The sky-high fertilizer prices that followed Russia’s invasion of Ukraine have largely receded to prewar levels, especially in the case of nitrogen fertilizer products. New trade patterns have emerged to even out the disruptions caused by sanctions and countersanctions, and trade volumes have returned to historical levels.

But this doesn’t mean that fertilizer companies can rest easy. To the contrary, they must prepare now for various supply- and demand-side challenges that they will face in the coming years. Demand, especially for nitrogen fertilizer, is likely to weaken as a result of intensifying regulatory pressure and the advent of new farming technologies. And greater competition for ammonia—the key feedstock for nitrogen fertilizer—and in particular for low-carbon ammonia, which chemical companies will produce in far larger volumes in coming years, will lead to a new supply structure and to regulatory actions that reshuffle cost differences between gray and green or blue fertilizers.

In short, fertilizer companies face considerable risks to their current business models—risks that will require them to reevaluate and redefine their strategies. But if they take the right approach, they can also benefit from the considerable opportunities that changes in demand and supply will bring. Here’s how.

Future Market Disruptions

As was the case with previous disruptions to the fertilizer market, fertilizer prices on average will probably remain somewhat higher than they were in the decade before the war in Ukraine. However, several trends will affect future demand for fertilizers, contributing to a significantly more challenging market for crop nutrition companies. Fertilizer market analysts Argus and CRU are forecasting that the global market for fertilizer will see annual growth of from 1% to 1.5% over the next several years, assuming business as usual.

We consider this forecast optimistic, however, and we expect global demand for fertilizer to decline substantially in the future, for two reasons. The first is the range of regulatory efforts that governments are undertaking to tackle the impact of nitrogen fertilizer on climate change and biodiversity loss. Countries attending the 2022 Montreal Biodiversity COP 15 meeting agreed on a goal of reducing excess nutrients by 50%, and products containing nitrogen are at the center of the effort. This reflects the climate impact of greenhouse gas emissions released during the manufacturing process, most notably nitrogen dioxide emissions that result from the natural urease and nitrification processes that occur in the soil. In addition, the leaching of excess nutrients into bodies of water can cause algae blooms and adversely affect water quality.

Every year, farmers use about 260 megatons of crop nutrients on fields around the world. Of that amount, some 20% is excess, in light of today’s nutrient use efficiency levels (NUE). However, NUE levels vary considerably from market to market. In large Asian markets, for example, nitrogen NUE is below 50%: just half of the applied nitrogen provides nutrition for farmers’ crops.

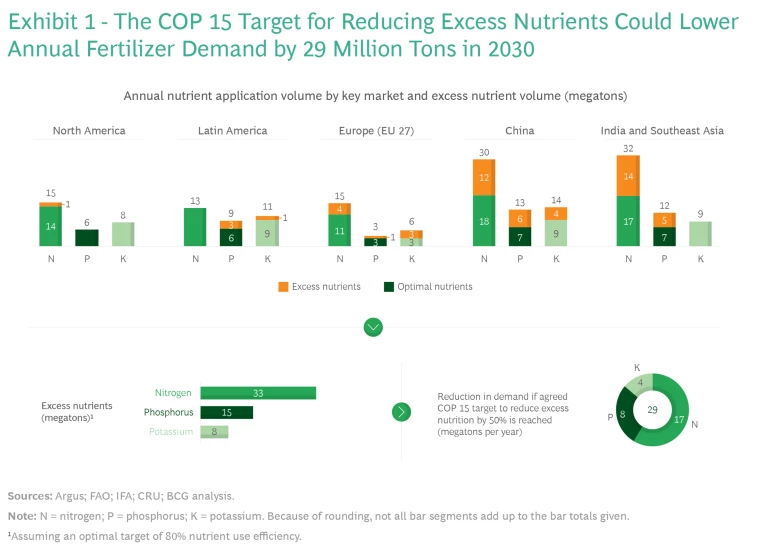

A healthy nutrient balance, in which soils are neither depleted from a lack of nutrients nor overwhelmed with excess nutrients, is represented by a NUE level of about 80%. Given this target level, the global excess nutrient volume in 2030 is expected to be about 58 megatons—33 megatons of nitrogen, 15 megatons of phosphorus, and 8 megatons of potassium. The COP 15 conference set the ambitious target of reducing the level of excess by almost half, cutting volume by around 29 megatons by 2030. That’s more than 10% of the current global market volume. (See Exhibit 1.)

