Software suites or best-of-breed applications? If you thought the choice would get easier, the current business and technology landscapes suggest otherwise.

Companies are in the midst of constant change. Shifts in geopolitics and new technologies, such as generative AI and AI agents, are rewriting the rules. And speed in operations, in product and service development, in market-facing activities, and in organizational interactions is an imperative. With so much volatility, there’s little room for missteps. Consequently, it is critical for companies to make the right choices about their applications environment. And perhaps the most critical component of a coherent and effective applications software strategy is determining the optimal approach: should a company choose an all-in-one, comprehensive software solution from a single vendor (a suite) or multiple software applications from different vendors, each tailored for a specific function or use (best of breed)? (See the sidebar “Understanding the Terms.”)

Understanding the Terms

There are a number of tough issues that companies must face when determining which option to choose, encompassing vendor relationships, cybersecurity, data privacy, and meeting growing financial and environmental, social, and governance reporting demands. On top of that, many companies are wrestling with challenges particular to their organization—including software systems that were inherited from M&As but don’t work well together, aging enterprise resource planning (ERP) systems that aren’t agile enough to support strategic goals for fast-moving teams, and the integration of AI. And despite all of this, no one is saying let’s double the IT budget to get it right.

Choosing between a suite and best-of-breed strategy depends on an organization’s structure and specific business needs. Suites offer the benefits of an all-in-one solution—integrated tools, tighter security, a common data model, and a harmonized user interface. Working with a single vendor can also significantly reduce complexity and risk. But best-of-breed programs can provide more flexibility and strategic opportunities since companies can choose the optimal applications for each function—and potentially stay nimble and respond faster to industry and organizational changes.

Given their contrasting advantages, selecting the ideal approach requires a clear, thoughtful evaluation. Without that, companies risk creating an application landscape that is costly to maintain and doesn’t deliver what the business needs.

Seven Questions Drive an Applications Decision Framework

To explore how companies are navigating the choice between a suite and best-of-breed approach, BCG surveyed more than 300 C-level leaders in IT and business from a variety of major industry sectors across Europe and North America. The respondents came from organizations with more than $1 billion in annual revenue. We also conducted extensive interviews with about 30 executives and experts in enterprise software about their strategic priorities and budgets. We focused on the most common core applications—such as ERP, customer relations management (CRM), and human resource management (HRM)—rather than niche, industry-specific tools. That way, we could make fair, apples-to-apples comparisons. We also drew on data collected from our annual IT buyer survey that queried 600 IT buyers at the director level or above across North America and Europe. Ultimately, our goal was to understand how companies are weighing the benefits, tradeoffs, and risks of each approach—and what criteria they’re using to make these high-stakes decisions.

The survey illuminated key points in the selection process. By a large majority (75%), decision makers—whether choosing a suite or best-of-breed approach—said that cost is their primary concern. Separately, 70% cited adaptability as the most important technical consideration. Decision makers at companies with more complex business and operations models lean toward a best-of-breed approach, while those at companies with limited IT support to manage their data more often choose a suite. And those who favor a suite often value the broader ecosystem of partners that these programs offer.

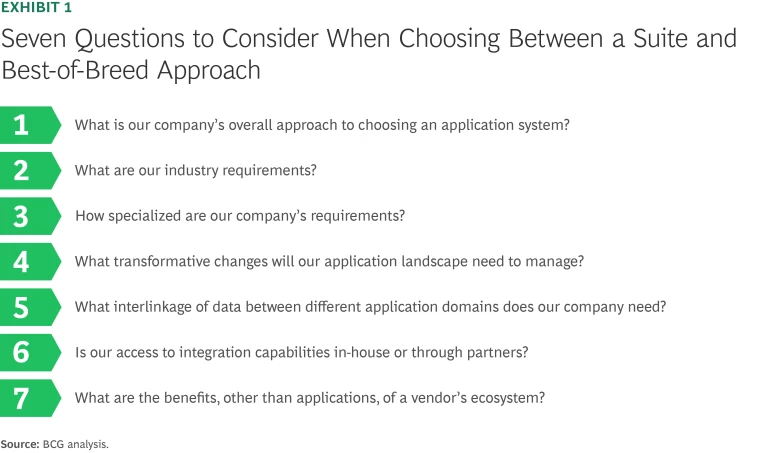

From the research, we built a decision-making framework grounded in seven strategic questions. (See Exhibit 1.) These questions can serve as guiding principles for decision makers evaluating suite and best-of-breed choices. The goal is to help organizations make the most advantageous choice—and provide a window into smarter decision making in a complex landscape.

