The looming demographic crisis faced by developed countries is borne out by alarming statistics. By 2050, all 38 countries in the Organization for Economic Cooperation and Development (OECD) will have aging populations; in all but 5 of those countries, 21% or more of the population will be aged 65 or older.

This trend carries critical implications, including possible labor shortages, declines in productivity and innovation, and shrinking domestic demand, among others. But aging populations—in effect, populations in decline—do not just create headwinds for GDP growth. They also have a profound impact on citizens’ overall well-being, a metric we assess through factors such as mental and physical health, human connections, and job engagement. At the same time, economic growth and well-being are linked—with both negative feedback loops and synergies between the two. The good news is that this interplay creates opportunity—the countries that best understand the dynamics have the greatest chance to forge a winning path forward.

To understand both the challenges and opportunities ahead, the BCG Henderson Institute (BHI) developed a proprietary neural network model. The model, which draws on 40 indicators for 13 OECD countries for the past 20 years, can project an individual country’s economic performance and its citizens’ well-being through 2050 under thousands of different

Our work reveals that demography is not destiny. Countries can build a future in which both their economies and citizens thrive.

A deep examination of Japan, which has been grappling with an aging population for decades––longer than most other OECD countries—yields further insight. The Japanese government has developed a broad-based strategy to address its demographic challenge, actions likely to move it closer to the aspirational case in the coming years. But our work found that Japan and countries like it can do even more to enhance their trajectory.

Our model is not intended to be crystal ball or to direct government policy. Rather, it identifies the levers that could play a role in shifting a country’s trajectory. Most important, our work reveals that demography is not destiny. Countries can build a future in which both their economies and citizens thrive. Moreover, our research reveals a vital role for the private sector; corporate action not only can help ensure that companies have the engaged, productive workforce they need in the future, but it also can contribute to building a more vital, prosperous society.

BCG Henderson Institute Newsletter: Insights that are shaping business thinking.

The Complex Union of Growth and Well-Being

For decades, economic growth was the primary measure of a country’s prosperity. In recent years, however, the importance of citizens’ well-being has become increasingly recognized—emphasizing individual happiness and quality of life alongside economic progress. BHI’s Flourishing Pathway Model assesses both factors—and integrates the tradeoffs and synergies between them. (See the sidebar “Mapping the Path to Prosperity.”)

Mapping the Path to Prosperity

The second component is well-being, reflected in an index that incorporates factors such as mental and physical health, human connections, and job engagement. There is no fixed upper or lower bound for well-being within our model.

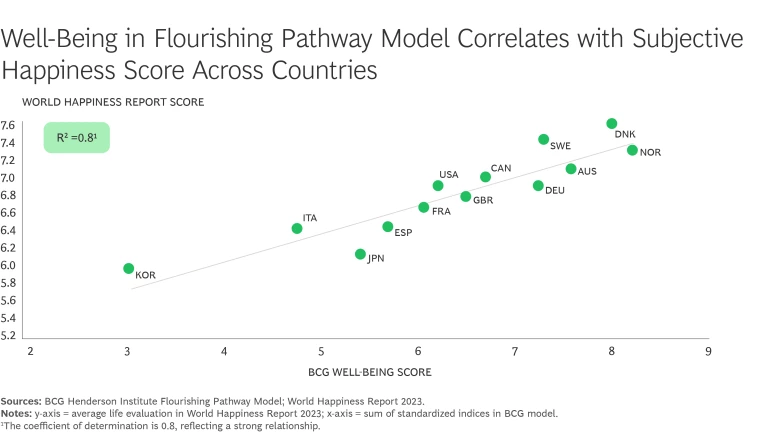

When comparing countries, Norway had the highest score at 8.2, while South Korea had the lowest at 3.1. Our well-being measure correlates strongly with other subjective measures, including the 2023 World Happiness Report. (See the exhibit below.)

The model aims to reflect the interplay among those economic and well-being factors.

To start, we incorporated equations or functions for those indices where there is an established, quantified relationship. For example, we integrated the Cobb-Douglas production function, which expresses the relationship between economic inputs (such as capital and labor) and economic output.

