The path of global electric vehicle (EV) adoption has splintered. Where previously annual sales projections through 2030 across China, Europe, and the US were heading in the same upward direction (though with a time lag from one to the next), our analysis now reveals a marked divergence between these regions. The Chinese market remains buoyant. Yet, we are currently seeing rockier growth in Europe and the US caused by factors including changes in federal policies and a poorer fit between product and price.

BCG’s Powertrain model enables us to predict future trends in vehicle sales. It uses a data-based approach that combines information on total cost of ownership (TCO), recorded sales, planned programs, regulations, and survey-based consumer insights. As well as signaling a more challenging environment for EV makers in key markets, the model has also identified that entry-level buyers are being underserved in the US and that a growing North-South divide is emerging in Europe.

Stay ahead with BCG insights on industrial goods

BEVs Are Gaining Traction in Key Markets

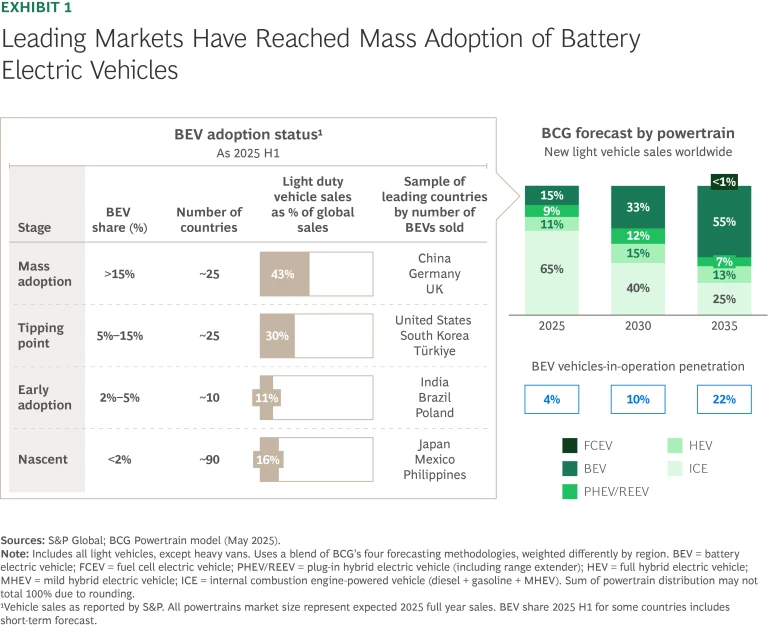

Despite greater variability across markets, global EV sales continue to grow. Out of the approximately 90 million new light duty vehicles (cars and vans) sold worldwide in 2024, pure battery electric vehicles (BEVs)—at 13% of the total—made up a bigger share than ever. (See “Glossary.”) In leading markets including China, Germany, and the UK, BEVs accounted for over 15% of light duty vehicle sales in the first half of 2025—a key indicator that they have become mass-market products—although the US remains at the tipping-point stage ahead of mass adoption. (See Exhibit 1.)

China remains the standout scale player. In the first half of 2025, Chinese sales of plug-in EVs—BEVs, plug-in hybrid electric vehicles (PHEVs), and range-extended electric vehicles (REEVs)—were 1.5 times all other global sales combined. Meanwhile, traditional OEMs recaptured market share worldwide, adding nearly 1 million BEVs compared to the first half of 2024 and outpacing new energy vehicle (NEV) OEMs.

By 2030, BEVs are projected to make up one-third of global new vehicle sales but just 10% of vehicles in operation (VIO). Full hybrid electric vehicles (HEVs), PHEVs, and REEVs will together account for 27% of new vehicle sales by then. However, according to our latest forecast, sales of all plug-in EV types (BEVs, PHEVs, and REEVs)—at 45% of the total—will be 3 percentage points lower in 2030 than we predicted in our 2023 outlook. Developments in Europe and the US have caused us to reduce our projection.