Stay ahead with BCG insights on technology, media, and telecommunications

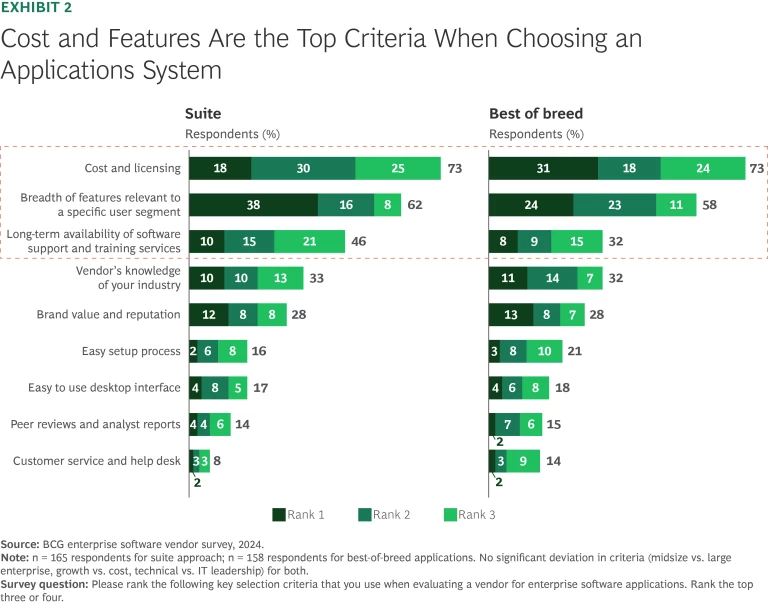

What is our company’s overall approach to choosing an applications system? Two criteria stand out: cost and breadth of features. Both suite and best-of-breed respondents ranked these among their top three evaluation criteria. (See Exhibit 2.) The emphasis on cost reflects a persistent reality: enterprise application budgets are tight. Despite rising demands, IT expenditures have grown at a modest pace of about 3% annually in the postpandemic period, well below inflation. Budgets are increasingly being stretched across emerging priorities such as AI, data analytics, and cloud migrations. Notably, spending on enterprise applications has remained steady at about 30% of total IT budgets for more than a decade, underscoring the competition for funding within IT portfolios.

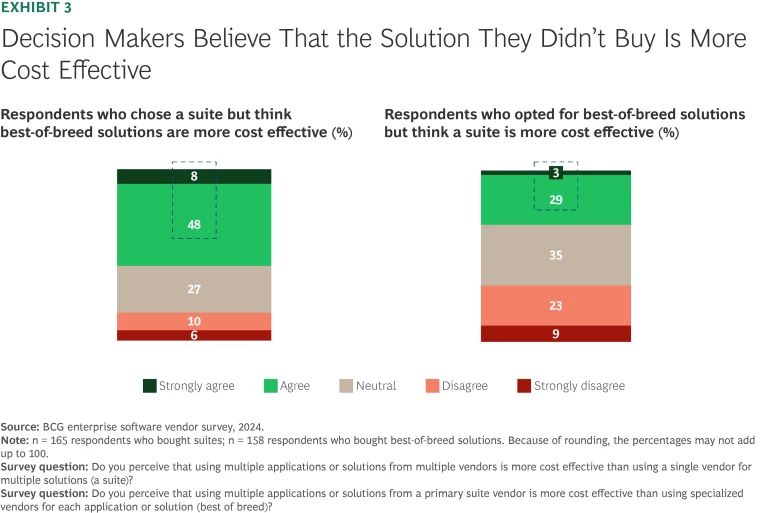

Still, although cost is top of mind, it is just one factor in the purchasing decision. Interestingly, about one-third of respondents who chose best-of-breed solutions believe that suite applications are more cost-effective—and yet they still moved ahead with best-of-breed solutions. (See Exhibit 3.) This suggests that cost, while important, isn’t necessarily decisive.