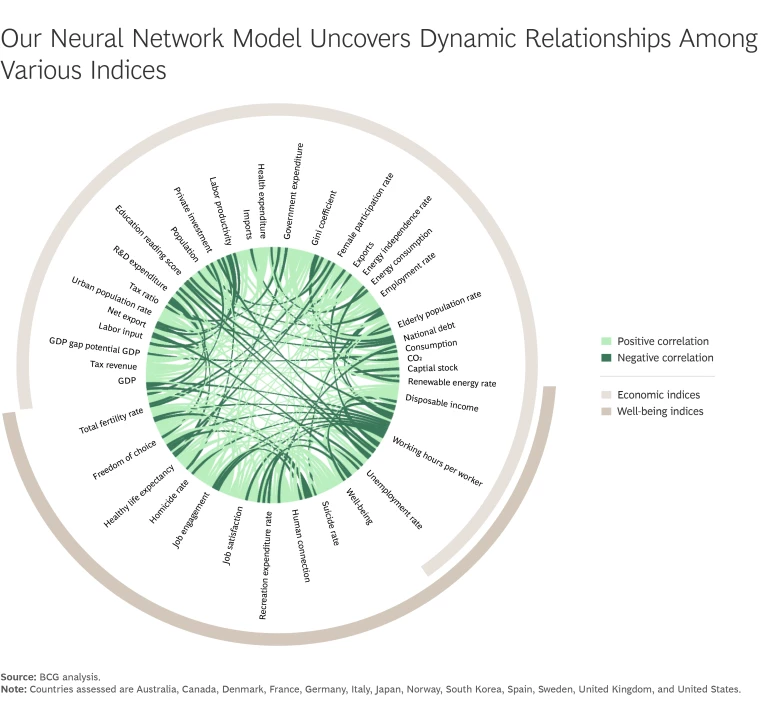

Of course, most of the interplay between the various factors in our model are not as straightforward or well-understood. For those we used machine learning to tease out the relationship among indices for 13 countries based on data from 2000 through 2019. The model examined the relationships among the indices for the 13 countries taken as a whole and also for each individual nation. (See the exhibit below.)

For any individual country, the interplay between indices will be quite distinct depending on the current state of the economy, the current characteristics of well-being, and the dynamic impact of that country’s aging trajectory. For example, the link between GDP growth per capita and well-being in Germany is more robust than the relationship in the US.

Based on these relationships, as well as some basic external projections around a few indices (such as the aging of the population), the model predicts well-being and economic growth going forward for any given country. We made adjustments for individual countries based on major external changes, for example expected government policies in Japan to promote digitization and remote work in small- and midsize enterprises. At the same time, we validated the model (both for all countries taken together and for individual countries) by taking past data and testing to see how well projections stacked up to reality. That process led to further adjustments and refinements of the model.

As sophisticated as any model is, it is impossible to eliminate uncertainty. We used a Monte Carlo analysis to look at thousands of potential scenarios. So, one can ask, for example, if the demand side changes a bit more than currently projected, what happens to economic growth and well-being? That allows us to understand the wide range of possible futures for every country assessed.

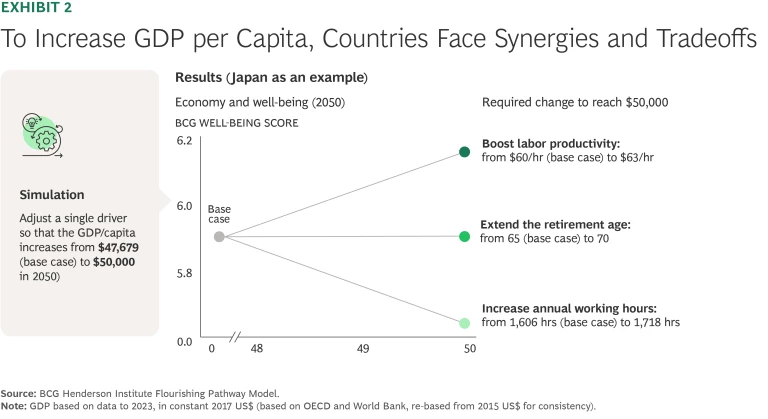

To illustrate the complexity of the dynamics at work, consider a scenario analysis of how Japan can boost annual GDP per capita from just under $48,000 to $50,000 (See Exhibit 2.)