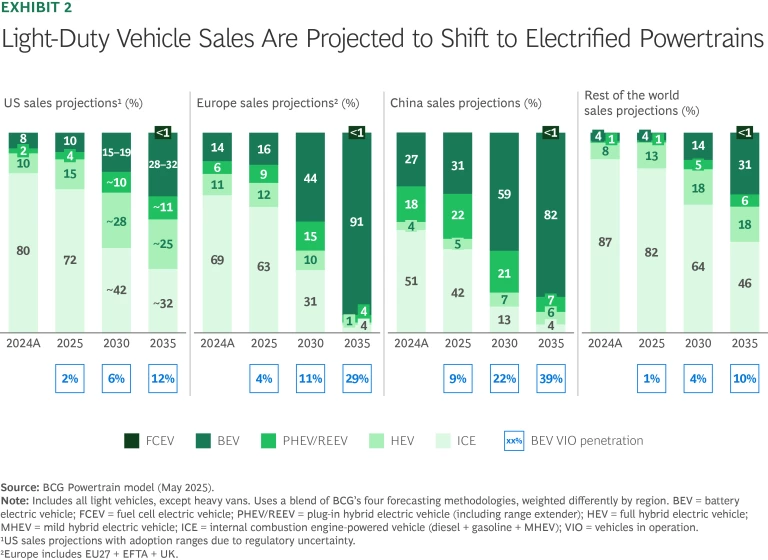

On their current path, vehicles with a plug will account for 80% of China’s new light-duty vehicle sales by 2030, with the market share of internal combustion engine-powered vehicles (ICEs) and mild hybrids falling to below 20%. Sales of vehicles with a plug in Europe should reach nearly 60% of the total by then—with particularly strong BEV growth in the final couple of years of the decade. Meanwhile, a policy overhaul in the US is expected to cause plug-in EV sales to rise more modestly but remain short of 30% by 2030. (See Exhibit 2).

Our Powertrain model allows us to take a deep dive into individual markets. By examining how sales trends will play out in the US, Europe, and China, we are able to provide several key insights on likely market dynamics.

US Auto Sector Is Downshifting on Its EV Transition

Sales of pure BEVs make up about 7%–8% of the new light vehicle market in the US as of the beginning of 2025. While overall growth has slowed, several leading OEMs—including General Motors, Ford, and Hyundai-Kia—have increased their sales volumes of vehicles with a plug. Each has US annual sales of 100,000 plug-in vehicles in its near-term sights. Tesla remains ahead in overall BEV volume and average volume per nameplate.

A shift toward more market-driven dynamics is underway. The US EV market has relied on having supportive policy initiatives in place since the early 2010s to generate demand. However, a shift in federal policy is set to change this key driver of BEV adoption. Recent legislation and executive actions remove tax credits for BEV purchases, seek to block efforts by California and other states to phase down fossil fuel use in vehicles, and remove civil penalties on cars and light trucks that do not meet fuel economy standards. Furthermore, we believe tariffs and export controls have increased the vulnerability of EV and battery supply chains for US-based automakers.

In the absence of incentives, we anticipate a brief surge in BEV sales in the third quarter—as the legislative moves start to take effect—before demand temporarily dips. For example, BEV sales in Germany took 12–18 months to recover after reaching a high-water mark in the run-up to incentives expiring, as consumers adjusted to the new environment. We expect a similar amount of time will be needed before the US achieves its next quarterly record of BEV sales.

