In the early 2000s, when a global shift to digital music seemed extremely unlikely, Apple invested heavily to develop the iPod, a portable digital music player, as well as iTunes, a digital music library. Later, in 2007, well before the mobile internet’s use had caught on, the company unveiled the iPhone, which combined a mobile phone, a digital music player, and internet communication capabilities. Realizing the criticality of applications for the device, Apple also launched an app-development platform. And in 2011, Apple introduced Siri, one of the first AI-enabled voice assistants at a time when generative AI was in its infancy.

Spotting consumer problems bubbling deep below the surface, developing innovations to tackle them, and seizing business opportunities even as they slowly emerge are critical to stay ahead of the pack––as market leaders such as Apple exemplify. That’s something commercial insurance companies, which are aggressively pursuing sales today, would do well to keep in mind.

Going against the grain may be critical for growth plans to become reality.

As insurers all over the world boldly declare their intentions of boosting revenues and profits at double-digit rates in the near term, going against the grain may be critical for such growth plans to become reality. But many insurers are busy tackling only the immediate challenges they face, such as rising prices and geopolitical tensions. They’ve responded to inflation by increasing premiums––Australia’s QBE Insurance hiked its premium rates by 8% in 2022, for instance––and boosting reserves, as Allianz Group did by adding $1.92 billion to its coffers last year. Insurers have also reduced their exposure to geopolitical risks by withdrawing from the world’s conflict zones. Among the first to pull out of Russia after its February 2022 invasion of Ukraine, for instance, were Zurich Insurance, Allianz, and Swiss Re.

Although necessary, such measures aren’t sufficient to turbocharge insurers’ growth. Besides, every insurer is taking similar steps to tackle their current challenges, making it unlikely that any of them will gain an advantage over the pack. To grow profitably in a volatile, uncertain, complex, and ambiguous world, insurers must push the envelope. Companies would do well to spot opportunities that lie hidden behind other trends––identifying prospects that are developing so slowly that they’ve been ignored in the past and preparing to seize those that may seem unlikely to ever come to fruition.

Companies would do well to spot opportunities that lie hidden behind other trends.

Insurers need to look closely at several developments that have been coming to a slow boil along the value chain but haven’t yet garnered much attention. Some of them are business challenges that insurers must tackle innovatively to survive; others are opportunities that they must grab quickly to thrive. These developments deserve a closer look, especially since the strategies to address them could dramatically shift the first movers’ growth trajectories in just the next three years.

The Pressing Imperatives

Before insurers can pursue profitable growth, they have to break new ground and grapple with three major obstacles.

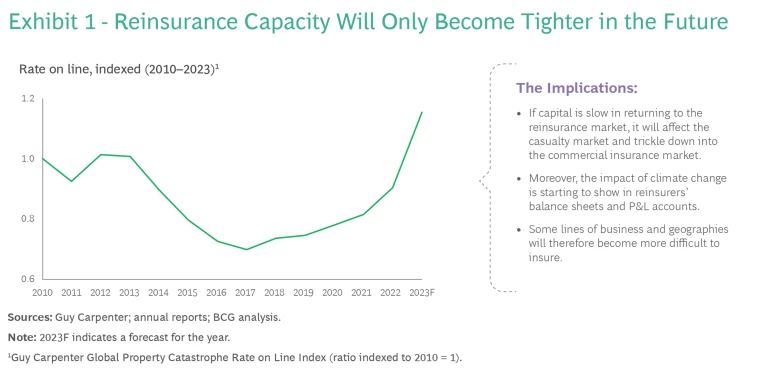

Resolve the capital conundrum. Insurers must first tackle their capital-related issues, particularly two fuzzy challenges. One, it isn’t clear to what extent fresh capital will become available in the reinsurance market in the next 12 to 24 months, which will determine the maximum amount of reinsurance that the market can provide. (See Exhibit 1.) That’s partly because the impacts of climate change are beginning to affect reinsurers’ balance sheets, and those impacts seem likely to grow over time.