One possible action is to increase the annual working hours per employee from 1,606 to 1,718. Although our model shows that such a change does push GDP per capita to the target level, it also negatively affects well-being by creating pressure on life expectancy and birth rates. Lower birth rates, of course, can further amplify a country’s overall aging rate.

A second option is to increase the retirement age from 65 to 70 years old. This option pushes GDP up, thanks in part to higher consumption, stemming from increased disposable income. But the impact on well-being is more complex. On the positive side, older citizens would have more freedom of choice, greater ability to spend income on the things they value, and the opportunity to continue to contribute to society. Moreover, the retention of older employees who wish to work—but have been precluded from doing so because of mandatory retirement ages or companies’ lack of clarity on how to adapt the workplace for seniors—boosts job engagement rates. But those benefits could be offset by a variety of negative impacts on individuals who do wish to retire earlier, rising unemployment caused by labor oversupply, and a reduced share of spending on recreation (because older adults in the workforce have less free time). The upshot: overall well-being is essentially unchanged.

The third option, increasing productivity, delivers gains in both GDP per capita and well-being. That’s in part because there is often a virtuous cycle between productivity and job engagement: high productivity brings a sense of achievement and increased rewards, which in turn enhances job engagement and drives further productivity gains. At the same time, productivity improvements not only drive economic growth but also contribute to improved well-being through increased disposable income and job engagement.

Increasing productivity delivers gains in both GDP per capita and well-being. That’s in part because there is often a virtuous cycle between productivity and job engagement.

Our model captures this complex web of linkages, paving the way for targeted actions that can improve both economic growth and well-being.

The Challenge and Opportunity for Japan

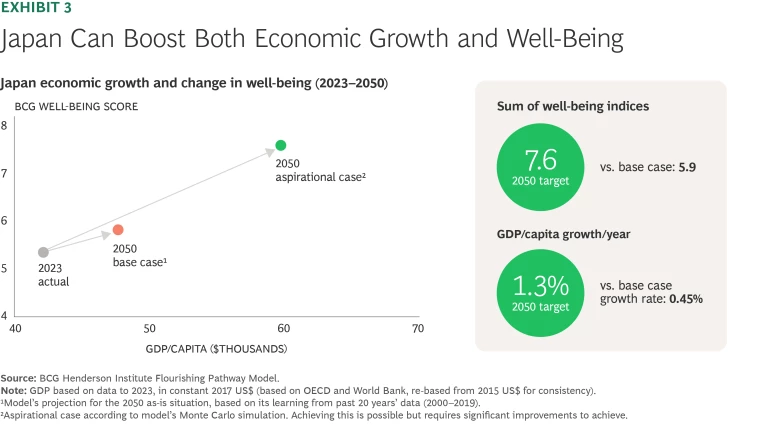

The aging of the Japanese population has been unfolding for decades, coming into sharp focus in the 1990s. In 2007 Japan officially became a “super-aged” society (with over 21 % of its population age 65 or older), the first country in the world to do so. Our model projects that from 2023 through 2050 Japan’s real GDP per capita is expected to grow at just 0.45% on a compound annual basis under our base case. And the country’s well-being score under our index, already the lowest among developed countries, is expected to improve only slightly, from 5.4 to 5.9.

Economic Growth

On the supply side, labor productivity is expected to grow slowly, at just 0.3% on a compound annual basis, constrained by two factors. First, despite increases in women’s participation and immigration, the Japanese workforce is aging rapidly. The United Nations projects the share of the population 65 or older will rise from 29% in 2023 to 37% in 2050, reducing the available workforce. Second, capital stock (such as equipment, R&D, and other assets) is forecasted to grow at just 1.1% on a compound annual basis. This in part reflects the limited adoption of emerging technologies such as AI, generative AI, and robotics particularly among small and midsize enterprises.

On the demand side, Japan’s total population is expected to decline by 20 million by 2050, the highest aging rate (37%) among developed countries. Disposable income will likely grow at a weak pace, at 0.47% on a compound annual basis, because of stagnant productivity and limited wage growth, among other factors. That in turn puts pressure on consumer spending, which accounts for a significant portion of overall economic demand. Private sector investment is projected to remain weak, growing at just 0.18% on a compound annual basis.

