AI and GenAI are capturing the imagination of finance leaders. After years of trial runs and pilot programs, the technology is now being put to work at scale—across accounting, treasury, planning, M&A, and more. The ambition is clear, and investment is growing. But the returns often aren’t easy to grasp. The key question: How can leaders move beyond the hype and deliver real ROI from AI and GenAI in finance?

In March 2025, BCG’s Center for CFO Excellence surveyed over 280 finance executives experienced with AI and GenAI in finance from large companies around the globe. It’s the first study to systematically quantify the ROI of AI and GenAI in finance—and empirically evaluate which specific tactics and use cases are driving that return.

What we found:

- Belief in the technology runs high, but results remain mixed. Median reported ROI is just 10%—well below the 20% many are targeting—and nearly a third of finance leaders say they’ve seen only limited gains. What’s missing isn’t interest or even effort. It’s value realization at a reasonable cost.

- Teams generating strong ROI are making different choices. They focus on value from the start, not on learning for learning’s sake. They take a broad transformation view instead of focusing development around single use cases. They actively collaborate with IT and vendors instead of trying to do everything internally. And they execute in a well-sequenced way—realizing value on the go.

Ultimately, outperformers understand that success with AI and GenAI isn’t just about impact—it’s about impact over effort. Here, we present a playbook for delivering impact that justifies the investment.

The ROI Gap Is Real

Finance functions are accelerating their use of AI and GenAI—but financial returns are mixed. Only 45% of executives can quantify ROI from their initiatives. Of those, a third report returns under 5%. Another quarter fall between 5% and 10%—well below the 20% threshold many are planning for.

One-third of surveyed finance executives are actively piloting new initiatives, and another 44% have moved into scaled deployment. Expectations are high: Some 30% believe AI and GenAI will deliver transformative value by the end of 2025. About half anticipate breakthrough results within the next three years.

While ERP transformation remains a top priority in finance, AI, specialized software solutions, and GenAI are next on the list. What’s more, CFOs view these technologies as considerably more transformative than earlier advances such as robotic process automation or process mining.

This confidence is already showing up in day-to-day applications. More than half of surveyed teams are using AI—both traditional and generative—in statutory and transaction accounting, as well as in treasury. And many are extending its use into more complex, higher-value areas such as controlling and M&A support.

So, what’s getting in the way of ROI? A major factor is that AI and GenAI isn’t an off-the-shelf solution that organizations can easily plug in and operate.

Finance teams often face more implementation hurdles than other functions, due to their responsibilities around compliance, regulation, and auditability. To help manage these challenges, many are turning to AI and GenAI agents—applications built to harness AI and GenAI within complex environments. (See sidebar, “The Future of Finance Is Powered by Agents.”)

The Future of Finance Is Powered by Agents

Our survey found that more than 75% of finance leaders expect agents to become a routine part of operations within three years. And for good reason: agents extend automation into complex, exception-heavy areas that traditional tools have struggled to reach.

Some organizations are already seeing results. Seventeen percent of finance teams are actively using GenAI agents today, and another 13% plan to follow suit. HighRadius, a leading finance automation provider, used agentic AI to eliminate a third of the manual effort in the cash application process.

Consider an agent embedded in accounts payable. It can scan invoices, compare them to purchase orders and contract terms, flag mismatches, and trigger approval workflows—cutting exception-handling time dramatically.

ERP providers are racing to embed agents natively. As adoption scales, companies will need new oversight models to ensure transparency, consistency, and strong controls—especially in regulated environments.

Organizations at the start of their AI and GenAI journey often lack the necessary resources, skills, and infrastructure. Those further along wrestle with high implementation costs and issues around data quality, auditability, and coordination. Underestimating these challenges is a risk in itself: our data shows that teams with a more realistic view of the road ahead tend to make faster progress than those expecting a smoother path. In all, 73% of executives say four or more of these barriers are critical, and 24% cite seven or more.

Yet despite these challenges, some finance functions are achieving strong returns. Roughly one in five report ROI of 20% or more from their AI and GenAI investments.

How Leading Teams Get Real Returns

What sets outperforming organizations apart are the implementation tactics they adopt and the use cases they prioritize.

