Pricing is a complicated and often frustrating challenge for business leaders because they have so many theories, concepts, frameworks, and equations to choose from. Some leaders deal with this challenge by relying on familiar approaches, such as what their company has always done. Others delegate pricing tasks to internal teams with a superior understanding of the intricate mathematics. When they want to change or optimize these processes, they either revisit the vast smorgasbord of pricing ideas or they upgrade their analytical capabilities.

In their attempts to simplify, business leaders miss opportunities to use pricing to grow their business, improve their company’s relationships with customers, and reshape their business and their industry. The more we investigated the roots of this problem over the past two decades—through our client work and through independent research at the BCG Henderson Institute—the more we realized that business leaders needed one unified theory of pricing to inspire and guide their decision making.

We have developed that unified theory, manifested in a tool we call the Strategic Pricing Hexagon, by bringing all the disparate pricing ideas, and the drivers and forces behind them, into one master structure. This article shows how the Strategic Pricing Hexagon allows leaders to look beyond the numbers and develop a pricing strategy that can change the entire trajectory of their business and their market.

Redefining What Pricing Strategy Means

The academic and business literature is vague about what constitutes a pricing strategy. Business leaders therefore tend to describe their pricing strategies in terms of pricing models (for example, discounts and subscriptions) or pricing methods (such as value-based and cost-plus). We redefine pricing strategy as a business leader’s conscious decisions on how to shape their market by determining the amount of money available, how that money flows, and to whom. This definition of pricing strategy recognizes the fact that the size of any market—-and especially how that pie gets divvied up—is the direct result of the countless pricing decisions that companies and customers make every day. This new definition expands the pricing conversation beyond the quest for better price points and enables pricing to inform and determine corporate strategy.

Linking Pricing Inputs to Pricing Approaches

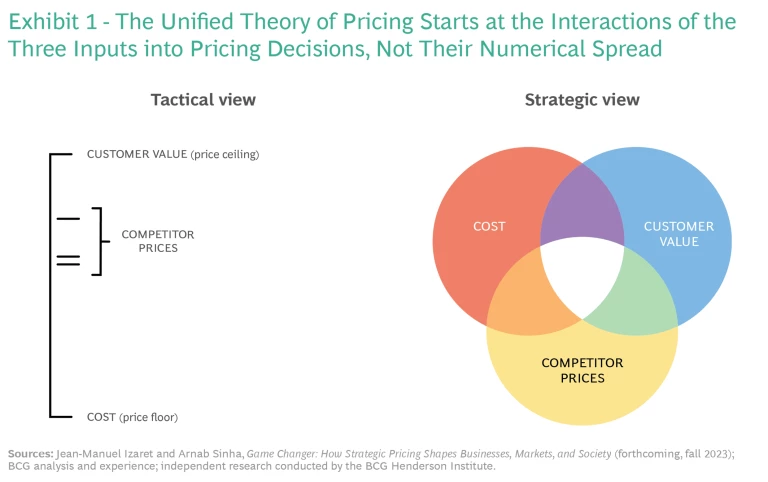

Developing the unified theory of pricing starts with cost, competition, and customer value, which are the three fundamental information sources for the development of any business strategy. The traditional pricing perspective, however, treats these information sources as inputs into price calculations, as shown in the left side of Exhibit 1. From this tactical perspective, customer value sets a price ceiling or a maximum price, while costs define the floor or the minimum price. To calibrate the range in between, leaders take competitor prices into account before deciding on the price they will charge for a product or service.

But costs, competitor prices, and customer value can generate important and more powerful strategic insights when leaders look at their interactions rather than how they behave in isolation. The intersections shown on the right side of Exhibit 1 reveal natural overlaps that correspond to four practical frameworks.

