Artificial intelligence and personalization are bringing a revolution to insurance distribution. Insurers that are quick to seize the opportunity can enhance their bottom line through cost savings and efficiency gains—and win market share.

The opportunity is opening up now owing to a convergence of factors. First, the data held by insurers has reached critical mass, an essential enabler of AI. But more important, today’s consumers want and expect personalized experiences because they’ve grown accustomed to online retailers, telcos, and companies in many other sectors successfully using AI to create customized services.

The good news is that there’s still time to become an early adopter and seize this opportunity. Despite a long history of data innovation—most notably in actuarial science—insurers have been slower than companies in many other industries to capture AI’s benefits. What’s held insurers back is a series of misconceptions, which we demolish later. Executives that ignore myths such as these and focus on the realities are taking an important first step toward unlocking the power of personalization.

Why AI Is So Valuable in Distribution

We focus on AI in insurers’ distribution processes because deployed here, it can uniquely drive growth. This is of particular value now, when the world economy is weakening and consumers are becoming increasingly reluctant to spend. Through data-driven personalization, AI can make the right customer offer through the most appropriate channel. This maximizes uptake, boosting revenue and market share. In addition, it allows insurers to identify the most cost-effective channels and reduce distribution expenses.

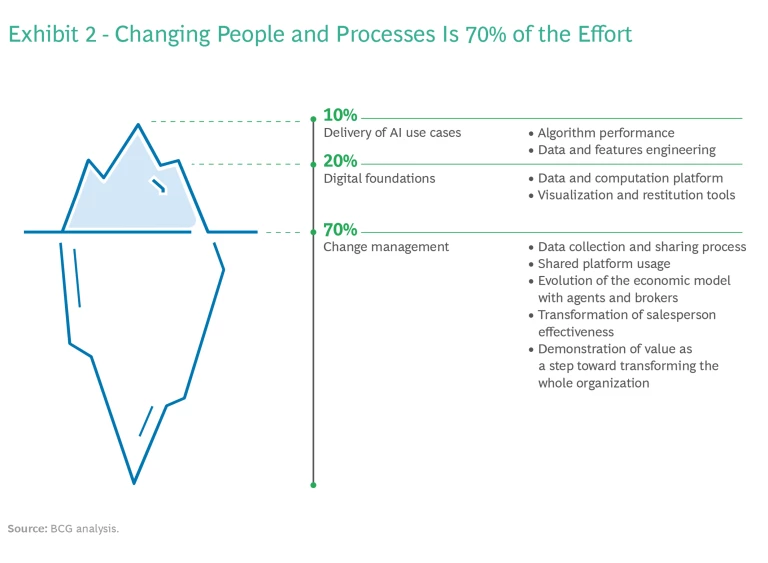

The technology can optimize a wide variety of processes in distribution. But we see particular success in three areas: helping agents find their next-best action, lead generation, and general sales support. (See Exhibit 1.)

Personalization using AI also helps solve a longstanding problem faced by many insurers that distribute via agents or brokers: stagnant agent productivity.

This is at the core of a solution we cocreated for an insurer in Singapore whose growth had plateaued and needed a kickstart. We assisted the company in introducing an “ever-learning engine” that generated the most appropriate combination of lead, agent, and product while providing agents with personalized talking points. This was technically challenging, with 300 million records processed to create the models. But the outcomes were dramatic: advisor productivity jumped by 25%, which in turn added 5 to 6 percentage points to business growth.

AI and Insurance: Myths Versus Realities

So, what are these misconceptions that are holding the industry back? When speaking to senior insurance executives, we hear about a few common ones.

Misconception #1: I can get the same results cheaper with traditional data analytics.

Reality: AI is far superior to conventional analytics at combining complex and large data assets, capturing nonlinear patterns, and developing granular insights.

When we helped a Belgian insurer upgrade to AI-powered distribution, the company unlocked a considerable array of benefits, including a new personalization engine and cutting-edge analytics to improve churn (reduced by 30%) and cross-selling (increased by 40%). The result was a €20 million revenue uplift.

Misconception #2: AI is costly and complex. I may never see value.

Reality: Our work emphasizes high-impact, proof-of-value use cases. Starting with quick wins allows insurers to “fund the journey” and build strong business cases for increasingly ambitious projects. Such projects can deliver valuable interim benefits.

For an insurer in Turkey, BCG helped design and implement AI-powered business processes to maximize upselling and cross-selling by matching the right customer, agent, and product. The result: conversion rates increased by a factor of 2.5 and the insurer saw a 30% uplift in product sales. But we also enabled the company to generate additional sales within six weeks via a rapid pilot.

Misconception #3: AI is a nice-to-have but won’t deliver a competitive advantage to my firm.

