The metaverse may be virtual, but its implications for health care are very real. Augmented reality, virtual reality, mixed reality, blockchain and virtual assets, and metaverse worlds—the underlying technologies of the metaverse—have established a firm footing across the sector, and use cases are proliferating quickly.

More than 70% of global health care executives surveyed recently by BCG said that their organizations are using metaverse technology in some capacity. There are metaverse use cases in all the major industry segments: providers, payers, medtech, and biopharma. Metaverse health care startups have received $2.3 billion in funding since 2017, funding has tripled since 2020, and investment is growing at an annual rate of 30%. As current use cases expand and new ones emerge, we expect health care to remain one of the five most active metaverse sectors, representing 10% to 15% of the total metaverse market.

Most health care companies and institutions are at least experimenting with one or more use cases, but less than 20% have established a strategy to guide their activities or have incorporated the metaverse into their broader business strategy. Leaders—and leading value creators—will start to strategically organize their metaverse activities now

The Health Care Metaverse Today

We recently described how the metaverse is benefiting patients and providers by increasing access, delivering better outcomes, and reducing costs. Patient benefits include better access, more affordable care options, better care quality, and improved convenience. We are also seeing benefits for companies across the sector as startups bring new offerings to market and more firms experiment with new use cases. Financial boosts include top-line growth, diversified sources of income, and lower administrative costs. The metaverse also enables more timely intervention and improved engagement with patients and health plan members. Strategically, engagement with the metaverse enables companies to move up the technology knowledge curve (for example, by learning how to utilize blockchain), form new technology partnerships, embed the value of innovation in their culture, and demonstrate their own ability to deliver better products and services through innovation.

Our research suggests that the metaverse in health care is developing in three phases, and we are currently at the end of phase one, the period of initial experimentation. In our previous article, we detailed many of the use cases in development by providers and by the startups developing new treatment technologies. There are other use cases in development across the sector as well, including the following:

- Medtronic (among many others) is using augmented realty (AR) to reduce training costs compared with traditional methods.

- Cedars-Sinai Medical Center has established a multidisciplinary virtual-medicine program to explore the use of mixed-reality (MR) technologies in education and training, as well as in the treatment of chronic pain (lower-back pain and the pain resulting from gastrointestinal cancer, for example).

- Novartis uses virtual-reality (VR) technology to provide 3D visualization of therapeutic targets and molecular structures in the design of new drugs.

- MediLedger (a blockchain consortium) has brought together 24 health care companies, creating connections and partnerships for future use cases in smart contracts, inventory management, and counterfeit-product elimination.

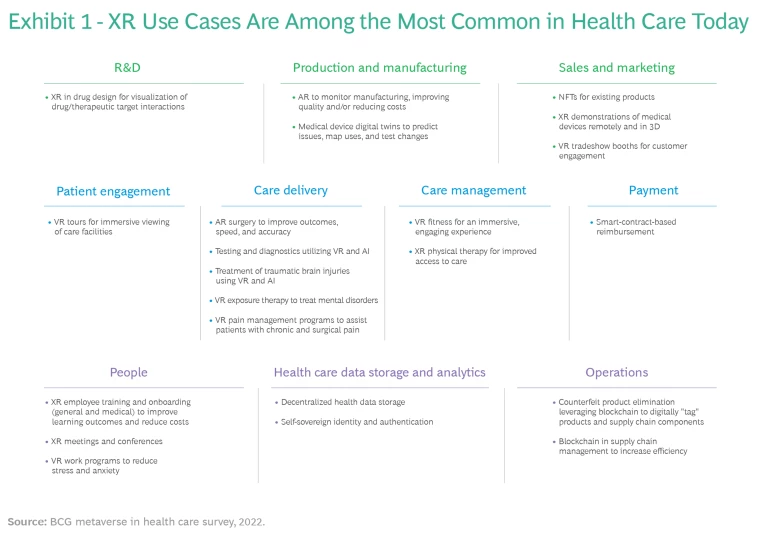

In our most recent survey of metaverse activity in health care, 71% of respondents reported having used metaverse technology in some capacity. But the activity is not yet strategic or particularly organized: only a quarter of companies are starting or scaling up initial pilot programs. Companies in Australia and North America are the most active (29% and 28%, respectively), followed by companies in Asia (20%) and Europe (17%). Thus far, the biggest benefits of the technology are improved training, quality of care, and customer engagement. Use cases involving VR, AR, or MR (collectively referred to as extended reality, or XR) dominate, especially in meetings, training, care delivery and management, and production and manufacturing. (See Exhibit 1.)

