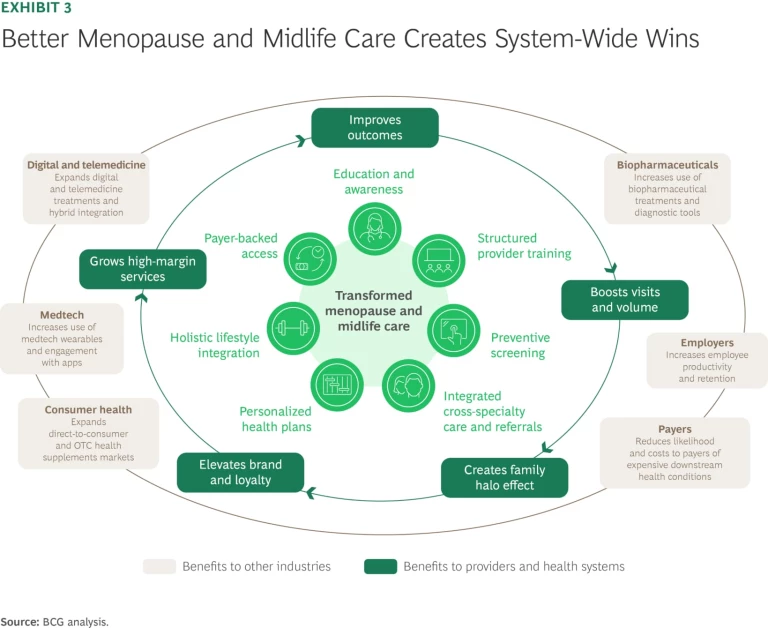

The changes can start with doctors and other health care providers, who are in the best position to deliver quick wins that can provide momentum for longer-term, system-wide transformation. To start, providers need better training on the diagnosis, treatment, and broad impacts of declining hormone levels on women’s lives. Health systems can gain market share by transforming the patient experience to be more proactive, personalized, and integrated, including by establishing centers that specialize in caring for women at midlife. Payers can improve their economics by preventing downstream conditions that can result in expensive, acute care. Biopharmaceutical, medical technology, and consumer health companies can generate growth by developing evidence-backed interventions that improve health outcomes for women and by collaborating on data-based innovations.

Stay ahead with BCG insights on the health care industry

Understanding Menopause

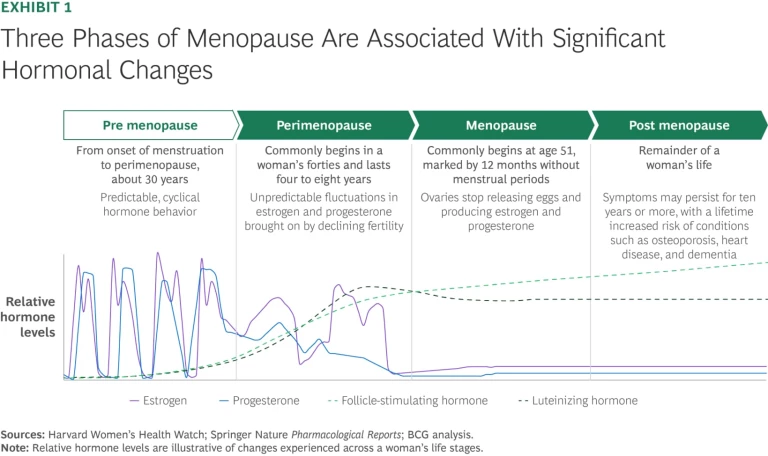

The menopause transition begins with perimenopause, when women reach the early stages of midlife, typically in their forties. During perimenopause, levels of sex hormones start to fluctuate, leading to a variety of symptoms that can last an average of four to eight years, and in some women, ten years or more. A woman is considered to be in menopause when she stops menstruating for 12 consecutive months, an indicator of a drastic reduction in estrogen and progesterone and an increase in follicle-stimulating hormone and luteinizing hormone. In some women, menopause symptoms can continue far beyond their last menstrual cycle, even persisting for the rest of their lives. (See Exhibit 1.)