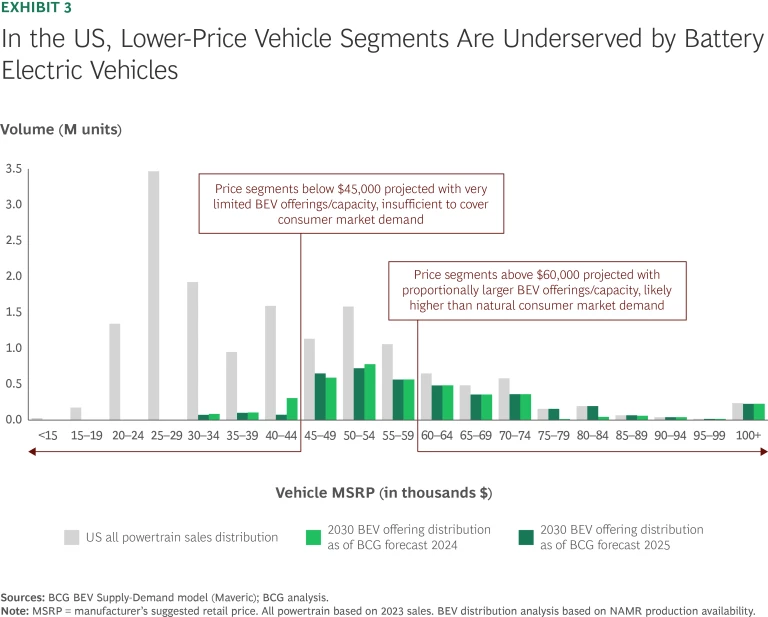

Entry-level buyers are underserved. In recent years, automakers have canceled or delayed programs to develop BEVs priced below $45,000 for the US market. And the $60,000-plus premium vehicle category is increasingly overserved. As a result, while premium vehicle consumers have ample choice due to the multitude of offerings at that price level, entry-level buyers are underserved.

From analysis carried out in mid-2024 (utilizing BEV variants that were set to be produced in North America in 2030), we projected that 300,000 BEVs would be sold in 2030 with a manufacturer’s suggested retail price (MSRP) between $40,000 and $45,000. But by the time we repeated the analysis (with an updated number of BEV variants) in mid-2025, volumes had shrunk in this price band while expected supply in the $75,000-plus segment increased. The lack of vehicles available below $45,000 could threaten BEV adoption or reshape vehicle affordability in general. (See Exhibit 3).

A residual value reckoning lies ahead. In the early ownership years, when cars lose their value most rapidly, BEVs typically depreciate by 2–6 percentage points more annually than ICEs (a similar trend is also evident in Europe). Depreciation could accelerate in the near term before improving. Vanishing tax credits will add to the combination of high leasing rates and rapid technology cycles that will likely cause depreciation rates for BEVs to diverge further from those of ICEs. This creates risks for buyers that depend on a resale or used vehicle strategy, such as fleet purchasers.

Hybrids have significant headroom to grow. Our analysis indicates a greater focus among OEMs on growing their full hybrid vehicle offerings. Sales of HEVs are set to increase from 15% in 2025 to 28% in 2030 (2.8 times more than 2024 figures). Popular mass-market models in the US, such as Toyota’s Camry and its RAV4, are—or soon will be—only available in a hybrid format. By phasing out ICE variants, carmakers such as Toyota are guiding consumers toward electrification. For their part, consumers are finding that hybrids offer an attractive purchase price for the savings in operating costs they provide, while also reducing impact on the environment.

But some hybrid programs set to launch remain untested bets. While PHEVs and REEVs are being actively promoted in the US, their mass market appeal is still unproven. Although PHEVs and REEVs are benefiting from strong consumer demand in markets such as China, there are question marks over whether US customers are willing to pay for the performance they get from these vehicles—especially when their performance and cost efficiency are at least a generation behind equivalent models in China. This could store up financial problems for OEMs in the US if they bet on a category that fails to garner a mass market following.

By 2035, BEV Sales in Europe Could Lag Regulatory Targets

After a strong rise in the early years of the decade, BEV sales declined in 2024 as the removal of incentives aggravated affordability concerns and persistent issues such as lack of charging infrastructure held back the next wave of potential EV buyers. However, we expect sales growth to accelerate again as these issues are resolved. BEVs currently account for about 15% of total new light vehicle sales in Europe today. Historically, regional OEMs have maintained a ~70% share of the BEV segment.

The regulatory roadmap is in place, but meeting EV targets will require further support from industry and policymakers. Recent European environmental legislation, particularly the 2030 Fit-for-55 reforms and the bloc’s goal of 100% zero-emission vehicles by 2035, has put into place a pathway for BEV adoption over the coming decade or so. At the same time, amendments―such as the European Union’s three-year averaging of vehicle emissions for compliance purposes for the years 2025, 2026, and 2027―suggest auto manufacturers may still enjoy some flexibility in meeting the goals.

