Evidence from across markets and sectors strongly suggests that capital markets reward green growth—when it achieves critical mass—with higher valuation multiples at the enterprise level. Investments in green growth seek to deliver revenue gains, competitive advantage, and multiple expansion while promoting sustainability goals such as carbon abatement and resource efficiency.

Capital flows, policy incentives, and technological innovation continue to support environmentally sustainable business practices. Even so, challenges persist, including regional policy variability that has made scaling green revenues across markets more complex for global companies. For those able to navigate this fragmented and evolving landscape, green growth can be a powerful driver of long-term competitive advantage and financial success.

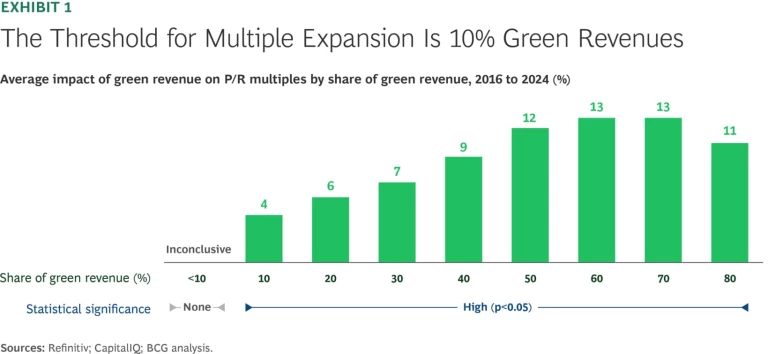

Empirical evidence points to compelling benefits. A BCG analysis, covering 2016 through 2024, shows that companies achieving green growth earn higher revenue valuations. (See “About the Study.”) The data reveals that once companies reach a meaningful green-revenue share—approximately 10%—their price-to-revenue (P/R) multiple increases. The valuation premium, in turn, unlocks accelerated growth through cheaper access to capital. Conversely, companies failing to reach this threshold risk competitive disadvantages.

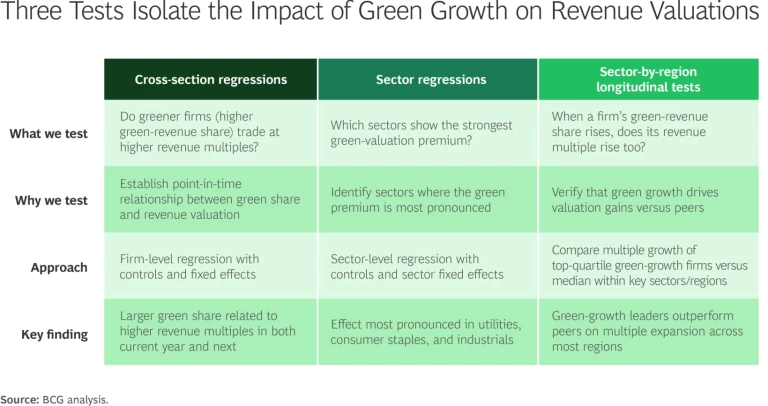

About the Study

The comprehensive green-revenue data set from FTSE Russell enabled a nuanced, tiered assessment of the impact of green revenues on valuation. The data set tracks revenue shares linked specifically to green activities across more than 19,000 publicly listed companies spanning 48 markets.

FTSE Russell classifies activities into three tiers based on their net environmental impact on the status quo:

- Tier 1 includes high-positive-impact activities such as renewable power.

- Tier 2 encompasses net-positive initiatives such as smart-city design.

- Tier 3 includes neutral or negative-impact sectors, exemplified by lithium mining.

Valuation Approach

Our analysis focused on revenue multiples because these metrics provide insights into investor perceptions and company value. P/R multiples offer a measure of investor sentiment, responding to shifts in revenue performance and market expectations. Conversely, enterprise value-to-revenue (EV/R) multiples capture broader structural valuations and companies’ overall capital structure. Analyzing both P/R and EV/R multiples thus comprehensively reveals how green-revenue growth can simultaneously influence investor sentiment and company valuation.

