Europe is rearming. European governments have pledged to mobilize an additional €800 billion for defense from 2026 through 2029. But how will Europe’s industrial base meet this demand?

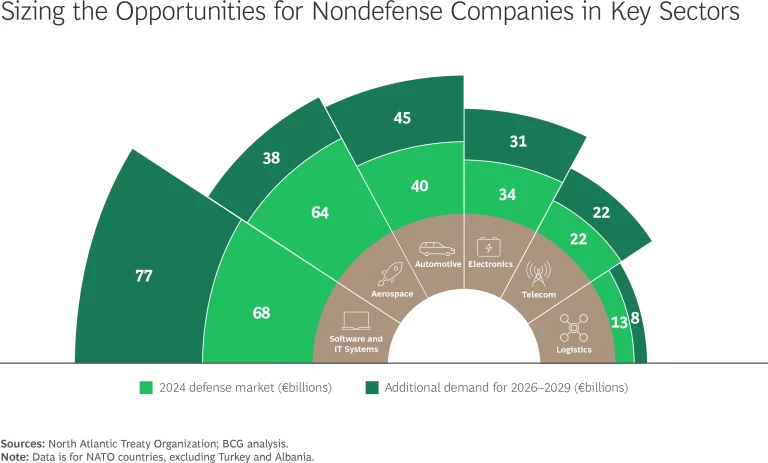

Companies outside the traditional defense value chain will likely play a major role in answering this question, as BCG’s modeling estimates the size of the opportunity for nondefense contractors at up to €500 billion over those four years, €220 billion in new demand. We see particularly strong opportunities for software and systems, aerospace, automotive, electronics, telecommunications, and logistics companies to enter the defense market or expand their share.

Europe’s public and private sectors should look beyond the defense implications and recognize that this spending surge represents an historic opportunity for industrial transformation. Combined with sound, well-executed industrial strategies, the defense push could help reinvigorate several key sectors that have suffered from underinvestment and boost the global competitiveness of European companies.

Realizing this ambition will require smart partnerships and strategic investments. In our experience, new entrants typically need help to understand and participate in the defense sector, particularly with regard to navigating defense procurement procedures and regulations.

Navigating Europe’s Defense Market

Companies entering the European defense market for the first time are likely to encounter several significant challenges. To capture the business opportunities, they must understand the following nuances:

- Prioritization of European Sovereign Supply. Europe has set local sourcing targets of 50% by 2030 and 60% by 2035 for defense procurement. This should translate into greater opportunities for European companies and local suppliers.

- Multiyear Tenders and Complex Procurement Processes. The long horizons for securing and fulfilling contracts mean that new entrants must often secure substantial financing up front.

- A Complex Regulatory Environment. Each European nation has its own panoply of regulations, and priorities and funding levels can change with new political leadership.

- Fragmented National Demand. Even though Europe is one of the world’s largest integrated commercial markets, government procurement varies from country to country, leading to relatively small purchases and production volumes.

Recognizing some of these barriers, the European Commission (EC) has outlined policies to encourage member states to better coordinate defense procurement, such as by aggregating demand and harmonizing rules. That would improve the investment environment. It is important for European governments and defense ministries to coordinate their regulations and procurement strategies to achieve speed and economies of scale, and to actively engage with the private sector, particularly new entrants.

Sizing Up the Biggest Opportunities for Nondefense Sectors

We see opportunities for companies outside traditional defense-industry value chains to capture a significant share of European military spending over the next four years. For six high-potential sectors, we have mapped out the size of the potential addressable market from 2026 through 2029 and identified the most promising segments. (See the exhibit.) We describe several of these segments in greater detail and discuss how companies and governments can realize these opportunities.

Software and IT Systems

Leading opportunities: Cyber, information, and operational technologies

Estimated market size in the next four years: €145 billion (240% growth during the period 2024–2029)

There are opportunities throughout the defense value chain in information technologies such as enterprise IT and in operational technologies to be deployed in the field. We expect investment in cyber capabilities and measures responding to hybrid warfare and digital sabotage to account for about one-third of EU defense spending on software and IT systems. Commercial cybersecurity firms will have opportunities to expand their portfolio to defense, such as by offering secure digital identity solutions, firewall hardware, blockchain-enabled imagery authentication, and encryption for protecting critical infrastructure. By partnering with existing defense system integrators seeking to bundle their hardware into secure platforms, cyber providers can gain a deeper understanding of the procurement landscape and certification processes.

