The insurance industry has outpaced other sectors in its early embrace of artificial intelligence. However, few insurers have delivered value at scale. Many AI programs, whether predictive or generative, have stalled because of organizational and individual resistance. The specific issues include limited business engagement, unclear roles and responsibilities, inconsistent support, and the probabilistic nature of AI, which clashes with the inherent culture of the insurance industry. The companies that find success at scale are those that think big, execute more effectively day to day, foster a culture of change and accountability, and focus on the few areas that will provide the most value across the enterprise. This article outlines how insurance organizations can get past the hurdles and unlock the unique aspects of scaling in this industry.

The AI Scaling Journey

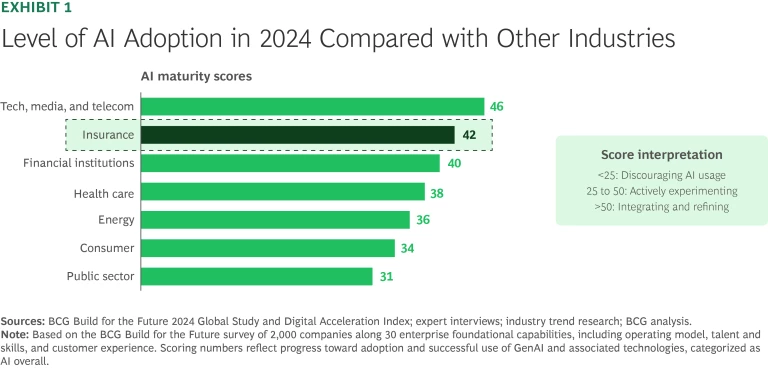

The insurance industry has made significant strides in adopting and testing predictive and generative AI systems and AI agents. A 2024 survey showed insurance companies outpacing nearly all industries and nearly at the same level of adoption as technology, media, and telecommunications companies. (See Exhibit 1.) Those results were particularly noteworthy compared with the industry’s track record in broader digital technology, where it had increased its adoption rate by close to 20% between 2019 and 2023 but still remained in the middle of the pack of industries.

Experience to date shows that the insurance industry has unique potential for unlocking value from AI. It has deep data reserves, including longitudinal data on customer practices and interests. It has long relied on data-driven decision making, with proficient staff and well-trained analysts. It has demonstrated rapid gains in productivity and new business through new AI implementations.

Experience to date shows that the insurance industry has unique potential for unlocking value from AI.

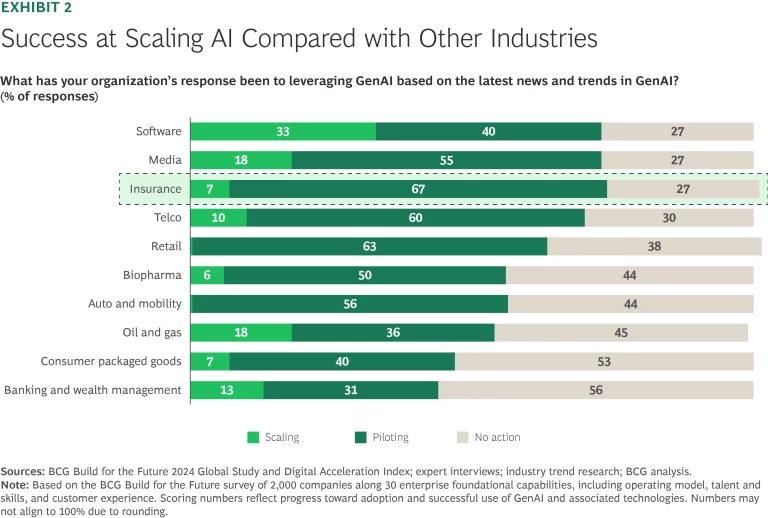

Despite these advantages, most of the industry has a long way to go toward gaining the benefits of this game-changing technology. Many companies begin enthusiastically with pilot projects and then scale back. Even when successful on their own terms, these projects raise concerns about the impact they will have on the rest of the company and existing ways of doing business. Only 7% of insurance companies surveyed have successfully brought their AI systems to scale—that is, few have installed even the most effective AI practices throughout their organizations. About two-thirds of insurers are still in the piloting stage, according to the BCG Build for the Future 2024 Global Study, a proprietary survey. (See Exhibit 2.)

BCG’s Digital Acceleration Index has found that organizations that move quickly to adopt AI and associated technologies consistently capture more value. Studies of the insurance industry show noteworthy gains from AI. For example, leading firms that equip service and operations employees with AI-empowered knowledge assistants bolster productivity by more than 30%. Firms are using AI systems to help migrate their tech infrastructure to cloud-based architectures. They are also creating personalized agents for customer support.

One example of scaling comes from a large insurance company, which handles nearly 50,000 claims-related communications daily. The company uses tailored versions of OpenAI’s GPT models to draft most of its messages to claimants. The models are trained on company-specific language and guidelines to maintain consistent tone and relevance, with a human claims agent reviewing outputs for accuracy. By using these models with all customers, the company is enhancing its brand and maximizing its productivity.

