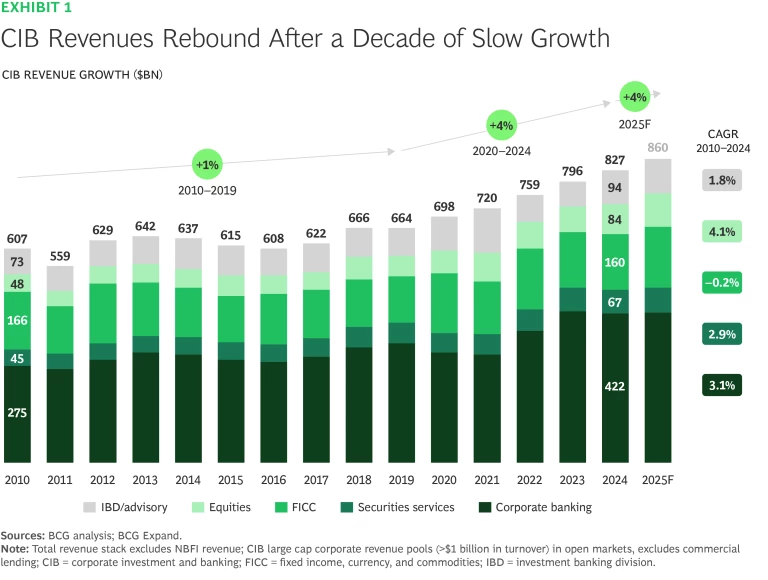

Corporate and investment banking (CIB) marked another year of growth in 2024, with total revenues rising 4% to $827 billion—$989 billion including non-bank financial institutions. Momentum has been strongest in investment banking, with exceptional growth in equity capital markets (up 54% YoY) and debt capital markets (up 39% YoY), and in equities (up 18% YoY). By contrast, fixed income, currencies, and commodities (FICC) were flat, and corporate banking revenues declined. (See Exhibit 1.) Growth continued into 2025, with H1 revenues up 5% YoY. Yet behind the rebound lies a sector in flux.

Four Structural Shifts Reshaping CIBs

Today, the industry faces foundational changes that are reshaping where and how value is created:

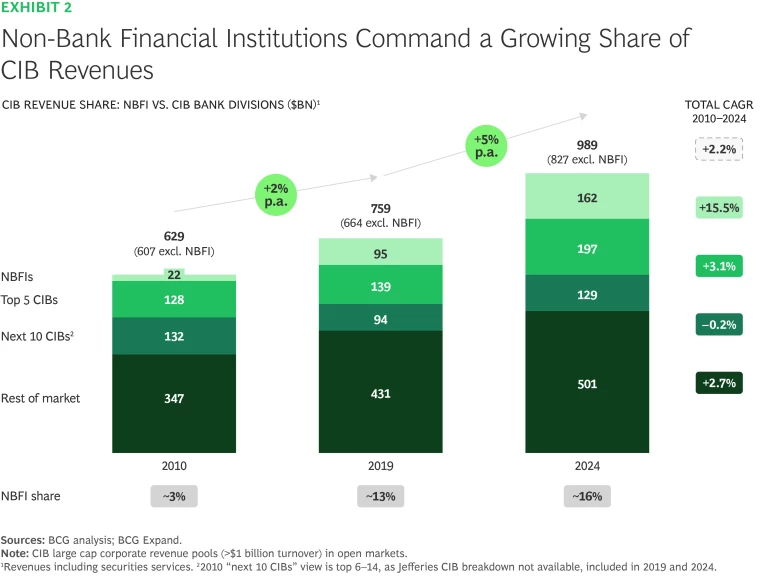

- Private markets and NBFIs extend their reach. In 2010, non-bank financial institutions (NBFIs) accounted for less than 5% of global CIB revenues; today they exceed 15%. Their reach now spans lending, advisory, and markets activity, and their share continues to expand. (See Exhibit 2.)

- AI adoption expands beyond isolated use cases. Leading firms are launching CEO- and CIO-backed transformation programs focused on four to six initiatives with clear P&L impact—giving them defined charters, owners, and enterprise scale.

- Digital assets and tokens see growing institutional interest. Stablecoins are projected to hit $3 trillion in market capitalization by 2030. Tokenization of real-world assets is gaining traction, especially in repo, collateral, and structured products.

- Geopolitical shifts alter the global financial map. Trade is fragmenting, reserve strategies are diversifying, and de-dollarization is advancing. Issuance and liquidity flows are becoming more regional, altering the competitiveness of financial centers and forcing a rethink of network design and regulatory posture.

CIB in 2030—A Scenario-Based Outlook

The near-term outlook for capital markets is stable. But look five years out, and the ground gets less certain—and more consequential. Because linear forecasts don’t work, leaders need to plan a range of possible futures.

Our report outlines three plausible scenarios for 2030.

- Base Case. In this scenario, secular industry trends continue at current pace. NBFIs reach up to 20% of CIB fee pools without regulatory hinderance; e-trading to surpass 70% of trading volumes.

- Surge in Tech and Alts. This sees an acceleration of NBFIs, AI, and digital asset adoption, which in turn will shrink corporate and investment banking revenues for incumbents as NBFIs gain share.

- Shift to Regional Capital Markets. Here, capital markets will increase regional fragmentation and value shifts toward EMEA and APAC. Should geopolitical fragmentation intensify, we’ll see growing divergence in regulatory regimes, capital mobility, and financial infrastructure.

Stay ahead with BCG insights on financial institutions

Imperatives for CIBs and Capital Markets

Advantage will favor firms that act early and decisively, scale selectively, and build resilience into their foundations. Decisions made in the next 12 to 24 months will shape competitive positioning for the decade ahead. To balance near-term performance with long-term resilience across multiple futures, banks must adopt a portfolio-based strategy.

Maximize potential in the core—50% of your focus and effort. Reinforce areas where you are already strong; consolidate leadership; scale proven winners:

- Redesign core workflows using agentic AI.

- Deploy AI copilots to free banker capacity.

- Modernize cash, liquidity, and lending infrastructure.

- Rationalize coverage based on forward RoTE.

- Build scalable platforms for core delivery.

Scale high-RoTE adjacencies—25% of your focus and effort. Accelerate promising businesses close to core; leverage brand and client access:

- Treat segment plays as full-scale businesses.

- Build capital markets capabilities selectively and partner.

- Unify onboarding, credit, and post-trade platforms.

Place targeted bets on emerging domains—25% of your focus and effort. Invest in new/disruptive areas; create long-term option value and relevance:

- Form select, deep strategic partnerships.

- Commit to growth in emerging capital pools.

- Build token-native product lines.

- Use M&A to remove execution roadblocks.

Conclusion

The conditions are in place for bold, informed action. Scenario-based planning can sharpen the signal, but advantage will come down to how leaders allocate capital, stretch capabilities, and shape the organization to respond—not react—as new conditions emerge.