Similarly, commercial developers of software-as-a-service, the Internet of Things, and edge analytics have opportunities to pivot into operational technology for defense. Among the market possibilities is modular defense software—particularly for AI-enabled, real-world battlefield simulations and training that use augmented reality and virtual reality. High-fidelity and interoperable synthetic training systems are in strong demand globally, with over $3 billion in recent tenders from defense agencies in the US, the UK, and other nations.

As NATO spending requirements increase, we expect to see spillover into noncritical budgets such as enterprise IT. We also anticipate that enterprise resource planning, human resources, logistics, and internal data integration solutions will be a growing subsegment, as defense ministries focus on making their operations efficient and resilient and aim to compensate for underinvestment during the past decade of peacetime. Enterprise IT vendors that currently count defense clients as only a small share of their business may consider tailoring their offerings and expanding their sales forces to better serve this growing market.

Aerospace

Leading opportunities: Aircraft maintenance, repair, and overhaul; avionics systems and components

Estimated market size in the next four years: €102 billion (190% growth during the period 2024–2029)

Europe’s aerospace sector already plays a central role in defense, particularly in avionics and dual-use platforms. But with defense demand accelerating, aerospace suppliers and maintenance, repair, and overhaul (MRO) providers now have a strategic opportunity to scale their presence and help fill capacity gaps in high-growth segments.

We see some of the best market opportunities for MRO providers in the expansion of training and intelligence, surveillance, and reconnaissance fleets. This opens the way for commercial providers to form partnerships with incumbent contractors. For example, AAR is collaborating with Delta TechOps on a $1.2 billion contract to support the US P-8A Poseidon maritime patrol aircraft. Entrants must have their MRO capacity certified for military aircraft and must establish dedicated hangar space and tooling. Defense ministries could consolidate shared platform demand across countries to ensure scale and to simplify contracts. The EC and policymakers could support recognition of civilian MRO certifications or allow streamlined upgrade paths for dual-use operators.

Avionics manufacturers can look forward to greater military demand, particularly for modern systems for unmanned aircraft and connectivity on the battlefield. Most avionics manufacturers have already heavily invested in the defense value chain, but they may find it challenging to ramp up production. Defense ministries could simultaneously help avionics companies scale up and reduce risk for investors by mandating modular, open system architectures during procurement and by providing long-term visibility into future avionics needs and procurement plans.

Automotive

Leading opportunities: Scalable manufacturing capabilities; experience in vehicle electronics and software integration

Estimated market size in the next four years: €85 billion (270% growth during the period 2024–2029)

Europe’s plans to sharply increase procurement of a range of land-based systems and its goal of electrifying and digitizing its automotive fleet is likely to pose challenges for an industrial base fragmented across the region. Europe’s commercial automotive industry, meanwhile, finds itself with excess production capacity as it faces declining demand in Western Europe and rising US tariffs. This presents a major opportunity for OEMs and Tier 1 and Tier 2 suppliers that can scale up and offer deep experience in vehicle electronics and software integration.

Auto suppliers with spare capacity could function as contract manufacturers for defense contractors, such as by producing powertrains or other components for unmanned ground vehicles. Although most European defense ministries prefer to procure parts domestically, they could encourage overall production by opening subcontracting of certain components to suppliers in neighboring countries. The EC could support such efforts by aggregating demand.

There are also opportunities for electric vehicle (EV) manufacturers and suppliers of advanced driver-assistance systems and automotive software. They could co-develop powertrains, autonomous driving stacks, diagnostic software, and digital twin architectures for military platforms. Their expertise could prove particularly valuable in filling the need for real-time battlefield awareness enabled by data fusion, secure communications, and interoperable software platforms. To gain market access, new entrants could pursue joint ventures with prime defense contractors or hardware suppliers.