To date, we see insurers fall into one of three main categories in their AI scaling journey:

- Locked into Pilots. The focus is on siloed or exploratory AI use cases, often initiated at the task level (using AI apps to automate claims applications and fraud checks, for example), with annual investments under $5 million.

- Broad Experimentation at a Limited Scale. These companies spread their AI activity across fragmented or exploratory use cases with modest, local impact (improving a local sales process, for example), supported by annual investments of $5 million to $25 million.

- Strategic Deployment at Full Scale. The most advanced insurance companies use AI to facilitate the redesign of end-to-end business processes, with annual investments of $25 million or more and often in the $50 million to $100 million range.

That last group of companies, those engaged in strategic deployment, will be the industry leaders who scale AI most rapidly and effectively while fostering a culture of agility and continuous learning. They are best positioned to reap the benefits of this technology in the short term, lead the industry in the medium term, and capture value through transformation over the coming decade. Because it will take some time to absorb GenAI at scale in a thoughtful, impactful way, those who seek long-term value are starting the GenAI transformation now.

Stay ahead with BCG insights on the insurance industry

Facing the Technology Challenges

Many factors prevent insurance companies—particularly those stuck in pilot mode or engaging in broad AI experimentation—from unlocking AI’s full potential and scaling it effectively. A relatively small percentage (about 10%) of the resistance-related challenges results from the AI models themselves. Some factors include a lack of reliable accuracy measurements and continuous improvement. Off-the-shelf AI systems should ideally include automated accuracy monitoring, a development pipeline, continuous model refinement, and consistent measurement, reporting, and evaluation. To enable production-scale deployment, the system should track key metrics such as user interaction, model output quality, technical performance, cost, and compliance with responsible AI guidelines and rules.

Other technological factors represent about 20% of the challenges. Most of these have to do with technological proficiency. These hurdles include lack of integration with legacy systems, data governance and accuracy issues, and procurement decision inefficiency. Teams often favor custom-built solutions over scalable low-code tools, missing opportunities for tech reusability and strategic scaling.

Large amounts of tech debt (sunk costs and well-established contracts) may also limit scalability. For example, a group of life insurance policies issued 20 years ago may still require manual handling, presenting significant opportunities for AI-driven efficiency improvements but also a considerable transition cost. Data challenges, such as fragmented data architectures and manual analytics processes, can also create friction.

The company may also discover that its platform capabilities are insufficient for GenAI. It may lack the infrastructure to test AI solutions in production-like environments, limiting its ability to evaluate performance for broader rollout.

As demand for AI-related services grows, vendors and in-house AI teams will deliver them, consolidating platforms, installing new tech systems, and training people to use them. However, even here the solutions may provoke further resistance. That’s to be expected because 70% of the problems in scaling AI have to do with people, organizational issues, and processes. It’s the human factors that always require the most attention and insight.

Most of the problems in scaling AI have to do with people, organizational issues, and processes. It’s the human factors that always require the most attention and insight.

People, Organization Issues, and Processes

The inherent ambiguity of AI-driven insights challenges the culture of insurance companies. Unlike traditional actuarial models that strive for near-perfect accuracy, AI solutions often operate with probabilistic outcomes. Language models seek solutions that are likely to succeed. Insurance companies must accept this shift and rigorously embrace their own role in compensating for it.

Sometimes, leaders don’t emphasize the link between their adoption of AI and their overall business priorities. When they define the expected value of a new AI system, they often leave out key stakeholders such as customers, business partners, and internal users. In broader use of AI in products and services, the most prevalent goal is profitable growth, but a focus on more specific goals can generate stronger results. Should the company’s AI use lead to operational efficiency, unlock new revenue streams, or enable more personalized products and services? Without clear answers, it’s much harder to gain stakeholder buy-in at the right level and redesign the workflow to maximize AI impact.

The siloed nature of large enterprises is another factor. Implementation of AI may stretch across multiple businesses and functions. Teams may not cohere to implement a full-scale solution. If there is no enterprise-wide resource coordination, then the AI transition could tax overstretched resources.

There may be fragmentation among teams. As groups follow the playbook for their part of the enterprise, they may rely on short-term Band-Aid solutions rather than driving end-to-end process reimagination. Tech teams may press for rapid iteration and deployment, while business teams might prioritize compliance or customer impact. These differences can lead to friction, stalled decision making, and missed opportunities. It can all add up to a disappointing rollout. Many insurance companies start setting up AI programs with top leadership buy-in and initial signoff. When the time comes to demonstrate enterprise-wide value or deliver results to the board, they aren’t able to muster the needed commitment.