On the demand side, Japan’s total population is expected to decline by 20 million by 2050, the highest aging rate (37%) among developed countries.

Well-Being

Well-being in Japan is projected to improve only modestly, for a number of reasons. For one, job satisfaction (48% satisfied in 2023) ranks the second-lowest among the 13 countries assessed in our model and is expected to increase by just one-tenth of a point on our index, reflecting broader economic issues such as stagnant wages and limited labor

Finally, younger citizens report lower well-being than older individuals. This group expresses concerns about the future health of the country’s social security system, and they sense that they have limited say in Japan’s future given the large voting block of older voters. Widening socioeconomic inequity compounds the disparity.

The Aspirational Path

Under the aspirational case, Japan can double its real GDP growth rate per capita to 1.3% on a compound annual basis and advance its well-being index score to 7.6—a gain of 2.1 points. (See Exhibit 3.)

The model identified six critical levers that could improve Japan’s path going forward:

- Boost productivity. For example, increase R&D expenditure, technology deployment (AI and automation), capital stock, and private investment.

- Promote domestic consumption. Take steps to increase disposable income, for example.

- Seize opportunities in global markets. This includes expanding access to global markets through increased net exports.

- Enhance job engagement. Bolster reskilling efforts and labor market reforms, for example.

- Improve human connections. This includes reducing social isolation and strengthening rural economies, by introducing cultural initiatives and new infrastructure to attract industry and people.

- Support families and older citizens. For example, take steps to directly address declining birth rates by offering expanded childcare benefits, and provide elderly assistance with housing and employment.

Japan has started to develop a comprehensive approach, with targeted policies to address each of those six areas to improve its demographic challenge (See the sidebar “Japan’s Policy Roadmap.”)

Japan’s Policy Roadmap

The policies expected to have a particularly strong impact include the following:

- Promoting Innovation. Japan has grappled with underfunding of basic research, the loss of scientific talent to other countries, and the inability to commercialize innovation. In response, the government is launching a ¥10 trillion university endowment fund and a ¥10 trillion startup development plan by 2027. These aim to nurture unicorns and foster stronger public-private innovation ecosystems. The government has also launched an initiative to revitalize regional economies by integrating local assets with cutting-edge innovation to foster high-value-add industries. Taken together, these steps can boost productivity.

- Increasing Investment in Priority Sectors. Productivity will likely be further enhanced by Japan’s push to invest in key areas including digital technologies, semiconductors, and emerging green business opportunities. For example, the government has created a comprehensive plan to deploy high-speed digital infrastructure nationwide and use digital technology to revitalize regional economies while also providing subsidies and tax incentives to spur digital transformation and automation, particularly among SMEs and midtier firms. Meanwhile the country has committed massive subsidies and investments to jump-start its once market-leading chip industry, including offering more than ¥1 trillion in subsidies to chip maker TSMC to establish semiconductor manufacturing within Japan’s borders. At the same time, the country has moved to transform the decarbonization of its economy into a growth engine, targeting ¥20 trillion in public and private decarbonization investment over the next decade to advance clean energy infrastructure such as large-scale renewable power projects and next-generation power grids.

- Reskilling Workers. Japan’s government has introduced a ¥1 trillion reskilling policy to promote skill transformation and career autonomy among workers. The policy aims to improve job engagement by offering workers clear pathways for growth, transition, and upskilling, especially into digital and green sectors. It includes subsidies, online training access, and employer-linked programs and has recently developed specific offerings targeted at middle-age/older- and blue-collar workers. Government bodies like the Ministry of Economy, Trade, and Industry (METI) and the Japan Business Federation (Keidanren) have also encouraged firms to allocate work time for reskilling. And companies like Yamato Transport and Japan Airlines now offer structured internal digital-transformation training.

- Taking Measures to Prevent Further Birthrate Decline. Since 2020, Japan has expanded support for families, shifting toward a comprehensive “all generation” support model covering childcare from pregnancy through university education. The new model offers consistent assistance at each stage of life, unlike earlier one-off means-tested policies. The model includes multiple levels of financial support, including a one-time ¥100k birth grant and free or subsidized education from preschool to university scholarship. Japan’s approach increasingly resembles that of France, which is moving toward universal child benefits and added support for larger families, and Sweden, which offers childcare access, regardless of maternal employment.