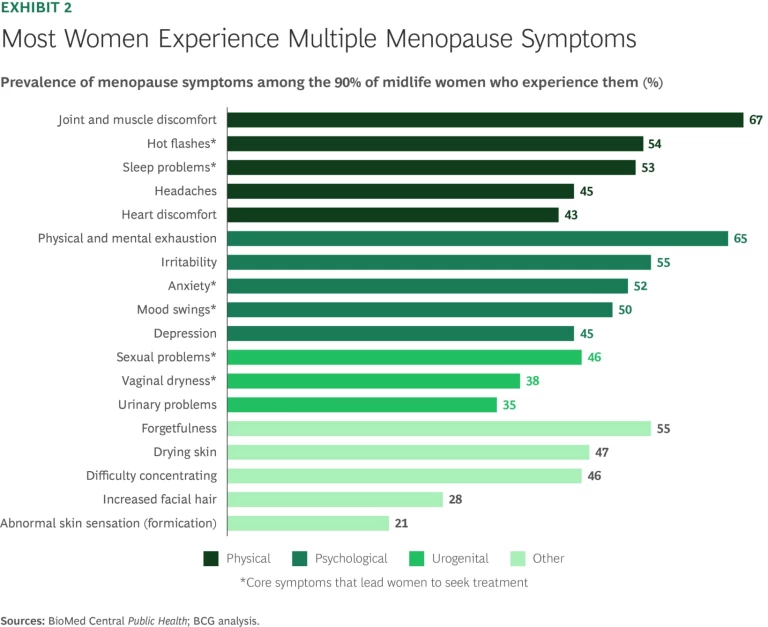

The shift in sex hormones that occurs during menopause has a dramatic effect on a woman’s body, almost like puberty in reverse. Estrogen, in particular, is a key player in the menopause journey. Among other things, it helps regulate body temperature, mood, bone density and growth, and urogenital health, and it protects cardiovascular and cognitive function. Declining estrogen can trigger a wide range of symptoms, including hot flashes, joint and muscle pain, physical and mental exhaustion, irritability, forgetfulness, and sleep disturbances. In the US, up to 90% of women experience menopause-related symptoms, and half report more than five distinct issues. (See Exhibit 2.)

Although these symptoms are the most visible expressions of menopause, they are not the whole story. A dramatic decline in sex hormones also increases other long-term health risks, which can include the following:

Cardiovascular Disease. A drop in estrogen increases the risk of developing cardiovascular disease approximately threefold. Early menopause can accentuate this risk: women who begin menopause prematurely have a 33% higher risk of heart failure in the nine or so years following the onset of menopause.

Behavioral Health. High variations in levels of sex hormones are strongly associated with increased symptoms of depression. In fact, women in perimenopause are 40% more likely than premenopausal women to experience symptoms of and be diagnosed with depression.

Bone Health. Declining estrogen levels can cause women to lose up to 20% of their bone density in the five to seven years after menopause, leading to osteoporosis. About half of all women over the age of 50 will experience a bone fracture due to osteoporosis.

Cognitive and Brain Health. Lower estrogen levels are associated with increased risk of cognitive issues. Two-thirds of women report memory complaints during the transition through menopause, and women are nearly twice as likely as men to develop Alzheimer’s disease. Emerging research suggests that frequent hot flashes, particularly at night, may be associated with Alzheimer disease biomarkers, though it is not yet known if the association is causal.

Given that menopause increases women’s risk of serious conditions, treatments for women at midlife must move beyond merely managing menopause symptoms to include understanding, preventing, diagnosing, and treating broader health risks.

Treatments for women at midlife must move beyond merely managing menopause symptoms to include understanding, preventing, diagnosing, and treating broader health risks.