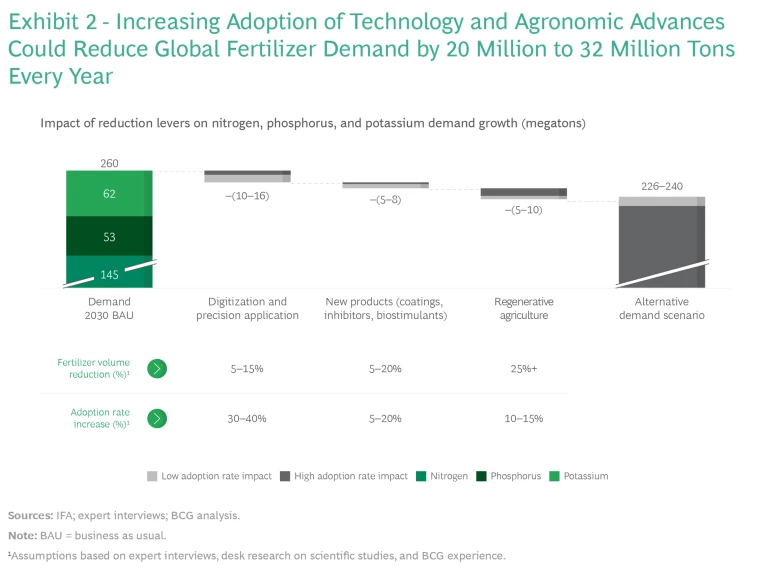

This target might sound unattainable, but that’s where the second factor comes in—new technologies and new farming practices. Adoption rates of digital and precision farming, leaching inhibitors, biostimulants, and regenerative agriculture practices such as cover cropping and legume integration are on the rise. Increased adoption of these techniques over the next ten years could reduce demand for synthetic fertilizers by 8% to 12%. (See Exhibit 2.)

These practices and technologies are already available in high-value niches and mature markets today. And they are likely to become standard in the agriculture industry worldwide, given their economic benefits for farmers, the increase in regulatory enforcement, and food producers’ push for more sustainable crops.

Future Supply Disruptions

Aside from the threat of declining demand, fertilizer companies must contend with looming disruptions to supplies of key feedstocks for their products. Global supplies of phosphorus and potassium are tied to mineral deposits and hence not threatened by technological disruption. Alternative sources of phosphorus from waste stream recovery will likely generate some local additions to supplies, but they will not significantly affect global market dynamics. As for potassium, two major mining companies have recently broken into the oligopolistic structure of the industry and are adding new capacity, This will likely make the market for potassium more competitive, but it won’t significantly disrupt the balance of supply and demand.

The future of nitrogen fertilizer is a different story. Supplies face significant technological disruption due to increasing competition for green ammonia, leading to a more fragmented and complex market environment. The vast majority of the ammonia produced today is gray and is used to produce fertilizer. But the global effort to decarbonize the energy sector, which will require massive investments in green hydrogen production, will amplify competition for low-carbon green and blue ammonia.

Regulatory tightening and decarbonization targets will increasingly push future production toward green and blue ammonia. Recent initiatives such as the EU’s Green Deal and Emission Trading System (ETS), the US’s Inflation Reduction Act (IRA), and Japan’s Hydrogen Strategy are likely to make green and blue ammonia cost competitive with gray ammonia in these markets, or even cheaper.