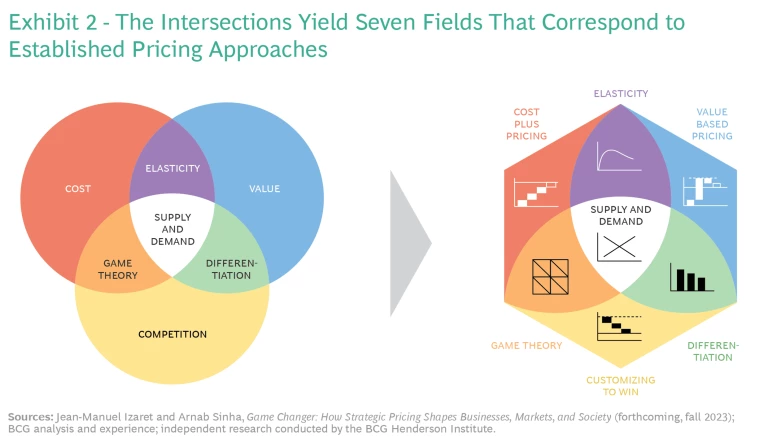

Exhibit 2 shows how these four frameworks, when combined with the three underlying inputs, create seven separate fields, each of which corresponds to an established pricing approach.

- Price Elasticity. The elasticity framework lies at the intersection of cost and customer value because cost and willingness to pay (based on value) are the two inputs necessary to calculate an optimal price based on how demand responds to price changes.

- Price Differentiation. This framework lies at the intersection of competition and value, where a company differentiates prices relative to competitors and relative to its own products. This framework combines insights from the theories of price discrimination and behavioral economics.

- Game Theory. The game theory framework lies at the intersection of costs and competition. When a company’s prices depend on the pricing behavior of a few individual competitors whose offerings all have very similar value, a company only needs costs and competitor price information to define optimal prices that maintain a market equilibrium.

- Supply and Demand. This framework lies at the intersection of all three sources of information. A market’s supply curve is based on the costs, capacities, and prices of every competitor, while the demand curve is a function of either the aggregated willingness to pay of individual customers or the value that those customers derive.

Even with these seven pricing approaches, leaders still require specific and systematic guidance on which approach will help them make faster, more confident, and more effective pricing decisions. The primary inputs for that guidance are the characteristics of their market.

The Essential Role of Market Characteristics

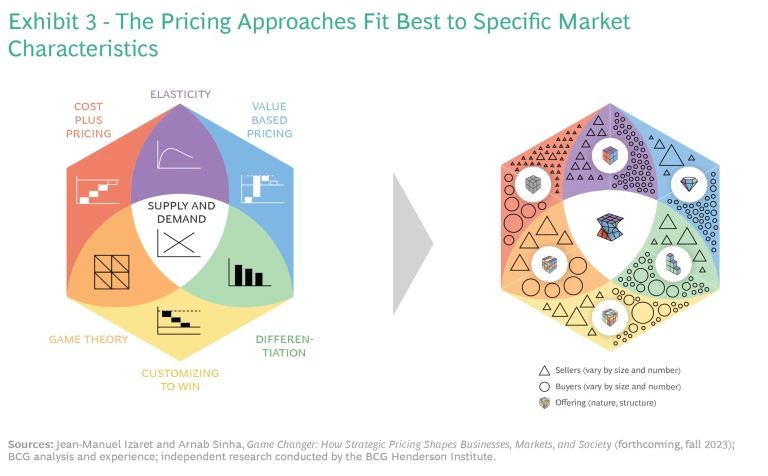

Each of the seven approaches is well suited to certain combinations of market characteristics, but ill-suited to others. These characteristics include the concentration of buyers and sellers, the diversity of customer needs, and the variety and differentiation of offers.

- Buyers. Customers can vary by their sheer numbers, but they can also differ by their individual needs and the volumes they buy. The latter two factors can show very large variance within a market.

- Sellers. Seller concentration can vary from low to high. A fragmented market tends to have several competitors with small market shares. In a concentrated market, the power dynamics will depend on whether one or two companies have high market shares or whether the shares are more evenly distributed among a few sellers.

- Offers. Offers usually vary according to their complexity and their degree of differentiation. These two aspects do not necessarily correlate. Advanced or complex machinery, for example, can still show a high degree of standardization across suppliers that need to find subtle forms of differentiation or compete on cost and efficiency.

The right side of Exhibit 3 links common combinations of these three market characteristics with the seven pricing approaches and, by extension, with the three inputs (cost, competition, and customer value) that underpin them. Observing the market characteristics enables leaders to determine which of the seven pricing approaches is best suited to their business and rule out those which are ill-suited.