Beyond pure health outcomes, untreated menopause symptoms can hinder women’s ability to meet their professional and personal responsibilities. Studies show that perimenopause and menopause can result in missed workdays, which can disrupt women’s careers. Untreated symptoms have prompted approximately 20% of all women in the US who are in menopause to leave or consider leaving a job, driving increased demand for menopause-specific work benefits. By one estimate, missed workdays due to untreated menopause symptoms results in $1.8 billion in lost wages annually. That number rises to $26.6 billion with the inclusion of additional menopause-related health care costs borne either by individuals or payers.

The Current Approach to Menopause Care Is Broken

Menopause is often mischaracterized as a short-term phase with limited symptoms that is a natural part of life. This narrow view, combined with other health sector shortcomings, has created widespread gaps in diagnosis and care. The failures are especially pronounced among Black women, who are less likely to receive treatment despite reporting more severe symptoms.

A closer look reveals the persistent barriers that have contributed to a broken system.

Shortages of Providers, Access, and Specialized Offerings. Lack of access to doctors in multiple specialties and limited time during appointments contribute to reduced midlife care. In one example, more than a third of US counties were reported to have no practicing obstetricians and gynecologists (OB/GYNs), and in areas that did have them, appointments were too short or not dedicated to discussing menopause symptoms. Apart from OB/GYN practices, most health systems do not have primary care doctors, internists, or specialists who offer integrated or dedicated menopause care. A handful of specialized programs for midlife women are concentrated in major US cities, but similar initiatives are scarce elsewhere. Even among the top 20 US hospital systems, more than a third lack specialized programs for midlife care for women, resulting in missed or delayed diagnoses.

Insufficient Provider Training. Only 31% of US OB/GYN residency programs include a menopause curriculum, and most of those offer only a lecture or two. Less than 7% of residents in key specialties such as family medicine, internal medicine, and obstetrics and gynecology feel prepared to support menopausal patients. As a result, medical providers don’t bring up midlife and menopause care with their patients to identify symptoms and address health risks. The Menopause Society Certified Practitioner program offers an opportunity to build expertise, but to date, its reach has been limited. As of fall 2025, the program had certified less than 1% of actively licensed US doctors. In New York state, where more than 4.5 million women are over the age of 45, the program has certified only about 200 of roughly 80,000 licensed doctors. Of those, the vast majority are OB/GYNs; only about 15% practice family or internal medicine, even though those types of doctors routinely provide midlife care to women.

Outdated or Misdirected Scientific Research. Menopausal hormone therapy (MHT), also known as hormone replacement therapy, describes the use of estrogen, with or without progesterone, to treat vasomotor symptoms associated with the menopause-related decline of estrogen and other hormones. MHT is the gold standard for menopause symptom treatment. It is proven to address key health risks that midlife women experience, including the risk of colon cancer, osteoporosis, bone fracture, genitourinary syndrome of menopause, and lower cognitive performance. Despite that, the use of MHT dropped significantly after a flawed 2002 Women’s Health Initiative study misstated its risks. From the mid-1990s to 2022, the number of postmenopausal women using MHT plummeted, from more than 40% to 4%. It effectively wiped out demand, left a generation of women without treatment, and left a generation of health care providers with limited or no MHT prescribing experience.

Stigma and Lack of Awareness. Although many women recognize common symptoms such as hot flashes and mood swings, far fewer understand the long-term health risks associated with menopause, including bone loss and cardiovascular disease. Stigma also silences many. Surveys show that approximately 40% of women report shame, and more than 80% report experiencing stigma around menopause. At work, menopause can be viewed as weakness, and socially it can signal aging or decline. And discussing the subject with providers can feel awkward or uncomfortable. Without clear information and the confidence to act on it, women may not seek treatment or may seek it for isolated symptoms rather than to address the underlying hormonal changes, missing the opportunity to protect their long-term health and well-being. While stigma remains a barrier, awareness is improving, and demand for midlife care is increasing.

Inadequate Insurance Coverage. Limited reimbursements and outdated insurance policies further restrict access. Many insurance plans require prior authorization for MHT, limit coverage for the therapy to a month at a time, or do not cover the full dosages that health care providers recommend. Insurers don’t cover testosterone treatment due to lack of FDA approval, and estrogen-based therapies still carry obsolete warning labels that deter prescriptions and usage.