A number of these actions will create positive spillover effects across multiple levers. For example, steps to boost productivity and enhance job engagement will also likely lead to increased disposable income—which in turn can promote domestic consumption.

Note that the measures outlined here have been introduced since 2020, with several important steps taken in 2024. Collectively, they are expected to move Japan closer to the aspirational trajectory, though additional reforms building on these will be necessary to fully realize the country’s potential.

We recommend the following key actions:

- Encourage industrial consolidation and exit from underperforming sectors. Today about 85% of Japanese firms are microenterprises (with an average of roughly 3.5 employees), hindering scale and innovation. Market concentration, as measured by the Herfindahl-Hirschman Index, is about 1,500—well below high levels of efficiency.1 Meanwhile, about 15.5% of companies are classified as “zombie” firms.2 Japan can embrace structural reforms to drive much-needed consolidation, including through financial incentives and modernized insolvency frameworks that speed up restructurings. Such moves would reinforce the actions the government has already taken to boost productivity.

- Drive adoption of AI and digital tools. Embracing technology could further bolster the country’s productivity. Japan ranks among the lowest in the world when it comes to maturity in AI, digital, and overall technology, according to BCG research. Only 20% of Japanese companies had fully implemented AI solutions in 2023, according to a study published by Japan’s Information-technology Promotion Agency. Although the Japanese government has taken steps to accelerate technology adoption and to support human-AI collaboration in ways that elevate individual capabilities and unleash creativity, much more can still be done. In particular, embedding a human-centric technology adoption model into both education and business can help the country leapfrog ahead in digital and AI.

- Foster globally minded startups. Japan has an opportunity to enhance its ability to seize global opportunities by providing more support for new businesses. Startups play a critical role in driving innovation and productivity. But while Japan has taken meaningful steps to support new ventures, the country’s startup ecosystem remains underdeveloped compared with global leaders. According to CB Insights as of June 2023, Japan had only 6 unicorn companies, equivalent to just 1.4 unicorns per $1 trillion of GDP, far behind the United States (656 unicorns, 24 per $1 trillion GDP), China (171, 10), United Kingdom (51, 15), and Germany (29, 7). In addition, the revenue base and strategy of most new ventures are still anchored in the domestic market. To develop a model for advancing startup global readiness, Japan could take a page from the playbooks of countries like Singapore (14, 28) and Israel (24, 47), which have had success in this area. For example, international expansion support could be embedded into Japanese incubators through outbound internships, improved access to global capital, and expanded entrepreneurial education. And the country could establish startup-focused special economic zones that offer support for startups with global ambitions, including through tax incentives and links to global investors.

- Support labor mobility. Japan has deeply rooted labor practices, such as lifetime employment at one company, limited career paths for part-time workers, and job opportunities concentrated in and around Tokyo. Workers therefore tend to put a premium on job security and on developing skills for their current role and employer—hindering movement within and among industries. To enhance labor mobility and ultimately job engagement, Japan could launch talent exchange programs that link shrinking and growing industries through cross-sector internships and job rotations. In addition, the country could adopt reskilling best practices observed in other countries. France offers annually funded training accounts, paid leave, and career counseling. Singapore provides S$500 for training and education for employees over 25, plus S$4,000 for those over 40, along with midcareer training support.

Embedding a human-centric technology adoption model into both education and business can help Japan leapfrog ahead in digital and AI.

Beyond these actions, additional innovative, and in some cases, bold steps could further soften the impact of demographic change. For example, global talent or energy partnerships—such as with African nations—can create more resilient pipelines of workers and energy. Initiatives to empower older adults through flexible, meaningful employment could allow people to work longer and with higher job engagement. Educational, technological, and cultural tools could reframe family life, improve interpersonal confidence, and foster relationships. And Japan can even leverage innovation to turn its demographic challenge into a source of national growth. (See the sidebar “Innovation Hubs for Aging.”)