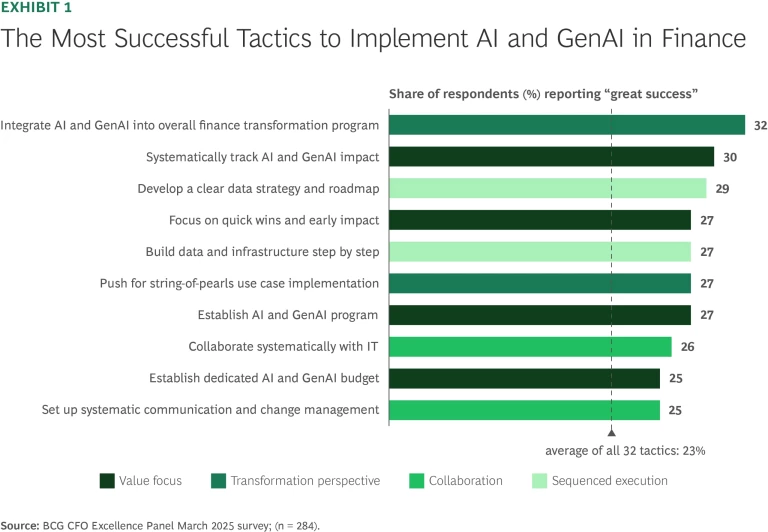

Out of more than 30 implementation tactics which we tested, ten stood out as being the most successful—including integrating AI and GenAI into the overall finance transformation, systematic tracking, developing a clear data strategy, and focusing on quick wins. (See Exhibit 1.) A systematic analysis of the data reveals that CFOs can significantly improve the ROI of their AI and GenAI efforts by following four proven strategies.

Focus relentlessly on value. High-return teams prioritize quick wins over open-ended learning or continuous improvement—and that focus pays off. Emphasizing early impact increases the likelihood of success by 6 percentage points.

Top ROI performers allocate a dedicated AI and GenAI budget to keep costs in check and channel resources toward what works—one of the top ten tactics. Projects must demonstrate tangible value to earn funding. Teams apply the same rigor they use for any other major investment—backing what delivers and cutting what doesn’t.

Systematic tracking is also essential to steer AI and GenAI decisions—but many CFOs admit they struggle to set this up. Some use cases are difficult to quantify, especially when the value lies in intangibles such as better insight. In such cases, leaders can use proxies—reductions in full-time resource load or gains in forecasting accuracy—to gauge impact. The metrics don’t need to be perfect to be effective. The practice of tracking value keeps initiatives anchored and reduces the risk that development effort will go toward bells and whistles.

Take a broader transformation perspective. Leaders who embed AI and GenAI initiatives into their broader finance transformation agenda increase the probability of success by 7 percentage points over those that treat it as a standalone effort.

Top performers stitch connected use cases together instead of running dozens of unrelated pilots, allowing the underlying investment in data, technology and other resources to stretch further. This string-of-pearl approach makes it easier for use case benefits to build on each other and unleash broader organizational redesign. Similarly, CFOs get better results when they apply use cases across end-to-end processes or domains rather than isolated activities.

The CFO of a consumer goods company employed this broad redesign approach to his financial planning and analysis department. At the start, the organization faced familiar challenges: team members gathered data manually from multiple sources to answer ad-hoc requests. Often the team could not correctly estimate the bottom-line impact of marketing promotions and struggled to compute other basics with confidence.

To solve this, the team stepped back and built a driver-tree model. The model mathematically connects operational metrics from different data sources to financial outcomes, allowing connections in the form of simple addition or even complex algorithms. The system also allows the team to easily add new data sources and change connections to adapt to different requirements and changes in business models. They then layered in a GenAI-powered natural language interface to extract the right answers to ad-hoc requests on demand. The redesigned system cut report generation time by 50%.

Once reporting was operational, the team extended the impact using the string-of-pearls tactic. Because the driver-tree model was already in place, they can now easily swap in new inputs to enable algorithmic forecasting. The result: forecasts that can be delivered 30% faster. On top, the same logic facilitates dynamic scenario modeling, a new capability for the team.

Finance teams need to understand how to use the new AI and GenAI systems—what the limits of these tools are, as well as how to review and validate results—and change their processes and working habits.

