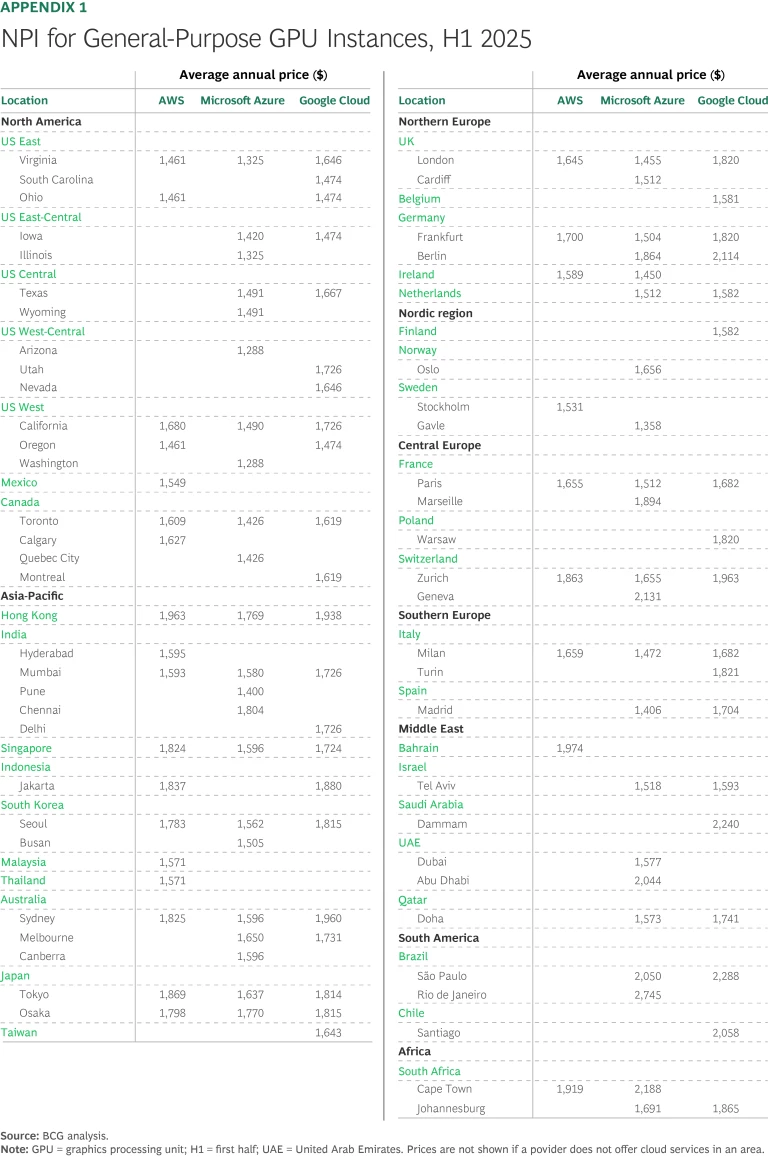

The Nimbus Pricing Index (NPI) for the first half of 2025 reveals the latest average list price for a basic enterprise-cloud package from the three main providers. (See Appendix 1.) Amazon Web Services (AWS) kept its pricing largely stable globally, with occasional strategic price reductions in highly competitive markets such as São Paulo. Microsoft reduced Azure’s prices aggressively in competitive Asia-Pacific countries—specifically, India, Australia, Malaysia, and Thailand. And Google consistently but moderately increased its rates worldwide for Google Cloud to reposition it in premium regions or to offset operational costs. Even so, Google Cloud remains competitive in major hubs, including Tokyo, Singapore, and London.

