Most transformations fail: roughly 75% fall short of their goals. Many things can go wrong. But one of the most common, and least acknowledged, is the lack of unified action between the transformation office and key C-suite players. Ambition, capital, and talent are table stakes. But without alignment between strategy, finance, and execution, even the best-intended transformation will stall.

The advent of the chief transformation officer (CTO) has improved execution. But a CTO operating in isolation cannot carry the weight alone. Transformation success hinges on tight coordination across the operational, financial, and strategic axes of the business—starting on day one.

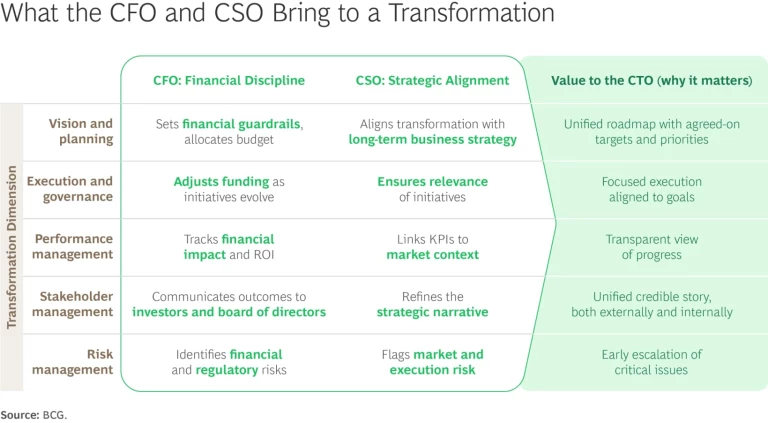

BCG research shows that when leadership is aligned from the outset, transformations are nearly 70% more likely to succeed. The most effective efforts are led by the transformation “trio”: the chief financial officer (CFO) and chief strategy officer (CSO), working in lockstep with the CTO.

Stay ahead with BCG insights on corporate finance and strategy

Here, we explore the power of this partnership, describing what CFOs and CSOs uniquely bring to the transformation table, how the three leaders amplify each other’s impact, and what it takes to make this partnership work in practice.

CFO and CSO Engagement Is a Force Multiplier

Many companies launch large-scale change programs without effectively engaging the CFO and CSO from the start. The result? A lack of financial discipline, strategic clarity, or both. Execution may look orderly on paper, but the work often spirals into siloed initiatives, narrow cost reduction efforts, or underfunded change agendas. Momentum fades. Results are disappointing.

When the CFO and CSO are embedded alongside the CTO from day one, the C-suite aligns early on the “what” of the transformation, not just the “how.” The CFO signals to internal teams and external stakeholders that the transformation is a top priority with financial rigor. The CSO ensures that it’s anchored to the company’s long-term strategy, not just to reactive measures or near-term targets.

Early alignment is only part of the story. The first wave of transformation often focuses on unlocking capital. But the real challenge—and opportunity—lies in how that capital gets redeployed. The CFO must resist defaulting to bottom-line absorption. The CSO must steer reinvestment toward strategic bets. Together, they turn cost savings into competitive advantage. Without their continued sponsorship, the transformation risks stalling or slowly reverting to business as usual.

Here’s how this alignment sounds in action from each leader’s perspective:

The CFO: “I own capital allocation. I can make sure we’re investing in the right priorities and capturing the value we’re creating.”

The CSO: “This is how we drive the long-term strategy forward—cutting where needed, investing where it counts.”

The CTO: “With my peers involved as active partners and owners, this isn’t a side initiative. It’s core to how we operate.”

The CEO: “My top team is aligned and mobilized. We’re shaping the future together.”

What the CFO Brings: Financial Rigor, Capital Discipline, and Credibility

As the architect of capital allocation and custodian of shareholder value, the CFO plays a pivotal role in making the transformation real and sustainable. That role extends far beyond budgeting oversight. The CFO helps ensure that the transformation delivers measurable outcomes, not just activity, in three crucial ways.