Innovation Hubs for Aging

The innovation hub could bring together top global talent related to academic research, startups, established corporations, investors, and government agencies to drive research, development, and commercialization of age-related technologies. The work could develop powerful solutions, including advanced telemedicine platforms enabling remote specialist consultations, personalized medical treatments based on genetics and lifestyle, and integrated robotics and smart-home systems for elderly care. Such an initiative could build on efforts already funded through Japan’s Moonshot Goals, including mitochondria- and microbiome-targeted therapies, as well as Tokyo University’s AI-driven “Bring the Hospital into the Home” project, which integrates smart-home devices and telemedicine.

The integrated elderly care center would allow seniors to test and provide feedback on new technologies. This real-time feedback would inform improvements in tech design and usability, fostering collaboration among residents, caregivers, and innovators. Additionally, the model could help develop innovative business models, such as licensing or subscription-based wellness services, creating a scalable solution poised for global adoption.

A Look at the United States and Germany

Leveraging our model to assess the US and Germany reveals two countries facing different issues and pathways ahead. Effectively confronting the challenge of an aging population demands tailored solutions rooted in each country's unique context.

United States

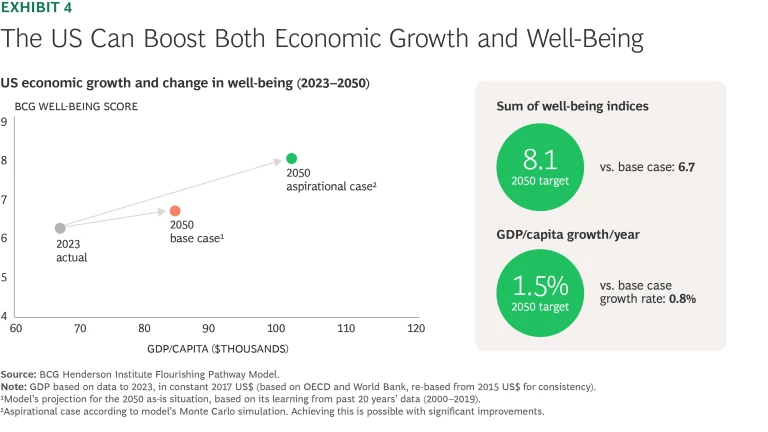

Under the base case in our model, US real GDP per capita is expected to grow by 0.8% on a compound annual basis through 2050. Its growth in well-being, however, is projected to increase less than GDP during that period.

Economic Growth. On the supply side, labor productivity is set to grow at 0.6% on a compound annual basis, driven by high levels of education and significant investments in R&D. The country’s fluid workforce also supports productivity. Meanwhile, our model shows that while the share of citizens older than 65 increases from 17.7% to 23.5% under the base case, those trends will likely be mitigated in part by immigration (considering long-term rather than near-term immigration trends). However, the female labor participation rate and hours worked per worker are projected to stagnate, limiting the potential for additional productivity gains.

On the demand side, personal consumption will remain a key driver of economic growth, accounting for 67% of GDP by 2050. However, the Gini coefficient, a measure of income inequality, continues to widen, exacerbating social disparities and making it harder for lower-income households to increase their disposable income.

Well-Being. Although disposable incomes are projected to rise, many Americans will struggle with access to essential services such as health care, housing, and education. Healthy life expectancy, which normally increases as an economy develops, has declined in the US since the early 2010s and could continue to slide.

Healthy life expectancy, which normally increases as an economy develops, has declined in the US since the early 2010s and could continue to slide.

Inequities in economic and other kinds of opportunities play a role here, with research showing a spike in rates of drug and alcohol-related deaths and suicide among those with lower education levels.3 Meanwhile, mental health and human connection may deteriorate due to isolation and economic anxiety.

The Aspirational Path. Under the aspirational case, our model shows that the US could accelerate growth in GDP per capita to 1.5% on a compound annual basis and boost its well-being index score from 6.2 to 8.1. (See Exhibit 4.)

The model identified five levers that could improve the US’s path going forward:

- Boost productivity. Make more investments in R&D.

- Increase the labor force. Tap into the power of women and older workers.

- Bolster demand. For example, increase people’s disposable income, expand social security, strengthen exports, and stimulate private investment.

- Improve foundational needs. Initiate enhancements in healthy life expectancy and the overall environment in which people live, reflected in factors such as personal safety.