About the Series

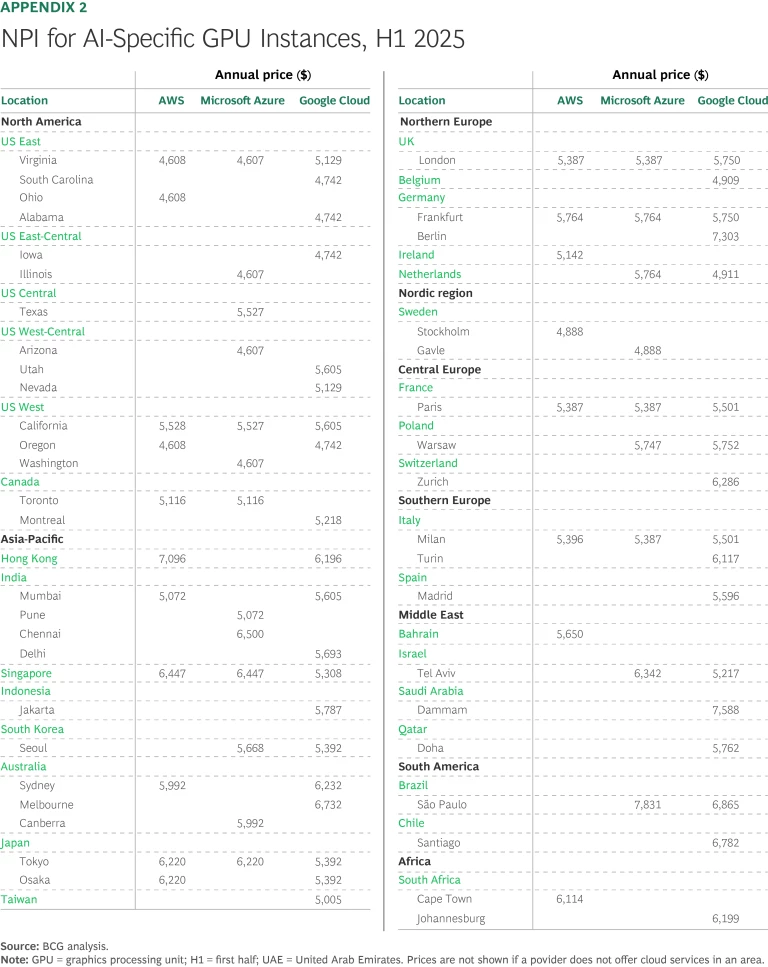

Across regions, there are notable pricing differences to use AI-specific graphics processing unit (GPU) instances, with AWS and Azure offering a clear cost benefit in the Eastern US over Google Cloud. (See Exhibit 1.) AWS and Azure also frequently have very close pricing in the Western US and in European hubs. Regionally, the cheapest AI-specific GPU instances are still in North America and the Nordic countries, while most of those in Europe and Asia‑Pacific range from $5,000 to $6,500. (See Appendix 2.) This range generally applies to Africa and the Middle East as well, and prices peak above $7,000 in South America. AWS and Azure shadow each other almost everywhere, diverging mainly in South America and the Middle East, whereas Google Cloud is slightly cheaper in Asia-Pacific and Europe where it has T4 capacity.

The Sovereign Cloud Redefines National Security

A sovereign cloud is a nationally controlled zone of public-cloud technology. It delivers the same scalability and on-demand services that are expected from AWS, Microsoft, or Google. The sovereign cloud has emerged as a strategic imperative for governments and local enterprises to ensure control over national data, retain operational independence, and maintain economic benefits.

- Regulation and Privacy. The European Union’s General Data Protection Regulation, France’s SecNumCloud rules, and India’s Digital Personal Data Protection Act all insist that certain data remain locally governed. With a sovereign cloud, enterprises can comply with local regulations while continuing to access cloud-native capabilities securely.

- Geopolitics. The Clarifying Lawful Overseas Use of Data Act in the US allows US authorities to subpoena data from any US-based provider even if that data sits in Europe or Asia. A country can use a sovereign cloud to build a jurisdictional firewall.

- Cyber Resilience. Conflicts such as the Russia-Ukraine war demonstrate how easily cross-border cloud access can be disrupted or weaponized. A sovereign cloud guards against nefarious foreign influence or attacks.

- Economic Strategy. By implementing a sovereign cloud, a country can nurture a domestic cloud ecosystem and keep jobs, tax revenue, and intellectual property value at home.

Analysts expect sovereign-cloud infrastructure as a service (IaaS) spending to leap from $37 billion in 2023 to $169 billion by 2028—a compound annual growth rate of 36%, versus about 24% for general IaaS spending.