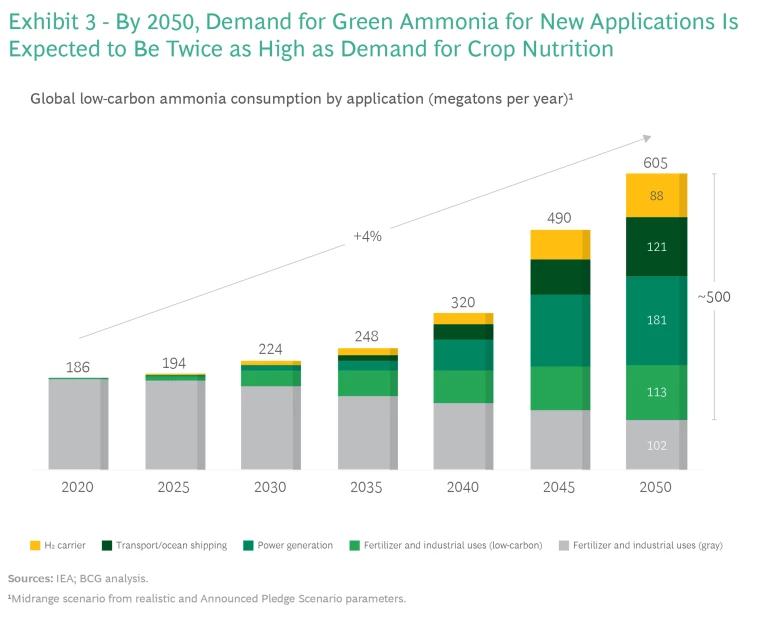

As blue ammonia and green ammonia become more economically viable, their energy density and conduciveness to safer and simpler storage and transportation than hydrogen will make them attractive low-carbon options for uses other than fertilizer. Possible uses include as a feedstock for electricity generation, especially for off-grid power plants or during peak load demand; as an energy carrier for green H2 transport over long distances; and as a marine vessel fuel for a decarbonized shipping industry. (See Exhibit 3.) Overall, the market for ammonia is expected to grow by 4% annually through 2050, and the volume of green ammonia produced is expected to exceed that of gray ammonia by 2040.

Changing Market Dynamics

As production of blue and green ammonia increases, the dynamics of the ammonia market will change.

Currently, fertilizer companies operate as integrated ammonia and fertilizer producers that convert ammonia to captive uses such as urea and nitrates. The volumes of ammonia traded in merchant markets are quite small and are limited primarily to industrial applications such as explosives. By 2050, however, the merchant market will be larger than the market for captive uses, and companies will trade ammonia more like a commodity. As a result, as the balance between demand and supply becomes increasingly unstable, price volatility will increase—in part owing to the need for large investments and long timelines to set up the supply-side infrastructure for green ammonia and to build necessary demand-side infrastructure such as power plants and ship vessel fleets with ammonia-fueled engines.

Whether fertilizer companies can benefit from these changes will depend on how the interrelated dynamics of the fertilizer, ammonia, and hydrogen markets play out in coming years. On the one hand, the magnitude of ammonia production by energy companies could put pressure on fertilizer prices, at least temporarily. In this case, the buildup of the supply of green hydrogen and green ammonia could outpace the growth in demand for maritime uses and energy infrastructure. But farmers would benefit from cheaper nitrogen fertilizers.

On the other hand, the new applications for ammonia could significantly benefit fertilizer companies that produce their own green and blue ammonia, if demand for green ammonia temporarily exceeds supply and if the price point is higher for these applications than for fertilizer products. But in this scenario farmers could face steep increases in the price of fertilizer.

Actively engaging in green ammonia production and in new applications for ammonia offers fertilizer players the opportunity to diversify away from the cyclical agriculture industry, fueling growth even as agricultural demand shrinks.