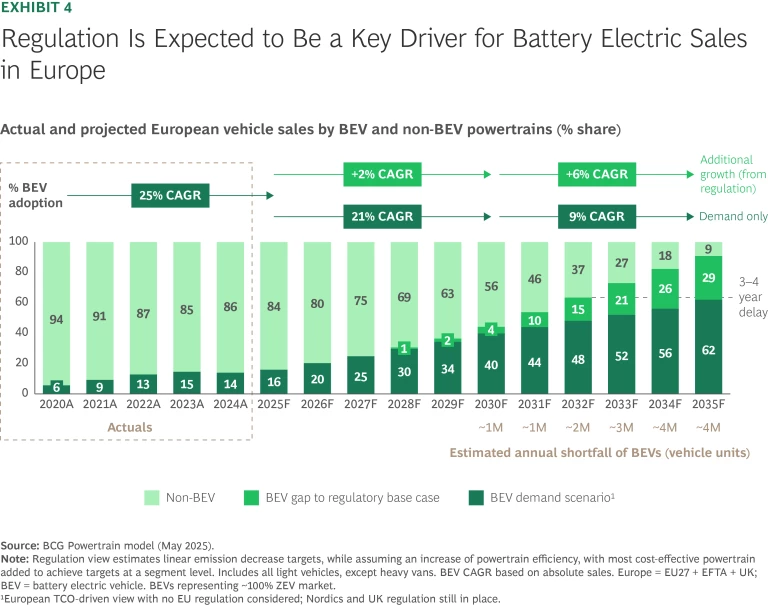

BCG’s analysis shows that there should be nearly sufficient BEV demand for Europe to achieve its 2030 environmental goals provided supply and product quality meet expectations. However, we expect a gap to open after 2030 between a purely demand-driven and a regulation-driven scenario. (See Exhibit 4.) We expect the shortfall to be equivalent to 4 million BEV units annually by 2035.

Bridging the gap will require action from both vehicle manufacturers and policy makers in the form of more aggressive improvements in vehicle specifications, driven by innovations in automotive technologies and manufacturing, and more targeted policies, especially in countries with lower adoption rates such as Italy, Poland, or Spain.

Chinese OEMs’ commitment to Europe is locked in—and growing. Chinese OEMs are making long-term investments in Europe, as exemplified by Chery’s Spanish joint venture. Chinese OEMs captured ~4% of sales across all powertrains and 7-8% of BEV sales in the first half of 2025. Furthermore, BYD nearly matched Tesla’s European sales in April of this year, selling over 7,000 units.

Meanwhile, in response to the introduction of European import tariffs on BEVs from China, Chinese OEMs have made hybrids the new focus of their strategy. Hybrid vehicles sold by Chinese OEMs in Europe increased nine times in the first half of 2025 compared with the first half of 2024. These vehicles will play an important role in enabling Europe to meet its emission targets.

Competition will ensure entry-level supply. According to our 2024 survey of EV ownership in Europe, the next generation of EV buyers (individuals who are considering purchasing an electric car) place far greater importance on purchase price than current BEV owners. On average, they are willing to pay a maximum of $58,000 for a vehicle—substantially less than the $77,000 that existing BEV owners were prepared to spend. Chinese OEMs and European brands are responding with inexpensive entry-level BEVs. The competition among EV makers looks set to ensure good availability of entry-level and midrange models.

A North–South divide in adoption poses risks. EV adoption across Europe remains highly uneven. While BEV sales in many Nordic countries have raced ahead in recent years, in parts of Southern and Eastern Europe they continue to languish below 10% (as a share of light duty vehicle sales). For Europe’s policymakers, different rates of EV adoption have the potential to create divisions that could threaten the bloc’s environmental ambitions.

Policymakers can use smarter, more targeted support measures. While wealthier European countries are phasing out direct financial incentives (Germany, for instance, ended grants for BEV purchases at the end of 2023), they will remain important to spur sales in markets—particularly in the south of the region—with low adoption rates. However, governments across Europe need to adopt a smarter approach and use more targeted measures that support a range of strategic goals, including better charging infrastructure, industrial scaling, and improvements in TCO. (In European markets that have entered a mass adoption stage, governments will first need to understand the more aggressive cost and performance requirements of their EV makers). Such support mechanisms can maintain sales momentum in the absence of purchase grants and help ensure consumer demand keeps pace with Europe’s environmental goals.