How to Transform Menopause Care

Although barriers to better treatment persist, change is possible. A model that is proactive, personalized, and integrated could shift the standard of care and unlock value across the health care sector. This transformation needs to incorporate menopause education for providers and patients, proactive screenings, more specialty menopause providers and referral networks, and improved payer reimbursement.

The business case for transformation is compelling. For providers, better care can improve health outcomes that in turn can create significant value by boosting patient footfall and volume, demand for high-margin services, and brand and loyalty. Improved care for midlife women also allows providers to expand their influence over the health care decisions that women make for their households. For payers, better care would prevent downstream conditions and costs and appeal to employers, given the potential for improved workforce productivity and retention. (See Exhibit 3.) For biopharmaceutical, medtech, and consumer health companies, developing evidence-backed interventions could expand markets by tens of billions of dollars within the next five years. (See “Opportunities to Improve Menopause and Midlife Care in Three Important Market Segments.”)

Opportunities to Improve Menopause and Midlife Care in Three Important Market Segments

Biopharmaceuticals. Renewed support in research and medical communities for menopause hormone therapy (MHT) and FDA approval for newer, nonhormonal treatments for menopause-related symptoms represent a market opening for biopharmaceutical companies. With appropriate rates of diagnosis and treatment, sales of MHT, nonhormonal medications, and other biopharmaceuticals to treat menopause symptoms could reach $16 billion by 2030. The portion of midlife women using MHT is less than 5%, but signs point to a resurgence. Common MHT options have expanded to include tablets, patches, creams, gels, rings, and inserts. The biopharma company Daré Bioscience is testing the first MHT vaginal ring treatment with estrogen and progesterone. Biopharma companies are also investing in better menopause education. In 2024, Pfizer announced a competitive grant program to fund provider education on menopause hormone therapy.

While MHT plays catchup, nonhormonal medications are expected to be a driving force in biopharma sales growth. Drugs that treat vasomotor symptoms such as hot flashes and night sweats are the main contributors to future menopause biopharma market growth. In the next five years, sales of nonhormonal vasomotor symptom treatments, such as Veozah from Astellas, and Elinzanetant, which Bayer is testing, are expected to surpass $1 billion. Other non-hormone treatments target specific symptoms, such as Brisdelle (paroxetine), a selective serotonin reuptake inhibitor used to treat hot flashes, and Osphena (ospemifene), which is used to treat menopause-related vaginal dryness.

Biopharma companies can gain additional market share by directing R&D toward less well understood symptoms and health risks (including cognitive difficulties and eye health issues), collaborating with health care providers on clinical trials, expanding therapeutic treatments to include perimenopause symptoms, and framing menopause as a condition that can be treated through medication. In addition, companies must plan how to scale production to accommodate the expected increase in women who use prescription medications to treat symptoms. Companies can consider investing in patient and provider education to reduce hesitancy and activate the market.

Medical Technology. In the past, medical technology companies didn’t put treating menopause systems on the same level of opportunity as developing treatments for other women’s health conditions. The popularity of wearables and at-home diagnostic tests has changed that. It’s ushering in a new era for medtech-based products for early intervention and personalized menopause management. By 2030, the market for menopause-related wearables and other medtech is forecast to reach $4 billion.

Part of medtech’s appeal is the power it gives women to act rather than react when managing their health. Devices such as Ōura Ring and soon-to-launch Peri allow women to track their hormone levels and menopause-related symptoms. Women who used at-home tests and trackers for family planning are using similar digital tools and apps to monitor their hormone levels. They can use devices from Modern Fertility, LetsGetChecked, and Thorne to identify hormone changes that indicate perimenopause.

Medtech companies can use interest in wearables to expand what they offer. By cross-linking data from wearables and test results, companies can create services for women to track their transition through menopause. Companies can share data from wearables and at-home tests with biopharmaceutical makers to design clinical trials. Medtech companies also can use data to observe how different age groups or segments adhere to self-monitoring regiments.