Developments to Come

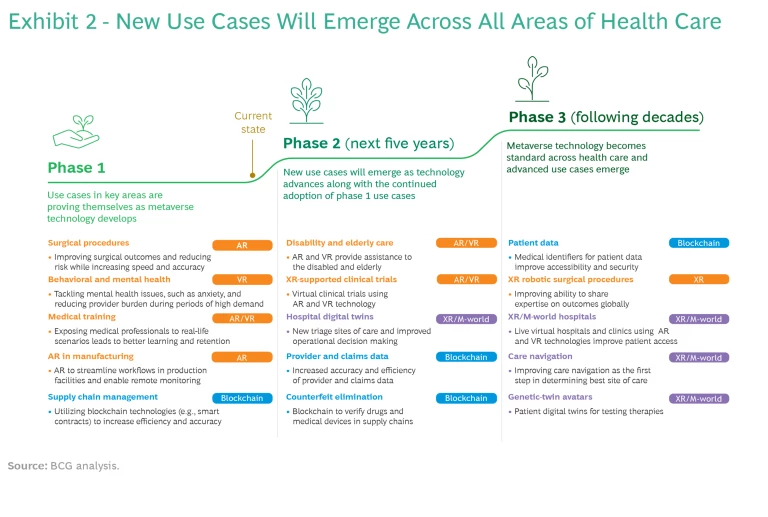

In phase two (the next five years or so), the health care metaverse will be defined by the broader adoption of current use cases and the emergence of new use cases as technologies advance. Phase three (the following decade) will see the development of more advanced use cases and the establishment of metaverse technologies across many areas of health care. (See Exhibit 2.)

XR technologies will continue to play the largest role, especially in the provision of care (such as disability and elder care) and support for clinical trials. But other technologies, such as m-worlds (virtual gathering places for millions of active users), blockchain, and virtual assets powered by innovative Web3 technologies, will also see wider use.

For example, blockchain can improve the availability and transparency of medical records and streamline administration. Patients, providers, and payers can access a single source of data (owned by the patient) from multiple medical systems and obtain a comprehensive view of the patient’s care. Blockchain can improve the efficiency and visibility of insurance claims processing, and blockchain-based payment systems can speed payments and estimates. In R&D, we expect corporate research functions and educational institutions to use blockchain technology to share information securely. NFTs and blockchain can give medical staff direct control over their credentialing data.

In time, we expect m-world hospitals and clinics to provide virtual triage or even complete care services. Hospital digital twins will improve operational decision making using scenario and root cause analyses. Genetic-twin patient avatars will be able to predict pharmaceutical responses.

The speed of such developments depends, of course, on the broader adoption of the underlying technologies. There are strong indications that this is underway in three key areas: technology (particularly better and cheaper XR headsets, which should be available soon), content, and enterprise use. As more companies in both B2B and B2C industries interact with users in metaverse environments, new content and solutions from both incumbents and startups are powering a maturing ecosystem and accelerating broader adoption.

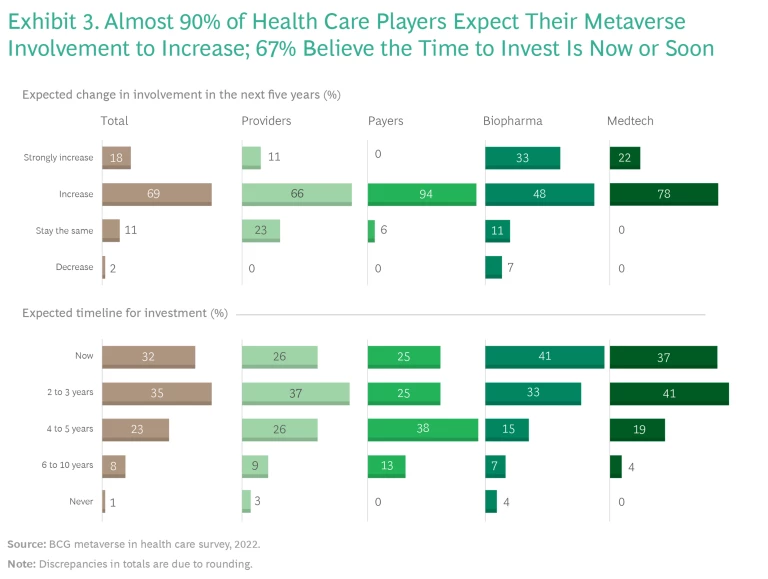

Perhaps most important, the number of enterprise strategies incorporating the new technologies is expected to grow in the coming years. Our survey found that 91% of health care executives believe the importance of the metaverse will increase, and 87% expect their involvement with the metaverse to rise. (See Exhibit 3.) Two-thirds believe it’s time to invest now or will be in the near future.