Commercial insurers should prepare for a world where the economic logic of passing on their risks to reinsurers no longer works as it once did, or at least will need a different rationale in the future. This will affect the pricing for property and casualty insurance as well, and, if the capacity to reinsure remains tight, many lines of business and geographies will likely become difficult to insure.

Commercial insurers should prepare for a world where the economic logic of passing on their risks to reinsurers no longer works as it once did.

Two, commercial insurers’ financial performance has improved over the past four years, leaving their balance sheets healthier than ever. How will swelling balance sheets affect the industry’s competitive dynamics?

On the one hand, no insurer will want to jeopardize its performance by becoming careless in underwriting and cost management. On the other hand, insurers’ healthy bottom lines could trigger a fresh wave of mergers and acquisitions. As the risks of buying bad books appears to be low, big players may flex their newfound financial strength to start buying up rivals. Taking competitors out of the market would increase rates and boost revenues. But they could also lower premiums and trigger price wars, in which case insurance rates in some market segments would likely tumble for a while.

The upshot is that commercial insurers need more underwriting discipline to improve the quality of their portfolios. That has made more popular the top-down, ex-ante steering of capital allocation, supported by AI and machine learning. Digital technologies allow for more precision and targeting, and the cells to which capital is allocated are increasingly becoming more granular. Granularity is basically subdivision of markets, but it now goes well beyond standard demarcations such as business lines, geographies, and currencies.

Digital technologies allow for more precision and targeting, and the cells to which capital is allocated are increasingly becoming more granular.

Still, it isn’t clear how far––or how fast––insurers should take the idea of granular steering. The availability of data and operational challenges are formidable barriers to creating and capturing value. Even so, commercial insurers should prioritize the refinement of their steering capabilities, which will enable them to make surgically-precise portfolio shifts as conditions change.

Finding and connecting data streams, internal or external, is effective both in underwriting and steering capital. The insurers that made large-scale investments in data analytics over a decade ago––and forged partnerships with digital giants––have reported sustained above-average performance. Their digital capabilities allowed for stress-testing and “what if” scenarios, which led to more advantageous renewal discussions with clients.

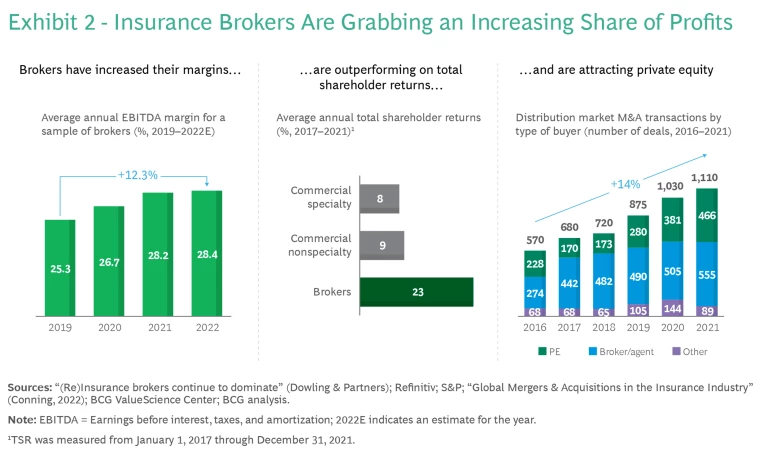

Tackle the distribution dilemma. Insurance intermediaries with extensive networks and strong distribution capabilities, especially retail brokerages and managing general agents, have captured an increasingly large share of the industry’s profits in recent times. Depending on the model, insurance brokers currently earn anything between 5% and 45% of premium revenues––up from 5% to 30% just a few years ago. Their profit margins have soared over the last four years, rising by more than 12%, on average, between 2019 and 2022, and they delivered total shareholder returns of 23% between 2017 and 2021, on average, compared with, say, the specialty insurers’ 8%. (See Exhibit 2.)

Many commercial insurers are still struggling to figure out if, and how, they should reshape the distribution dimensions of their growth agendas. To thrive, even survive, commercial insurers have no choice but to double down on distribution in a deliberate way. They have to find ways to create more value pools by working alongside distributors and, above all, to engage productively with managing general agents (MGAs).

