In the age of AI, customers expect a highly personalized experience at every touchpoint, whether they’re shopping at a luxury boutique, making travel reservations online, seeking healthcare, or weighing an investment decision. True personalization requires creating experiences at scale that become more fine-tuned with each successive interaction. True personalization empowers customers to get what they want—faster, cheaper, and/or more easily.

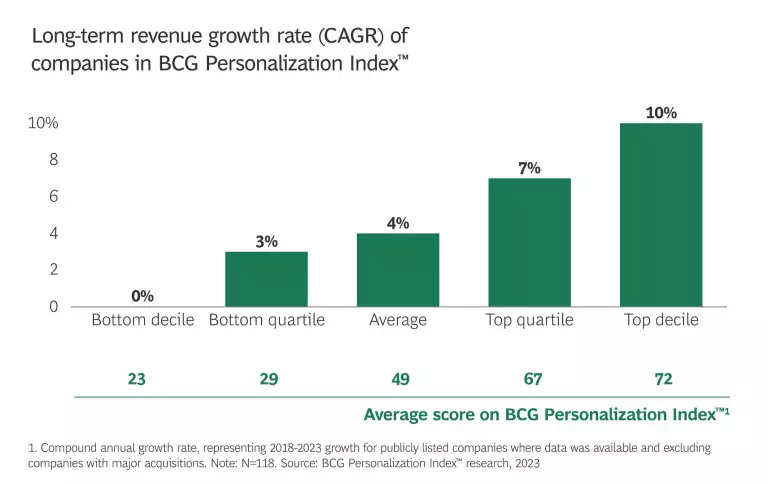

Businesses that are leaders in personalization achieve compound annual growth rates that are 10% higher than those of laggards, as well as higher shareholder returns. (See Exhibit 1.) Yet, only 10% of companies are leaders—and are the brands positioned to capture an outsized share of the $2 trillion value at stake in the next three years.

This year, BCG is kicking off a new annual tradition with the BCG Personalization Index™ Report, building on the popularity of our book Personalized: Customer Strategy in the Age of AI.

The BCG Personalization Index™ provides a report card on the state of personalization across sectors. We surveyed 200 brands, acted as mystery shoppers to observe how companies delivered experiences across channels, and performed a financial analysis of the impact of personalization on companies’ growth and shareholder returns.

The index measures how companies across the following seven sectors deliver on what we call The Five Promises of Personalization that customers expect from the brands that get their business:

- Empower Me. We look at how a company is using personalization to help its customers get what they want better, faster, cheaper, and/or more easily. We use mystery shopping activities and customer surveys to assess the level and quality of personalization that a company is delivering across channels.

- Know Me. Here, we look at the number and depth of digital relationships a company has with customers and its ability to retain them. We also look at the maturity of its customer data management and identity matching.

- Reach Me. To assess an organization’s maturity in this area, we examine the sophistication of its targeting intelligence, how advanced its experimentation capabilities are (as measured by the volume, speed, and scale of its experiments), and how well it orchestrates actions across channels.

- Show Me. To evaluate a company on this promise, we look at the sophistication of its content creation and management capabilities and how well it personalizes text, images, and videos for individual customers.

- Delight Me. This is the hardest promise to deliver. We measure the speed and scale of a company’s test-and-learn process, the sophistication and automation of its measurement, and how it is set up overall for personalization at scale.

The BCG Personalization Index™ Report is a call to action to prioritize improvements to the customer experience as customers compete on personalization in the age of AI.

Stay ahead with BCG insights on marketing and sales

Sector Spotlights

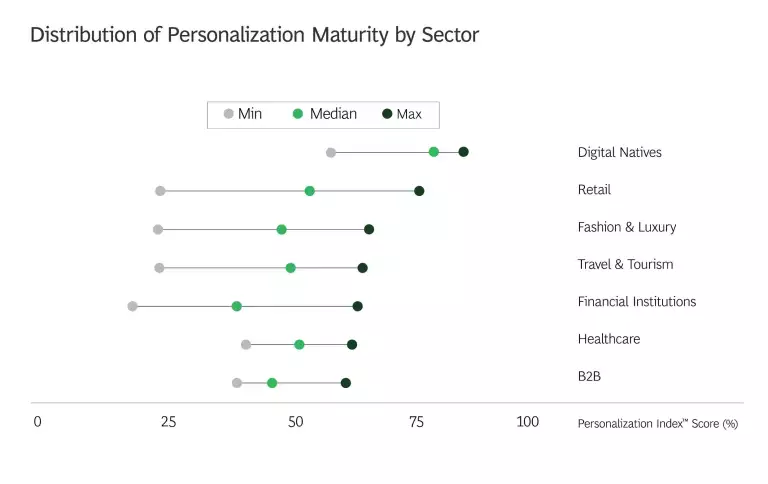

The breadth and depth of customer relationships are the main drivers of differences in maturity levels across sectors. (See Exhibit 2.)