For companies that chose suites, breadth of features was the most commonly cited reason: 62% of suite adopters pointed to this as their top priority. These organizations are drawn to the appeal of a comprehensive, all-in-one platform—but they also want assurance that breadth doesn’t come at the expense of capabilities. In choosing to forgo the specialization of best-of-breed tools, suite buyers are opting for a platform that spans individual domains.

The third preference for respondents is long-term availability; not surprisingly, they seek stability for their consolidated systems. Those choosing the best-of-breed approach, especially smaller companies with $1 billion to $3 billion in revenue, have a slight preference for vendors that have specialized knowledge about their industry, no doubt reflecting that they expect software vendors to have a comprehensive understanding of how the programs will be used.

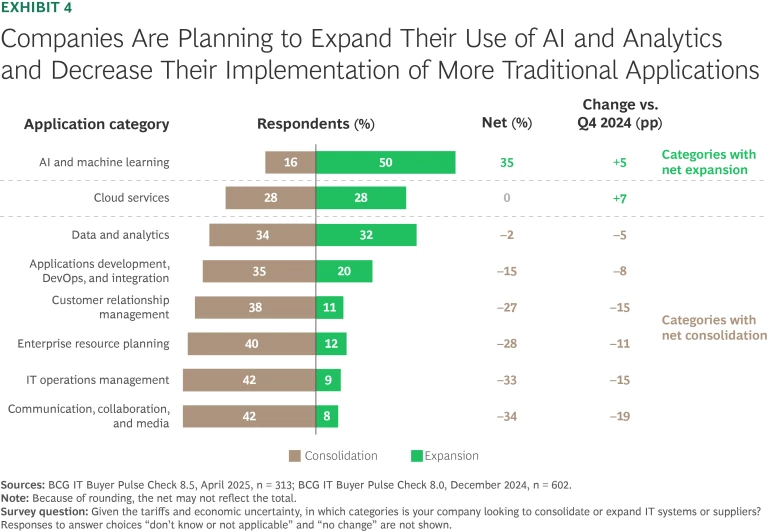

As the applications landscape evolves, companies have more to juggle when making purchasing decisions. They need to evaluate where to expand—for instance, by adding more AI and machine learning programs—and where to contract, generally in established applications categories, such as CRM and IT operations management. (See Exhibit 4.) And they have to balance the constraints of a limited budget. “IT budgets in regard to enterprise applications are always tight, as you have to spend the vast majority of the budget on maintaining your existing infrastructure,” said the chief of new technology solutions at a large global manufacturing company. “So, naturally, you have to be careful with what is left and make sure you get an adequate ROI.”

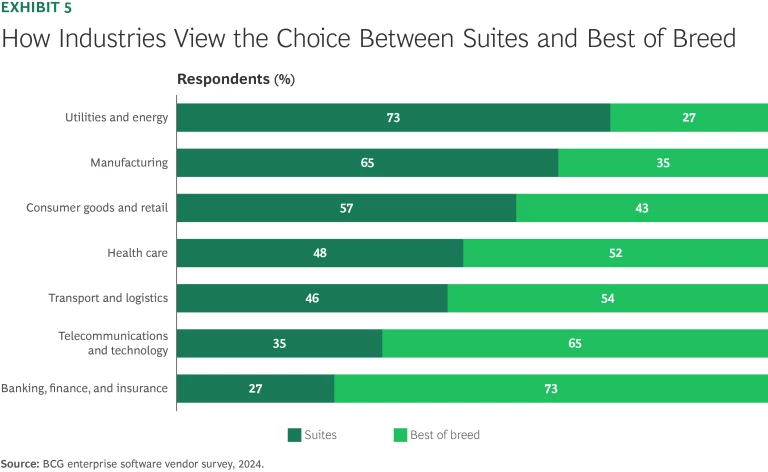

What are our industry requirements? Industry-wide factors, such as regulatory complexity and the degree of reliance on technology, can strongly influence whether companies lean toward suite solutions or best-of-breed tools. For instance, a majority of the manufacturers (65%) and consumer goods and retail companies (57%) surveyed opted to purchase a suite, indicating that their operational performance is not dependent on overly specialized programs for standard applications but rather requires the broad and integrated functionality that is available in suites. (See Exhibit 5.)