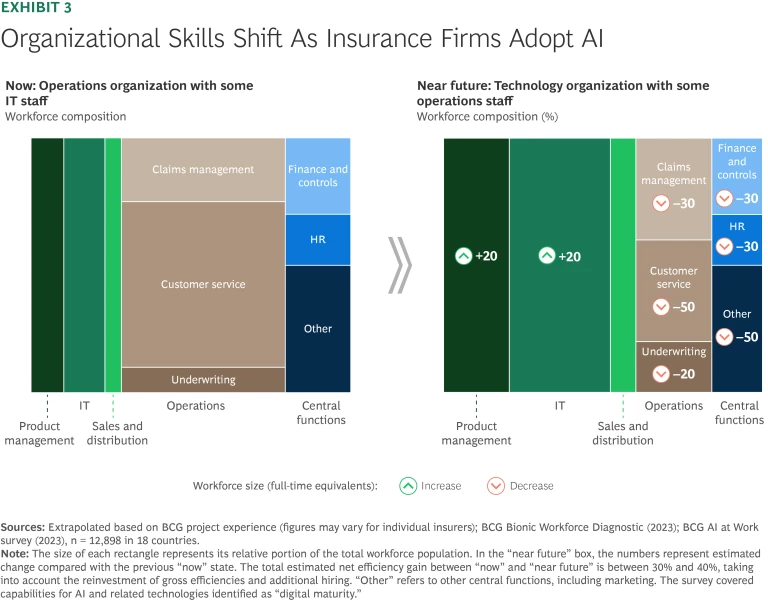

A final organizational hurdle involves the IT functional approach. To scale effectively, insurance organizations often need to shift from operations-heavy structures to more centralized, technology-driven models. (See Exhibit 3.) This shift can transform the composition of the workforce and result in 30% to 40% gains in net efficiency.

AI Mobilization in the Insurance Industry

To accelerate the momentum of AI programs, companies should focus on mobilization: delivering targeted outcomes wherever the projects appear. There are three general precepts for accomplishing this.

Think bigger and longer term:

- Identify strategic opportunities that address top priorities—both business gaps and future aspirations. These opportunities can be as simple and direct as better customer experience, more cost efficiency, or revenue growth. One life insurance firm recognized that efficient knowledge capture and sharing are key drivers of operational efficiency and long-term growth. To address this, the company adopted Scribe, an AI-powered platform that lets users capture workflows and automatically generate step-by-step, shareable guides.

- Outline the steps of business process reimagination. Compare the current state of the insurance value chain with your desired future state. Redesign the workflows to reach your high-priority strategic opportunities. Assign clear business owners and sponsors to drive accountability and sustain momentum.

- Develop a cost-benefit assessment to demonstrate the value potential of scaling each opportunity, obtain leadership buy-in, and express commitment. Some firms have invested as much as $1 billion in growth and technology, with a particular emphasis on AI.

Optimize day-to-day delivery:

- For each AI-enabled initiative, appoint a business-aligned, enterprise-wide product owner (PO). The PO articulates the vision and value opportunity, outlines the build plan, drives decisions, and escalates to resolve roadblocks.

- Mobilize a dedicated cross-functional delivery team (or “pod”), with the necessary cross-functional capabilities and clear visibility into available resources. This team should have the skills needed for “human-in-the-loop” roles in AI systems development.

- Define governance systems and incentives to accelerate decision making and promote an “operate-as-one” mindset across business and tech teams.

- Set up production support with a plan for ongoing training, evaluation, monitoring, and maintenance, supported by a scalable tech stack.

- Identify constituent user groups for ongoing feedback. Developers of AI-enabled models related to specialized health care fields like oncology, chronic disease, or mental health could consult with experts in those fields.

- Develop a user adoption plan that includes identified champions, tailored communications for end users, and embedded training within day-to-day AI solution use—such as prompt-writing guidance. The plan should also incorporate a feedback loop from User Acceptance Testing to enable continuous improvement.

Foster a culture of change and accountability:

- Demonstrate leadership commitment to the AI program through visible actions. For example, ship a new feature, tool, or capability every 100 days.

- Foster knowledge sharing and cross-functional collaboration through workshops. Use these sessions to align teams on the next steps for AI initiatives, with a strong emphasis on speed and execution. In a market where dozens of vendors offer near-identical solutions to the same buyers, momentum is a competitive advantage. For example, in software development, Cursor's rapid product velocity has made it not just a tool but a competitive brand.

- Embed AI learning into team development plans, making continuous upskilling a core part of talent and capability growth.

- Codify lessons learned and best practices into an evolving playbook that supports consistency and scale.

- Continuously assess and enhance broader enablers, such as the AI operating model, ensuring clear collaboration across the company.

The insurance industry has reached an inflection point with AI. The question is not whether AI will reshape insurance but which insurers will shape that transformation. At times like this, it’s often tempting to let other companies be the early adopters. In this instance, however, the case for change is broadly visible. Switching costs are low, and productivity gains are quickly realized. The industry’s new leaders will be the companies that recognize AI as a catalyst for fundamental business transformation and are willing to experiment and reinvent themselves.