Unlike other industries, engineering and construction (E&C) has been slow to adopt new technologies and has never undergone a major transformation. As a result, productivity has stagnated over the last 40 years or, in some cases, even declined.

This unimpressive record looks set to change very soon, however, and very dramatically. Profound changes are already taking place—though not yet on a sufficiently wide scale—in many aspects of the construction industry. A famous phrase from the writer William Gibson fits the industry perfectly: The future is already here—it is just not evenly distributed.

The key is digitalization. More and more construction projects are incorporating systems of digital sensors, intelligent machines, mobile devices, and new software applications—increasingly integrated with a central platform of building information modeling (BIM).

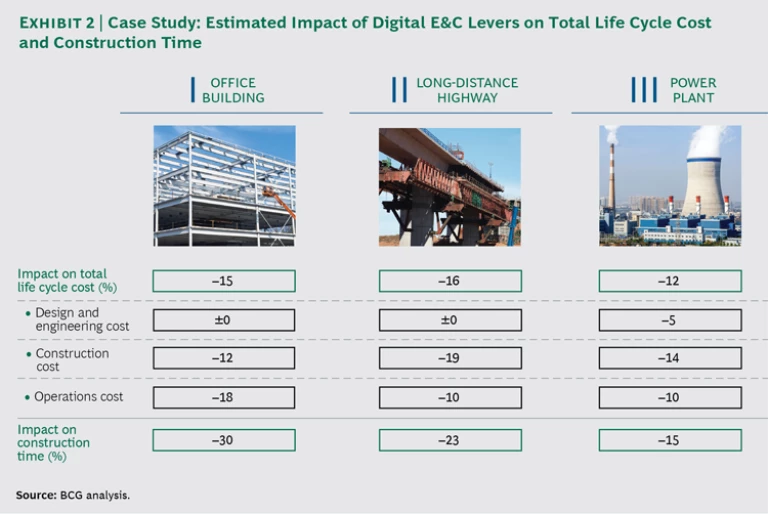

The challenge now is to achieve widespread adoption and proper traction. Wherever the new technologies have properly permeated this fragmented industry, the outlook is an almost 20% reduction in a project’s total life cycle costs as well as substantial improvements in completion time, quality, and safety.

Construction Reconstructed in All Its Phases

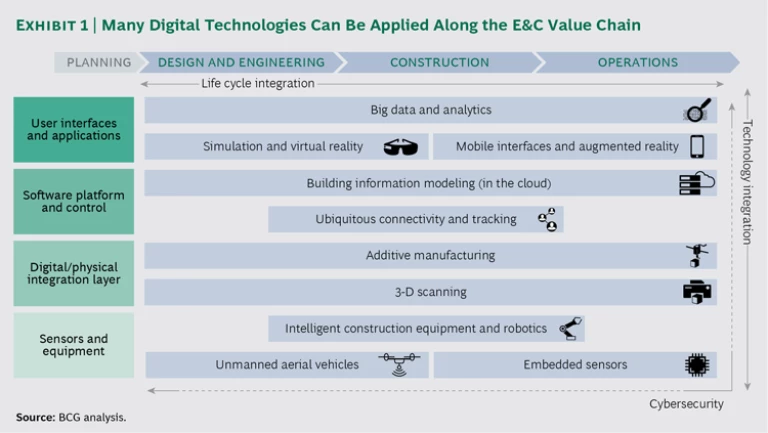

Technological advances are now revolutionizing almost all points in the life cycle of a built asset, from conceptualization to demolition. Exhibit 1 shows the relevance of digital technologies along the E&C industry’s value chain.

Digitalization is transforming all three major life cycle phases of construction projects. Consider the following scenario—no longer futuristic, but “here today,” though its building blocks are still distributed patchily over disparate projects.

During the design and engineering phase, BIM identifies potential design clashes and constructability issues, thereby averting costly corrective rework, and it improves the tendering process by making the information more transparent and accessible.

An interesting example is that of Crossrail, one of the world’s largest and most complex infrastructure projects, building a major new underground line across London. The designers and engineers are using a centralized set of linked BIM databases to integrate about 1.7 million CAD files into a single information model.

During the actual construction phase, drones survey and inspect the construction site. Three-dimensional printers prefabricate many of the building components. GPS and radio-frequency identification (RFID) are used to track the materials, equipment, and workers, in order to then optimize flows and inventory levels. Robots and autonomous vehicles do much of the actual building work. And 3-D laser scanning or aerial mapping is used to compare work in progress with a virtual model, thereby enabling prompt course corrections and minimizing corrective work.

Take the case of a Japanese equipment manufacturer that has developed fully autonomous bulldozers, led by drones that map the area in real time to provide data on the workload.

During the operations phase, embedded sensors continue to monitor any given part of an asset, checking for deterioration, facilitating predictive maintenance, and continually updating a central database. Augmented reality is used to guide maintenance crews.

Big data—on traffic movements, electricity consumption, and so on—is collected digitally and subjected to advanced analytics, in order to optimize decision making and generally boost operational efficiency.

By way of illustration, consider the approach taken by the Japanese building service provider NTT Facilities to the inspection, maintenance, and repair of its R&D premises: by integrating BIM into the building’s facility- and asset-management system, and making intelligent use of this combined resource, the company was able to reduce the cost of operations and maintenance by an estimated 20%.

Gathering Momentum

On average, uptake of these transformative technologies has been slow initially. They have faced some resistance to adoption, and some companies that do deploy them have struggled to capture all the potential benefits.

The obstacles are being overcome, however. More and more companies are now embracing the opportunities, with productivity starting to rise and promising to soar.

Within ten years, according to our estimates, full-scale digitalization will lead to huge annual global cost savings. For nonresidential construction, those savings will be $0.7 trillion to $1.2 trillion (13% to 21%) in the design and E&C phases and $0.3 trillion to $0.5 trillion (10% to 17%) in the operations phase.

Note that the productivity gains will vary not only across the life cycle phases but also across the subsectors: vertical, industrial, and infrastructure. Exhibit 2, which is based on a study of construction projects from each of the subsectors, shows the variation in detail.

The gap between digital leaders and laggards is widening—for construction companies themselves, for technology providers, and for governments in their role as project owners and regulators. All these stakeholders need to master the dynamics, upgrade their competencies and investments, and adapt their processes and attitudes. Otherwise, they risk losing out competitively.

This article was originally published by the World Economic Forum. For more information, see Shaping the Future of Construction: A Breakthrough in Mindset and Technology, which was written under the umbrella of the Future of Construction initiative launched in 2015 by the World Economic Forum, with BCG as knowledge partner.