Reality: Strong AI capabilities help insurers construct moats of competitive advantage and resilience by building deep customer insights and tapping into new pools of value.

Our work with a North America–based global insurer goes beyond dramatic improvement in individual use cases such as churn and cross-selling. It aims to nurture a deeper connection with clients and develop enhanced, innovative strategies for each use case, creating defendable long-term advantages. An example is the management of “orphans,” customers with no apparent tie to an agent or broker. The global insurer has achieved a 50% contact rate for these customers, which reduced churn and made these customers more valuable in the long term.

Although we’ve demolished the myths, it’s essential to recognize that there are genuine challenges to overcome.

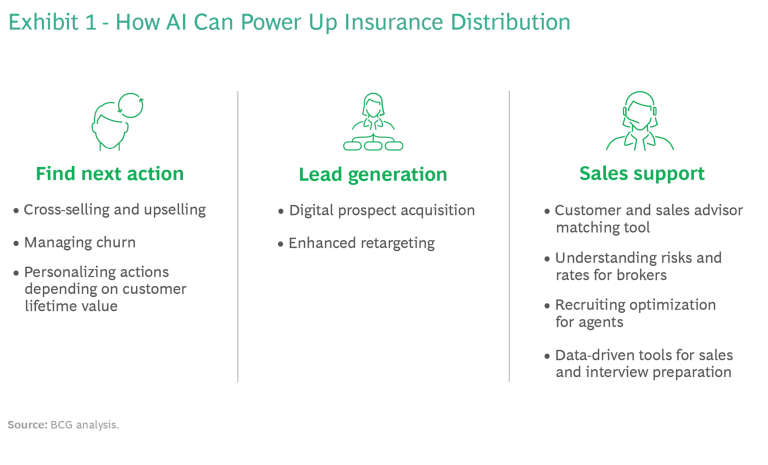

Although we’ve demolished the myths, it’s essential to recognize that there are genuine challenges to overcome. They are not only technical: for most AI transformations, just 30% of the effort involves technical tasks such as building a data platform and developing and improving the performance of algorithms—the tasks most people associate with AI development. A full 70% of the undertaking is focused on change management. (See Exhibit 2 for more details.)

Data Is the Foundation

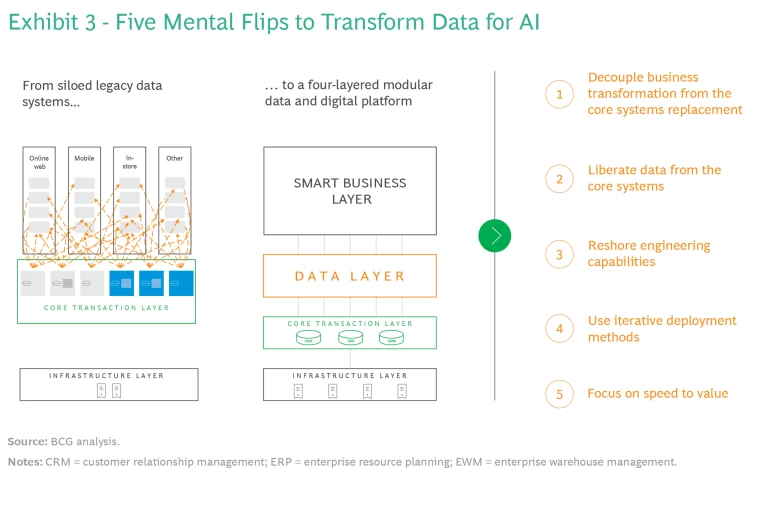

Insurers have centuries of experience leveraging data in underwriting, claims, and pricing. But for most insurers, the data in their core legacy systems is not ready to be used for AI use cases. It’s stored in siloed systems that may have highly inconsistent definitions of data types. And data quality may vary substantially.

The solution is a layer that decouples front and back systems, liberating data from the core transactional systems. (See Exhibit 3.) These new digital foundations should be built using a modular, cloud-based architecture.

But you don’t need to wait to have all these new foundations in place to develop AI products. They can be built in parallel with the delivery of key AI initiatives.

It’s important to underline that insurers’ internal technical skills, such as data science and engineering, will need to be strongly reinforced. Staff will need to be upskilled. And new capabilities will need to be imported.

This requires much more than just placing an ad on a recruiting website. Insurers that want to attract data scientists must develop a value proposition that is appealing to top talent, offering flexibility and highlighting the interesting problems they will tackle. Insurers also need to use the appropriate recruiting channels and engage with the data science community via hackathons or platforms such as Kaggle (a data science site where firms can post real-world challenges for the community to solve). In addition, insurers must create a speedy recruiting process that identifies their best candidates, supplementing interviews with coding and analytics tests.