Achieving transformational scale requires deep user adoption. Finance teams need to understand how to use the new AI and GenAI systems—what the limits of these tools are, as well as how to review and validate results—and change their processes and working habits. That’s why change management and communication also rank among the top ten tactics for success. As one finance executive told us: “Go slow to go fast by spending more time on stakeholder management.”

Governance must also be defined. Auditability is a top concern, and addressing it early—through practical, well-scoped frameworks—builds trust and reduces the risk of downstream disruption. These steps are difficult. Many CFOs said their organizations struggled with them. But without clear policies for risk, explainability, and compliance, even promising AI and GenAI programs can stall. Rather than push these difficult topics to the side of the desk, finance functions should address them head on.

Stay ahead with BCG insights on corporate finance and strategy

Collaborate actively. Finance functions don’t need to build everything themselves and often see higher returns when they don’t. As one blue chip CFO we interviewed underlined: “Collaboration between finance and IT was really key for us to ensure the necessary adoption of AI.”

AI and GenAI transformations depend heavily on IT. Not just for infrastructure, but for deep technical expertise. Top performers work hand in hand with IT and free up the right people within finance. Fully staffing dedicated teams (instead of spreading people part time) boosts success rates by 5 percentage points.

Better collaboration with outside partners is also important. Hiring specialized AI and GenAI experts is difficult. In our data, partnering with vendors to leverage their expertise can raise the odds of success by 5 percentage points.

The same logic applies to technology. Using what’s already available from software vendors—rather than always building from scratch—can improve ROI. Yet, 40% of CFOs still don’t know what their vendors already offer. Getting up to speed is one no-regrets move finance executives can make now.

Leading ERP systems already embed AI and GenAI capabilities. SAP, for example, includes agents that draft reports, match cash, and predict payments—accessible through its Joule natural-language chatbot. BlackLine uses AI and GenAI to spot close risks and match transactions. These features are regularly upgraded, giving finance teams access to sophisticated, off-the-shelf tools that already take care of challenges like data auditability and security.

That doesn’t mean off-the-shelf is always the answer. On average, about 55% of solutions are built in house. But custom builds should be reserved for cases where real differentiation or material customer value is at stake. Take algorithmic forecasting—a high-impact use case for many. To work well, it needs to be tailored to a company’s data, business model, and decision context. That’s worth the investment into a proprietary solution.

Execute in targeted, scalable steps. “Not having a clear roadmap and prioritizing key areas. Having too much scope for little wins. That was our biggest mistake at the start,” said the CFO of a large consumer goods company.

Top performers learn from this. The most successful finance teams don’t try to transform everything at once. They build what’s needed, when it’s needed—and ensure each step delivers tangible returns.

When starting, CFOs should set up a small team to lead the AI and GenAI transformation rather than experimenting broadly. This targeted approach reduces wasted effort and sharpens lessons learned—increasing the probability of success by 6 percentage points.

Pilots alone won’t deliver ROI. The most successful teams think about scaling from the start—investing less in showpiece pilots and more in the steady, often unglamorous work of driving adoption.

Data transformations are also best done step by step—letting use cases inform what high-quality data to invest in instead of trying to construct the perfect data environment at the outset. This sequenced approach ensures quick value realization and speeds further advances, since infrastructure built for one use case often supports others in the string-of-pearls approach.

