This is the third edition of the Global Fintech Report, coauthored by BCG and QED Investors.

The global fintech industry is entering a new chapter—one defined by the coming of age of a class of scaled fintechs, the emergence of new technologies and business models (especially AI), and an intensified focus on profitable growth.

This report looks at where fintechs have won so far and offers five forecasts for what lies ahead. It concludes with clear imperatives for each stakeholder in the ecosystem. Our analysis draws on conversations with more than 60 fintech executives and investors from across the globe and our own experience and analysis.

What we’ve found: 2024 marked a turning point. Funding and valuations stabilized, and fundamentals improved sharply. Fintech revenues grew 21% year-over-year, up from 13% in 2023, and outpaced the 6% growth in the broader financial services sector. EBITDA margins for public fintechs increased by 25%, and 69% of them achieved profitability—up from less than half the year before.

Fintech Penetration Resembles Swiss Cheese: Plenty of Holes

Fintech has penetrated only about 3% of global banking and insurance revenue pools. Moreover, approximately 60% of all fintech revenue is generated by fewer than 100 scaled players—which we define as those with over $500 million in annual revenue. As they come of age, these “winners” of the first chapter in fintech will be increasingly expected to act like mature public companies.

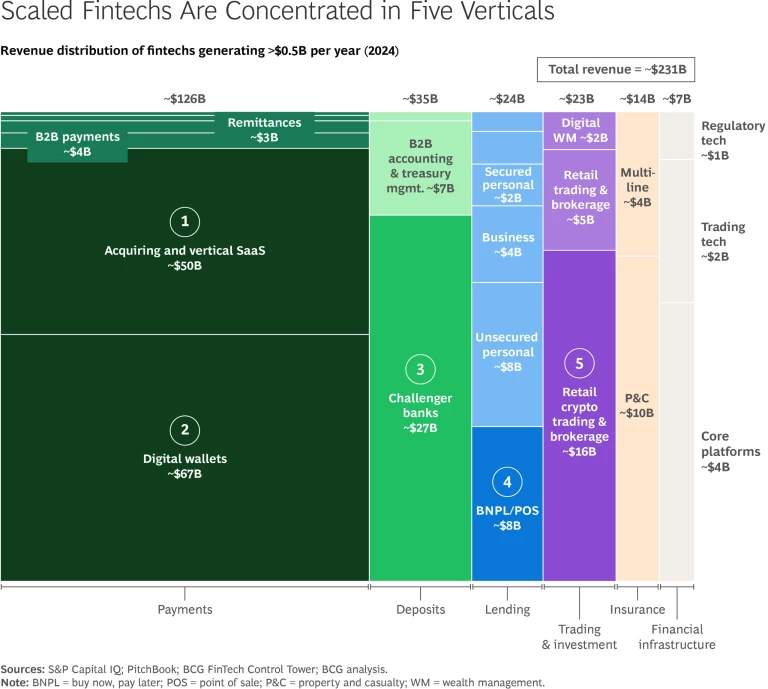

Interestingly, these scaled winners are largely concentrated in five verticals. (See the exhibit.) Payments is the clear leader, accounting for approximately $126 billion of scaled fintech revenues in 2024. More specifically within payments, digital wallets with $67 billion in revenues, and merchant acquiring and vertical SaaS with $50 billion, have seen standout success. Challenger banks represent $27 billion of scaled fintech revenues—a distant third—while retail crypto trading and brokerage account for around $16 billion. Though representing only 4% of revenues, BNPL/POS lenders are scaling rapidly, marking them as the fifth successful vertical. (See the exhibit.)

Broadly, fintechs have won where banks have been:

- Uncompetitive. Vertical SaaS solutions have addressed gaps in merchant needs (e.g., restaurants, retailers), while modern acquirers have simplified omnichannel payments.

- Unwilling to Serve. Challenger banks and BNPL lenders have captured underserved, often lower-income, segments neglected by traditional banks.

- Unwilling to Go. Regulatory and strategic constraints have limited banks’ ability to compete in areas such as crypto and digital wallets, giving fintechs space to thrive.

Clearly, many opportunities remain for fintechs to further penetrate incumbent revenue pools.

