Activewear has been on a remarkable run over the past two decades, as the boundaries between work, home, and travel, and workout blurred. But the days of strong tailwinds, easy growth, and undifferentiated offerings are over.

After years of consumers snapping up activewear apparel and footwear, the market is reaching saturation. Sales are projected to grow at a modest 3% to 5% annually through 2029—far from the double-digit performance of the past.

At the same time, pressures on brands are intensifying. The top 15 US activewear (as defined by the S&P) companies have collectively lost market share over the past decade as challenger brands nibble away at their dominance.

We recently surveyed more than 4,000 US consumers to understand how brands can still win by focusing on how the different generations wear, shop for, and think about activewear. The results are outlined more comprehensively in the accompanying slideshow.

Gen Z: Confidently Cool, Always On-Trend

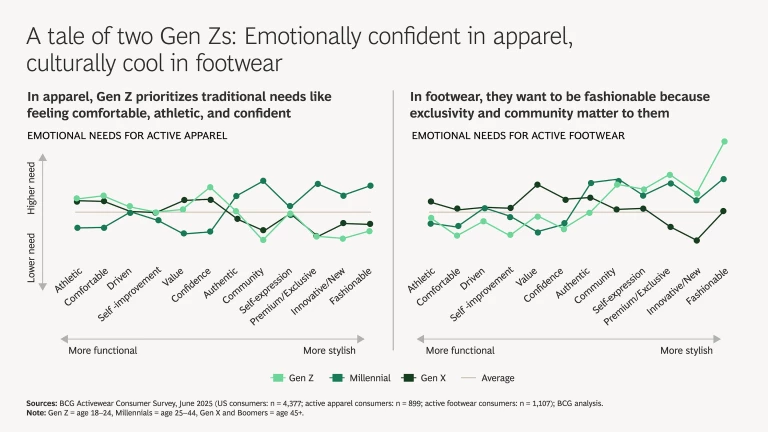

Gen Z is emerging as the style compass. Activewear is not just about function but also self-expression. In apparel, Gen Z wants to feel comfortable and confident; in footwear, they lean toward on-trend looks that signal exclusivity and community. Their influence extends far beyond their own closets. Brands that capture Gen Z’s attention often enjoy a halo effect on older generations. Staying relevant with Gen Z sets the tone for the entire market.

Millennials: Community Meets Longevity

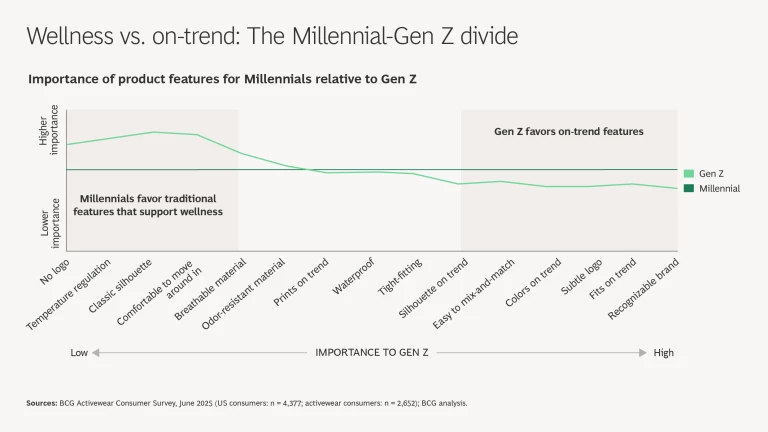

Millennials view activewear through a dual lens. Activewear is a marker of identity and belonging, often tied to wellness and lifestyle choices. It’s also deeply practical: Millennials are investing in health, fitness, and longevity, with activewear purchases that support wellness-driven lifestyles. Their spending habits reflect both a desire for status, self-expression, and an investment in long-term wellbeing.

Gen X and Baby Boomers: Comfort and Premium Upgrades

Gen X and Boomers are the biggest buyers of activewear, accounting for an outsized share of total spending. Many are planning to increase their budgets even more, particularly for premium upgrades. But their needs are distinct. They’re more focused on comfort for everyday, low-intensity activities like walking.

The New Consumer Journey: Complex and AI-Driven

Generational divides extend beyond product preferences into how consumers discover and buy activewear. More than half of all shopping journeys now start online, especially for Gen Z and Millennials.

Influence has also fragmented. One in four Gen Z and Millennial consumers say they’ve bought a product based on an influencer’s recommendation. But the type of influencer matters: celebrities deliver broad reach, macro influencers offer scale with some trust, and micro influencers win on credibility but lack mass exposure. For brands, the trade-offs are real, and choosing the right mix is critical.

What It Takes to Win

The era of strong tailwind growth is over. For brands to stay relevant, four lessons stand out:

- Sharper differentiation. Brands must stand for something distinctive, whether it’s cutting-edge fashion, wellness, credibility with elite athletes, or comfort-first design.

- Stronger relevance. Tailoring offerings to generational needs is key.

- Greater agility. From shortening design cycles to integrating AI in customer engagement, brands need to move faster to keep up with shifting expectations.

- New forms of influence. Brands must adapt their approach to evolving customer journeys to accommodate a world of AI, social commerce, and online marketplaces.

The activewear market is slowing, but it’s not run out of steam. The brands that thrive will be those that understand not just what people wear, but why they wear it.

We thank Justin Vincent, Kunal Bhatia, and Henok Eyob for their contributions to this article.