As a result of these powerful drivers, by 2028, 65% of nations are expected to implement a digital sovereignty plan with three pillars:

- Data Sovereignty. All customer data—including backups and metadata—stays inside national borders, encrypted with keys that the customer (or a designated national body) controls.

- Operational Sovereignty. The day-to-day administration is carried out only by people who are legally subject to the local jurisdiction. Foreign authorities cannot compel those staff members to hand over data.

- Technological Sovereignty. The cloud stack can be inspected, escrowed, or replicated, ensuring that the nation isn’t reliant on a single foreign vendor during a crisis.

While the reasons to implement a sovereign cloud are similar across countries, as are the stakeholder groups within the sovereign ecosystems, each country decides the level of sovereignty that it wants to achieve.

Vendor Models That Address Sovereign Cloud Demand

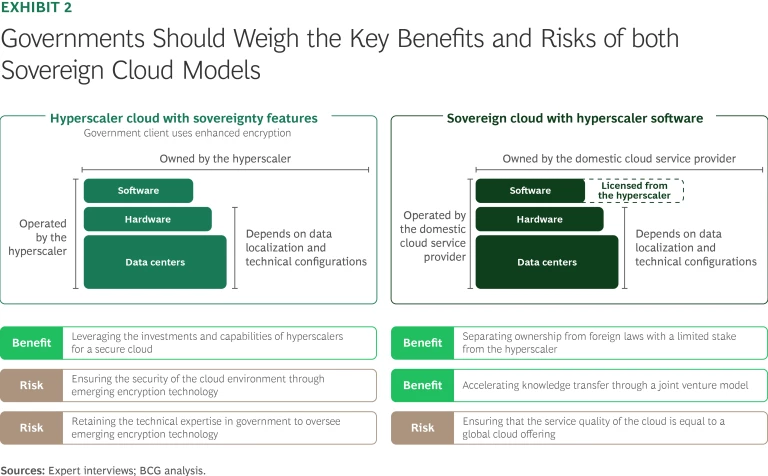

Vendors offer two primary sovereign-cloud models that address governments’ digital sovereignty needs:

- Hyperscaler Cloud with Sovereignty Features. Vendors make this model available to the general public, but customers can add security features for an extra charge. Customers also manage data encryption through their network.

- Sovereign Cloud with Hyperscaler Software. Vendors provide the physical infrastructure and configure the technical setup, and a local partner (for example, OVH US, Thales, or T-Systems) conducts the physical operations.

It’s important to weigh the benefits and risks in each model. (See Exhibit 2.)

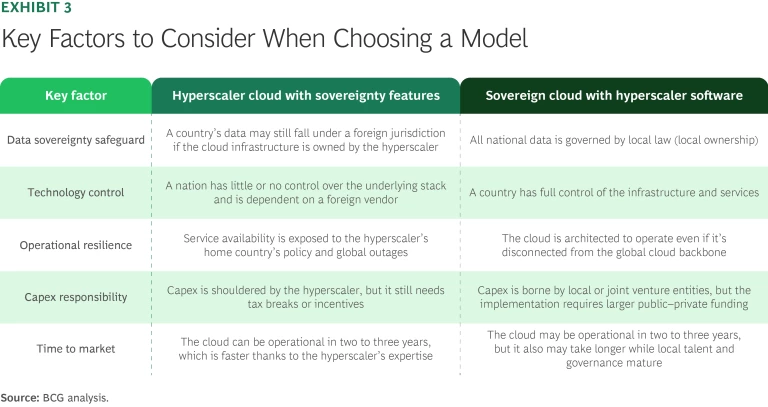

In our work with clients, we have identified five key factors when choosing between the two models. (See Exhibit 3.)