- Enhance social and psychological fulfillment. Take measures to improve human connection and freedom of choice, for instance by enhancing support for lifelong learning.

Germany

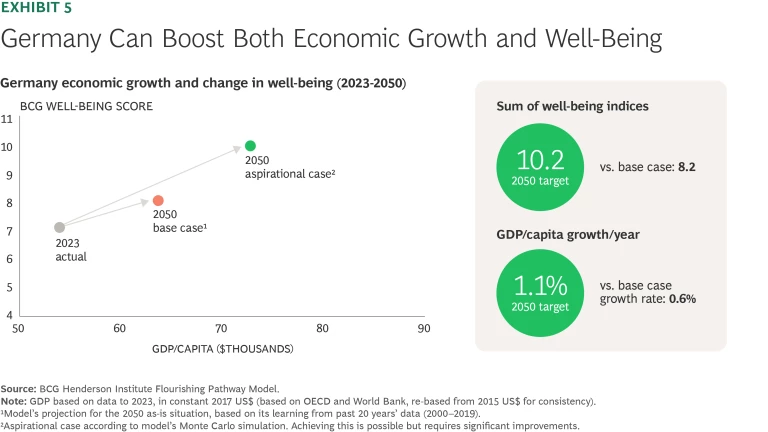

Germany is on track to age at the same pace as Japan, with the share of the population over 65 increasing from nearly 22.3% in 2023 to 30.5% in 2050. Real GDP per capita is expected to grow at just 0.6% on a compound annual basis, and well-being is projected to make a modest gain.

Economic Growth. On the supply side, stagnating birthrates and an aging population will decrease the number of hours worked per employee. Consequently, labor input is declining even after factoring in increased immigration and employment rates for women and older citizens. Labor productivity is forecasted to grow at 0.5% on a compound annual basis, supported by high levels of education and strong investments in advanced manufacturing. Despite these gains, Germany’s reliance on SMEs, which are slower to adopt digital technologies, will constrain overall productivity growth.

On the demand side, domestic consumption is expected to decrease as a share of GDP, falling from 50% to 46%. This reflects the broader challenge of sustaining demand in an aging society. However, net exports will likely continue to support Germany’s economy, accounting for 7% of GDP in 2050.

Well-Being. Improvements here are driven by factors such as a 2.1-year uptick in healthy life expectancy and a decrease in hours worked.

The latter shift stems from an expansion in part-time work among women and older workers, the introduction of flexible working hours, and legal worker protections. However, there are risks related to declining job engagement and job satisfaction, particularly among younger workers.

The Aspirational Path. Our aspirational case shows Germany delivering per capita real GDP growth of 1.1% on a compound annual basis and increasing its well-being index score from 7.2 to 10.2. (See Exhibit 5.)

The model identified five key levers that could improve Germany’s path going forward:

- Increase disposable income. Take measures such as reducing tax rates.

- Encourage private investment. For instance, provide incentives for investment into new businesses and growth industries.

- Improve job satisfaction and job engagement. Enhance working conditions to improve overall mental health, for example.

- Improve foundational needs. Enhance healthy life expectancy and fertility rates, for example, by educating citizens about disease prevention, fostering biomedical innovations, and increasing socioeconomic support for childbearing.

- Enhance social and psychological fulfillment. Improve the quality and frequency of human-to-human connection and interaction.

The aspirational cases above reveal how governments can identify the most promising areas for action amid seismic demographic change. Of course, private sector players also have much at stake. Potential repercussions of aging populations—including workforce shortages and flagging customer demand—could have a direct impact on company performance, making it critical for C-suite leaders to take action that ensures their businesses can adapt and thrive. (See the sidebar “Building Competitive Advantage in an Aging World.”)

Building Competitive Advantage in an Aging World

Put global aging on the agenda. Companies should recognize the aging of the global population as the megatrend that it is. Much as they have integrated climate change and AI into corporate strategy today, they must also factor looming demographic changes into the core of the business. This includes assigning cross-functional teams to assess demographic impacts and using those insights to adapt product offerings, workforce plans, and regional growth strategies.

Calibrate the impact on the business. Companies need to assess the impact aging populations will have in two areas. First, they should evaluate how the employee base, including recruitment and retention, will evolve over time. Second, they can determine what changing demographics will mean for the business itself, including potentially a shift in their target consumer base.