Forecast: Five Trends That Will Shape Fintech’s Next Chapter

With over $13 trillion in global banking and insurance revenues still in play, the future of fintech remains full of potential. We believe five key trends will shape the next chapter:

Agentic AI will change the game . . . eventually. Many scaled fintechs are just beginning to move from GenAI pilots to production-scale deployment. The next leap—agentic AI—has the potential to be as transformative as the internet or mobile. Its immediate impact will be felt most in software development—particularly for earlier-stage fintechs, which are using these tools to dramatically improve delivery speed and cost. Over time, agentic AI will fuel innovation across commerce, SaaS, and personal financial management. While challenges remain for this technology to scale safely in financial services, its transformative impact should not be underestimated.

Onchain finance has promise, but hurdles remain. Blockchain scalability and growing regulatory clarity signal an inflection point for onchain finance. While stablecoins are currently in the spotlight as they promise to streamline cross-border payments in corridors where correspondent banks add friction, the bigger opportunity lies in asset tokenization. By tokenizing illiquid assets such as bonds, private funds, and real estate, financial institutions can address long-standing issues like slow settlement times and high intermediary costs. Given the vast size of addressable asset pools, this has the potential to catalyze the movement of more economic activity onchain. Realizing this potential means overcoming several challenges: developing interoperable, bank-grade infrastructure; establishing unified standards; and providing comprehensive regulatory guidance. But major financial institutions are already actively piloting scalable use cases, although these will need to be scaled in the coming years to trigger network effects.

Challenger banks’ product and customer segment expansion have higher odds of success than going global. Challenger banks are now an established part of the banking landscape. To sustain their rapid growth, they are pursuing strategies such as growing deposit balances, diversifying products, and expanding into more affluent customer segments. Geographic expansion, however, remains a risky bet—and one that both fintechs and retail banks have struggled with. Diverse regulatory environments, cultural nuances, and intensified competition make international scaling difficult.

Stay ahead with BCG insights on financial institutions

Fintech lending is experiencing new tailwinds. Fintechs have only scratched the surface in lending, with $500 billion in outstanding fintech-originated loans globally compared to approximately $18 trillion in US household debt alone. While banks retain a funding advantage in the form of low-cost deposits, fintechs are gaining traction with more seasoned customer data and maturing underwriting models. Private credit funds are also emerging as a new tailwind. With $1.7 trillion in assets under management and a growing appetite for fintech-originated assets, as evidenced by multiple multibillion-dollar announced deals over the past year, we estimate a $280 billion white-space opportunity for private credit funds in fintech-originated loans. Still, despite these new tailwinds, the resilience of the fintech lending model remains untested through a full credit cycle.

The next wave of growth will come from B2B(2X), financial infrastructure, and lending. The first chapter of fintech produced scaled winners in digital wallets, acquiring, vertical SaaS, challenger banking, crypto trading, and BNPL. While a few players may still scale in these areas, these winners will be increasingly hard to displace. Future growth is likely to come from fintechs in three emerging segments:

- B2B(2X). Businesses still face many pain points in payments, accounting, and treasury management—areas where AI can automate. Fintechs also still have much room for growth in embedding their solutions in SaaS platforms.

- Financial Infrastructure. Though slower to scale due to longer sales and implementation cycles, the world’s financial infrastructure requires modernization to take advantage of technologies like AI and onchain finance.

- Lending. Lending remains underpenetrated and ripe for innovation beyond unsecured consumer credit, especially in business and secured lending. As noted, new tailwinds are emerging that will support growth in this area.

Where We Go from Here: Calls to Action

As fintech enters its next chapter, regulators, investors, fintechs, and banks each have distinct roles in sustaining the industry’s momentum:

- Regulators must move faster—particularly in AI and digital assets. Harmonizing regulations across jurisdictions and investing in critical digital public infrastructure (for example, real-time payment systems) will promote competition and financial inclusion. Clarity is more powerful than caution, and the pace of innovation demands a more responsive regulatory posture.

- Investors have a critical role to play—not out of goodwill, but because opportunity lies in underpenetrated verticals and in emerging regions where unmet needs persist. Capital deployed here is more likely to back the next wave of scaled winners. Investors also are key to accelerating AI adoption and enforcing growth discipline.

- Fintechs, at all stages, must continue to relentlessly focus on the fundamentals in areas such as pricing, compliance, and capital allocation. Early-stage players can win by targeting unresolved pain points with new business models and technologies. Scaled fintechs must double down on their home markets, pursue strategic M&A where logical, and embed AI deeply into their product and operations—or risk falling behind.

- Banks are far from passive observers. They must move beyond incrementalism on AI to unlock productivity and innovation, pursue fintech partnerships strategically, and develop clear digital asset strategies—especially in high-potential areas like asset tokenization.