This report is part of BCG’s research on the future of automotive, a series of publications focusing on new technologies that are transforming the industry. Here, we examine the evolution of the powertrain. The Reimagined Car focused on the ways in which shared autonomous vehicles will change mobility in the US. A future publication will look at the impact of technological change on the profit pools of an automotive-based mobility industry.

More than 100 years after the first battery-powered production vehicle hit the road, the tipping point for electric vehicles is finally in sight. How will automakers and suppliers manage the transition from a century of mass-market dominance by the internal combustion engine (ICE) as, over the next dozen years, alternative powertrains capture more than half of the global automobile market? What powertrains will be required by 2030, for both owned and shared mobility?

BCG has been tracking powertrain development for the better part of a decade. We have examined how far and how fast mass-market adoption of alternatives to the ICE might move, especially given advances in the cost of batteries relative to the cost of other advanced combustion technologies. We have also looked at other factors, including regulatory pressures, energy prices (oil and alternative fuels), and, of course, consumers’ interest and willingness to pay. Along the way, we have asked such questions as:

- What kinds of new propulsion technologies are likely to make sense, both technically and commercially? Where and when can we expect to see them entering the market? And what kinds of cars, finally, will consumers be willing to buy and drive? (See The Comeback of the Electric Car? How Real, How Soon, and What Must Happen Next, BCG Focus, January 2009.)

- What impact will the development and cost of various types of batteries have on the emerging market for electric cars? How much progress can we hope to see in the next decade, and what critical barriers will need to be overcome along the way? (See Batteries for Electric Cars: Challenges, Opportunities, and the Outlook to 2020, BCG Focus, January 2010.)

- Which technologies will prevail? How will consumers react to an expanding range of choices? How is the battle for market share—conventional versus electric vehicles—likely to shake out? What are the specific go-to-market challenges facing electric vehicles? (See Powering Autos to 2020: The Era of the Electric Car?, BCG report, July 2011.)

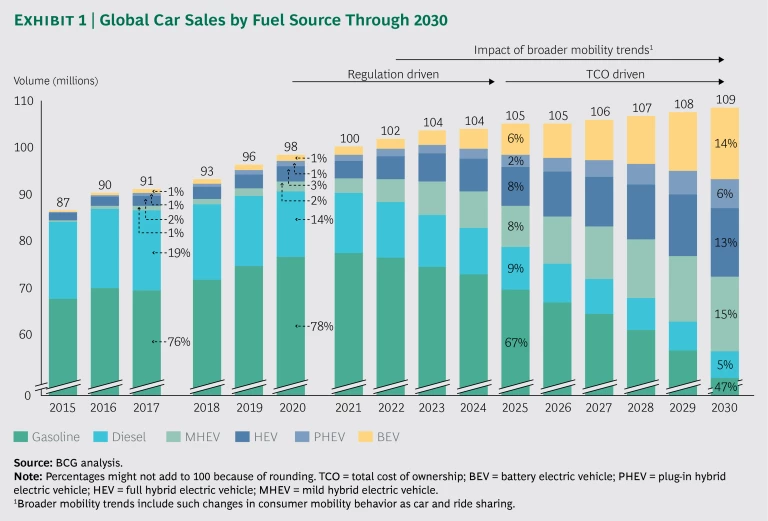

Recent years have seen significant—and market-changing—developments on several fronts, the most important being regulation, battery technology (and therefore price), and consumer attitudes. These shifts are coalescing and, as a result, we now expect the market to move toward electrified powertrains with increasing speed beginning in about 2020 and accelerating thereafter, such that in 2030 electrified propulsion will approach, and perhaps even surpass, the ICE in global market share. In the early years of this transition, the changeover will be driven primarily by regulatory mandates, but between 2025 and 2030, we expect, consumer demand will shift into high gear and propel fast-rising sales of vehicles powered in some way by electricity. (See Exhibit 1.)

When combined with ride-sharing and autonomous-driving technologies, this shift will be second in impact only to the invention of the assembly line in the history of the auto industry. (See Revolution in the Driver’s Seat: The Road to Autonomous Vehicles, BCG report, April 2015.) This prospect leads us now to take an updated look at where powertrains are headed and how the industry can manage the transition.