To thrive, even survive, commercial insurers have no choice but to double down on distribution in a deliberate way.

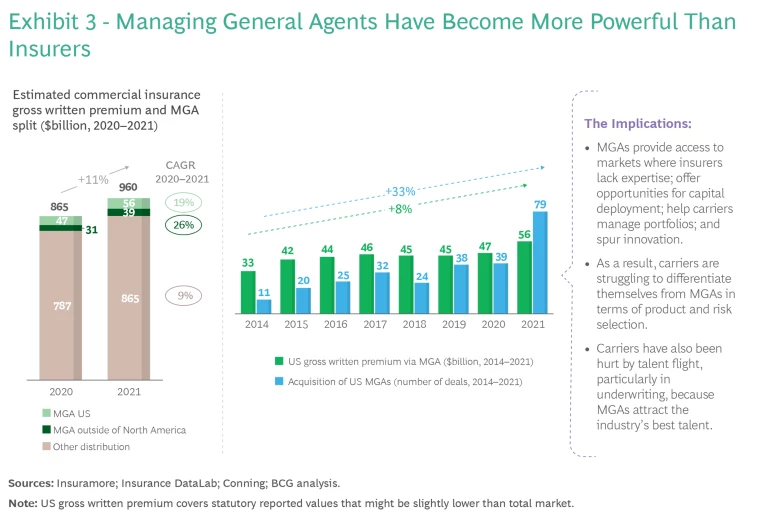

An MGA strategy can take many forms, but the starting point has to be insurers’ willingness to collaborate rather than being squeamish about delegating underwriting authority to MGAs. Don’t forget that private equity’s interest and investments in insurance distribution remains undiminished, with no end in sight to high valuations. (See Exhibit 3.)

As insurance distributors become better funded and waves of consolidation ripple through the MGA business, the latter will be emboldened to expand their role in the value chain. Moreover, MGAs know they don’t face competition––yet––from full-service insurers because investments in specialized distribution skills and systems are costly and capital intensive. Several MGAs have become more innovative, so commercial insurers are struggling to differentiate themselves in terms of products and risk selection. That’s making MGAs more attractive to clients, investors and, above all, talent: it has led to a talent flight from insurers, particularly in underwriting.

Good underwriters are increasingly exploring opportunities with MGAs as a way of increasing their share of the profits, which allows the agents to expand their capabilities and services. MGAs therefore will soon command a larger share of the returns on underwriting, which will shrink those for full-stack insurers.

To remain relevant, insurers will do well to continue to partner with MGAs, particularly when they develop innovations across the value chain. They can also develop or acquire MGAs, which will allow insurers to access new segments, including those in which they lack expertise. Acquisitions may also provide novel opportunities for capital deployment and, ultimately, allow insurers to generate better shareholder returns by reintegrating all the links in their value chains.

To remain relevant, insurers will do well to continue to partner with MGAs, particularly when they develop innovations across the value chain.

Bolster data and AI capabilities. Many insurers have recently increased their investments in data and analytics; 83% boosted their IT investments in 2021, according to a recent BCG survey. Even so, many commercial insurers appear hesitant to maintain or increase their investments in digital technologies. Those that aren’t prepared to continue to invest in data, digital technologies, and AI are bound to fall behind.

Smart insurers will continue to develop the business case for the use of data and analytics to transform organizations, especially given the rapid ascendancy of GenAI. They will focus on developing data-driven solutions in their core business activities––such as underwriting, portfolio steering, and claims processing––and use their data as well as those of brokers to drive their businesses. Importantly, they should use all the data they’ve accumulated for their own benefit before letting others do so.

Some insurers, especially the larger ones, will try to go it alone but, in an ecosystem era, partnering will likely be a rewarding strategy.