Consumer Health. As women stopped using MHT, market activity suggests that some may have attempted to fill the gap with vitamins, supplements, and hormone test kits, which have varying levels of scientific evidence to support their effectiveness. Nearly half of US women in menopause have used supplements to manage symptoms. Supplements and test kits are driving sales of menopause-related consumer health products that, with appropriate scientific evidence, diagnosis, and uptake rates, could reach $12 billion by 2030.

More supplement makers are tailoring products to either perimenopause, menopause, or post menopause, and demand is especially strong for products that are scientifically proven or backed by clinical evidence. However, scientific backing for supplements remains inconsistent, and improving the evidence base represents a promising market opportunity for consumer health players. Aside from that, the market is growing but fragmented, giving players the chance to differentiate themselves by strengthening claims for products that treat specific symptoms. Direct-to-consumer and online sales have led health care product growth, but traditional retailers are catching up.

It’s not necessary to wait for a complete system overhaul to create meaningful change and capture value. Children were once treated as small adults until the medical field recognized that they had distinct physiology and care needs, leading to the birth of pediatric medicine. The change came in small steps, including the implementation of training, growth charts, and child-specific screenings.

Midlife health care is at the same inflection point and can follow a similar trajectory. Players throughout the menopause ecosystem can take incremental, targeted steps to raise the standard of care while laying the groundwork for expanded access and improved health and economic value. Various menopause and midlife women’s health societies are beginning to pave the way for a transformed model through physician training initiatives, endorsements of cross-specialty care guidelines, and events and webinars to expand patient awareness.

Providers are well positioned to activate a transformed care model. They can start now with practical, high-impact moves and new approaches and scale what’s effective. Even modest interventions can yield rapid improvements in outcomes and patient satisfaction and generate proof points that drive long-term institutional shifts. Here are some of those practical starting points.

Improve provider training and readiness. Health systems can build menopause training into the regular care practices for providers of all types. For primary care clinicians, this could include short continuing medical education modules, certification courses, and role‑specific refreshers. Subspecialists can get trainings to recognize how hormonal changes intersect with their fields, so they don’t miss or misattribute symptoms. Nurse practitioners, physician assistants, and clinic nurses can acquire triage tools and counseling scripts to handle first-line questions, and pharmacists can reinforce adherence to medications and explain newer therapies. Counseling templates in electronic medical records (EMR) systems can support training at the point of care, making discussions about menopause more consistent and actionable. Training can strengthen trust, differentiate a practice, and lay the foundation for subspecialties that attract new patients and referrals.

Expand clinical workflows and tools. In the absence of widely accepted guidelines for proactively screening women at midlife, providers can make menopause part of an annual checkup beginning at age 40. At this appointment, a provider can use a short checklist supported by EMR prompts and simple, patient-friendly surveys to ask questions and outline treatment options and health risks. Such a routine can normalize the conversation about menopause and removes the onus from women to bring up the subject.

Providers can include assessments for associated risk factors related to cardiovascular, bone, cognitive, and behavioral health needs. For example, a provider could incorporate the formal fracture-risk (FRAX) tool into the checklist to determine if a patient should get a dual-energy X-ray absorptiometry (DXA) bone scan prior to the typical age of 65. They could add an atherosclerotic cardiovascular disease (ASCVD) risk estimator and routine labs to assess a patient’s cardiovascular health, and for someone who reports memory concerns, a brief cognitive evaluation consistent with current US Preventive Services Taskforce guidance. Including such assessments in an annual checkup turns menopause care from piecemeal and reactive to systematic and preventive. It also strengthens the doctor-patient relationship, which can improve patient retention and lead more women to seek out the provider for subsequent care, increasing volume.

Including assessments in an annual checkup turns menopause care from piecemeal and reactive to systematic and preventive.

Increase treatment options. For women who need treatment for menopause symptoms, clinicians can present the full range of available options that are safe, effective, and evidence based. Those include multiple forms of MHT, along with newer, nonhormonal alternatives. The alternatives include NK3 receptor antagonists for vasomotor symptoms; low‑dose selective serotonin reuptake inhibitors and serotonin and norepinephrine reuptake inhibitors and selective estrogen receptor modulators for bone and urogenital health; and holistic lifestyle interventions. (See “Menopause Hormone Therapy Is Poised for Growth.”)