The Dawning of the Age of Electricity

The age of the electric automobile is finally in sight, but the transition away from internal combustion powertrains will take time. The speed of change in three areas (technology, regulatory mandates, and consumer cost of ownership), along with the rise of autonomous mobility, will shape the changeover, which we expect to play out over three phases and about a dozen years. The ICE is not going to disappear (or even decline in importance) anytime soon as the majority of electrified vehicles will also have an ICE.

The ICE will continue to be the dominant powertrain for the next several years, at least through 2020, the first phase of the transition, during which we will see limited adoption of either electrified or fully electric vehicles. The prices of electrified vehicles will remain high, even with incentives, and the payback period based on the total cost of ownership (TCO) for consumers will be too lengthy to be attractive. In addition, manufacturers will readily meet 2020 emission regulations with advances in ICE technology.

As the industry moves into the next phase, which we estimate will run from roughly 2020 to 2025, electrified vehicles will increase their market share as OEMs are forced to meet tightening fleet-wide efficiency and emission standards, principally by incentivizing sales of non-ICE vehicles. The electrified vehicles available during this phase will mainly be hybrids—mild hybrid electric vehicles or 48-volt hybrids (MHEVs), full hybrids (HEVs), and plug-in hybrids (PHEVs)—and as such, they will help prolong the life of the combustion engine. Although we believe the long-term future belongs substantially to battery-powered electric vehicles (BEVs), their rise will be more gradual and, for multiple reasons that we will discuss, they will not start to acquire significant market share until the third phase of the transition, from 2025 to 2030.

As the transition unfolds, we expect pure ICE vehicles to decline in share from their current 95% of the global market to about half of all vehicles around 2030. The other 50% of the market will be made up of MHEVs, HEVs, PHEVs, and BEVs, which we collectively refer to as xEVs.

The timing of the market’s transition to a new type of powertrain has long been the subject of debate. In our previous reports, we urged caution, for several reasons, including high battery costs and the ability of the industry to meet emission requirements through improvements in ICE technology. The combination of cost and concerns over driving range has kept BEVs from catching on with consumers. (Tesla is the exception to this, but it remains a premium-segment player, in part because of the high cost of its large battery packs. The more “mass market” Tesla Model 3 could lead to a repositioning of the company, but Tesla still has to demonstrate that it can make the transition profitably.) In addition, from a global-warming perspective, the overall “well to wheel” impact of EVs has been neutral, especially in markets, such as the US and China, where carbon fuels are still the primary source of electricity generation.

The prospects for electric vehicles are now clarifying and a transition period is about to commence, from an ICE-dominated marketplace to a market in which EVs gain share and BEVs start to compete with hybrids and ICE vehicles. Each national and regional market (the US, Europe, China, and Japan, for example) will move at its own pace. The trend will be in the same direction, but the evolving mix of ICE-powered, electrified, and electric vehicles will vary according to the relative cost of gasoline and electricity, the number of miles that consumers drive in each market, and local regulations and incentives.

Technological Advances

Three types of technological advances will shape the powertrain future. Through 2020, technological improvements in ICEs should be sufficient to enable the industry to meet regulatory emission requirements in major markets. There will be an active market for turbochargers, gasoline direct-injection technology, and other ICE-related enhancements. The biggest change will be in Europe, where diesel engines, which held 48% of the market in 2016, begin a relatively rapid decline in share toward 36% in 2020, owing both to the rising costs of meeting nitrous oxide and nitrous dioxide emission requirements and to “clean” consumer trends that will compel buyers to explore less expensive forms of xEVs.

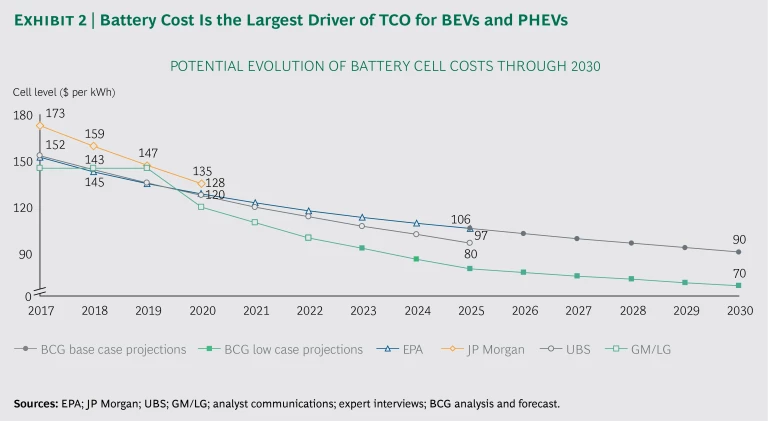

At the same time, battery costs, which are the single largest driver of TCO for BEVs and PHEVs, are declining further and faster than projected just a few years ago. They have dropped from about $700 per kilowatt-hour (kWh) in 2009 to about $150 to $175 per kWh today at the cell level. BCG forecasts that batteries’ cost per kWh will fall to $80 to $105 by 2025 and from there to between $70 and $90 by 2030. (See Exhibit 2.)