Electronics

Leading opportunities: Unmanned aerial vehicles (UAVs); aerospace components; rugged semiconductors; sensors; rare-earth element processing

Estimated market size in the next four years: €65 billion (250% growth during the period 2024–2029)

The market for a range of electronic components, such as radar and electro-optical/infrared sensors, is likely to benefit from increased spending on all types of military platforms. European militaries are projected to acquire around 380 fighter jets and 490 UAVs from 2026 through 2029, for example. The emphasis on sovereign sourcing of electronic systems and components creates opportunities for Europe-based suppliers.

Higher European military investment in drones and other UAVs, now projected at €28 billion, will also create a significant opportunity for commercial OEMs that can produce lightweight but durable military-grade drones and components suitable for surveillance or carrying warheads. Commercial and military UAVs use similar manufacturing processes, core components, and software architecture. The key differences tend to be in materials, autoclaving processes, encryption, hardened communications, and mission-specific payloads. Because China dominates the global commercial drone market and its supply chains, Europe may look to develop a sovereign manufacturing base. Defense ministries will also need to define requirements for endurance, range, and other capabilities, and clarify procurement pathways for dual-use suppliers.

Telecommunications

Leading opportunities: Secure communications systems; data centers; cloud storage; navigation systems for military vehicles

Estimated market size in the next four years: €45 billion (260% growth during the period 2024–2029)

The European defense buildup will significantly boost demand for hardware, components, and software across the telecommunications sector. Compared with companies in other sectors, commercial telcos may have an easier time navigating European defense procurement because they are already accustomed to dealing with regulators across the region and have extensive experience in cybersecurity.

Secure communications on the battlefield are a top military priority. This need will create growing demand for commercial suppliers of radio access networks that collaborate with software firms to develop encrypted communication hardware. Prime defense contractors should work with these OEMs to integrate their modules into existing military platforms based on cyber-hardening and encryption standards set by defense ministries.

The development of sovereign networks—communications and data infrastructure systems designed, owned, controlled, and operated within a particular nation's borders—is a growing priority as Europe seeks to become more self-sufficient. Because Europe lacks hyperscaled technology companies, telcos are the most likely providers. Accomplishing the necessary scale of development in this area will require collaboration among companies, governments, and regulators. Policymakers and the EC can incentivize network buildouts through public-private partnerships and by harmonizing spectrum policy.

Logistics

Leading opportunities: Warehousing infrastructure and services; training for handling hazardous materials; transport of heavy equipment

Estimated market size in the next four years: €20 billion (180% growth during the period 2024–2029)

Our estimate of a €20 billion addressable market for commercial logistics firms from 2026 through 2029 may be low because it includes only direct military spending—not costs related to handling inputs and outputs of European defense contractors and their suppliers.

We anticipate significant defense-related demand for freight forwarders to transport heavy machinery, as well as for third-party logistics providers of warehousing services such as optimization, digitization, and supply chain management. Commercial logistics firms can also provide workers to help companies manage production ramp-ups, and they can train personnel on the proper handling of hazardous materials.

New entrants, however, must learn to navigate Europe’s complex procurement rules and processes, as well as understand the scope of demand and requirements for specific transport corridors. Defense ministries can engage directly with logistic firms to ensure that they receive the information necessary to perform their tasks appropriately. In the longer term, Europe’s public and private sectors should collaborate on developing state-of-the-art air and sea transportation infrastructure capable of meeting future military needs.

In all of these undertakings, the role of the public sector is crucial. Governments, particularly defense ministries, can support the industrial base by maintaining effective two-way market engagement, signaling demand, and providing a clear timeline.

Europe’s defense buildup will certainly change the dynamics of regional security, but it will also help determine the future of multiple industries in the region, from automotive to electronics to telecommunications. With strategic planning, policy coordination, and public-private collaboration, new defense investments can help build a dynamic tech sector—an area where Europe has fallen behind. Companies that invest strategically and forge the right partnerships with prime contractors and defense ministries can unlock new revenue streams, become more globally competitive, and strengthen the continent’s resilience at this critical moment in history.