Persistent volatility in world markets—combined with several intensifying trends and both short- and longer-term shifts—is fundamentally reshaping retail, making it increasingly difficult for retailers to craft effective responses. Consumers have high and rising expectations for value, choice, speed, convenience, and personalization. Meanwhile, supply chain disruptions, greater operating and channel complexity, stronger competition, and rapidly evolving technologies pose additional challenges to retailers. Scale matters more than ever, driving industry consolidation.

This uncertain environment raises an urgent question for retailers across all sizes, regions, and subsectors: What does the optimal future of merchandising look like, given its traditional role as the command center of a retail organization?

To answer this question, BCG recently surveyed merchants and merchandising leaders from 350 retailers across key subsectors and regions. The insights from that research, together with input from our internal experts, affirmed that merchants will remain essential as the ultimate decision makers for the trade-offs the retailer needs to make across various functions, experts on forward-looking customer trends, the relationship managers for vendor interactions, and the single owners of the category P&L. However, their role and how they execute it will change significantly.

At the same time, the research showed that merchants feel they are currently far from that future state—and further away than their managers think.

What Is the Future of Merchandising?

The envisioned merchant of the future will be an elevated and empowered category leader working within a more centralized structure. They will have specific decision rights within guardrails that are aligned with a portfolio strategy set by the business. This structure will focus on a single view of the customer and one cohesive strategy across categories, in turn driving better decisions to deliver the right product choices at the right price and place. Ultimately, this will drive higher growth and profitability. Key enablers to this vision are highly sophisticated, integrated tools and a strong, data-powered center of excellence (CoE) or merchandising operation (merch ops) that will provide operational and analytical support.

The majority of merchandising experts and leaders we interviewed accept this vision, with 59% of respondents expecting strategy and analytics to become fully or partially centralized, and an additional 21% anticipating a balanced approach between merchants and central teams.

This approach is expected to deliver significant benefits to the organization and to the merchants themselves, including the ability to make better, integrated decisions across categories and levers with an end-to-end view of the business. The time required to focus on that work will emerge as AI automates or replaces the merchants’ manual work. Merchants currently spend 40% of their time on manual tasks that could be automated, and a majority of merchandising leaders (69%) believe that automation through AI will unlock more time for strategic thinking or to drive greater customer value. The estimate from our survey is that automation could allow merchants to redeploy around 10 hours per week of their time to higher-value tasks, such as driving private-label products, delivering product launches, and enhancing speed to market.

Stay ahead with BCG insights on the consumer products industry

How Far Are Retailers from the Envisioned Future State?

While retailers can see the vision for best-in-class merchandising, in reality the majority of them are far from realizing it. The gap between the current state and the envisioned future state is large and deep-seated across critical dimensions—automation, data, technology, upskilling, and innovation—as well as in the ways merchants interact with merch ops and other functions.

Challenges with data and technologies.

Merchants estimate that around a third of the data they use is either inaccurate or contains errors, and feel that about 40% of the technology available to them goes unused for a variety of reasons. Some 49% of the merchants cited a lack of time to use the technologies, while 50% cited a lack of training and 40% noted a lack of access. Furthermore, 35% of merchants receive no training on advanced analytics tools and 53% face considerable challenges to innovating how they work.

Suboptimal processes and team structures.

Regarding their collaboration with CoEs, around 44% of merchants noted ineffective processes and ways of working as well as a lack of trust. Some 43% said that data science is not tailored to their needs. Staffing may contribute to these inefficiencies, as 36% of the respondents said their organizations do not have sufficient talent.

Issues working with other functions.

All survey respondents reported at least one issue in working together with other functions. Most often they cited coordination issues with go-to-market strategies, issues with the supply chain and data, and process conflicts.

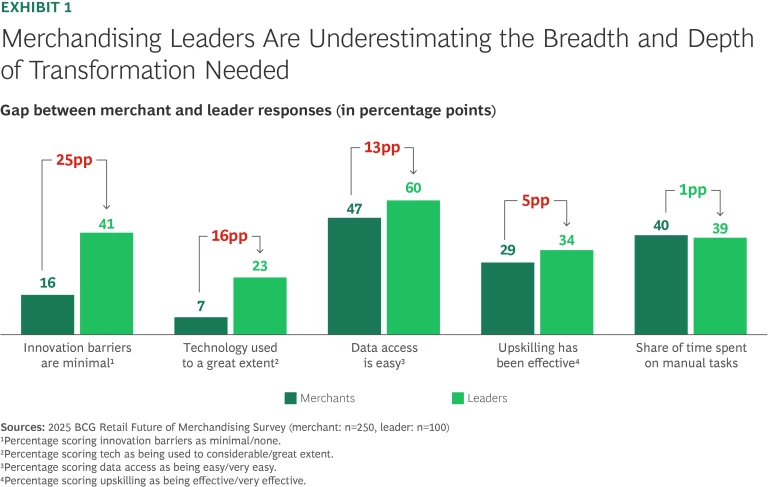

Aggravating these challenges are the gaps between how merchants evaluate the current state of merchandising and how their leadership views it. (See Exhibit 1.)