Turning Cost Savings into Strategic Investment. Most transformations begin with cost and productivity efforts. These create financial breathing room—but what happens next separates success from stagnation. The CFO must ensure that freed-up capital isn’t simply absorbed into the bottom line but is deliberately reallocated toward bold growth bets, capability building, and strategic reinvestments that will shape the future business.

For example, transformation efforts often force tough decisions regarding business-unit or product funding. CFOs who lean in to having the hard conversations about where to reduce spending and where to double down can shift the organization’s investment profile materially. This is not just about where the company puts capital. It’s also about how it pays for talent: cutting in one area to invest in top-tier capabilities in another.

Such action requires more than approval rights. It demands active stewardship that ensures capital moves with intent, at the right pace, and in line with long-term value creation.

Embedding Transformation into the Planning Architecture. Transformation goals are often bolted onto the annual operating plan (AOP) or long-range plan (LRP), but without integration, the numbers don’t hold. Inevitably, this leads to overpromising, execution drift, and diluted accountability.

That’s why the CFO must lead the charge to fully integrate transformation into the core financial planning processes. That means every business and product owner must evaluate transformation initiatives alongside their base budgets, prioritizing across both, not in parallel. The goal is a single, bottom-up plan that reflects the full picture: what gets funded, what gets paused, and what gets killed.

Transformation also creates an opportunity to pressure-test the LRP. Partnering with the CSO and CTO, the CFO can help drive a “no sacred cows” refresh, challenging legacy assumptions and forcing strategic tradeoffs across the portfolio.

Telling a Credible Story to Investors. If transformation is about driving long-term performance, the CFO needs to communicate a clear rationale for how capital is being deployed and when results will become visible. That means resisting the urge to sandbag or obscure.

Some CFOs hesitate to quantify transformation KPIs too precisely, fearing they’ll lock themselves into expectations. But too little specificity erodes investor trust. Instead, the CFO should define a set of externally appropriate metrics, ones that link to specific levers and demonstrate progress over time. This approach gives the company the flexibility it needs. Moreover, by anchoring external targets in rigorous scenario planning and aligning with the CEO and the board, the CFO builds credibility. Over time, that credibility compounds—quarter by quarter, KPI by KPI—fueling investor confidence and long-term shareholder value.

What the CSO Brings: Strategic Clarity, Boldness, and Focus

If the CFO ensures that capital is unlocked and deployed wisely, the CSO ensures that the transformation stays strategically coherent. The CSO sets the company’s north star and connects short-term actions to long-term ambition, guiding tradeoffs and pushing the organization to stay bold and focused.

Transformations often start with a burst of activity. But activity is not strategy. The CSO lifts the organization’s focus from tactical execution to transformative action, ensuring the effort remains anchored to a bigger vision of the desired future.

And the impact is real. According to BCG’s Strategy Health Check Survey of C-suite executives from hundreds of companies worldwide, transformations with a strong long-term orientation outperform all others, earning a 10- to 15 percentage-point-greater total shareholder return over a five-year period. The CSO anchors that long-term perspective in three important ways.

Backing the Big Bets. While the CTO orchestrates a broad portfolio of initiatives, the CSO focuses on the few major moves that will reshape the business. These might include M&A, a shift to a new business model, geographic expansion, or AI deployment with disruptive potential. Such levers alter the company’s trajectory. But they require deliberate design, sustained sponsorship, and strategic guardrails.

Strong CSOs don’t just name the opportunity; they blueprint it. That means defining how the business will build or buy capabilities, rewire talent, forge partnerships, and resource at scale. They provide the operating-model thinking that’s needed to make high-risk moves executable.

Pushing for Boldness. One of the most common reasons transformations fall short is that company leaders don’t go far enough. They hesitate to divest, reorganize, or push beyond the safe zone, even when the need is clear. The CSO must be the one challenging peers beyond incrementalism.