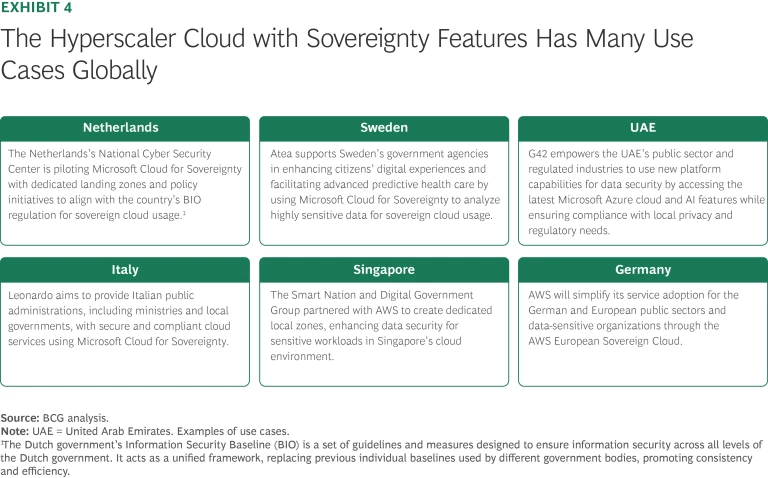

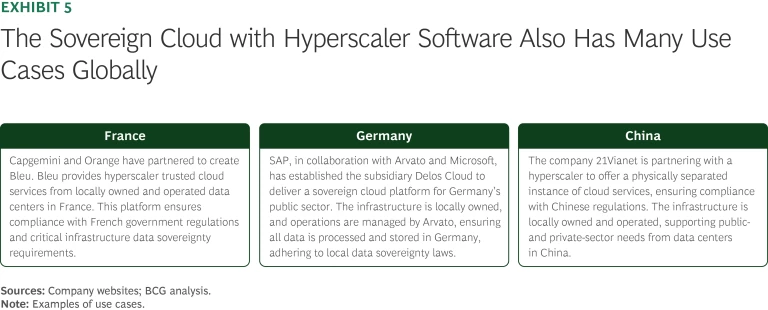

Ultimately, each model varies in sovereignty level, cost, and scalability in ways that appeal to different countries. There are multiple use cases globally for both models. (See Exhibit 4 and Exhibit 5.)

Tech + Us: Harness the power of technology and AI

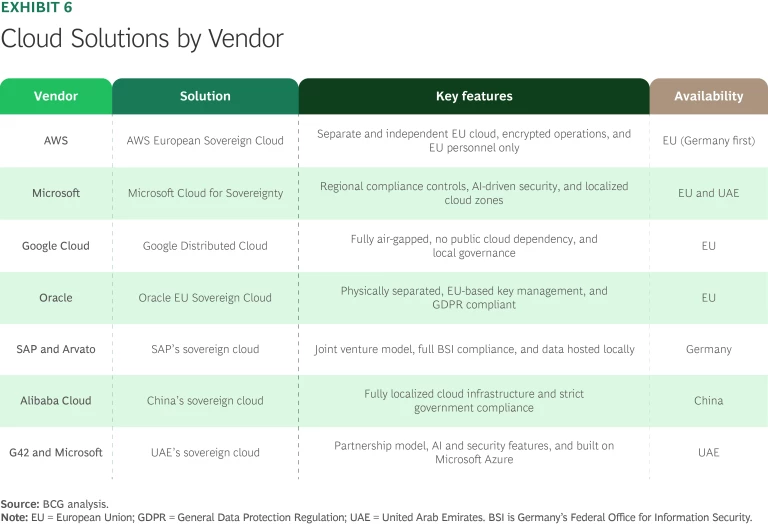

Specific Vendor Offerings

Several major cloud providers have developed sovereign cloud solutions that are tailored to the different regulatory and sovereignty needs worldwide. At a minimum, these solutions address data sovereignty, operational sovereignty, and technological sovereignty. (See Exhibit 6.)

The Economics of a Sovereign Cloud

Dedicated sovereign-cloud offerings focused on specific regions require a screened staff, have fully isolated infrastructures, and are compliance heavy. The result is a price premium over public clouds. For example, Google Sovereign Cloud is priced 10% to 20% over the public cloud, while Oracle EU Sovereign Cloud charges a 15% to 30% price premium. Meanwhile, ultraisolated government-cloud offerings are air-gapped with strict residency and security controls. For example, AWS GovCloud is offered at a 20% to 30% price premium over the public cloud, and Microsoft Azure Government carries a 15% to 25% price premium.