By contrast, about three-quarters of banking, finance, and insurance respondents, whose firms manage significant amounts of detailed and sensitive customer data in relatively closed and secure network environments, prefer best-of-breed applications. These firms face constantly evolving regulatory demands, and they perceive that they can tailor best-of-breed applications to meet those needs.

Similarly, 65% of respondents in the telecommunications and technology industry favored best-of-breed tools, driven by the need to frequently update and replace applications. For telecom companies in particular, as well as many financial services firms, IT systems are not viewed as a commodity but a core operational capability. These organizations often employ skilled IT teams that can manage the complexity of handling multiple best-of-breed applications.

Spending patterns further underscore this divide. According to a 2024 Gartner report, the cross-industry median for IT spending is 3.1% of revenue, but in industries that rely heavily on specialized technology, the figure is much higher: banking spends 6.8%; software publishing and internet services, 6.6%; and telecommunications, 4.1%. By contrast, retail (at 1.5%), industrial manufacturing (2.0%), and consumer products (2.8%) fall below the median.

In some cases, though, suites are favored even if an industry has very specific needs that would seem to be better met in a best-of-breed environment. For instance, due to the many joint ventures and the complex ecosystem of supplier-buyer relationships in the utilities and energy sector, companies have sophisticated industry-specific accounting requirements. But suite vendors have for a long time offered products designed for these needs—and have gained loyal followings. A chief information officer (CIO) of a large oil and gas company told us, “The best-of-breed provider can’t always support this in the same way as a suite provider.”

How specialized are our company requirements? Choosing between a suite or best-of-breed approach is rarely a binary decision. Rather, it is more nuanced. For instance, generally companies with broad product portfolios, diverse customer segments, or aggressive acquisition strategies tend to favor best-of-breed solutions. These firms require the technical flexibility to tailor or replace applications without major disruption—especially as needs shift. In fact, 70% of respondents in such environments cited technical adaptability in an enterprise software solution as their top priority, and 51% emphasized the importance of being able to replace tools as business conditions evolve.

But even within complex organizations, integrated suites can be more suitable. This is particularly true if they need to integrate data and processes across the organization and the individual components of their portfolio. In these cases, a suite may be a more holistic option for ensuring that the disparate company units can be viewed from a data and planning perspective as a single unified entity without too many IT and integration headaches.

International reach adds yet another layer to this discussion. Regional operations often require a more flexible strategy since application needs—and vendor capabilities—vary around the world. Companies with international breadth must have a technology approach that can be supported by local or regional software firms. As a vice president and global head of enterprise architecture and innovation at a global manufacturing company put it: “Even if you intend to stick to one strategy in different geographies, the reality is that you have to make regional adjustments and go with different vendors who offer something more relevant to that region.”

What transformative changes will our application landscape need to manage? Companies that are anticipating significant and even disruptive transformations in the near or medium term must make their application landscape future-ready. Whether preparing for digitization, industry disruption, M&A activity, or regional expansion, the right applications strategy needs to support not only current operations but also the profound changes that are likely to reshape them. In each case, businesses need to weigh standardization versus differentiation and how that impacts decisions about applications strategies.

Consider a digital transformation as an example. When companies adopt emerging technologies, best-of-breed solutions can often offer greater speed and flexibility, providing a quicker path to implementation due to their smaller code bases and shorter product development cycles. This, of course, assumes that the digital transformation does not involve complex application-integration scenarios, which could increase the time and cost to link up the best-of-breed products. Over time, suite providers embed these advanced, newer capabilities in their applications—and when they do, they are integrated deeply into the suite, leveraging and combining data from all applications and, thus, improving functionality at scale.