Controlling for Other Variables

To isolate the independent effect of green-revenue share, we controlled for other company characteristics using enterprise value as a continuous variable for scale, dividends for payout policies, and total revenues for baseline revenue differences. We confirmed the robustness of our results by demonstrating that green-revenue share predicts valuation multiples both in the current year and with a one-year lead, indicating that the effect is not merely contemporaneous. We further accounted for unobserved heterogeneity through fixed effects for sector, industry, subindustry, country of incorporation, fiscal year, and firm age. Across all model specifications, the green-revenue share coefficient remained highly significant and economically stable—reinforcing that the relationship with valuation multiples reflects a true underlying link, not differences in firm size, maturity, or industry mix.

Some may question whether this dynamic will persist amid shifting market sentiment and policy reversals. Although it is too early to draw definitive conclusions, many of the forces that underpin the valuation premium—such as investor appetite for resilient, forward-looking business models and favorable capital flows—are still in play. These enduring drivers suggest that the green-growth effect can continue for companies that move decisively and strategically.

To capture valuation premiums fully, companies must not only surpass the 10% threshold but also build profitability and competitive advantage into their green-growth initiatives. Success requires demonstrating robust margins that signal financial health to investors and establishing a “right to win” in rapidly evolving green markets. Transparent, value-creating communication with stakeholders is equally crucial.

The Evidence: Green Growth Enhances Revenue Multiples

Our analysis demonstrates a statistically significant link between green revenues and higher valuation multiples. Increases in green revenue positively influence both P/R multiples and enterprise value-to-revenue (EV/R) multiples, observable in the current and subsequent fiscal year.

Stay ahead with BCG insights on climate change and sustainability

Companies that surpass the 10% green-revenue threshold begin to see an expansion in their P/R multiples. As the share of green revenue increases, so does the valuation uplift—from an average premium of 4% at a 10% green-revenue share to a 13% premium at a 60% share. (See Exhibit 1.) This clear, upward trend suggests a strong positive linkage between market valuation and green-revenue share. The corresponding effect on EV/R multiples is more gradual, given that this valuation metric also accounts for the impact of capital structure.

In aggregate, utilities, consumer staples, and industrials show the strongest impact of green-revenue growth on revenue multiples. Within these sectors, our analysis shows that the top quartile of companies in green-revenue growth experience higher multiple improvements than their peers in most regions. (See Exhibit 2.) Although the relationship is less consistent across other sectors, we have observed multiple improvements in select companies in real estate, IT, and financials, highlighting the broad value of green strategies.

What Drives Green-Growth Valuation Premiums?

Several interrelated mechanisms underpin the financial benefits derived from green growth.

- Investor Demand. Companies that surpass key green-revenue thresholds often attract heightened interest from both general ESG funds and specialized green-thematic investors. Many large ESG portfolios begin to significantly increase their holdings in companies once green revenues reach approximately 10%, while thematic funds typically target companies with more pronounced green exposure—approximately 20% or higher. Crossing these materiality thresholds can increase investor demand and contribute to upward pressure on valuation multiples.

- Revenue Growth and Investment Opportunities. Pursuing green-revenue streams allows companies to tap into rapidly expanding markets fueled by supportive regulations, grants, voluntary corporate initiatives, and carbon credits. Together, these factors create attractive investment opportunities with lower downside risk.

- Risk Mitigation and Resilience. Companies with significant green revenues reduce their exposure to climate-related regulatory risks—such as carbon pricing, emissions caps, and potential litigation—thereby lowering the discount rates investors apply to future cash flows and enhancing valuations. Additionally, companies with robust green portfolios demonstrate greater resilience and adaptability to climate impacts, effectively lowering operational risks and ensuring long-term sustainability and financial stability.

Critically, green-revenue growth alone does not guarantee valuation premiums. Successful companies build profitability and maintain robust margins within their green- revenue streams, demonstrating financial strength to investors. Equally important, these companies establish a compelling competitive edge—a convincing right to win—that reassures investors of their potential for long-term success. Surpassing the materiality threshold of 10% green-revenue share is also essential for gaining investor recognition and unlocking higher multiples. Finally, successful companies clearly articulate their green-revenue strategies and showcase tangible outcomes, boosting transparency, investor trust, and, ultimately, valuation growth.