Driving range is still an issue. Many in the industry assumed that consumers would be satisfied with a 100-mile vehicle range for BEVs, but it now appears that 200 miles is likely to be the new minimum. Longer ranges require larger, and therefore more expensive, batteries, which is one reason why falling prices are so important to market uptake.

The third relevant area of technology is electric-power generation. So long as fossil fuels (with the slight exception of natural gas) remain the predominant source of electricity in major economies such as the US and China, the impact of xEVs on climate change will be negligible (after taking into account the energy required for the production and recycling of batteries). Only when alternative energy sources—nuclear, wind, and solar, for example—become major factors in electricity generation will electric powertrains make a material contribution to lowering greenhouse gases.

Regulatory Requirements Dominate: 2021 to 2025

The years 2021 to 2025 will be particularly challenging for the industry. OEMs will no longer be able to meet regulatory mandates without significant increases in sales of xEVs. Consumers will not be ready to make the shift, however; without significant incentives, the TCO of xEVs will still be too high. In fact, our projections show that the US and EU governments will require OEMs to sell 11.8 million and 3.5 million more xEVs, respectively, than consumers will be willing to buy.

In the US, OEMs will seek to meet regulatory requirements by reducing the overall market share of pure ICE vehicles from 95% in 2020 to 66% in 2025. Companies will market more MHEVs and BEVs because these powertrains will initially provide the most effective way to meet tighter requirements. MHEVs have relatively low manufacturing costs, and they can be adapted to current vehicle platforms. We expect their share of the market to expand to almost 20% in 2023. After that, BEVs will become the most efficient solution; as battery costs fall, their share should expand rapidly from close to 2% in 2020 to 8% in 2025.

The European market will follow a somewhat different trajectory to regulatory resolution, because European regulations provide a multiplier effect to BEVs, which makes them the most efficient way to reach current and projected EU mandates. While ICE vehicles will continue to hold the biggest market share, we expect BEVs’ share to increase from 1% in 2020 to 13% in 2025 while the share of all other xEVs rises from 5% to 18%. Gas- and diesel-powered vehicles will drop in share from 93% to 68% over the period, with diesel’s share falling the furthest and fastest as it is overtaken by BEV and hybrid technologies.

Our analysis shows regulatory requirements adding an increasing amount to the cost of a vehicle in Europe and the US, from a negligible sum in 2021 to $470 and $580, respectively, in 2025 (although this analysis does not include the additional cost of improving the efficiency of ICEs). Some combination of increased costs for consumers, lower margins for OEMs, and incentives from government will be necessary to shoulder the expected cost burden of $21 billion in the EU and $25 billion in the US over this period.

Consumer Demand Takes Over: EVs Accelerate in 2025

Research consistently shows that consumers around the world are favorably disposed to xEVs, and particularly to BEVs, and they believe that if autonomous driving is to become a reality, autonomous vehicles (AVs) will most likely be electric. (For more on the impact of AVs, see the next section.) However, three big constraints—price (even with falling battery costs), range, and charging-station infrastructure—will slow the adoption of fully electric vehicles in most markets. In the meantime, hybrids will dominate.