The same dynamics can arise in other types of transformation scenarios. For instance, an industry-level shift can significantly affect how firms need to operate. A good example is the automotive industry’s transition from internal combustion engines to electric motors and battery packs. That change has rippled across sourcing, plant operations, cybersecurity, data handling, new revenue models, and product-to-market speed. Having best-of-breed solutions would seem to be advantageous given their modular flexibility and the magnitude of the disruption. Yet making the choice isn’t always that simple or straightforward. If a company believes that its suite vendor has a deep understanding of its industry and can readily adapt its product development plan to the changing dynamics—or if there are existing industry-specific application offerings that are easily integrated into the suite or an ecosystem of potential partners that can facilitate this—choosing a suite could be a smart decision. This would allow the company to focus more on the transformation process and less on technology adoption.

A large number of survey respondents clearly indicated that over the next five years, their company hoped to adopt more advanced technologies—either best-of-breed applications (67%) or a suite (45%)—and move to cloud-based or software-as-a-service solutions (69% and 42%, respectively). These plans would seem to favor best-of-breed vendors, because the new technologies would, in many cases, be integrated into existing programs. Despite this, 63% of all respondents, whether they favor suites or best-of-breed applications, hope to simplify their technology stacks by consolidating vendors in the coming years. Moreover, respondents choosing best-of-breed solutions (71%) anticipate more consolidation than do those choosing a suite (57%).

The implication is clear: even those who prioritize agility and flexibility are increasingly aware of the complexity that can result from having numerous applications. A head of IT architecture at a large financial institution put it plainly: “To maintain a technological advantage, we need to constantly rethink our tech stack and make sure that it is aligned and working with latest technology changes like cloud and AI, while at the same time not be so complex that maintenance and performance suffer.”

Taken together, this data would seem to indicate that decision makers expect some degree of disruption. Suite adopters may expand cautiously and focus on making existing platforms more robust, while best-of-breed users are more likely to add cutting-edge tools knowing that they will eventually face the challenge of knitting disparate components into a unified architecture. In both cases, the goal is the same: support transformation without letting complexity undermine performance.

What interlinkage of data between different application domains does our company need? Data is a unique and essential asset for virtually every company now—and as AI tools and AI agents gain in popularity, the importance of using data in optimal ways across an organization will be amplified. Yet integration remains a persistent challenge. Despite the necessity of high-performing digital platforms, most companies continue to operate with fragmented application environments. As of 2024, organizations used, on average, more than 1,000 different applications across the enterprise—and only 29% of these applications were integrated for data interchanges. Poor integration significantly limits the value that companies can extract from their data—especially as decision making becomes more reliant on real-time analytics and AI.

For companies that are not well set up for intracorporate data sharing but have an urgent need to integrate valid data insights into their business decisions, suites are an easier and quicker way to build a robust company-wide information system. Because they are offered by a single vendor and are integrated by design, suites allow for real-time, unified data sharing across business functions. Most modern suites also have integration tools that support best-of-breed add-on capabilities while maintaining consistency and data flow across the stack.

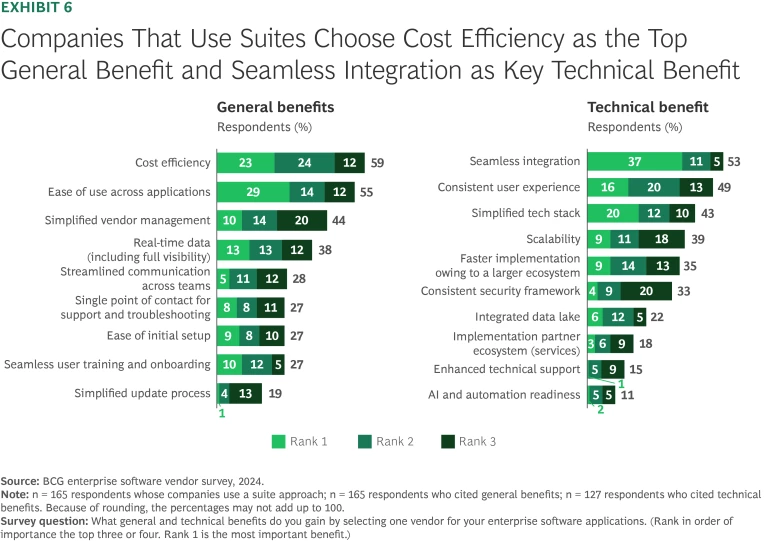

The importance of being able to expand suites without too much difficulty is clearly reflected in our survey. Fifty-three percent of suite-oriented decision makers cited seamless integration as the top technical benefit. (See Exhibit 6.) By contrast, those opting for best-of-breed strategies most frequently flagged complex integration (66%), complex vendor management (51%), and data inconsistency (55%) as the top risks associated with their approach.