The AI and GenAI Use Cases That Generate the Highest ROI

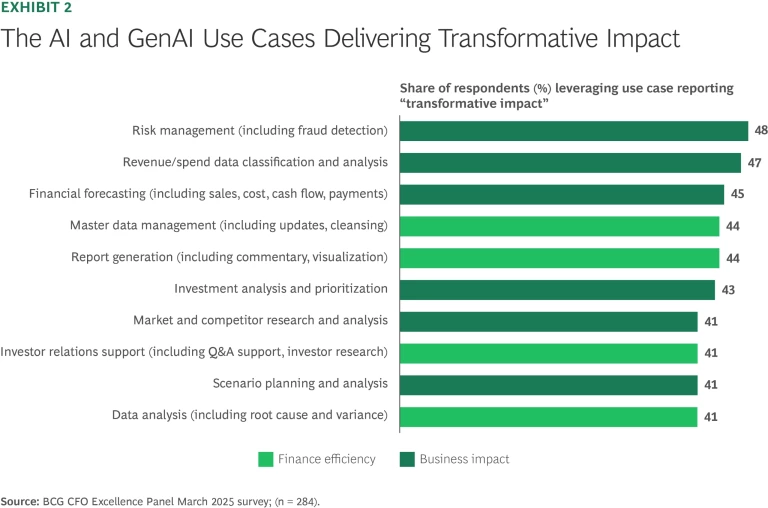

Our analysis looked not just at implementation tactics, but also at which AI and GenAI use cases generate the greatest value. (See Exhibit 2.) Interestingly, most of the top ten use cases are in risk, financial planning and analysis, and statutory accounting, not in finance operations.

Risk management tops the list—a somewhat surprising result because the topic doesn’t often come up in conversations about AI and GenAI. Yet, finance leaders that leverage the technology to detect fraud and reduce related costs frequently see transformative results. Financial forecasting ranks close behind, with high-impact application in cash flow modeling, sales planning, or inventory management.

What we learned, however, is that only a handful of finance teams are exploring those that consistently deliver outsized ROI.

This is not for lack of activity. The typical finance function has six use cases in the proof-of-concept stage and five already in production. More advanced organizations may have one or two additional use cases underway, but few have more than ten active in total.

What’s missing isn’t effort—it’s impact. Most finance teams currently prioritize use cases that promise internal efficiency, especially in transactional areas like payables and receivables, policy drafting, or coding. These use cases are often faster to implement and easier to justify, particularly when efficiency gains are needed to fund the journey. But advanced finance functions don’t stop there. While they still pursue efficiency, they give greater weight to use cases that unlock business value—things like better decision making, improved forecasting, or faster time to insight. Our data shows they’re far more likely to prioritize these high-impact areas alongside core productivity plays.

Leading teams are already redirecting attention toward high-ROI use cases, which is the surest path to turning effort into real impact. One global entertainment company recently piloted a GenAI-driven tool that exemplifies a high-value risk use case. The tool scans financial developments, identifies anomalies, and automatically generates executive-ready alerts—giving leaders a near-real-time view into emerging risks. This kind of application reduces exposure and positions finance as an intelligence center for the broader business.

Leaders also need to understand when to use GenAI and when not to, since what it does well is very different from traditional AI. (See sidebar, “Using GenAI Where It’s About Language, Not Math.”)

Using GenAI Where It’s About Language, Not Math

This distinction matters. Many finance workflows involve deterministic questions with only one correct answer: verifying sales, reconciling accounts, or ensuring regulatory compliance. GenAI isn’t built for those. That’s why machine learning, rule-based automation, and traditional AI remain critical for precision work. Structured data tasks are often best handled via APIs, SQL-based queries, and real-time dashboards that provide clear, auditable results.

If teams still need to verify GenAI-generated output line by line, the efficiency gains evaporate.

But there are real opportunities. GenAI performs well in automating financial commentary, drafting investor communications, powering natural-language interfaces to core systems, and even generating Python scripts for advanced analytics.

What GenAI may change is where some of this work gets done. Because it can operate across languages—and because GenAI assistants can guide workers through complex steps—more finance activity can shift to shared service centers. Tasks that once required local language fluency or deep institutional knowledge can now be supported more broadly.

CFOs should stay clear-eyed and have realistic expectations: GenAI won’t help leapfrog ERP issues or fix data quality problems. But used selectively, and in the right context, it can expand capacity, boost productivity, and unlock new efficiencies.

AI and GenAI is already reshaping finance—making the finance function not just leaner, but more strategic by producing faster and better insights. Returns on the effort won’t come from experimentation alone, however. They’ll come from treating AI and GenAI as a performance investment—one that demands clear goals, disciplined execution, and measured impact.

The finance teams seeing the strongest results aren’t doing more. They’re doing what works. They focus on value. They scale with purpose. And they measure everything.

The roadmap is now clearer than ever. For CFOs, the next step is simple: make ROI the strategy—and lead from there.

To receive BCG’s detailed guide, “How to Drive ROI from Your AI and GenAI in Finance,” please drop a short email to bcgcenterforcfoexcellence@bcg.com