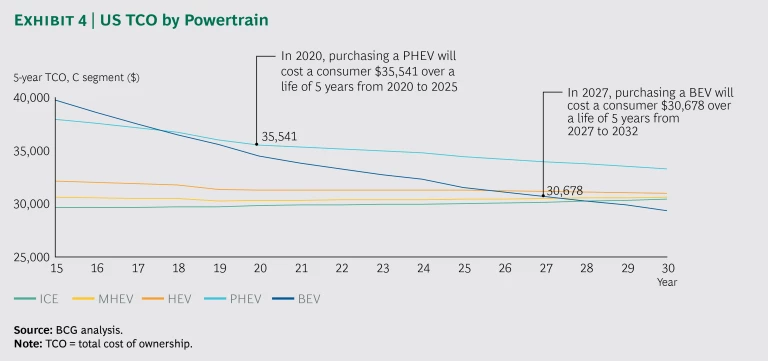

Consumers typically make rational decisions about big purchases, and as battery costs fall, receptivity to xEVs will increase because electricity is cheaper by kilometer or mile than gasoline. Our research indicates that the percentage of consumers willing to purchase xEVs will jump into the 25% to 40% range when the payback period drops to three years. If production costs continue to decline at their current rate, we see a strong economic proposition for consumers to make the shift to EVs starting in about 2025. At that point, we expect the global share of xEVs to be about 25%, from which it will rise rapidly to 50% by 2030. We expect the share of BEVs to be 6% in 2025 and 14% in 2030, with China and the EU leading the pace. Hybrids will be the biggest sellers, taking about a third of the global market.

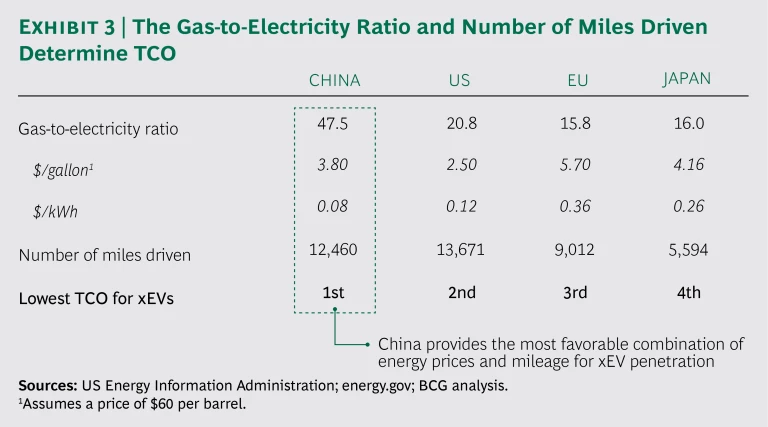

The adoption curve for EVs varies to some extent by market depending on the TCO, which reflects several factors. These include the price of the vehicle, the number of miles driven, and gas and electricity costs. (See Exhibit 3.)

In China—which is the leading market for EVs so far—high mileage, low electricity costs, and high gas prices already combine to give these vehicles a favorable TCO relative to ICE-powered cars and trucks. Thanks to the Chinese government’s incentives, the consumer’s TCO for BEVs reached a five-year payback in 2015. Not surprisingly, China has the highest number of xEV sales of any major market. Even so, xEV penetration is only 3% there currently, and we expect only modest increases until about 2025. At that point, xEVs’ share will approach 20% and begin to accelerate more rapidly. By 2030, China will be the largest single market for BEVs, which will have a 17% share of auto sales; hybrids will take another 28%.

In Europe, the high cost of electricity, along with the relatively low number of miles driven (compared with China and the US), will continue to make the ICE the powertrain of choice for most consumers through 2025. Thereafter, the market will shift, with BEVs taking a 22% share by 2030 and hybrids a collective 33% share. Diesel’s share will drop to 12%; gasoline’s, to 32%.

The low cost of gas in the US leads to similar result. The rapid growth of MHEVs that will start in 2021 will continue, and these vehicles will represent almost a quarter of the US market by 2030. (See Exhibit 4.) Another quarter will be divided among other xEV types, leaving about 50% for ICE vehicles. Most of the EV growth will occur in smaller vehicle segments: by 2030, almost all vehicles in the C segment will be electrically powered, while ICEs will remain the primary powertrain for pickup trucks (even though electrified pickups under development will be introduced in the US and will take some share). Electric or hybrid engines will take about 45% of the SUV segment, of which more than half will be MHEVs.

Hybrids will dominate the Japanese market, with a collective share of 53% by 2030. Japan will likely see rising sales of HEVs and MHEVs moving forward because of the low mileage driven and domestic OEMs’ focus on these emerging technologies. The share of pure ICE vehicles in Japan will fall to 36% in that year, the lowest penetration in the world.

(For a detailed analysis of projected sales volumes by powertrain in the world’s major markets, see the appendix.)

The Impact of Shared, High-Mileage Vehicles

Over the next decade and half, the impact of car and ride sharing on the market for xEVs will only increase. There’s already a good chance today that anyone hailing a New York City taxi or ordering a ride from Uber or Lyft will be traveling in a hybrid vehicle. Hybrids offer the best economics for heavily used vehicles, such as taxis, which can put 50,000 to 75,000 miles a year on the odometer. (New York City says that each of its ubiquitous yellow cabs drives an average of 70,000 miles a year.)