Still, best-of-breed solutions can be a suitable option for companies that rely on the quick adoption of the most innovative and advanced applications to bolster their performance. For instance, AI and machine learning are among the few application areas in which targeted startups and vendors with standalone products are more commonplace. These vendors’ development efforts are buoyed by rapid innovation cycles and potential high returns on investments. And in turn, companies that prize cutting-edge technologies are drawn to experimenting with these best-of-breed products.

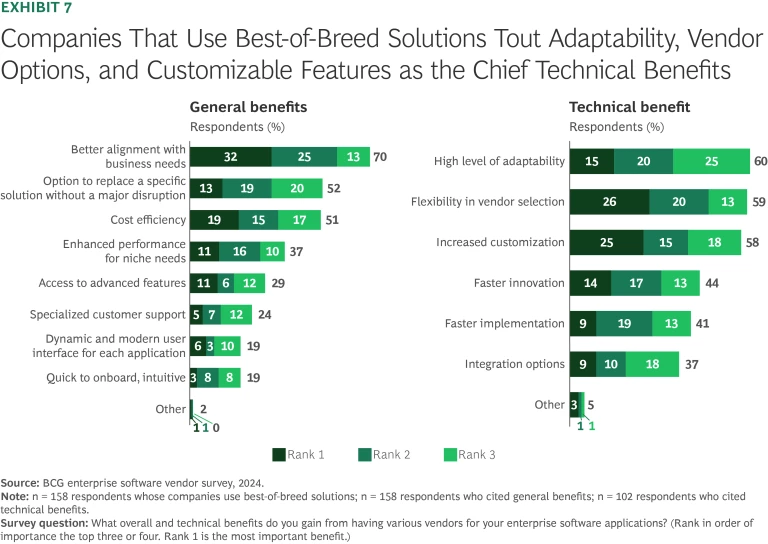

Generally, although not always, the executives we interviewed held that targeted best-of-breed products are more technologically up to date than suite solutions. Indeed, 60% of best-of-breed advocates cited adaptability as the top technical advantage, and 70% said these systems offered better alignment with evolving business needs. (See Exhibit 7.) As one IT executive described the application flexibility that is important to his organization: “It’s not a one-size-fits-all decision. If a smaller, boutique solution can give us better results in one factory, we’ll go with it.”

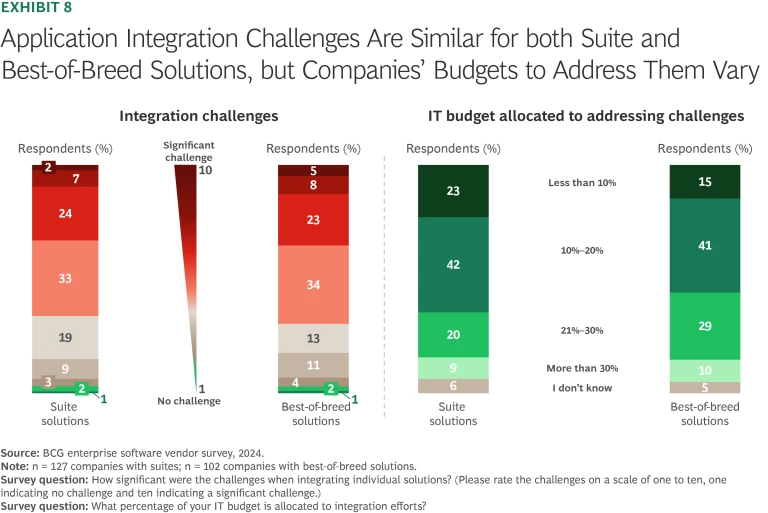

Is our access to integration capabilities in-house or through partners? At first glance, it may seem intuitive that adding a new application in a suite environment would be simpler than integrating a standalone best-of-breed tool. After all, suites are designed for interoperability. But the reality, as reflected in our survey, is that integration challenges are common regardless of the chosen strategy. As businesses scale, even those that choose a suite often find themselves expanding beyond the initial integrated environment and then, down the road, having to consolidate their many vendors. Similarly, best-of-breed adopters face recurring technical complexity every time a new domain-specific solution is added. It’s no surprise then that decision makers across both camps reported similar levels of integration difficulty. (See Exhibit 8.)