Asymmetrical Development

Metaverse development so far has been uneven across the four segments of health care, a pattern that seems likely to continue despite the similar expectations of executives in each sector. Medtech companies have been by far the most active (94% are using metaverse technologies), followed by providers (74%), biopharma companies (67%), and payers (37%). Medtech also leads in starting and scaling pilots (47% of companies). Biopharma (36%), providers (17%), and payers (6%) have been less aggressive.

While all companies in all segments see the same three top-three benefits (improved training, better quality of care, and improved patient or customer engagement), other expectations vary and give some indication of where companies will be placing their metaverse bets:

- Medtech: Physician engagement, surgeries, and diagnostics

- Providers: Surgeries, physician engagement, and therapies

- Biopharma: Drug design and discovery and clinical trials

- Payers: Physician engagement, therapies, and patient health records

Executives appear measured in their expectations, perceiving hurdles to metaverse development specific to each segment. In medtech, unclear regulation, high costs, and data ownership and privacy issues are top of mind for executives. Providers believe the high cost of technology and investment, patient access to technology, and cybersecurity are the biggest potential impediments. The main concerns for biopharma companies are high costs, patient access to technology, and cybersecurity. Finally, payers are concerned about unclear regulation, cybersecurity, and the ownership and privacy of patient data.

Getting Started

Given the metaverse’s demonstrated and potential impact, we believe most companies will at least want to follow developments closely, and many will actively pilot use cases with an eye toward building capabilities in areas aligned with their overall business strategy (and, in the case of providers, their patient care strategy). There are four steps for getting started and developing a metaverse strategy in health care.

Clarify your perspective. The first step is understanding the growth drivers, hurdles, and scope of use cases in your segment or niche. We recommend clarifying this perspective early, as there is higher value potential in early participation if a targeted growth scenario materializes. Early participation will also enable you to stay ahead of the curve, adding competitive capabilities when the time comes and establishing partnerships, building networks, and accumulating data and talent ahead of competitors.

Define your strategic posture. On the basis of your informed perspective, decide on the optimum level of involvement. As of now, only a few companies have formed a metaverse strategy, and almost none have clearly articulated their ambitions to potential partners or investors. (See Exhibit 4.) Payers and providers lag biopharma and medtech in this regard. Since talent, partnerships, and ecosystems will be critical to success, companies need to be clear on what they intend to achieve and communicate this ambition to potential stakeholders.

Determine where to play. Once your strategic posture is set, prioritize use cases according to desirability, viability, feasibility, and alignment with the corporate strategy. Key questions for evaluating a potential use case include:

- Do customers want it?

- Will it differentiate us from the competition?

- Will it generate financial value?

- What is the projected time to impact and ease of entry?

- Does it align with our strategy and priorities?

Invest for success. Moving ahead will require investing in the needed talent, technology, and partnerships, which most health care organizations do not now have. Companies must evaluate their strengths and weaknesses in key areas, make the proper investments, and build the relationships needed to ensure successful implementation. Securing talent will likely require establishing new roles and recruiting people with unfamiliar skills, such as software engineers with AR and VR skills, product managers, spatial-experience designers, blockchain developers, and metaverse marketing specialists.

The metaverse tech stack is complex and dynamic. It will require investing in new technologies, such as cloud capabilities (which may raise regulatory issues) and working with external technology providers. For companies new to the metaverse, investment in infrastructure, user hardware, and content is a priority. While companies should focus on building their own metaverse capabilities, partnerships can help drive innovation and unlock value, as many providers have demonstrated in their work with metaverse technology startups.

The metaverse is currently looked upon with some skepticism owing to early hype, last year’s turmoil in crypto currencies, and a general technology market reset. But in health care, the use cases continue to start up and prove out. It’s not too soon for companies across the sector to set their ambitions and strategies and move swiftly toward implementation.