Menopause Hormone Therapy Is Poised for Growth

- Up to 3.7 million cases of coronary heart disease

- Up to 2.2 million new diagnoses of type 2 diabetes

- Up to 400,000 women suffering from fatalities connected to osteoporosis-related hip fractures and another 500,000 from being admitted to long-term care facilities for the same reason

- Up to 1.6 million instances of Alzheimer’s disease

- Up to 27 million urinary tract infections

Explore specialty and virtual care models. Medical groups and health systems that have pioneered specialized health care options for women at midlife show how the approach works. The Cleveland Clinic’s Center of Specialized Women’s Health integrates gynecology, endocrinology, and cardiology with a comprehensive menu of outpatient services and education. New York University’s Langone Center for Midlife Health and Menopause is a specialty clinic that, among other things, offers 45-minute patient consultations and customized treatment plans and streamlines referrals to specialists in other NYU Langone treatment centers for related issues such as bone loss and depression. These models differentiate health systems and can serve as referral hubs for other specialties.

Emerging virtual health care providers are an example of a relatively low-cost opportunity for new players to enter the market. Virtual providers such as Midi Health, Maven, and Carrot with online menopause consultations, prescriptions, and related services contribute to a market that’s already valued at more than $500 million. As these types of companies mature, they may offer personalized care plans with integrated symptom management, preventive screening, and long-term risk reduction. They could gain traction through strong referrals and elevated reputation to the point where they could become centers of excellence in the future.

Share data on learnings. Tracking and sharing improvements in health outcomes can reinforce the need for better menopause care. Health systems can chart their progress by tracking such EMR data as screening, follow-up rates, and days from first complaint to plan. They can collect data on sleep, mood, and symptoms with minimal extra effort by asking patients to fill out short surveys. Aggregating, analyzing, and sharing the data and survey results in internal forums, publications, or on clinical networks can help normalize menopause treatment as preventive care, reduce stigma, and build the case for broader support from payers and employers. Publishing data-based outcomes can establish providers as leaders in midlife care, which could enhance their brands in a competitive market.

The Opportunity to Improve Care Beyond Providers

Providers play a pivotal role, but other health care stakeholders can make changes to close the menopause care gap. The opportunities differ for each:

Payers. Payers can reduce long-term health costs by making care easier to access and covering recommended therapies and screenings without unnecessary prior authorizations. Investing in preventive care for midlife women can lower the incidence and severity of costly chronic conditions such as heart disease, osteoporosis, and dementia and could lead to measurable return on investment over time. When competing for employer contracts, better menopause-related coverage and benefits could differentiate a payer from other companies.

Employers. Employers can improve productivity and workforce retention by integrating menopause care into employee benefits, offering flexible work policies, expanding medical leave options, and creating supportive environments. US employers can join programs such as The Menopause Society’s Making Menopause Work initiative and adopt MiDOViA and Henpicked’s Menopause Friendly Accreditation, which has been widely embraced in the UK. Employers can also set up employee resource groups to support midlife women as they balance health changes and the demands of work.

Biopharmaceutical, Medtech, and Consumer Health Companies. Other entities can unlock new revenue streams by expanding existing or developing innovative new evidence-based menopause diagnostics, treatments, over-the-counter solutions, self-management, and patient engagement tools.

The call to transform menopause care is real and urgent, driven by a generation of women who expect proactive, personalized treatment. Providers and other health sector players that embrace these priorities and take steps to act on them will set a new standard of care. They will improve health outcomes and capture the benefits of a growing, underserved market—and have the chance to tap into a multi-billion-dollar opportunity.

The authors wish to thank Nicole Barman, Ricky Cordova, Julie Dethier, Sweta Patel, Monica Schwarm, Becky Shapiro, and Anna Zimmerman for their contributions to this article.