However, a notable difference emerged in how companies allocate resources for integration. Of the respondents who use best-of-breed solutions, 39% spend more than 20% of their IT budget on integration efforts, whereas of those who use a suite, just 29% spend more than 20% on integration. The greater modularity of best-of-breed systems often requires more intensive and ongoing integration investments.

We have found that internal IT capabilities are the strongest determinant of integration success. In-house teams with strong integration capabilities—especially those deeply familiar with the company’s systems and strategy—are better positioned to support both suite and best-of-breed integrations. These teams can also provide the capabilities to simplify customization and handle rapid on-demand changes.

By contrast, hiring a partner to handle integration has the potential benefit of faster completion and lower initial capital expenditures. But there is a substantial risk in relying on an external provider. In particular, it may make it difficult to do future adaptations or even make small fixes without the partner’s involvement, particularly if the internal IT team was not engaged in the implementation and may lack the tools or the wherewithal to expand the system or fix problems that arise.

Additionally, companies that opt for best-of-breed solutions must make certain that their developers are familiar with all their applications, especially if they come from multiple vendors. Often, integrators focus solely on a specific applications ecosystem and may not be able to manage a disparate technology stack. In turn, the integration is less cost effective and more complex.

A promising development highlighted in our research is the emerging role of generative AI in simplifying integration tasks. As its capabilities mature, developers can use GenAI tools to reduce complexity, accelerate implementation, and ease documentation. As the chief digital officer at a large consumer goods company observed: “GenAI enables my developers to build functionality that would have previously taken three days in 12 minutes. It is instrumental in allowing quicker API integrations for best-of-breed applications, while helping more efficiently maintain documentation for suite solutions.”

What are the benefits, other than applications, of a vendor’s ecosystem? Some suite vendors combine access to a variety of partners along with their more traditional applications packages. These ecosystem players commonly provide extensions for the suite applications as well as more specialized products and services, such as technology platforms and accelerators that can produce custom data and analytics.

Alternatively, these companies may offer cloud services and other external technologies that plug directly into the enterprise software system. And sometimes they can address the need for additional IT talent and skills to tackle a rush project or one that the internal technology team does not have the capabilities to handle. In some cases, especially for companies seeking trusted third-party partners to help build out their applications and technology stacks, the presence of an ecosystem could tilt the scale in favor of a suite.

“Because my suite vendor knows the manufacturing industry extremely well, I can take advantage of the many add-ons which it offers in its partnership ecosystem. I would say that, in general, the process is quite convenient, and I feel like a company of my type is catered to well,” an executive vice president and CIO of a medium-sized global manufacturing company told us.

