BCG's Centre for Growth conducts a monthly Consumer Sentiment Snapshot to track public attitudes towards spending habits, disposable income and the UK's economic outlook.

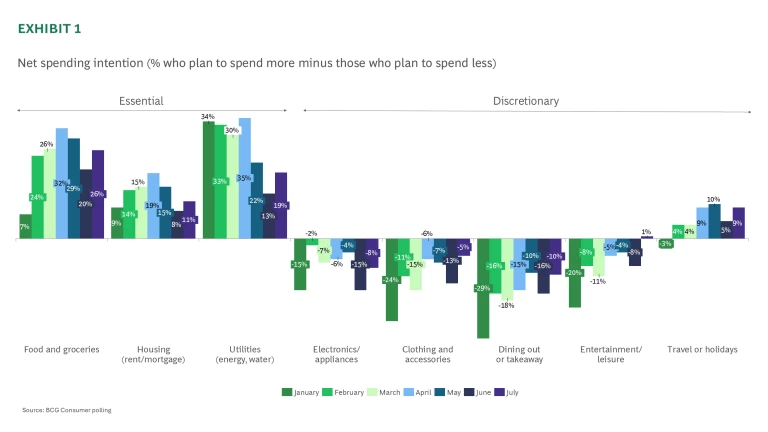

In June, consumer sentiment strengthened, with more people feeling confident about their personal finances. There was a net +7 percentage point increase in optimism compared to May, and for the first time, the public plans to increase spending in a majority of spending categories. Essential spending rose across all categories, most notably food and groceries, which saw a 6pp jump in net spending intention, while discretionary categories like entertainment and dining out saw their strongest results yet this year.

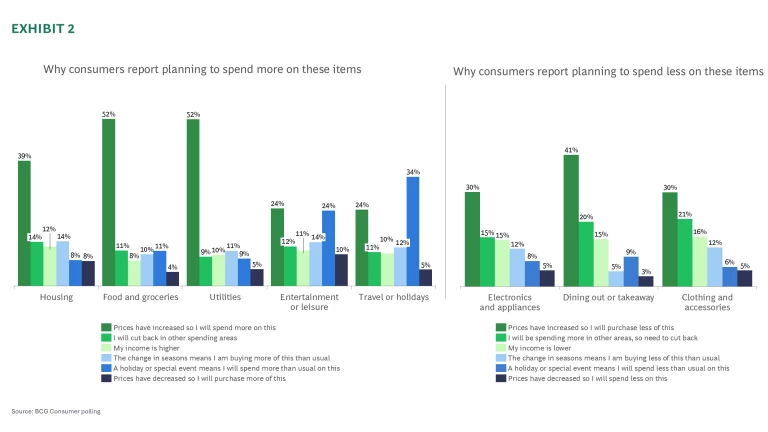

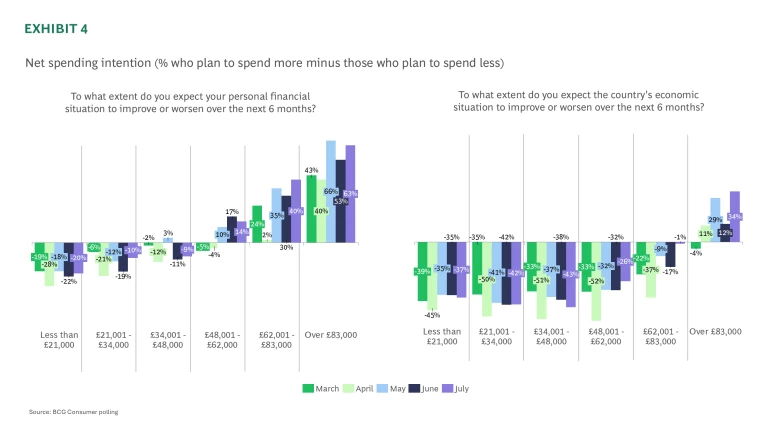

This improving sentiment is being driven by higher income households. Those earning above £48,000 reported net increases of more than 10 percentage points across nearly all categories, while lower income groups showed little change in their spending plans. Despite this, price sensitivity remains high: over half of those increasing spending on essentials cite rising prices, though this is down from 66% for utilities and 60% for food in June.