The Strategic Pricing Hexagon

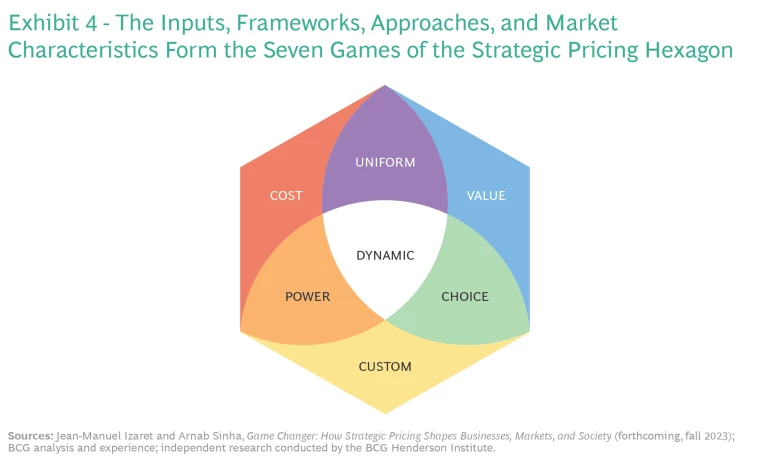

The shift of pricing from the tactical plane to the strategic plane becomes complete when we turn the information and insights shown in Exhibit 3 into an organizing principle for a company. The tool or touchstone that provides that guidance is the Strategic Pricing Hexagon, which we also call the Strategy Hex. As shown in Exhibit 4, it provides seven distinct pricing games that, in aggregate, cover nearly every challenge and opportunity a business leader will encounter.

By synthesizing all this information, the Strategy Hex becomes a decision support tool that enables any business leader to formulate a clear pricing strategy and shape their business and markets with authority. It is a guide to help leaders identify the imbalances in their markets, assess the resulting opportunities and risks, and then frame their options depending on how they want to direct the flows of money in the market.

- Value Game. Players in the Value Game—such as high-tech, luxury goods, and pharmaceutical companies—succeed when they align the prices of their unique solutions with customer value and then obsessively direct their marketing efforts to defend that value and shape demand. A value-based pricing approach is most helpful when an offering’s economic and emotional value far exceeds what competitors offer and when the buyers are so numerous and fragmented that no individual customer or group holds significant purchasing power.

- Uniform Game. Players of the Uniform Game—such as consumer goods companies and retailers—win when they optimize the same prices for all customers by carefully weighing the tradeoffs between volume and margin. The elasticity framework is the best approach for making efficient and confident pricing decisions when markets have a very large number of buyers with relatively homogenous needs, served by numerous and comparable sellers.

- Cost Game. Players of the Cost Game—such as some industrial suppliers, distributors, and government contractors—succeed when they use greater efficiency to create the degrees of freedom in commoditized markets with a fragmented base of sellers. Players use a cost-plus approach to set prices when these characteristics apply.

- Power Game. Players of the Power Game—such as many high-tech suppliers—rely on slim advantages to negotiate high-stakes deals that preserve the market’s balance of power. Game theory is the main framework for pricing decisions when a market is concentrated on both the buyer and seller sides and offers show limited differentiation, often because buyers impose technical standards that only a few sophisticated sellers can fulfill.

- Custom Game. Players of the Custom Game—which include a wide range of B2B suppliers—win by customizing discounted deals with individual customers amidst heavy competition. The negotiated terms, conditions, and supplemental offerings make each deal unique, even when the underlying products from each supplier seem similar. Pricing to competition is the recommended approach when market characteristics prevent a convergence toward large customer segments, common price structures, and similar product configurations.

- Choice Game. Players of the Choice Game—an eclectic group which includes software suppliers and some restaurant chains—rely on behavioral economics to help their customers self-select from a well-structured lineup of offerings. How prices compare to each other matters far more than the individual prices themselves. Price differentiation is especially important when offers have limited or no marginal costs.

- Dynamic Game. Players of the Dynamic Game—including airlines, sports teams, e-commerce retailers, and logistics firms—have begun to apply artificial intelligence together with human judgment to share value with customers in real time in response to supply and demand signals. This need can arise when a company has adjustable capacity, perishable inventory of relatively undifferentiated products, or constantly fluctuating demand from a broad base of customers.