MHEVs and HEVs are already the most cost-effective choice for most owners of taxis and other shared vehicles. About 60% of the New York City yellow taxi fleet is already hybrid. One manufacturer of London’s famous black taxis has invested £300 million in a UK factory to turn out London-style hybrid taxis for sale across Europe. Even though hybrids are more expensive to buy, heavy usage means a much shorter payback period for the initial premium cost. At 70,000 miles a year and the current cost of gas in New York, cab owners pass through parity early in the average taxi’s three-year life.

BEVs are still too expensive for shared-vehicle owners, especially because these cars need a healthy range. (That average New York City taxi travels about 110 miles in a 9.5-hour shift.) Although newer BEVs such as GM’s Bolt, the upcoming Tesla Model 3, and the Nissan Leaf already get about 200 miles per charge, we believe a tipping point will be reached around 2025 as battery prices decline, making BEVs economically competitive with hybrids. This could provide a significant boost to BEVs’ sales and share of market. An even bigger boost could come from sales of AVs used for car sharing because they pack a double economic wallop—lower operating costs and no driver (and hence no driver costs). We have estimated previously that the biggest benefits from an urban mobility revolution will come from the widespread adoption of robo-taxis. (See Self-Driving Vehicles, Robo-Taxis, and the Urban Mobility Revolution, BCG report, July 2016.)

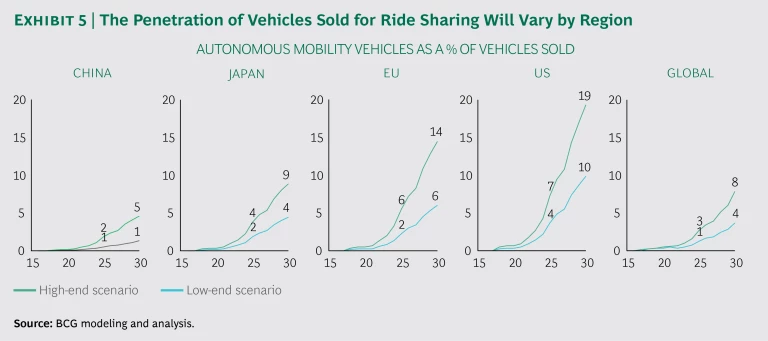

Our current research indicates that ride-sharing adoption rates by 2030 will be highest in large and very large cities (populations of more than 1 million), where they are likely to range from 40% to 80%. We also expect ride-sharing penetration to be significant—20% to 40%—in the metropolitan areas immediately surrounding city centers. Uptake will vary by region, with the heaviest usage likely in the US (a range of 10% to 19%) and Europe (6% to 14%). (See Exhibit 5.) Because all of these shared cars will be electrified by 2030—with the majority of them fully electric owing to the fast payback possible by that time—shared mobility will significantly boost the proportion of new-vehicle sales claimed by electrified vehicles.

Other Factors Affecting EV Market Growth

Several variables, such as the price of oil and subsidies, will affect the growth of the EV market. For example, our base model assumes a steady oil price of $60 a barrel. A jump to $90 would see a 3.4% decline in the global market share of ICE vehicles and a 1.5% increase for BEVs and plug-in hybrids. Similarly, if governments were to maintain current subsidies for BEVs through 2030, xEVs would gain almost 5 percentage points of share, at the expense of ICE vehicles. But the impact of these factors will be subdued compared with that of the fall of battery cost and the rise of AVs and car sharing.

The impact of regulatory shifts could be significant. In the US, the Trump administration has already indicated an intention to loosen regulations on ICE emissions, which would slow the adoption of hybrids and BEVs. The global impact of such moves may be muted, however, because OEMs still need to produce xEVs for sale in the rest of the world. We would also argue that loosening regulations on emissions could actually undermine the long-term competitiveness of US OEMs and suppliers in a global market that is clearly moving toward cleaner sources of propulsion. In addition, a greater number of xEVs would mean lower demand for gasoline, which would help keep gas prices down—a boon for both consumers and other sectors of the economy as consumers would have more money to spend elsewhere. (See “The Emission Standards Paradox.”)

The Emission Standards Paradox

The Emission Standards Paradox

US automakers have generally received favorably the news that the Trump administration would review the emission standards set by its predecessor, with an eye toward relaxing them. But will loosening emission regulations really benefit manufacturers?

