Methodology

From April to May 2025, BCG surveyed more than 90 senior executives involved in digital and AI in the construction sector across Denmark, Finland, Norway, and Sweden. Respondents represented the full value chain: asset owners and managers, design and engineering firms, construction and EPC companies, and service and maintenance providers. The survey assessed maturity across five dimensions: strategy and leadership alignment, IT and data foundations, people and operating models, adoption of digital and AI technologies, and realized business outcomes. Our insights in this article are based not only on the survey findings but also BCG’s experience in the sector.

BCG’s Global Study Confirms That Companies Making Progress in Digital and AI Are Reaping the Rewards

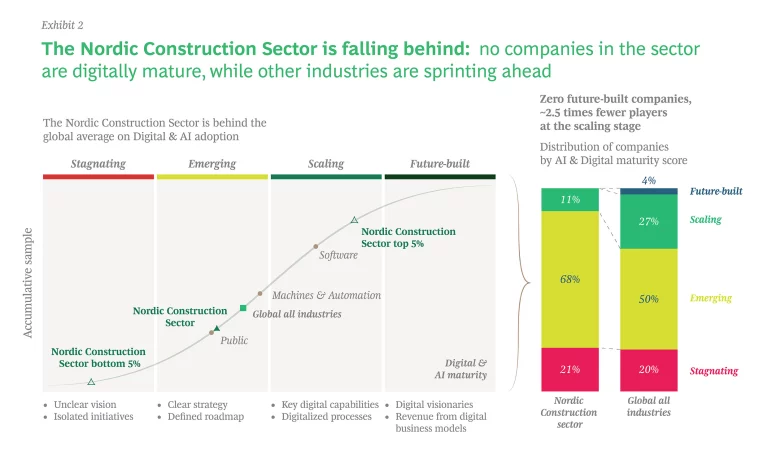

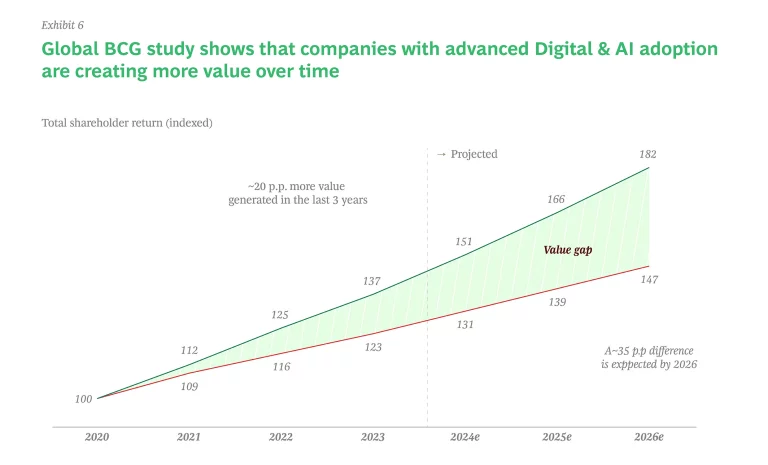

Digital and AI technologies are no longer optional; they are essential levers of competitiveness. Across industries, companies with higher levels of digital and AI maturity are consistently outperforming their peers in revenue growth, operational efficiency, and shareholder return. However, in the Nordic construction sector, we see a stark disconnect: digital ambition is high, but impact is alarmingly low.

BCG’s latest Build for the Future study gathered input from more than 90 senior leaders across the Nordic construction value chain, including asset owners, design and engineering firms, construction and EPC players, and service providers. It reveals a concerning pattern. While nearly all companies have begun integrating digital and AI into their strategic agendas, the majority remain in the early stages of execution and have delivered only limited value.

Stay ahead with BCG insights on urban planning

Lots of Talk About Digital and AI, but Not Enough Action

Compared with global benchmarks across industries, the Nordic construction sector lags behind in digital and AI implementation. Fewer than half of the companies in the region have moved beyond early experimentation, yet none qualify as “future-built”—the most advanced maturity tier in BCG’s framework. The result is a widening performance gap as the more digitally advanced firms pull further ahead.

