Demand for health care in

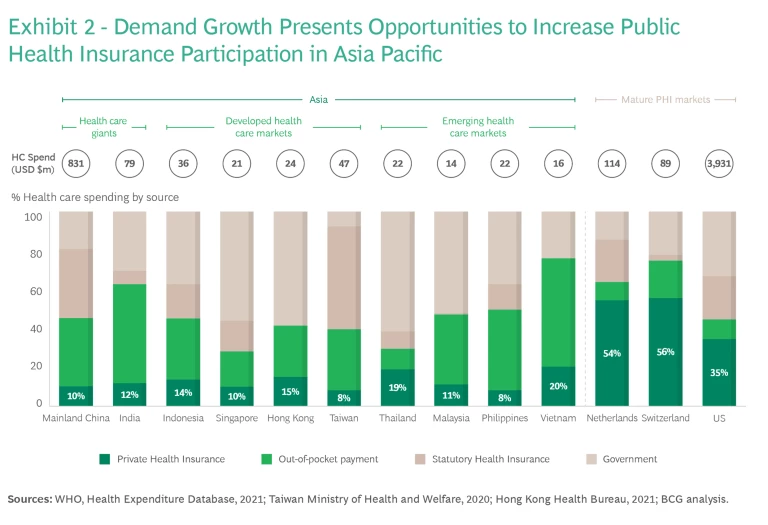

Across much of Asia, the burden of health care funding sits disproportionately with the consumer as out-of-pocket spend. This is due to two factors. First, universal health care schemes, which are now commonplace across much of Asia, provide insufficient coverage. In addition, middle class consumers are increasingly demanding higher quality care beyond that which government schemes can provide. To address this high spend, consumer demand for health insurance will continue to grow substantially. (See Exhibit 2.)

Health has long been front-of-mind for consumers and is frequently the basis for their engagement with insurers, in many cases as the key driver of an initial product purchase. The COVID pandemic has been a catalyst for consumers to focus on their health and wellness, both in terms of practicing healthier behaviors and reviewing the adequacy of their health protection. The pandemic also triggered an increase in consumer acceptance of digital care or telehealth, particularly at the beginning of the patient care journey and in the management of chronic disease. Consequently, the digital wave in health care is at an inflection point, enabling insurers to engage consumers and policyholders in ways that have not been possible before and presenting an opportunity to radically differentiate from competitors.

Now is the time for the insurance industry to enhance its focus on health within their portfolios. The question is: What does it take to succeed, outcompete, and win in this space? Before we explore this, let’s first look at the current state of play.

The Starting Point for Future Growth

The health insurance space in Asia today is defined by a number of realities that point to opportunities for creating a winning model for health insurance.

Health has emerged as a major business line for, primarily, life insurers as a consequence of their significant scale in distribution. Today, health-focused products make up approximately 25–35% of total premium volume and are among the fastest growing insurance product lines. Health insurance across the region typically comprises two major product groups: fixed benefit plans, such as critical illness, and medical indemnity plans.

Since their emergence in Asia in the 1980s, critical illness plans have come to dominate the health insurance landscape. This has been driven by affordability, relative to medical indemnity plans, and simplicity, with benefits focused on diseases and conditions that most concern consumers, such as cancer, heart disease, and stroke. In addition, critical illness plans are frequently sold as an income replacement product, enabling larger premium sizes and thus higher commissions for distributors and further driving scale. Insurers have sought to differentiate through broader coverage across many disease types and stages and multiple occurrences. Yet the potential for further innovation along these vectors is finite, and critical illness is becoming increasingly commoditized, resulting in margin compression as price becomes the dominant battleground.

Medical indemnity products are likely to best serve consumers seeking private health care funding. Like critical illness, medical indemnity has grown substantially. But even the most “health-evolved” insurers would recognize that this growth has preceded the development of technical health insurance capabilities—particularly true when compared to relatively more sophisticated insurers in Europe, North America, and South Africa, many of which play a far more active role in policyholders’ care pathways.

In addition, many insurers continue to measure their health insurance business performance using life insurance frameworks and yardsticks—sometimes leading to limited understanding of profit drivers and difficulty in realizing expected profitability. Attempts to separate health from life insurance measurement are further complicated by many medical indemnity products being bundled with life and savings plans, such as riders on investment-linked plans.