Reaping the Benefits: A Virtuous Cycle

By achieving premium revenue multiples through green-revenue growth, companies unlock more efficient access to both equity and debt capital. Higher share prices allow for less dilutive secondary offerings and more attractive valuations for equity‐financed M&A, while stronger credit profiles enable the issuance of bonds, especially green‐labeled debt, at lower spreads. These financing efficiencies reduce the company’s weighted average cost of capital.

With more affordable capital, companies can readily invest in further growth opportunities, including expanding their green-revenue streams and entering new markets. This creates a virtuous cycle: increased growth boosts revenue and overall financial performance, which in turn enhances market valuations further, continually reinforcing the company's competitive edge and financial strength.

Several examples illustrate this dynamic:

- BKW, a Swiss utility, made significant investments in expanding renewable-energy production from 2017 through 2024. Over the same period, its EV/R multiple rose by 28%, significantly outperforming the flat median valuation trend among regional and sector peers. BKW was also able to access low-cost capital through the issuance of green bonds at favorable terms to further accelerate its clean-energy investments.

- CG Power and Industrial Solutions, an Indian industrial company, increased its green-revenue share from 17% in 2017 to 30% in 2024 by expanding offerings tied to renewables and electrification. Over the same period, its EV/R multiple surged approximately tenfold—far outpacing the flat valuation trend among regional and sector peers. The company’s strategic pivot toward green technologies helped unlock substantial investor interest and dramatically enhance market valuation.

- Nutanix, a leader in hybrid multicloud computing, vaulted from 0% to 42% green revenue between 2017 and 2024 by offering energy-efficient cloud solutions and integrating renewables into its operations. As the US company’s green footprint expanded, so did investor confidence: its P/R multiple surged by 4.6 and its EV/R multiple rose by 2.2.

- SKC, a South Korean materials company, saw similar results. By investing in green innovations—in both its core offerings (for example, thin-film technology for renewables) and emerging solutions (biodegradable plastics)—SKC raised its green-revenue share from 4% in 2017 to 20% in 2024. With the green-revenue share surpassing materiality thresholds, the company’s EV/R multiple surged nearly fourfold, from 1.2 to 4.6, reflecting growing investor confidence in its long-term value creation.

How to Translate Green Growth into Tangible Benefits

To effectively convert green growth into tangible valuation and growth benefits, corporate leaders should take a number of actions:

- Set clear green-revenue targets. Define ambitious yet realistic goals to exceed the critical green-revenue threshold, typically between 10% and 20%. This is essential, as peers already surpassing that threshold can gain significant valuation premiums and competitive advantages.

- Develop a comprehensive roadmap. Outline a clear, actionable path to achieving green-revenue and profitability targets. Rapidly scaling via mergers, acquisitions, and strategic partnerships can significantly enhance your market positioning and accelerate your growth trajectory relative to peers.

- Prioritize value-focused communication. Clearly and consistently communicate to investors how your green initiatives align specifically with their valuation criteria, financial expectations, and risk assessments. Tailored communication that directly addresses investor priorities—such as profitability, market competitiveness, and growth resilience—strengthens confidence and enhances valuation perceptions.

- Use your valuation premium to accelerate growth. Leverage your enhanced valuation by securing cheaper capital through financial instruments like green bonds, which carry lower interest rates. Capitalize on your elevated market position to execute secondary share offerings at favorable valuations, minimizing dilution. Additionally, utilize your stronger equity valuation to pursue strategic share-based mergers and acquisitions, efficiently expanding your market footprint and driving further growth.

Our study confirms that green growth is statistically linked to higher revenue valuations, creating a potent competitive lever. Companies surpassing the 10% green-revenue threshold capture significant revenue premiums, enabling cheaper access to capital and accelerating growth. By contrast, companies failing to reach the 10% threshold risk missing out on valuation benefits and falling behind peers that are leveraging lower capital costs.

While today’s macro environment includes mixed signals—such as shifting regulatory priorities and uneven investor sentiment—capital flows, policies, and innovations continue to support environmental sustainability. To keep pace, leaders must act decisively to set ambitious green-revenue goals, craft actionable roadmaps, communicate their strategies to investors, and leverage the resulting higher valuations to fuel growth. The financial future favors companies that pursue green growth—and hesitation will be costly.

The authors thank their BCG colleagues Siddharth Jain, Philip Palanza, and Vuk Trifkovic for contributions to this article.