China Solidifies Its EV Dominance

Due to soaring domestic demand, NEVs (which comprise BEVs, PHEVs, and fuel cell electric vehicles) accounted for 45% of Chinese light vehicle sales in 2024, with the segment recording a five-year compound annual growth rate of 60%. Currently, EVs with a plug make up about half of Chinese sales of new light vehicles and are projected to reach 80% by 2030.

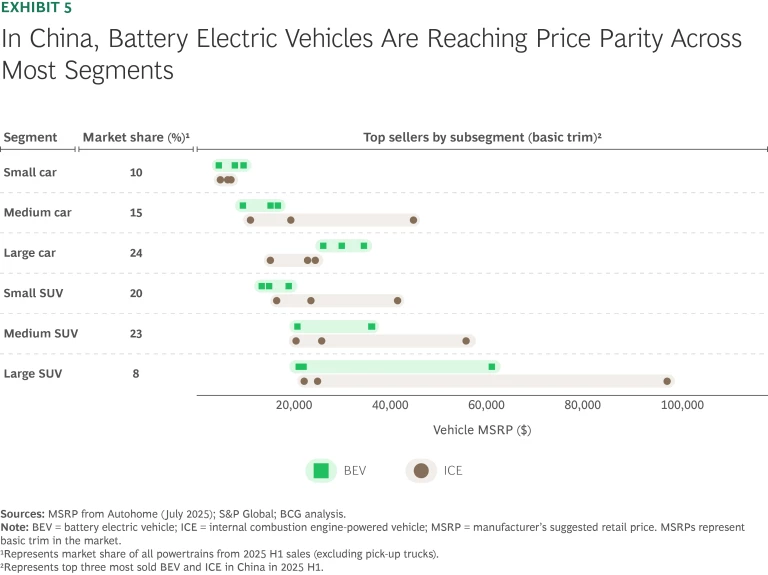

China leads in BEV affordability and product-market fit. Intense competition and a consistent focus on making affordable, high-quality vehicles have fueled the growth of BEVs in China and enabled BEV models to generate strong sales with a competitive price compared with their ICE equivalents. (See Exhibit 5).

Chinese OEMs are supported by a strong, motivated innovation ecosystem. Among China’s ten biggest automakers, several sold more NEVs than conventional vehicles in the first half of 2025. For example, BYD, China’s biggest vehicle manufacturer, just makes plug-in EVs, while more than half of Geely’s and Wuling’s first-half sales were NEVs.

Their success has come on the back of rapid innovation—resulting in improvements in battery and vehicle technology—and mature and cost-competitive supply chains. However, with NEV penetration approaching 50%, the market is entering a more complex phase and faces potential growth constraints from insufficient charging infrastructure and saturation. Despite this, continued innovation in battery technologies, connectivity, autonomous driving, and modular platforms—along with rising competition from more tech-driven players like Huawei and Xiaomi—are expected to help China maintain its position as the leading EV player worldwide while also driving industry consolidation.

REEVs are no longer seen as transitional vehicles. Due to their far greater range, better energy efficiency, and more advanced technological features (including driver-assistance and infotainment systems), REEVs have become more popular than traditional PHEVs. They are no longer seen as primarily a transitional vehicle between ICEs and pure BEVs. These cars appeal to urban buyers given they are as economical as a BEV for day-to-day city commuting and can also be used as an ICE for long-distance driving without the anxiety about range. However, a new generation of PHEVs is emerging—with improved ranges, better performance, and smarter onboard systems—which could challenge not only the recent market gains of REEVs but also the HEV market.