To be sure, looser regulations mean less pressure on design and production and lower prices for consumers in the near term. But lower standards now do not necessarily undermine, or change, the broader market trend toward cars and trucks with fewer emissions and less environmental impact. For one thing, California does not plan to slow its regulatory march. For another, the US is only one market, albeit a big one, among many the world over. Because most automakers operate globally, their fleets still need to meet the standards set by different governments. US automakers in particular may remember the big gains made by upstart imports following the second OPEC oil embargo in 1979, when the big run-up in oil prices drove a dramatic market shift toward more-fuel-efficient vehicles.

An argument can be made that tighter regulations actually have a benefit for OEMS and suppliers—in this case, they are driving more R&D, faster technological advances, and a generally quicker climb up the alternative-power-train development curve. Manufacturers benefit from developing new technologies and moving them into mass production quickly; indeed, those that move the fastest have the opportunity to establish a tech-based competitive advantage. In addition, they can roll out technical advances globally to help meet regulatory requirements in other major markets.

In an age of increasing consumer concern over climate change, there is also the hard-to-quantify reputational benefit of being seen as a part of the solution rather than a leading contributor to the problem.

In addition, one might consider the role of increased fuel efficiency on the lower gasoline prices that consumers enjoy today. In the US alone, the average miles per gallon for cars and trucks is expected to increase by about 40% and about 30%, respectively, from 2017 to 2030. The resulting reduced demand will help keep gas prices down, which along with more stable prices at the pump, is an additional economic benefit of tighter regulation for consumers.

One of the biggest long-term variables is the impact of the sharing economy. We expect car- and ride-sharing trends to follow regional TCO, so markets that have higher TCO will likely see more car sharing more quickly. Because one of the largest drivers of cost per mile is the difference between fossil fuel and electricity costs, MHEVs and HEVs are already the most cost-effective choice for most owners of taxis and other shared vehicles. By 2025, BEVs should enjoy a significant and fast-climbing advantage when the falling cost of batteries gives electricity a distinct and rising price-per-mile edge over oil. Ride sharing therefore has the potential to be a significant driver of BEV sales in markets such as the US from 2025 on.

The Impact for OEMs and Suppliers

As the industry moves through the transition to hybrids and then to fully electric powertrains, OEMs and their suppliers are going to have to balance a complex set of considerations that affect all aspects of the business, from supply chain through sales strategy, and that vary by region and market around the world. The challenges to profitability will be significant, and the competitive landscape could be complicated in the medium to longer term if tech giants continue to see opportunities for themselves in the nascent market for AVs.

OEMs. Perhaps the biggest challenge for OEMs will be developing and managing an ecosystem of partners and suppliers for the design and production of hybrids and BEVs alongside existing ICE networks. OEMs have demonstrated that they can innovate in new product areas—Nissan’s Leaf and GM’s Bolt are two examples—but most manufacturers are playing catch-up, particularly with respect to BEVs, and they will need to work with others to develop their xEV product lines. Traditional suppliers are one type of potential partner (although these companies will need to raise their own xEV game as well), but tech companies, software designers, and ride-hailing companies such as Uber and Lyft are others given that the economics of xEVs are more favorable for shared vehicles. (Many OEMs are already striking deals with, or making investments in, tech-oriented players.)

A complementary, but different, set of ecosystems may grow up around the design, production, and sale of AVs as the technology becomes commercially available. Our research shows that most consumers are looking to auto OEMs to play the lead role in AV development, but many also see tech companies as viable competitors. Technology operating systems as well as automotive powertrains could both be focal points at the center of these ecosystems.

In the medium term, as hybrids take a bigger share of the market, OEMs will face difficult choices in how, how much, and where to invest in various technologies, especially if they see the hybrid as a transitional phase on the road to fully electric cars and trucks. These choices will be complicated by the varying mix of hybrid vehicles in major markets. Again, partnerships with suppliers will be critical to managing hybrid production.

Many in the industry see innovation and differentiation as a growing challenge, especially with respect to BEVs, because one battery pack operates much the same as the next and power and range are mainly functions of size. We agree that differentiation will remain critical: consumers like choice in vehicles and their attributes, including design, performance, and features. Tesla has shown that BEVs can be highly distinctive, especially in the premium segment. GM, Nissan, Toyota, and Honda have all brought differentiated BEVs and hybrids to the market, each with its own appeal. Designing and manufacturing differentiated, high-quality vehicles at scale is something that major OEMs are good at, and this will continue to be an essential capability for automakers. However, BEVs reduce the barriers to entry for vehicle manufacturing in that they use more openly available components than ICE vehicles.