We worked with a European insurer that took four months to recruit data scientists, creating a constant risk of losing much-needed talent to rival insurers. An overhaul of the company’s recruiting processes reduced this time to just one month.

Change Management: The Real Challenge

Change management is essential in any AI project, but the stakes are particularly high when it is deployed in insurance distribution. The challenge is that this function—so critical to an insurer’s business—is typically done by outside advisors, agents, or brokers.

Any new system must get buy-in from this highly heterogeneous, semiautonomous group, and some of them may be very skeptical about change. They may have many ways of working and varied attitudes toward technology. They may perceive some changes as not being beneficial to them.

Change management is essential in any AI project, but the stakes are particularly high when it is deployed in insurance distribution.

There is also an essential connection with the data challenges mentioned earlier. Agents may be reluctant to share the data necessary to the success of AI projects for a number of reasons, one of which is a fear of disintermediation. More broadly, they may worry about a change in the value split between themselves and the insurer—to their detriment.

The agent mindset, however, can be turned into an advantage if the new AI-driven processes are implemented with care. Agents have an entrepreneurial mentality with strong financial incentives; they will overwhelmingly adopt new ways of working and tools if these deliver additional sales or productivity.

From the start of the project, it’s key to demonstrate that agents will be empowered—not replaced—by AI.

The best strategy is an end-to-end approach that considers change management even at the first stage, when insurers are identifying and selecting their AI solutions. Strong product managers are needed who link technical and business teams. Change management must remain an integral part of the project as it continues through development and scale-up.

Here are five levers for generating the essential buy-in:

- Cocreate from the start. At the proof-of-concept stage, cocreation is essential. A dedicated team embedding agents and technical contributors will secure early agent participation and ensure that the tool fits their needs. As deployment progresses, the team will kickstart a feedback loop that will iteratively improve AI effectiveness.

- Encourage data sharing. It’s vital to incentivize agents’ data sharing by leveraging data from other sources, such as digital channels or claims management centers. Hopefully, when agents see how this data adds value, they will be more willing to share data into the pool.

- Explain why. The AI should provide agents with some rationale when it recommends actions. Without this, the agent may not take the suggested step.

- Make it easy. Everything must integrate with agents’ workflow and tools such as click-to-call or email automation. The new system must reduce, not increase, pain points.

- Be flexible. The insurer’s change management support must adapt to each agent, reflecting that agents vary significantly in their tech maturity and ability to absorb new systems. The tool should recommend only those actions that the agent can perform.

Getting onto the Launch Pad

We are frequently asked which use case insurers should choose first. But this is different for each insurer. Once business ambitions and clear strategic objectives are set, use cases should be carefully selected along two dimensions:

- Business value combines the size of the impact and speed to value. This is essential internally to win further investment and start a virtuous cycle of increasingly ambitious investment and return. But proof of value is also vital for the agent and broker network, breaking down resistance and getting the network enthusiastic about the changes.

- Feasibility looks at the size of two gaps. The first is the disparity between today’s technical foundations and what’s needed for deployment. The second is between agents’ current skills and working methods and what they will need to do after the new system is deployed.

We advocate launching a pilot project first, but it’s essential to clarify the definition. This is not a technology experiment in a low-impact business unit. It should be a stepping stone toward a strategic, high-impact use case with complete interconnection to legacy systems. Once pilot results are clear, it’s time to automate, integrate, and progressively scale up.

Stay ahead with BCG insights on artificial intelligence

To see the value of a well-chosen pilot, consider a US insurer that needed action to reactivate dormant customers, defined as those generating no new business in 36 months or more. These customers made up 35% of the company’s portfolio, in part because agents received better commissions for acquiring new customers than for serving existing ones.

The BCG team developed an AI model to decide which dormant customers should be activated first as well as the most effective and efficient way to do it. To minimize the time to value, within 24 weeks we helped the US insurer define a strategy, implement the call center, and launch a pilot outreach program. During the first 8 weeks of the pilot, some 1,000 accounts were reached, with a 40% re-engagement rate—early but real proof of value.

We’ve discussed multiple successful case studies to underline a point: across the globe, in numerous markets, early adopters are already enjoying the real benefits of AI in distribution.

In many cases, the financial benefits from one project can more than fund the next, building momentum with no cost. As skills develop, subsequent projects can be implemented at greater speed and with lower risk, accelerating a rapid, top-to-bottom upgrade to an insurer’s entire distribution process. The enhancement will drive cross-selling, upselling, retention, and the ability to peel customers from rivals.

The question insurers need to ask is: Do they want to face a competitor like this? Or do they want to be one, enjoying all the associated benefits of above-trend growth?

There is still time to be among the first insurers to seize this substantial competitive advantage—but the opportunity for first-mover advantage is narrowing.