Doing so takes more than issuing a strategy slide deck. It means applying pressure and framing what’s possible with benchmarks, scenario planning, and external signals. At times, it means getting directly involved: helping business leaders source new talent, co-developing investment cases, or guiding teams through unfamiliar strategic terrain.

Bold transformation is not just about direction; it’s also about momentum. The CSO helps create both.

Killing Low-Value Work. Transformation is also a capacity management exercise. The CSO plays a central role in identifying which activities should stop—the legacy projects, incremental initiatives, or near-term earnings plays that divert focus from what matters.

Ruthless prioritization is one of the most underutilized levers in transformation. When the CSO partners with the CFO and CTO on a full financial and strategic refresh, the three can reset the entire enterprise agenda, concentrating capital, time, and leadership attention where it counts.

Prioritization also sends a powerful cultural signal: that change isn’t just additive. It requires tradeoffs. Focus, and not the volume of activities, is what drives results.

Making It Happen: Best Practices for Collaborative Leadership

A transformation can only go as far as the leadership team in charge takes it. While appointing a capable CTO is a starting point, transformation success depends on how the CTO, CFO, and CSO work together—consistently, visibly, decisively.

Here are five practices we’ve seen that make the difference between alignment on paper and alignment in practice.

Declare a shared mandate. From the outset, the CEO must position the transformation as a shared mission across strategy, finance, and execution and not a CTO-only initiative. All three leaders should be explicitly accountable, with defined transformation objectives embedded in their objectives and key results and roles. Together, the trio should participate in steering committees and other key decision-making forums. No major decisions—whether about funding, prioritizations, or tradeoffs—should happen in isolation from one another.

Clarify roles, rights, and escalation paths from the outset. Clear decision rights prevent misalignment. The three leaders should address questions such as these: Which thresholds require CFO approval? Which strategic initiatives need CSO input? What happens if trio members disagree? These boundaries and escalation paths must be defined early, documented, and then reinforced in practice. Alignment isn’t about agreeing on every detail. It’s about knowing who owns what and how to move forward when the stakes are high.

Institutionalize the partnership. Informal alignment fades. The trio’s collaborative relationship must be formally embedded within the transformation office itself. Beyond execution coaches, the trio needs dedicated finance and strategy leaders in the office. This also means that the CSO, CFO, and CTO must engage in one-on-one working time between each pair as well as three-way sessions on a regular basis to deal with progress, pivots, and unresolved tensions in the transformation effort. Operating as a unit in decision making, communications, and governance, they build clarity and speed across the organization.

Model the change. The transformation trio can’t just sponsor change; they must embody it. For example, the CFO should champion the initiatives within finance, whether it’s modernizing forecasting, simplifying reporting, or streamlining cost structures. The CSO should embed transformation language in strategic planning and in internal and external narratives. The CTO should celebrate these moves. Together, the three demonstrate to the organization that the transformation is real and that no function is exempt.

Sustain the pressure over time. Early alignment is critical, but it won’t carry a transformation through its later phases. As first-round initiatives mature and complexity creeps in, the trio must stay engaged. The CFO keeps capital flowing to priorities. The CSO ensures that efforts remain connected to the long-term strategy. Together, the three leaders reassert focus when the transformation risks reverting to business-as-usual mode. Momentum is not self-sustaining; it’s led.

Lasting Change Is a Team Effort

In today’s environment of constant disruption, transformation failure is not an option. When the CFO and CSO act in concert with the CTO, organizations are better positioned to execute bold strategies, reallocate resources with discipline, and deliver tangible, lasting results.

For CEOs and boards overseeing transformation efforts, the call to action is clear:

- Is your CFO actively reallocating capital to fund the future?

- Is your CSO ensuring strategic clarity and pushing for bold, long-term bets?

- Is your top team moving visibly and consistently as one?

Transformation doesn’t fail in execution. It fails in alignment. Fix the trio, and you flip the odds of success.