China’s EV policy has shifted from subsidies to strategic pressure. The Chinese government continues to provide EV subsidies in 2025—such as handing payments to consumers who trade in their old vehicles for a new EV—though it is expected to gradually phase out the scheme in 2027. China’s “dual credit” policy, which sets manufacturers’ credit targets for producing both NEVs and fuel-efficient vehicles, also still exists but is no longer the main driver of EV growth. Instead, strong consumer demand—helped by TCO parity between NEVs and ICEs, lower upfront costs, and smarter features—is pushing OEMs to expand NEV production to remain competitive. At the same time, policymakers are using mandates strategically, rather than applying incentives, to encourage the development of NEVs.

Global export and localization strategies are accelerating. Buoyed by the competitiveness of their NEV products and the maturity and scale of their supply chains, Chinese OEMs are accelerating their global expansion efforts. But rather than focusing solely on exports, OEMs are collaborating with local partners in manufacturing and technology. For instance, they are targeting emerging markets in Latin America and the Middle East as key export destinations while at the same time creating local production and strategic partnerships in regions such as Southeast Asia and Europe as a means of dealing with tariffs and securing long-term access.

By 2030, we expect the global EV landscape to be increasingly polarized. Among the rest of the world markets, BEV penetration is likely to remain very low. But even among leading regions, OEMs’ powertrain strategies will need to be more targeted. Based on our analysis, we would characterize these markets as follows:

United States. Due to policy headwinds and affordability gaps in BEVs, the US is shifting toward hybrids. Amid regulatory changes and saturation in some BEV segments, OEMs will need to find a better product-market fit to succeed given that the US is at an adoption tipping point.

Europe. Growing uncertainty around the 2035 zero-emission-vehicle (ZEV) mandate requirements —exacerbated by a recent regulatory softening and ongoing lobbying efforts—raises the risk of delays or revisions to the goal. The region needs to focus on how to spur a meaningful uptick in demand post-2030 to stay on track, while not leaving its OEMs and automotive workforce behind. Chinese OEMs appear ready and willing to reshape the competitive landscape, especially in entry-level segments. Continued progress for EV makers and policymakers will hinge on affordability, coordinated policy, and aligning supply to meet 2035 environmental goals.

China. The country is the world’s NEV powerhouse, helped by a strong technology and cost base. It is advancing toward plug-in EVs making up 80% of new light vehicle sales by 2030 and is increasingly exporting to emerging markets and building plants in regions such as Southeast Asia and Europe. Export strategies and local partnerships will continue to be important ingredients of Chinese OEMs’ future success.

Industry stakeholders, manufacturers, and policymakers in nascent and early-adoption markets may decide to look towards the three big automotive markets—capturing lessons learned, assessing shared challenges, and charting their course along one of the three distinct paths. But for the industry as a whole, the growing divergence between China, Europe, and the US creates a fresh set of challenges for global companies that were getting used to BEV adoption in leading markets following the same broad course. We don’t expect these markets to reconverge anytime soon. It won’t be easy, but OEMs will need to adopt region-specific strategies and get comfortable with living in an uncomfortable world.

Glossary

Internal combustion engine (ICE) vehicle: Powered solely by a combustion engine using liquid or gaseous fuels. No electric motor support.

Mild hybrid electric vehicle (MHEV): Combines a combustion engine with a low-voltage electric motor (below 60 volts) that assists during acceleration or with heavy loads. Cannot operate on electric power alone and lacks plug-in capability.

Full hybrid electric vehicle (HEV): Combines a combustion engine with a high-voltage electric motor (above 60 volts). Can operate on either power source alone or in combination. Lacks plug-in capability.

Plug-in hybrid electric vehicle (PHEV): Similar to an HEV but includes a plug-in battery that can power the vehicle independently. Can switch between electric and combustion-driven propulsion depending on conditions.

Range extended electric vehicle (REEV): Primarily an electric vehicle that contains a small combustion engine. This is used to recharge the battery when low and does not propel the vehicle directly. REEVs also have a plug-in charging capability, and under normal conditions they are charged like a battery electric vehicle. The range extender provides additional flexibility for longer trips by maintaining battery charge when plug-in charging is unavailable.

Battery electric vehicle (BEV): Powered exclusively by electricity from externally charged high-voltage batteries. No combustion engine or fuel tank.