Companies need to determine which components add value by being manufactured in-house and which are commodities and should be outsourced to suppliers. The mix may be different by type of xEV. Toyota, for instance, is making its own traction motors.

Managing production strategy will require accurately anticipating regulatory requirements, the falling cost of electrification, and the rise of consumer demand in order to scale up xEV manufacturing at the right time. OEMs will need to work closely with suppliers as xEV production ramps up and to manage revamped supply chains oriented around xEVs that work alongside existing ICE supply chains. Questions of location, type of component, and cost of production must all be resolved.

Sales strategy will be another complex issue, especially in the transitional years between 2020 and 2025. Manufacturers will need to determine the best pricing strategy to persuade customers to buy sufficient numbers of xEVs to meet regulations, which can be done through incentives, increasing the cost of ICE vehicles, or some combination of the two. Sales strategies will differ by region based on regulatory requirements and consumer behavior. Profitability will be under pressure, unless sales are supported by government incentives.

And, of course, there is the issue of electric-charging-station infrastructure and who will construct it. We expect that OEMs will have no choice but to help develop charging networks in order to overcome consumers’ anxiety about the range that EVs can cover. Indeed, some are already doing so: Tesla has announced that it plans to double the size of its global charging network, and Volkswagen has committed to building approximately 400 fast-charging stations as part of its diesel emission settlement in the US.

Suppliers. These companies will need to make their own calculations as to where they can best find opportunities to add value. Like OEMs, they will need to carefully manage the timing of investments and the building of manufacturing capacity. They will also want to position themselves as top suppliers both to leading OEMs as demand for EV components starts showing significant growth and to potential new entrants that see the opportunity to change the game, whether they be tech giants or startups.

One place to start is the shift in the mix of components that will occur as production of xEVs scales up and the size and complexity of ICE vehicles fall. Key decisions include which specific xEV components are most attractive: Where are the best opportunities for differentiated products and high ROI? Does this attractiveness vary by region? What level of investment is required, by component, in each region? And, for suppliers that have long specialized in ICEs, what is the ideal strategy (internal investment, acquisition, or joint venture) for investing in new EV-driven adjacent markets?

At the same time, suppliers will have to manage the profitability of improvement and manufacturing of ICE components. Even as demand for these components falls, they are still critical to their OEM customers and to meet regulations. Again, regional variations in both declining ICE components and growing xEV components will complicate decision making.

Considerations for Governments, Too

The shift toward a market divided between traditional and electric vehicles raises its own issues for governments and regulators. For example:

- To what extent do they want to support the transition to xEVs by providing incentives for purchase? Our analysis suggests that a certain of level of incentivizing will be required until 2025, when the market becomes more self-sustaining. How do they fund those incentives?

- Longer term, how do governments compensate for the decline in tax revenue that will come with lower sales of gasoline and diesel fuels? In the US, for example, federal gas tax revenue exceeded $35 billion in 2014, and each of the 50 states also raised money through taxes on gasoline and diesel fuels. Do governments shift taxes to the sale of electricity (which could dampen the uptake of xEVs and have broader economic impacts)? What will be the impact on transportation infrastructure spending, which in many countries has been funded by fuel-related taxes?

What incentives will national, regional, and local governments offer as companies start to build new manufacturing facilities for xEVs and their components?

The tipping point is in sight. EVs are set to be a major market reality inside of the next 15 years. But the road from here to there is anything but straight. Regulatory-driven change, the presiding paradigm from 2020 to 2025, is rarely predictable. And given a variety of cost considerations, including how far and how fast battery costs fall, the pace of consumer demand for EVs could vary as well. It will certainly vary by market.

OEMs and their suppliers should keep their eye on two broad trajectories: the rise in the market share of xEVs from about 5% today to 50% sometime around 2030 and the increase in the share of BEVs from almost nothing to about 14% of the global market in 2030. The pace of change will vary depending on regulatory actions, the availability of AV technology, consumer adoption of ride sharing, and the economics of different fuel sources. Companies will need to develop a suite of strategic and product options to manage the transition to an economically sustainable xEV market. This will require clear choices with respect to investment and meeting market demand.