While the list prices for sovereign cloud regions and ultraisolated government-cloud zones are higher than standard public-cloud regions, cloud providers increasingly offer discounts to anchor tenants—especially early, credential-building customers. Deep incentives (such as subsidized bandwidth and free credits) can narrow the real-world premium well below the list price range.

The Outlook for the Sovereign Cloud

We have identified three key trends that will shape sovereign-cloud adoption from 2025 through 2028.

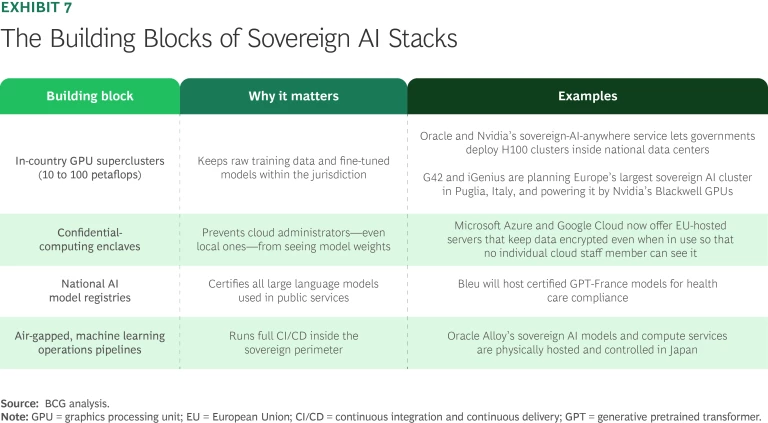

Sovereign AI Stacks. When a country insists that all data (training sets, model checkpoints, and telemetry) stays on its soil, it also needs local AI horsepower. That requirement is driving the implementation of a new layer of sovereign AI infrastructure. Hyperscalers are already partnering with national operators to stand up in-country GPU “gigafactories,” while new rules such as the EU Artificial Intelligence Act require local custody of model weights and audit logs. As chip subsidies and anchor-tenant discounts kick in, companies will be able to fine-tune large language models inside protected regions, making sovereign AI a practical, policy-driven extension of today’s sovereign data clouds. (See Exhibit 7.)

Hybrid Sovereign Landing Zones. Few organizations can afford to keep every workload in a premium sovereign-cloud region. The emerging pattern is a hybrid landing zone that stitches together two resource pools:

- Global public-cloud pods, which are cheap, elastic, and ideal for developing, testing, and anonymized analytics

- Sovereign partitions, which are dedicated subtenants or completely separate regions that are holding regulated data

For example, Microsoft’s open-source Sovereign Landing Zone adds extra policy packs and management groups on top of the standard Azure Landing Zone so workloads can step up from public-cloud pods to sovereign partitions with the same DevOps tooling:

- Data Classification Tags. These let administrators label every resource public, restricted, or secret, enabling automated routing to the right side of the hybrid fence.

- Encrypted Cloud-to-Cloud Links. By using TLS 1.3 (the latest version of the Transport Layer Security protocol) with a company’s own keys—and sending the traffic straight across without detouring through any cloud provider’s relay servers—the customer can move nonpersonal data cheaply while keeping the sensitive bits locked down.

- Shared ID and Policy Plane. One tenant for Azure role-based access control and Azure active directory can span both landing zones, avoiding the two-cloud, two-teams overhead.

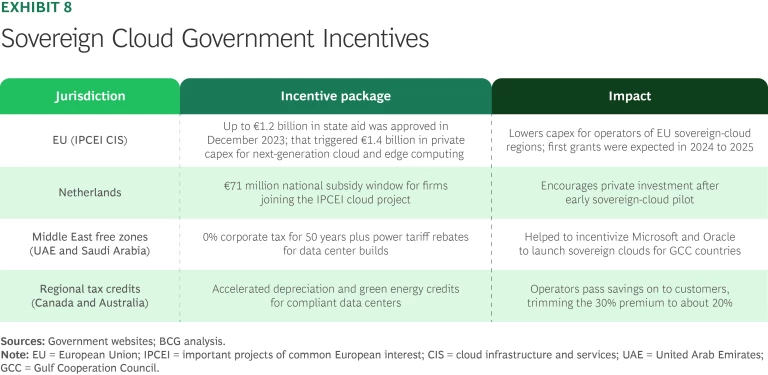

Subsidies and Tax Breaks. Sovereign cloud regions still carry a 15% to 30% price premium over standard public-cloud regions, but governments are offsetting much of that extra cost with incentives to entice their private sector to move workloads to the sovereign cloud. (See Exhibit 8.)