A disconnect may be emerging between personal and national economic sentiment. While most individuals feel better about their own financial outlook, those in households earning under £48,000 are increasingly pessimistic about the broader economy. Higher earners, meanwhile, continue to view the national outlook more favourably.

Key findings

Essential spending is rising again this month, while an improving discretionary spending outlook suggests improving consumer sentiment. In the first six months of this year, decreases in essential spending tended to be coupled with increases in discretionary spending – suggesting that as the cost of living reduces, the public felt more able to spend on luxury and non-essential items. This month however, essential spending has increased slightly across all categories – with the largest jump being a 6pp increase in food and grocery net spending – while discretionary spending also shows an improved picture. While overall the public still reports planning to spend less on discretionary items, the extent of this has reduced. For clothing and accessories, dining out and entertainment/leisure, the net spending intention is the highest it has been since the start of our consumer survey. In particular, the net spending intention for entertainment and leisure is positive (+1%) for the first time.

Seasonal effects are driving the increase in entertainment and holiday spending, while price increases are the primary cause for climbing essential spending. In line with previous months, over 50% of those who say they will increase spending on food and utilities say this is as a result of price increases. However, this is lower than last month when 66% said price rises were driving higher utilities spending and 60% for food spending. Meanwhile, unsurprisingly, there has been an increase in respondents planning to increase spending due to seasonal trends or holidays.

Higher spending on essential items compared to June is exclusively driven by wealthier households. There has been little change in consumer spending plans among those in households earning under £48,000. However, for those earning over £48,000, spending has increased significantly – there has been over 10pp net increases for every category except for entertainment for those earning over £83K.

A slight disconnect has appeared this month between the public’s attitudes towards their own finances and the economy. For the first time, we have seen a slight decoupling in these two indicators. The public generally feels better about their own financial situation, there has been a +7pp net increase compared to June figures, with all but the £48k-£62k group appearing more positive. However, while higher income groups are more positive about the economy, the three income groups earning under £48K all feel more pessimistic about the country’s economic situation this month compared to last month.

Business outlook

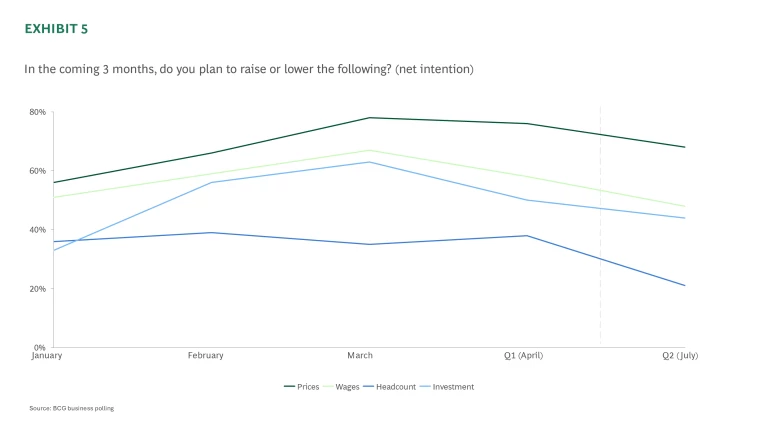

- In BCG’s quarterly business polling, we see signs of the labour market softening. While overall, businesses are still more likely to say they will raise rather than lower headcount in the next three months, the net intention has fallen to its lowest level, at just 21%. This is driven by a reduction in businesses saying they will increase their headcount.

- Despite this, the public feels more secure in their jobs than at any time since our survey started. A net 28% feel more secure in their job this month than last month, suggesting some disconnect between employers and employees.

Raoul Ruparel, Director for BCG’s Centre for Growth, said:

“We’re seeing a welcome improvement in consumer sentiment, driven primarily by stronger personal finances and a more positive economic outlook— particularly among middle- and higher-income households. This reflects a growing confidence in their own financial positions.

“At the same time, however, there remains a degree of caution about the broader picture, with persistent concerns around the health of the wider economy. Signs of a softening labour market are continuing to emerge too, which could weigh on sentiment in the months ahead. This will be an area to watch closely.”

Details on the survey:

These results are from a nationally representative poll of UK adults with a sample size of 1,500. Fieldwork was conducted between the 27th and 30th June. The poll results were weighted to the latest UK figures for gender, age, education, and region to ensure overall representativeness.

For further information on the findings, please contact Mel Walker.