“Fewer than one in four banks are ready for the AI era.”

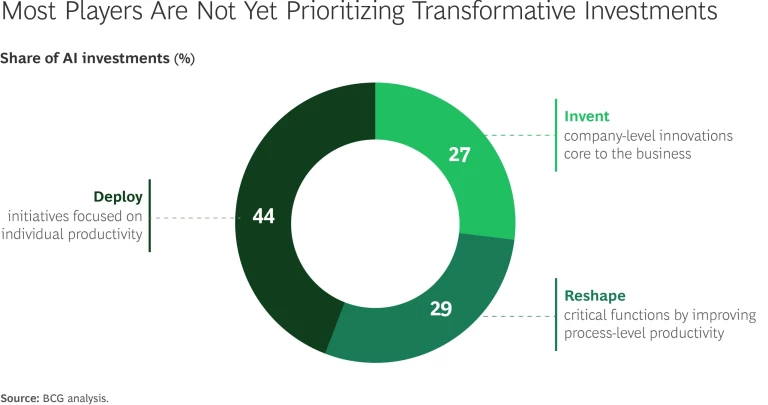

The leap from predictive analytics to generative AI—and now to fully autonomous, agentic systems—is here. AI is no longer a fringe experiment; it’s the engine of next-generation banking. Customer interactions, loan approvals, fraud detection, even compliance monitoring: all are ripe for reinvention. Yet a recent BCG survey finds that only 25% of institutions have woven these capabilities into their strategic playbook. The other 75% remain stuck in siloed pilots and proofs of concept, risking irrelevance as digital-first competitors accelerate ahead. Most banks are deploying AI toward basic activities—not those that lead to transformation. (See the exhibit.)

Why Banks Can’t Afford to Wait

Every day you delay is market share surrendered. GenAI can already customize advice at scale; soon, agentic AI will autonomously execute routine tasks from trade settlement to document review. Without a unified strategy and the right foundations, the pilots that banks are investing significant time and resources into will never graduate—and competitors will own the privileged customer touchpoints you leave behind.

Traditional moats are being dismantled. The banking business model has long relied on customer inertia, opacity in pricing, and control over distribution. AI is eroding all three. As AI-powered financial agents become more sophisticated, they will fundamentally change how customers interact with banks, forcing institutions to rethink their value proposition.

Current profit models are also coming under strain. Markets are becoming more transparent, making it easier for customers to compare offerings. And while AI-driven efficiencies will lower bank costs, customers will expect many of these savings to be passed on to them.

Within the next few years, and certainly by the end of the decade, the banking landscape will look fundamentally different. Caution on the part of banks is costing them time.

Four Moves to Reclaim Advantage

- Upgrade your strategy. Ask “Where can AI deliver defendable advantage?” and craft your AI vision and business strategy from there.

- Put AI at the center of tech and data. Invest in the foundations that can unlock the ROI of AI—integration, orchestration layer, and hybrid infrastructures.

- Own the governance agenda. Don’t wait for rulebooks to catch up. Engage regulators proactively and create risk management frameworks geared for auditability, explainability, and fending off the next wave of financial crime.

- Realign talent and accountability. Plan now for the organizational changes that can put talent and AI-enhanced processes to best use.

From Proofs to Production

- Get started with no-regrets moves. Drill into the numbers and assess where AI can drive high ROI. Connect use cases to processes to get wider, more sustainable benefits. And set clear outcomes to maintain strong focus and momentum.

- Drive alignment from the top down. Track what matters—and do so rigorously and frequently. Make sure senior leaders across the organization are brought into the change process and actively engage in the transition. Be clear-eyed about the capital requirements and avoid putting off the investment needed. Acquiring best-in-class capabilities will only get more costly.

- Lead from the top. Leverage the full power of the CEO. Get serious about data governance. And back the development of in-house expertise across product, tech, and operations. Create space for new roles and ways of working to take hold.

Ready to Lead?

The next wave of AI will reward focused execution. Banks that align their strategy, technology, governance, and talent now will grow stronger customer relationships, reduce cost to serve, and compete more effectively.

The institutions that succeed won’t just deploy AI—they’ll reshape how their business creates value. That shift is already underway. The only real question is how far ahead you want to be when it reaches scale.