The next wave of sovereign clouds will blend local-first AI, cost-smart hybrids, and government incentives. This will make compliant, in-country clouds the new normal rather than a premium exception.

Rising Cloud Waste and How to Optimize Spending

Cloud computing has revolutionized the way enterprises operate, offering unparalleled scalability, flexibility, and innovation. However, with the rise in cloud adoption comes a significant and growing challenge: cloud waste.

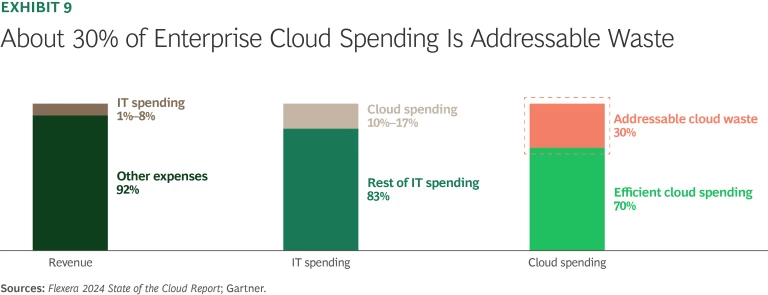

Studies indicate that up to 30% of cloud spending is wasted due to inefficient usage and a lack of cost control. Given that cloud costs now account for as much as 17% of IT budgets and about 80% of companies expect cloud spending to grow further, addressing this inefficiency is an imperative. (See Exhibit 9.)

We have identified five key reasons for cloud waste:

- Decentralized Cloud Procurement and Governance. The self-service nature of cloud platforms empowers teams to procure resources independently. While this accelerates innovation, it also can result in uncontrolled provisioning of virtual machines, a lack of visibility into actual usage, and ineffective cost accountability.

- Overprovisioning and Poor Resource Utilization. Many organizations provision cloud resources on the basis of peak demand rather than actual usage. Instances and storage are often oversized, and unused resources continue running, leading to unnecessary costs.

- Ineffective Pricing and Discount Strategies. Organizations often fail to leverage available pricing models effectively. Many still operate with on-demand pricing, neglecting cost-saving options such as reserved instances, savings plans, and spot instances. Poor contract negotiations with cloud providers can further compound the issue.

- A Lack of FinOps Practices. Many enterprises lack a structured framework for cloud financial operations (FinOps), leading to poor alignment between technical teams and financial goals. Without continuous monitoring and optimization, cloud costs can spiral out of control.

- Data Storage Inefficiencies. Cloud storage costs often escalate due to excessive data retention, a lack of tiered storage strategies, and redundant data copies. Organizations often fail to implement archival and life cycle management policies, resulting in bloated storage expenses.

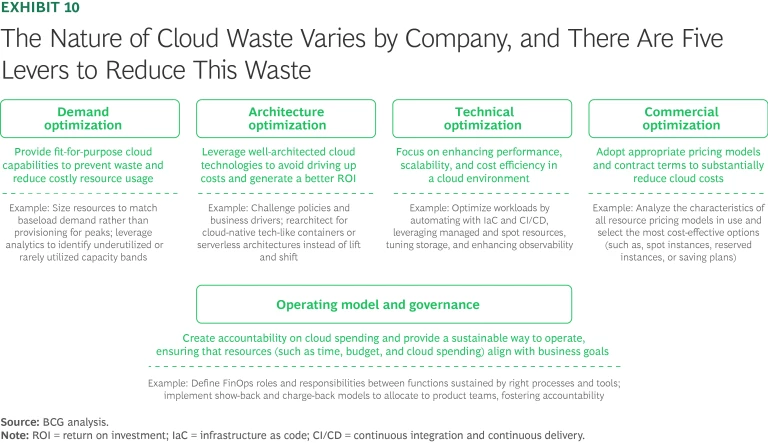

Fortunately, there are several powerful levers to mitigate cloud waste. (See Exhibit 10.)