Market Dynamics and New Strategies

In light of these considerations, fertilizer companies must begin to adjust their business models and go-to-market strategies to remain competitive in their core markets while seeking growth in new businesses. They must decide both where to play and how to win.

Where to Play

The new dynamics of both fertilizer and ammonia will create opportunities for new products and services as well as new markets.

Products and Services. Given the likelihood that the market for core agricultural fertilizer products will be flat or in decline, companies will find that the volume strategies that most of them have long pursued are no longer tenable, especially in highly regulated markets such as the EU, North America, and parts of Asia. Instead, they must compensate for declining volumes and maintain their value share per hectare of farmland, while limiting market volatility and stabilizing revenues and profits.

To accomplish these things, they must emphasize decarbonizing the way their products are used and thus limiting their scope 3 emissions. This in turn will help reduce the scope 3 emissions of consumer goods and retail companies that depend on agricultural products, a critical element in the ongoing transformation of the global food system. Companies must invest in building complete solutions for a broader portfolio containing a greater share of nitrates versus urea in the core fertilizer offering, along with adjacent technologies and products such as leaching inhibitors to reduce nutrient losses from urease and nitrification, biostimulants to improve crops’ nutrient uptake efficiency, and slow- and controlled-release coatings for fertilizer products to increase NUE by lowering nutrient losses.

Fertilizer companies should also develop strategies for nonconventional ammonia applications. This means using their core capabilities in ammonia production and handling to open new outlets for ammonia over the next 15 years. Done right, such efforts can be a source of competitive advantage over new entrants in the ammonia market from the energy or other industries.

In these endeavors, fertilizer companies can benefit from partnerships, joint projects and co-investments with energy companies. This will be useful not only on the feedstock/energy supply side but also in opening routes to market for the new applications, since energy companies have already established business relationships with vessel fuel customers and utility companies.

Current and Future Markets. A company’s strategy for winning in a chosen market will depend on its ability to tailor its value creation models and value chain coverage to the needs of each market. In a world of increasing trade barriers, tariffs, and energy price disparities in such areas as the cost of renewable energy, fertilizer companies must also made decisions about their current and future target markets, their production footprint, and the likely effects of their strategic direction on their product portfolios.

In the EU and North American markets, for example, farmers typically pursue more sophisticated fertilization approaches than do their peers in Asia and Latin America. To cater to these markets, fertilizer companies will need to produce nitrates such as ammonium nitrate and calcium ammonium nitrate, rather than standard urea. Various government regulations impose specific product requirements, too, such as the obligation to use neem-coated urea in India and to add urease inhibitors to urea in Germany.

In Africa, companies should plan to expand downstream given the current shortage of blending and distribution capacities. In more mature geographies, partnerships and strategic collaboration with strong distribution players and cooperatives will be crucial.

Finally, given the degree of fragmentation in the fertilizer industry, active players will likely find opportunities to expand geographically and to add to their product portfolios through M&A.

How to Win

Fertilizer companies looking to thrive in a decarbonizing world must rethink how they operate and how best to lower their own carbon footprint.

New Business Models. Fertilizer companies must rethink their business models to offer new solutions and services, including agronomic advisory services and digital tools to limit excess nitrogen and increase nutrient use efficiency, while also supporting the shift to regenerative agriculture and carbon farming.

Green Fertilizer Plays. Starting from their current ammonia production asset footprint, fertilizer companies need to invest in decarbonizing their production volumes. In the medium term, carbon capture, utilization, and storage for blue ammonia will be crucial to generating immediate impact and to meeting market requirements such as those contained in the EU’s ETS framework. In the long term, building capacity for producing green H2 will be essential. So companies should either invest in their own renewable energy production or strike supply partnerships for access to cheap renewable energy.

For some fertilizer companies, many new technologies for crop nutrition and new applications for low-carbon ammonia may seem too remote to worry about today. But building the necessary capabilities and pursuing new M&A opportunities will take time and thoughtful planning. Companies must review and redefine their strategies now if they are to set a course for future growth.