How Companies Are Expanding Their Suite Footprint

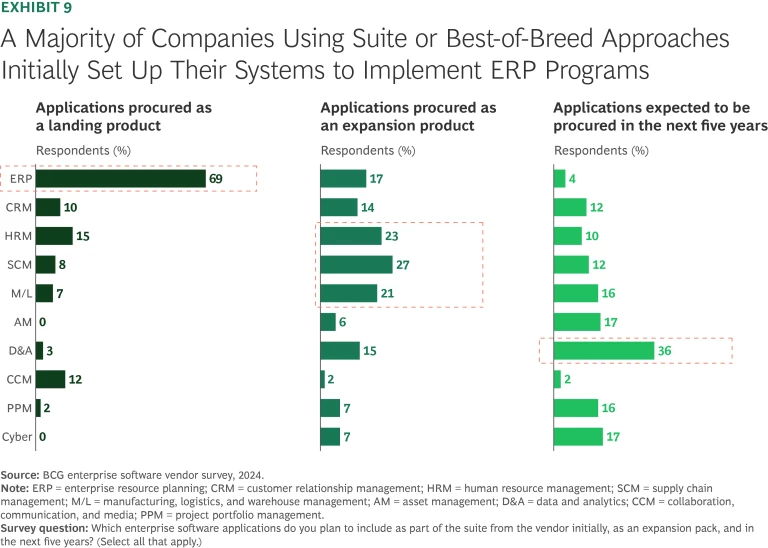

More often than not, companies choosing to go the suite route are primarily interested in implementing an ERP system as the initial or so-called landing application. (See Exhibit 9.) But as business needs evolve, so, too, do expectations for what a suite must deliver. To expand their suite in the short term, most respondents favor supply chain management and HRM products. And looking further ahead, 36% plan to procure a data and analytics applications within the next five years, signaling a shift toward insights-driven operations and a deeper integration of decision making and execution.

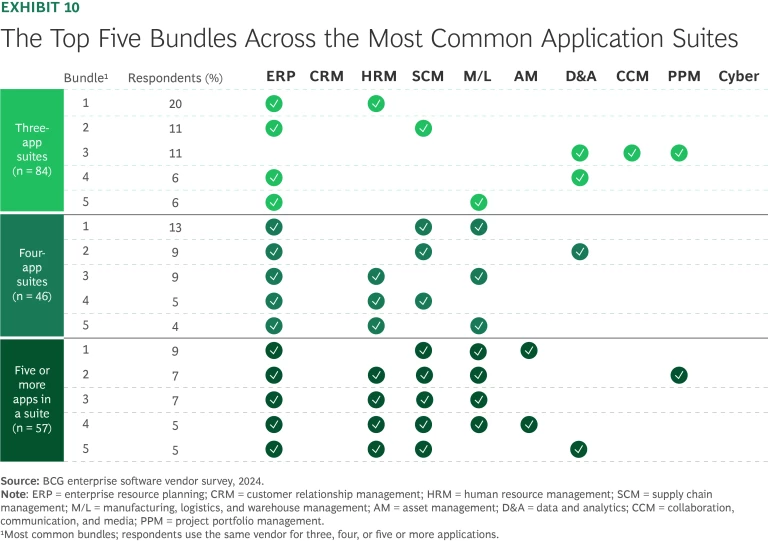

This expansion isn’t happening in a vacuum. In response to the modularity and adaptability offered by best-of-breed systems, suite vendors are enhancing their offerings on the basis of shifting customer needs. According to our survey, ERP and HRM are the most common core components in three-application suite systems. (See Exhibit 10.) As companies build out to four-app bundles, supply chain management, manufacturing, logistics, and warehouse management become the next layers of integration, underscoring the suite’s growing role in supporting end-to-end operational continuity.

Choosing Your Applications Strategy

In the years ahead, smart enterprise application choices won’t be needed just to keep up—they’ll have to be strategically aligned and purposefully designed to help companies overcome intensive marketplace demands and obstacles. Shifting business priorities, regulatory requirements, emerging technologies such as AI, and relentless pressures involving cost, cybersecurity, and vendor complexity will only raise the stakes. Long-term organizational agility, resilience, and competitiveness will depend on decisions that leaders make now about the applications they adopt.

The seven strategic questions outlined in this article offer a compass to navigate growing complexity, surface critical tradeoffs, and make purposeful, forward-looking applications choices about suites or best-of-breed solutions. Indeed, some companies may opt for a mixed approach—suites for applications that are more comprehensive and best of breed for applications that are driven by specific operational or regulatory requirements. By considering these questions, organizations can break from default mindsets and instead develop an enterprise applications strategy that reflects their structure, matches their ambition, and responds rapidly to change.

About the Research

The research presented in this article is based on a proprietary BCG survey of enterprise software decision makers and approximately 30 executive interviews, both conducted specifically for this publication. SAP provided partial funding for this portion of the research. The analysis also draws on findings from BCG’s IT Spending Pulse 8.0 (December 2024), which surveyed more than 600 senior IT executives across North America and Europe, and IT Spending Pulse 8.5 (April 2025), a follow-up pulse survey of 300 executives. These surveys informed the overall analysis and are the source for several exhibits.