- Demand Optimization:

- Rightsizing and Auto Scaling. Ensure that compute instances match actual workload demands.

- Auto Shutdown Policies. Shut down during idle time outside of business hours.

- Serverless and Containerization. Transition workloads to serverless or containerized architectures for cost efficiency.

- Architecture Optimization:

- Refactoring for Cloud-Native Efficiency. Adopt microservices and serverless architectures to optimize cost-performance balance.

- Efficient Data Management. Implement data compression, tiered storage, and life cycle policies to minimize storage costs.

- Technical Optimization:

- Improved Utilization. Automate provisioning and scale intelligently to lift utilization. Codify infrastructure and deployment using infrastructure as code and continuous integration and continuous delivery, leveraging spot and ephemeral capacity for bursts.

- Continuous Optimization. Tune compute and storage classes, adopt a managed platform as a service, and embed observability to drive continuous optimization.

- Commercial Optimization:

- Reserved Instances and Savings Plans. Move workloads from on-demand to reserved capacity, reducing costs by up to 65%.

- Multiyear Commitment Discounts. Engage in long-term negotiations with cloud providers for additional discounts.

- Competitive Benchmarking and Vendor Management. Continuously compare pricing across providers to secure a better deal.

- Operating Model and Governance:

- Charge-Back and Show-Back Models. Foster cost accountability by tracking expenses at the team or project level.

- Automated Cost Monitoring and Alerts. Use FinOps dashboards and anomaly-detection tools to enforce financial discipline.

- Regular Audits and Cost Reviews. Conduct periodic cost audits to identify and eliminate inefficiencies.

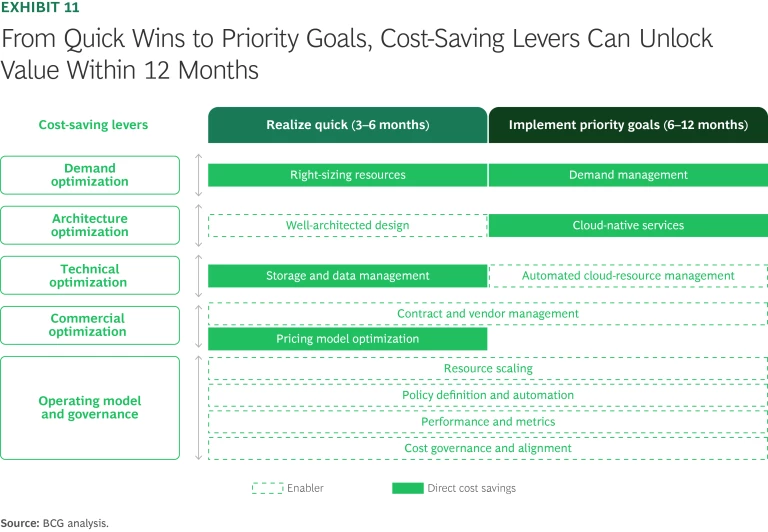

To put these guiding principles into practice and target the 30% of addressable cloud waste, companies should identify and prioritize quick wins, which can reduce addressable waste by 6% to 14% by swiftly diminishing cloud excess and securing a rapid return on investment through immediate cost reductions. (See Exhibit 11.) Companies should also invest in priority goals where targeted efforts can drive substantial, quantifiable returns and significantly reshape cost structures, reducing addressable waste by 8% to 20%. Meanwhile, companies should probably minimize efforts focused on long-tail events, which can only reduce addressable waste by 3% to 6%.

Cloud computing remains essential for business innovation, but without strong cost controls, inefficiencies will continue to drive waste. Organizations need to move beyond basic cost-cutting measures and adopt a structured FinOps approach to ensure cloud spending aligns with business value. By leveraging best practices in usage, pricing, architecture, governance, and vendor negotiations, companies can significantly reduce cloud waste and unlock sustainable cloud cost savings.