Of course, demographic aging is not uniform across the globe, and neither are the impacts and reactions from policymakers and society. That’s why companies need to take a de-averaged approach to identifying the impacts that will affect them—directly, as well as in their supply chains and business ecosystems—and the opportunities that these impacts present.

Shape the new reality in the market. Aging populations create headwinds—but they also open new market opportunities. Companies that develop products and services tailored to the needs of older consumers—what is known as the “silver economy”—can drive meaningful top-line growth. UniCharm, a leading manufacturer of baby diapers that subsequently developed solutions for adult incontinence—is a well-known example of how companies can successfully tap into a previously overlooked market. Beyond repurposing technology, firms can also leverage policy-backed innovation platforms—such as the innovation hubs outlined above—to partner on the development of novel aging-related solutions.

Shape the new reality on employee well-being. Companies have the opportunity to shape new people strategies that will help them attract and retain the talent they need. This effort will have three key components.

- Employee Engagement. Companies can create environments that prioritize employee well-being and engagement. They can encourage longer careers, helping offset workforce decline and easing pressure on systems like pensions. For employees in their 40s and 50s, companies can offer later-career planning tools such as self-assessments, reskilling opportunities, and flexibility for side jobs that may lead to new and rewarding career moves. Cross-generational collaboration can also be strengthened through thoughtful career design, clear roles, appropriate rewards, and mentorship programs. BCG research reveals there are tangible benefits for businesses that lead in such areas: companies in the top 25% for employee engagement achieved up to double the three-year average total shareholder return of those in the bottom 25%.

- AI and Automation. Companies can make smart and ambitious investments in AI and automation to drive a step change in productivity and bolster company performance. To make the productivity promise a reality, companies must prioritize engagement while redesigning work with an AI-first mindset and rebuild operations to integrate AI from the ground up. At the same time, they should focus on human effort where it adds unique value. If done well, automation can boost morale by removing tedious tasks and enabling more meaningful work. Corporations can aspire to leap ahead and become the world’s best users by mastering human-AI collaboration.

- Elder-Care Support. Companies can help address the impact that elder-care responsibilities have on their workforce. In Japan, for example, more than 7 million people take care of their aging parents, with more than 100,000 people quitting their jobs every year to manage that care. Meanwhile, the Ministry of Internal Affairs and the Ministry of Economy, Trade, and Industry estimate that by 2030, 3.2 million people in Japan will be working while taking care of their parents. That is forecast to create a $60 billion-plus drag on economic output in the form of lost productivity. Corporations can design flexible ways of working and HR measures to support employees caring for aging parents and collaborate with policymakers to build new mechanisms that address the issue on a national level.

As governments make meaningful changes to policies and social systems, companies should also take the opportunity to collaborate with the private sector and help shape those new approaches. Such partnerships can ultimately lead to better policies and a flourishing path for countries and their citizens.

Acknowledgments:

The authors thank the following BCG colleagues for their contributions to the research: Takashi Goto, Yuta Hino, Masatake Hirono, Sho Iizuka, Kentaro Ikeda, Ayuko Kobayashi, Kaiko Kuwamura, Daiki Miura, Ryo Murata, Takahiro Sudo, Kent Toshima, Mai Tsujikawa, Miaoqing Wang, Shuji Yamamura, and Yiyun Zhao. The authors would also like to thank Motoshige Itoh, professor emeritus at University of Tokyo, and Yoshinori Hiroi, professor emeritus at Kyoto University, for their input and guidance.

[1] An HHI of 1,500 is well below the 2,500 thresholds for high concentration (Japan Fair Trade Commission, 2014, p.6) or the level of 3,400 where productivity is said to peak (Bersch, Eppinger, and Schiller, 2023, p. 22).

[2] “Zombie” firms are companies that would normally be considered insolvent (unable to cover debt interest payments) but continue to operate with ongoing support from banks/ government assistance. The Bank for International Settlements defines zombies as companies that have had an interest coverage ratio of less than 1 for three consecutive years and have been in existence for more than ten years.

[3] https://ldi.upenn.edu/our-work/research-updates/health-inequity-in-the-united-states-a-primer/