From a proposition perspective, a number of insurers have sought to leverage the health and wellness theme to differentiate, drive appeal, and deepen engagement. These programs have enjoyed varying degrees of success—with marketing and positive-selection benefits being balanced against significant and required ongoing investment, low levels of engagement and utilization, and difficulty in proving impact on policyholder behavior change. In regions outside of Asia, some insurers have been successful in driving sustained engagement and behavioral change that yield significant health benefits. The question remains to what extent this can be replicated in Asia. Despite this, insurers have proven that policyholders are willing and wanting to engage with their insurers on the topic of health and wellness beyond a pure financial protection basis.

Digital solutions enable insurers to improve access to care and to deliver interventions at scale and at lower cost than conventional channels. These solutions also facilitate data collection that, in turn, enables an unprecedented degree of product personalization .

Policyholders want to engage with insurers on the topic of health and wellness beyond a pure financial protection basis.

Finally, there remains a large pool of consumers whose needs are inadequately addressed today, including those suffering from chronic disease or with adverse medical histories—which means they often struggle to access health protection. This pool offers opportunities for insurers to innovate, disrupt, and lead, although the major prize remains in standard risk.

Given this environment, what issues must insurers consider to optimize the potential opportunities?

Some Food for Thought in Developing a Winning Health Insurance Play

Insurers have numerous options to differentiate and win in Asian health insurance. These include vertically integrated payer-provider models; health care service offerings that enable a shift from pure payer to partner; digitally-enabled engagement to improve overall health and wellness; and clinical capabilities to enhance the experience and quality of care pathways.

Regardless of the strategy deployed, there are common threads to building a winning model. We distill six critical questions that insurers must address to define their own unique and successful initiatives.

How can I disrupt the traditional product-centric approach through superior, segment-specific, needs-based propositioning?

Key considerations include how to deliver propositions to underserved segments and how to build consumer trust by better aligning product economics with improved health outcomes (for example, through severity-based incentives, early detection, and prevention). Another is looking at how to best appeal to top-of-mind concerns (such as cancer and diabetes) and deliver holistic propositions that include relevant clinical service components to partner with consumers and truly deliver better health outcomes.

How do I build data and analytics capability that delivers insights to enable population health risk management through risk stratification and targeted interventions?

Insurers will need to consider where the sources of this data exist—whether from the insurer, policyholders, or their health care providers—how to access the data, and if incentives will need to be provided to facilitate its exchange. For implementation, insurers must leverage data insights and define how to successfully execute three actions: deliver personalized health journeys for policyholders, direct targeted health interventions, and do so in a holistic, value-oriented manner.

To what extent and how do I deliver health care services across the care continuum?

The outcome that delivering these services seeks to drive is critical both in terms of selecting the service itself as well as the delivery method. This holds true whether the insurer seeks to offer wellness engagement or population health services, drive better clinical outcomes, or manage health care costs down. It’s also important to determine whether these services need to be provided by partners or can be built internally. Finally, consider if the services can be funded—and whether the policyholder sees sufficient value to pay for them.

What is the role of digital in delivering compelling, seamless, end-to-end policyholder and patient journeys?

Considerations here should include where along the common buy-serve-claim journey digital should be emphasized as a touchpoint and how digital complements other channels, including agents, for a consistent experience. In terms of value proposition, think about the role of digital with respect to engagement, behavior change, and delivery of health care services—either directly or through partners—and the implications of this on the technology stack.

What technical capabilities must be built to deliver sustainable health care funding, and what is the optimal operating model?

Insurers will need to establish a clear understanding of their health insurance economics and baseline to enable sustainable management of their portfolio. This includes looking at how to build these capabilities and, for multinational insurers, how to balance them between business units and central functions. The partnership model among insurers, health care providers, and other stakeholders must be considered, as well as how to structure incentives that prioritize value-based care and drive cost efficiency and superior outcomes. Furthermore, in the context of population aging, increased disease burden, and medical innovation, insurers will need to anticipate these inflationary pressures and effectively deploy technical measures to mitigate and contain medical cost.

How can I drive my sales and advisory capabilities to effectively go to market with needs-based propositioning?

Broader, needs-based, and segment-specific propositions will likely represent a new and unfamiliar challenge to sales advisors compared to their status quo approaches for conventional health products. Insurers will need to consider how to upskill and augment their salesforce capabilities, including their use of technology.

Insurers that take a holistic view and execute effectively across these six elements will be well positioned to unlock the substantial growth opportunity in health—and to do so in a financially sustainable way. For those insurers who have yet to embark on this journey, it is not too late. Even insurers that are furthest ahead are only in the early stages. But the first steps should be taken soon.