The leaders we surveyed feel that the merchandising function is closer to reaching the ideal future state than the merchants themselves do. The sharpest differences show up in the perception of the innovation barriers that merchants face and in the perceived extent to which they are using available technologies. The barriers the merchants cited most frequently are organizational resistance to change, integrating new solutions with legacy technology, and a lack of skilled personnel.

Success Will Depend on People and the Operating Model

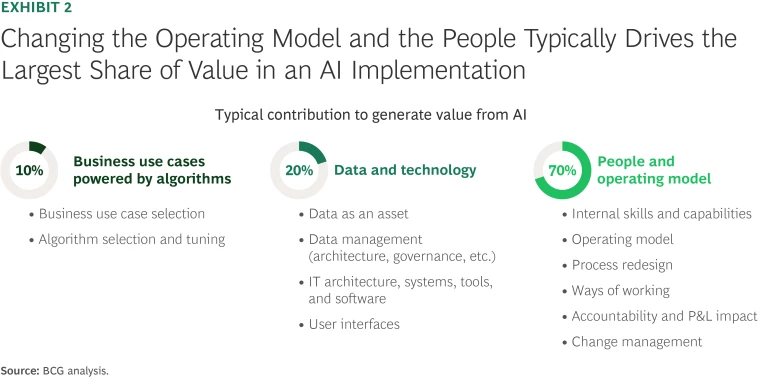

The overarching challenge for retailers is to figure out how to evolve the merchandising function when there are so many gaps to close amidst ongoing volatility and uncertainty. To deliver the envisioned future of merchandising, an organization must make step changes in three areas. (See Exhibit 2.) Based on our research, leaders see elements of AI-driven business use cases, data, and technology—such as algorithm selection and data architecture—as table stakes to remaining competitive. In BCG’s experience, such improvements account for around 30% of the overall impact in an organizational transformation. The remaining 70% of value will come from upskilling, change management, and improvements to processes and ways of working. Leaders see those aspects of people and operating models as “make or break” for a successful transformation.

The key takeaway for retailers is to realize that the future of merchandising will be primarily a people transformation and, secondly, a technology transformation. Getting decision-making processes right will unlock more value than getting the technology and analytics right. That’s why the investments in people and operating models will make or break the company’s efforts.

Merchants will need the right skill sets and deep, regular training to harness new technologies and platforms. The operating model will need clear roles and responsibilities as well as streamlined processes and ways of working for effective collaboration. It will be critical to find, retain, and develop the right talent and get the change management right along the journey.

While 72% of survey respondents expressed optimism or confidence about AI’s potential direct impact on merchandising, the rest cited concerns or anxieties about AI’s steep learning curve, lack of central oversight, need for real-time responsiveness, and its ability to overshadow human decision making. More than half of the respondents mentioned key elements of the operating model and people—such as data management, skills, and capabilities—as challenges in AI integration.

How to Start and Manage the Transformation

The retailer’s first step is an assessment of their current situation. Retailers can pinpoint where they stand and identify priority capabilities they need to build to empower merchants to spend time on critical decisions. This will guide retailers on important changes involving people and the operating model. They can then identify critical enablers that will be needed in AI, technology, and data. In parallel, leaders need to look at where they can centralize—for example, in techology solutions that enable meaningful scale in analytics that are currently repeated across desks or in strategic trade-off decisions that need to be made across categories, such as pricing investments.

BCG’s research and experience have yielded several insights that will help retailers manage their transformation to the future state of merchandising.

Develop technological capabilities end-to-end, not in isolation.

This should be a combined effort from commercial and technology teams with joint accountability. The focus should be on end-to-end system solutions, rather than isolated or point solutions, to drive enhanced outcomes through consideration of the business-wide impact of merchandising decisions. These solutions should prioritize capabilities that increase sales and margins, because these will enable investments in efficiency as well as in the customer value proposition through levers such as pricing and promotions. They should also prioritize capabilities that make the lives of merchandising teams easier. Retailers can develop these capabilities alone, through partnerships, or through mergers or acquisitions.

With respect to AI, retailers should identify the highest-value use cases and then start building the integration roadmap. The focused deployment of AI merchandising solutions can have financial, commercial, and organizational impacts that are both rapid and significant.

Be prepared for significant investments in people.

This transformation will require significant dedicated investment to create a team of merchants that will create more value, guided by clear vision and expectations. A large part of this will be upskilling the top talent already within the organization, with a strong focus on learning by doing things in new ways. The supporting CoEs or merch ops will need high-performing, forward-thinking category analysts who will bridge the gap to advanced automation.

Do not underestimate the “70%” challenges.

This critical part of the journey has several dimensions. The move to future ways of working should not delay decisions or create risk in existing processes. Leaders will need to strike the right balance between short-term needs and the longer-term vision. Our experience has also shown that getting this transformation right will require a change management program that begins right away and has clear plans to adapt governance models, allocate resources, and define accountability.

Retail managers and executives will need to make a host of make-or-break decisions in the coming years. The transformation of merchandising is no exception, and the current state of the function is further away from its future state than leaders believe. AI, data, and technology remain necessary to transform merchandising. The ultimate success, however, will depend on how quickly and thoroughly a retailer can upskill their teams and transform ways of working to reflect the new reality.