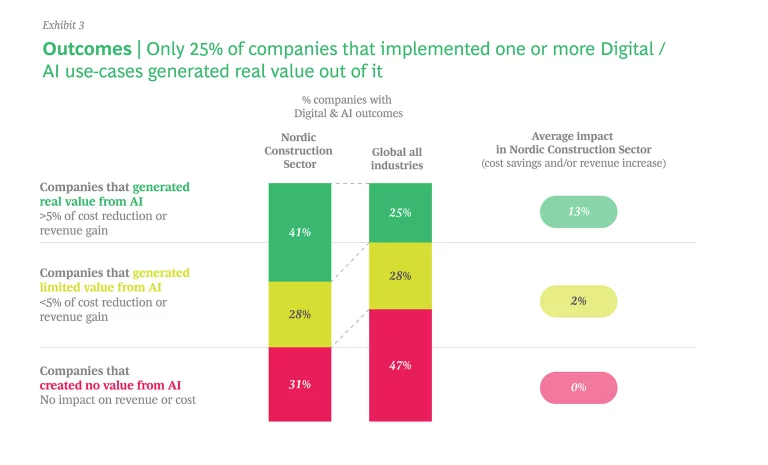

While more than 60% of Nordic construction companies have implemented at least one digital or AI use case, only one in four reports generate any meaningful business impact. That means four out of five companies in the Nordic construction sector are experimenting with technology but are not turning it into measurable value.

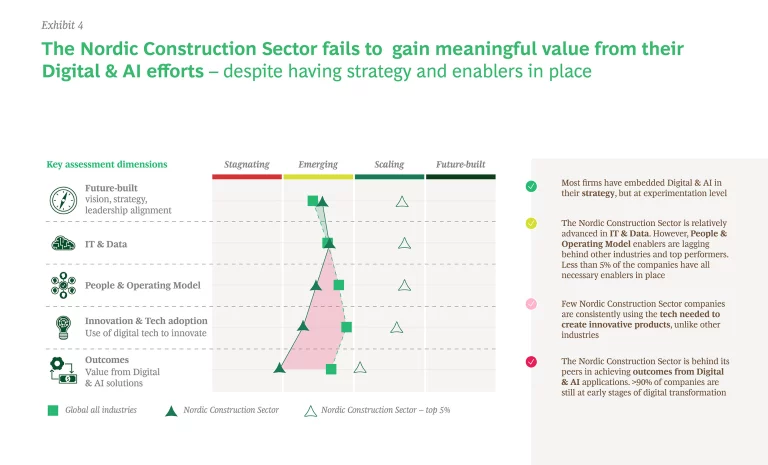

The root causes are complex, but the most significant barrier is not technology itself. Instead, it is the readiness of organizations and their ability to build a balanced portfolio of digital and AI use cases. Many companies already have basic IT and data foundations in place but have not mobilized the talent, operating models, and governance structures required to scale digital solutions and sustain impact. Change management and leadership support is another area where most companies fall short.

Digital and AI Value Is Unlocked by a Balanced, Value-Driven Approach

The impact of these gaps is clear. While firms talk about becoming data driven and digitally enabled, few have managed to embed Digital and AI technologies into everyday workflows. Most initiatives remain at the pilot stage, disconnected from business outcomes and without scaling strategies in place.

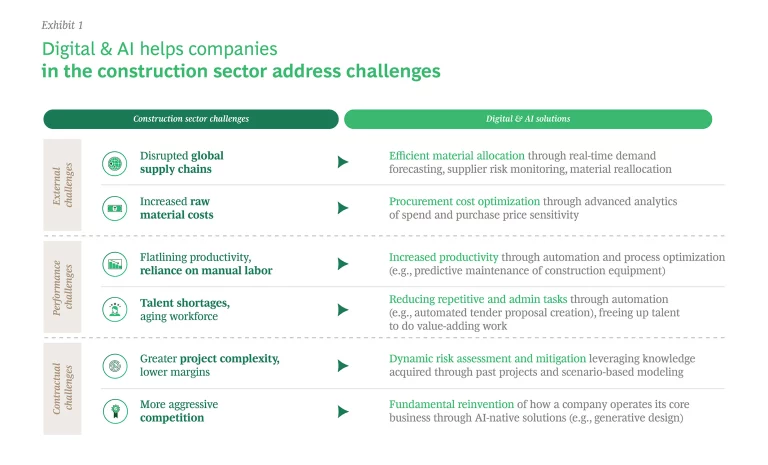

Digital and AI are uniquely positioned to help the construction sector tackle its most pressing external, performance, and contractual challenges. From mitigating supply chain disruptions and rising material costs through smarter procurement and material allocation to boosting productivity and reducing administrative burdens via automation, the use-case potential is broad and tangible. Leading companies are slowly starting to apply AI to address talent shortages, manage project complexity, and rethink how they operate in increasingly competitive environments. These are not theoretical ambitions—they are real solutions, ready to be deployed.