The best way forward for insurers may be to enter into data-sharing relationships with insurance brokers and MGAs. Some insurers, especially the larger ones, will try to go it alone but, in an ecosystem era, partnering will likely be a rewarding strategy. Insurers skilled at teaming up with firms that provide customer and company data; analytics firms that assess and predict risk in real time; and workflow-solutions providers that consolidate data and analytics systems will likely gain an edge in an AI-driven future.

The Emergent Opportunities

Once they’ve overcome the immediate challenges, insurers will be able to capitalize on opportunities that are the keys to unlocking rapid growth. They can break new ground by focusing on three nascent areas in particular.

Sustainability. Despite the attention the business world has started paying to sustainability, insurers have taken relatively little action. They aren’t sure what it will mean for themselves or other companies. Only a few have realized that sustainability has become a critical priority that insurers’ strategies and operating models must reflect.

Sustainability presents both risks and opportunities. Because of the sharp increase in destructive weather events, insurers are having to factor climate trends into underwriting decisions and position themselves to manage the adverse effects that the weather is having on the global economy. Their long-term viability and financial success will increasingly be tied to climate change.

Insurers are hobbled by the lack of pricing data for climate risks, which they don‘t fully understand. They have a long way to go before they can come to grips with climate change’s impact on their business models.

At the same time, insurers are hobbled by the lack of pricing data for climate risks, which they don‘t fully understand. They have a long way to go before they can come to grips with climate change’s impact on their business models. Consequently, insurers‘ current responses range all over the spectrum, from AXA’s all-in strategy to AIG’s wait-and-watch approach.

With mandatory ESG risk-assessments and disclosures on the horizon, now is an opportune time for insurers to become advisors. They can become catalysts of sustainability by supporting clients during energy transitions. For instance, insurers can help companies manage the tradeoffs between profits and carbon emissions. They also have an opportunity to expand, alongside their clients, into new industries such as green hydrogen and wind energy.

To do so, insurers will have to find new ways of getting more quantitative and qualitative data from larger clients. Moreover, the green rush will result in a battle for scarce talent. As commercial insurance and reinsurance companies, as well as the world of brokerage, have already found, the pool of sustainability experts in both energy insurance and underwriting is small, making it tough for every firm to develop the capabilities it needs.

Midsize Market. For some time now, the midsize companies segment (corporations in the developed world with between 50 and 999 employees) has been attracting the attention of big-ticket insurers. Dynamic insurers on both sides of the Atlantic are starting to explore this market, but most are still unsure about how to address it.

Quite a few midsize companies have set up captive subsidiaries to meet their risk-management needs––a strategy whose use will only grow tomorrow.

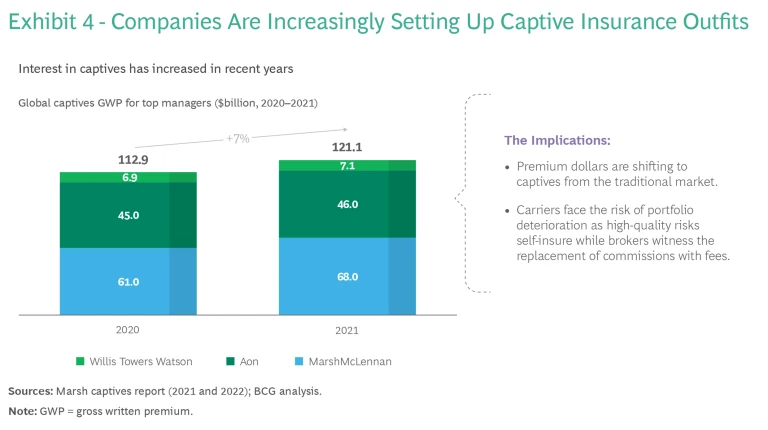

With two-thirds of the insurers in this segment holding market shares of less than 4% each, the midsize market is ripe for coverage consolidation. Early birds such as Chubb, AIG, and Travelers Insurance have tasted success. It isn’t just the commercial insurers, though; several MGAs have also woken up to the segment’s potential, with some––such as Accelerant––making steady inroads. Also, quite a few midsize companies have set up captive subsidiaries to meet their risk-management needs––a strategy whose use will only grow tomorrow.