Digital Natives

As mature platforms see slower user growth, the industry’s focus is shifting to deepening engagement and monetizing ecosystems—including ads, subscriptions, loyalty, and new services—without compromising experience. Expectations are high, and so are costs. Users want frictionless, real-time, hyper-relevant experiences. Companies must balance innovation with responsibility. GenAI, identity graphs, and recommendation engines offer upside, but also risks around bias, consent, and consumer fatigue. Players have an opportunity to make personalization feel useful, delightful, and trustworthy again.

Retail

Discretionary spending is tightening, and brand loyalty is increasingly fickle. Rising costs are squeezing margins. At the same time, retail media and personalization at scale offer a path to more efficient, higher-return marketing and merchandising. Expectations are outpacing legacy technology. Shoppers want curated, seamless journeys across digital and physical touchpoints, but many retailers still operate on fragmented stacks and rigid promotional playbooks. Privacy expectations are also evolving faster than compliance systems.

Fashion & Luxury

Tariffs and trade wars are upending planning cycles in the US, with spillover effects around the world. Direct-to-consumer disruptors and more casual, hybrid lifestyles are changing what customers value and how they shop. Legacy brands face the challenge of staying aspirational while becoming more agile and inclusive. The move away from mass promotions and into personalized styling, back-in-stock alerts, and curated experiences requires new investments in content and commerce infrastructure. Digital relationships are redefining loyalty. Modern luxury consumers expect personalized clienteling, experiential perks, and tailored offers. But in-store and digital journeys often remain disconnected—and loyalty programs still feel transactional.

Travel & Tourism

The sector has been on a rollercoaster ride ever since COVID, with growth uneven across segments and regions. Brands must rewrite their engagement playbooks around new motivations. Loyalty is harder to earn, but brands that can integrate flights, hotels, dining, and experiences into a single, personalized journey will win more share of wallet. As third-party cookies fade and privacy laws tighten, travel brands must lean into known-user strategies. They have an opportunity to build next-best-action engines powered by loyalty and consented data.

Healthcare

New treatments, aging populations, and chronic conditions are straining the system. New personalized treatments and diagnostics hold the promise of highly tailored care. Payers and providers must balance cost containment with access and equity—while investing in long-overdue digital upgrades. Patients expect to be understood, not processed. From preventive care nudges to personalized chronic condition support, patients want seamless, relevant, and empowering experiences, but legacy infrastructure and reimbursement models make these efforts hard to scale. AI and automation present huge potential, but personalization in healthcare must always start with privacy, empathy, and equity.

B2B

High-value deals with long sales cycles make personalization feel harder to justify—especially with multiple buyers, influencers, and use cases in play. But B2B customers are increasingly using digital channels to narrow down their choices before they ever talk to a salesperson. B2B brands must personalize not just by company, but also by role, region, maturity level, and behavior. This means integrating data across fragmented systems and investing in orchestration that feels useful, not robotic. The new playbook is proactive, predictive, and personal. B2B leaders are rethinking personalization as a way to add value beyond the product and build stronger post-sale relationships.

Financial Institutions

Fee compression, fintech competition, and shifting consumer preferences are challenging traditional banking and wealth management models. To stay competitive, financial institutions must evolve from product sellers to lifelong financial partners. Core banking infrastructure and data silos inhibit real-time personalization. Meanwhile, compliance costs keep rising, and AI investments are constrained by talent shortages and regulatory ambiguity. Consumers are privacy conscious and often skeptical of personalized nudges. But firms that build transparency, relevance, and goal-based guidance into every touchpoint can deepen trust and lifetime value.

Leading the Change

Companies need to view personalization as a strategic mandate, with a clear leader to drive the roadmap. They should measure the impact through personalization profit and loss statements, assessing and optimizing personalization campaigns independently from other functions. Personalization leaders build their back-end architecture to maximize the value of their personalization technology and data capture.

Read more to dive into the lessons from this year’s Personalization Index™ leaders and the questions you should be asking your team as you accelerate your own personalization strategies.