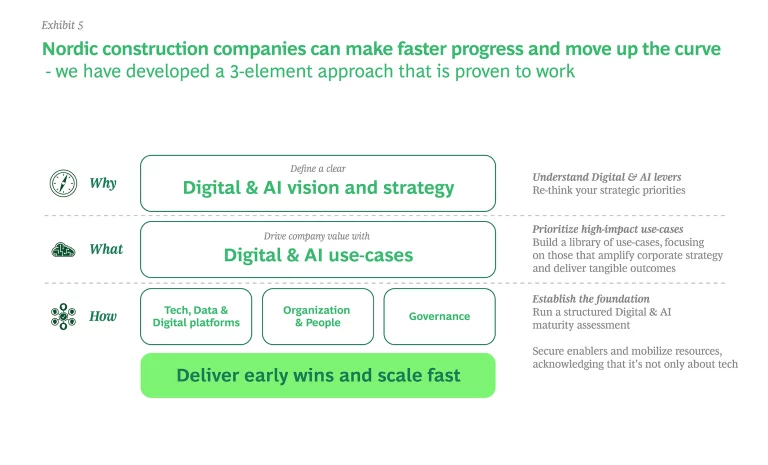

BCG’s research shows that companies that successfully implement digital and AI achieve a revenue uplift or cost reduction of around 13%. Maximum value from digital and AI is unlocked when companies align three core elements: a clear and enterprise-linked digital and AI vision; a balanced portfolio of high-impact, value-generating use cases; and a strong array of enablers, including the right technology, data, talent, and governance.

The most urgent priority for the Nordic construction sector is the “what.” The first step is to define and build a balanced use-case portfolio that incorporates three elements:

- Deploy everyday AI tools that drive productivity gains of 10%–15% by streamlining operations and eliminating inefficiencies.

- Reshape initiatives to transform how value is created in core business areas, such as design, planning, procurement, and execution, delivering ROI improvements of up to 30%.

- Invent bold, AI-native solutions that enable new value propositions and business models, redefining how companies operate and compete.

Every company’s journey will be different as it strives to build a balanced use-case portfolio that calibrates each of the three elements to its strategic priorities and stage of digital maturity.

BCG has identified over 40 high-impact use cases deployed by leaders globally that demonstrate the opportunities digital and AI represent and would benefit the Nordic construction sector. Examples include the following:

- An AI tool that analyzes historical procurement and accounting documents for discrepancies and identifies both opportunities to claim back past overspend gaps in and processes to prevent future leakage.

- An AI-powered tendering and planning optimization toolkit that uses historical data to improve bid accuracy, prioritize the most promising opportunities, and forecast cost overruns and scheduling risks. This solution boosts win rates while increasing margin reliability with 10%–15% EBITDA improvement.

- A digital collaboration platform that integrates stakeholders across the value chain in real time. With embedded AI, the platform accelerates decision-making, reduces design clashes, and enables faster, more coordinated planning, design, and project monitoring.

These approaches are already delivering results. Nordic construction firms don’t need to invent use cases; they just need to select and embed them.

It’s Time for a Change!

There is still mounting urgency for action. As the digital frontrunners surge ahead, the cost of standing will only grow. By 2026, the projected performance gap between digitally advanced and lagging firms will exceed 35 percentage points in total shareholder return.

The good news is it’s not too late. With commitment from the C-suite, and the right vision, use-case roadmap and organizational foundation, Nordic construction firms are still in a good position to shift from planning to performance in digital and AI.

When treated as strategic assets and backed by the right enablers, digital and AI technologies are powerful catalysts for growth, efficiency, and innovation.

The future is being built now. It’s time to make digital and AI deliver.

Acknowledgements

We would like to thank the following colleagues for their valuable input to this study: Chao Wei Lai, Andrew Newsome, Esben Wilken, Ellen Gaunby, Daniel Yeates, and Martin Goldmann. Their contributions have been instrumental in shaping the findings.