Insurers will need to develop two strategies to unlock the market of midsize companies. One, they must develop a different approach to distribution, partnering with innovative brokers and deploying novel online abilities compared with those they’ve developed until now.

Two, processing midsize companies’ risks requires a different attitude to underwriting. The risks are no less complex than those associated with big companies, but the absolute premiums make the midsize market unappealing to process submissions. That’s why insurers have to use digital technologies and shift to a portfolio-underwriting mindset. As more MGAs and captives enter the segment, the midsize market is bound to become more competitive. (See Exhibit 4.) First movers, therefore, have the best chance to get ahead and stay there.

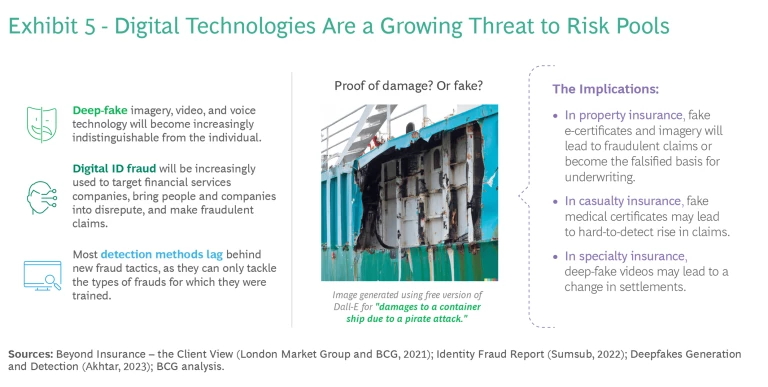

Fraud. Digital technologies have escalated threats to the insurance industry, but the age of AI exacerbates those risks further. Digital “deep fake” images, doctored videos, and phony voice recordings are now indistinguishable from those of real people. As a result, digital identity fraud will increasingly plague financial services companies, and duplicitous claims will be filed with property, casualty, specialty, and operations insurers. (See Exhibit 5.)

Commercial insurers must greatly increase vigilance in their underwriting and claims businesses, deploying state-of-the-art technologies, such as AI, to spot fake data. They must develop automated fraud-detection and remediation capabilities, and enhance existing ones. The only alternative are manual methods, which will soon be financially unviable.

Several capabilities have recently emerged to help insurers get ahead of the digital threat. For instance, generative AI (GenAI) underwriting software platforms streamline the underwriting process by bringing together submission, quote management, and task workflows. They use data-ingestion technologies and GenAI to create automated processes that extract data quickly from any format. Not only does that speed up the process, but it also helps insurers improve their underwriting performance by allowing automatic comparisons to similar risks and formulating arguments for costing decisions.

The traditional submission intake and analysis process is labor intensive, but insurers can use AI to automate it.

Claims intake techniques help insurers evaluate policies and determine insurance coverage in advance, reducing the analysis time for claims handlers. The traditional submission intake and analysis process is labor intensive, but insurers can use AI to automate it. In the case of simple claims and capacity-based triaging, AI can automatically send work to the relevant claims handler to improve submission throughputs; accelerate the time to revenue; reduce premium leakages; and build more profitable businesses.

In the fast-changing insurance industry, the pursuit of rapid growth is leading insurers to adopt aggressive strategies that are akin to spraying bullets in every direction. Yet not every business opportunity will translate into greater revenues, and even fewer will result in higher profits.

Successful strategies require a nuanced approach. A reactive approach could lead insurers to chase opportunities that appear promising, but don’t align with their strategies. Doing so will also divert time and resources from promising strategies and could cause confusion within the organization.

Cautious opportunism is critical; instead of indiscriminately pursuing every potential avenue for growth, insurers must carefully evaluate options that reflect their strategic objectives. That means adopting a discerning approach to identify and pursue business opportunities that align with the insurer's long-term vision and strengths while looking beyond the surface and around corners. As someone once said, the business of the future will always be shaped by those who dare to go beyond the obvious.