Most markets fit very well to one of the games, but some may fit to more than one game. This is not a flaw, but rather an opportunity for leaders to decide which game to play, depending on their competitive advantages.

The Strategy Hex also prevents leaders from acting on incomplete information, falling prey to pricing misconceptions, or applying frameworks or techniques that are ineffective or inefficient for a particular game. Elasticity, for example, is a core framework for the Uniform Game, but it is significantly less important for business leaders playing the Power, Custom, or Choice Games.

Managing and Changing the Game

The person or people who can direct the flows of money within a firm and a market wield enviable power. This makes the pricing governance model an essential part of each pricing game.

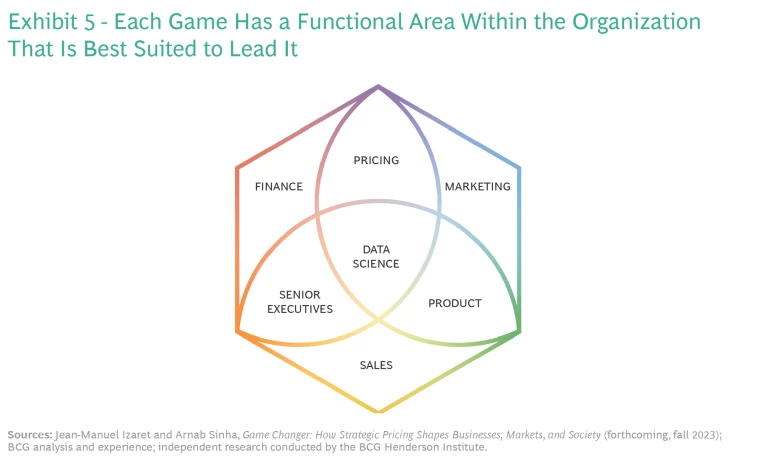

The pricing governance model determines how a company manages and distributes business intelligence and pricing authority within the organization. The lead function in any pricing game is the one that manages the most critical tradeoffs. Exhibit 5 shows the corporate function best suited for this role in each game. The other functions provide necessary checks and balances on that leadership role because pricing is cross-functional.

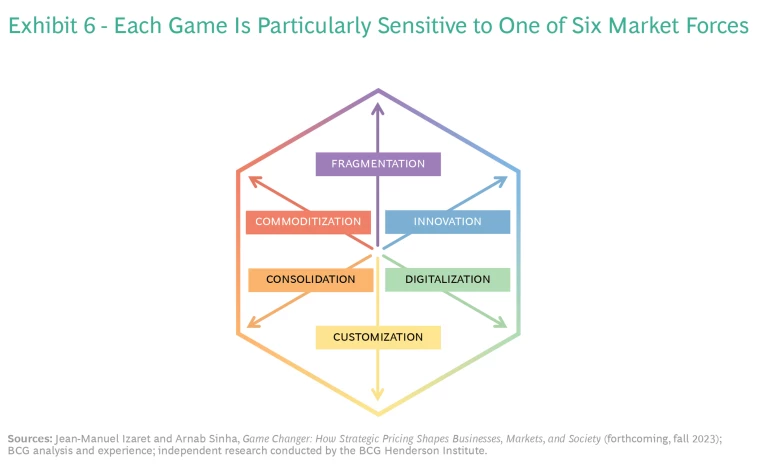

Each game is also subject to six well-defined forces—innovation, commoditization, customization, digitalization, fragmentation, and concentration—that can cause a market or company to shift toward a different part of the Strategy Hex, as shown in Exhibit 6.

Business leaders can harness these forces to help their companies reshape their business and their market. Digitalization, for example, tends to reduce marginal costs and allow a broader set of offers, thus pushing companies toward the Choice Game. Developing an innovative solution can enable a company to move from the Cost Game to the Value Game or Choice Game, depending on their existing market characteristics. Rapid consolidation in a market on the buyer or seller side can confront a company with a fundamental strategic decision: reorganize to play the Power Game or make another move that will allow them to enter another game.

No matter how markets around the world evolve, pricing will always remain the common business challenge that every executive and manager must address. The unified theory of pricing, as manifested in the Strategic Pricing Hexagon, enables business leaders to simplify pricing conversations, accelerate and improve decision making, and increase their confidence that they have chosen the best long-term strategic path for their company.