This article was developed in collaboration with Customs Support Group.

Customs management has long been treated as a necessary administrative function—complex, technical, and often delegated to large external brokers or local specialist providers in what used to be a relatively stable environment. For many companies, it’s managed quietly in the background, far from senior executive decision making.

This mindset is no longer tenable. According to data from the World Trade Organization, the World Bank, and UNCTAD, customs authorities levied an estimated $600 billion to $900 billions in tariffs in 2024. That’s almost 1% of global GDP, a figure that could double as trade tensions rise. Meanwhile, global trade is becoming more fragmented and less predictable, rules of origin for products traded around the world are tightening, and carbon-related border measures and sanctions are expanding.

These forces are not new, but the frequency of their fluctuations is accelerating and their operational impact has become increasingly material, even as companies face growing pressure to improve margins, respond faster to market shifts, and manage geopolitical risk.

In this context, customs management is emerging as not simply a regulatory hurdle but a material driver of performance. When embedded into sourcing, product design, supply chain management, and planning decisions, customs considerations can reduce landed costs, accelerate time to market, and build resilience against disruption. Companies that act now to reframe customs management as a more strategic capability can gain a real competitive edge.

BCG recently partnered with Customs Support Group, a leading European customs broker, to explore current industry trends based on CSG’s experience working with European import/export companies and the steps companies are taking to introduce new customs management practices. We outline the hidden costs of inefficient customs operations, present five strategic levers to unlock value, and define five organizational enablers that support long-term transformation.

From Cost Burden to Business Lever

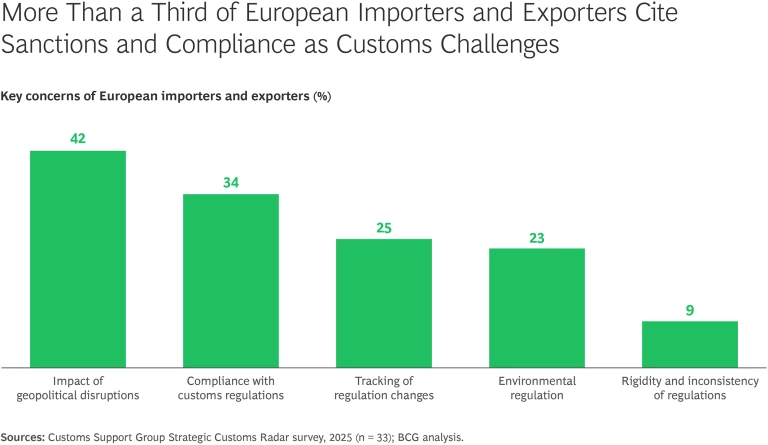

The current global trade environment, and especially sanctions and compliance issues, is putting increasing pressure on all companies that move goods across international borders. As the results of a recent survey show, only geopolitical disruption tops customs compliance as a critical challenge for European importers and exporters. (See the exhibit.)

Stay ahead with BCG insights on transportation and logistics

Among the issues is cost visibility. Because customs costs are fragmented across logistics, tax, legal, and finance, they are hard to measure, typically underestimated, and rarely visible as such in the P&L. But they are significant—and damaging to competitiveness. Among the causes:

- Delays. Customs clearance times in Europe average between two and three days, according to World Bank and UN estimates. Clearance delays drive up inventory costs and, in the case of perishables, can result in missed sales or complete write-offs, particularly for cold-chain shipments of pharmaceuticals or produce.

- Errors. Preventable classification and documentation mistakes cause 20% to 40% of shipment delays, judging from the experience of customs brokers.

- Fees. Demurrage and detention fees charged to shippers for container storage often exceed several thousand dollars per container, depending on location and commodity.

- Penalties. Retroactive documentation audits by customs authorities can generate up to ten years of customs fee corrections, with added interest and fines.

- Missed Recovery. Duty overpayments due to the underutilization of free trade agreements (FTAs) or misclassification of products routinely reach seven figures annually for global importers.

Rather than continuing to simply bear the many hidden costs of customs, leading companies are treating customs compliance as a strategic capability. By building customs considerations into their sourcing platform, for example, procurement teams can see in real time how the origin of materials and components affect landed costs under different agreements. This strategy results in substantial reductions in average duties paid on sourced components—around 10% less in the case of one global OEM.

Rather than continuing to simply bear the many hidden costs of customs, leading companies are treating customs compliance as a strategic capability.

Companies that have integrated their customs activities into sourcing, design, and planning have benefited in four ways:

- Margin protection through better product classification and reductions in trade agreement duties and taxes

- Speed to market via pre-submission of customs paperwork and simplified customs clearance processes

- Risk reduction through fewer adverse audit findings and less rework of customs declarations due to mistakes, customs questions, and other issues

- Operational agility amid sourcing shifts, regulatory changes, and trade disruptions

The difference between leading companies and others can be significant. For example, a recent client paying about $100 million annually in duties and taxes to import industrial equipment in Europe generated cost savings of around $5 million through better customs management. This was the result of more accurate product classification leading to lower duties and taxes, reduced fines and noncompliance penalties, more automated processes driving more consistency and productivity, and faster turnaround, which generated working capital savings. The company’s reinforced customs capabilities have also been instrumental in improving its resilience in the face of disruption, providing increased transparency, and enabling it to rapidly optimize costs following changes in its supply chain configuration.

Five Strategic Levers to Unlock Value

Across industries, five strategic levers have emerged as critical to unlocking value from customs management, not just by reducing costs but through greater speed and resilience and better decision making.

Integrate customs into sourcing and product design. Many customs-related costs originate long before a shipment is sent. Decisions made during supplier selection, materials specifications, and product design often lock in duties, classification complexity, and rule-of-origin limitations. By embedding customs intelligence into upstream workflows, leading companies are turning cost avoidance into a design principle.

A large pharmaceutical company, for example, reduced its average landed cost by around 12% by adjusting packaging and formulation to fall under more favorable classification rulings. In addition, tariff simulation tools integrated into ERP systems now allow procurement teams to compare supplier options based not only on price or lead time, but also on the duty implications of product origin and material composition.

Centralize data and governance. In most global organizations, customs data remains siloed across brokers, countries, and IT systems. This limits visibility, slows down decision making, and increases the risk of noncompliance. As a result, collecting and validating the data required to file customs declarations is time-consuming and often carried out manually, with multiple parties communicating by email and phone. The share of exporters, importers, and customs declarants using digitized data or relying on automated workflows supported by intelligent document processing—including systems using AI-powered solutions to extract, validate, and process data from trade documents—represents less than 50% of the market in the EU, according to top customs brokers.

Centralizing data across declarations, duty payments, product metadata, and classification records creates a strong foundation for audit readiness, smarter analytics, and improved control. The visibility provided by centralized customs platforms allows companies to monitor trends, identify anomalies, and align customs logic globally. Predictive audit tools can simulate customs authority logic before filing, flagging high-risk declarations and reducing audit exposure.

Develop cross-functional customs capabilities. Customs sits at the intersection of numerous corporate functions, including tax, legal, finance, logistics, supply chain, and IT. Yet in many organizations, it lacks a clear owner and all too often resides in just one functional silo, such as operations. High-performing companies are building enterprise-wide capabilities underpinned by shared governance, centralized teams, and consistent execution standards.

Global “control towers” are now used to monitor broker performance, validate classification accuracy, and track FTA eligibility in real time across markets. Shared service centers bring consistency to documentation and filing, while governance forums align customs policy with broader business objectives.

Generative AI tools are increasingly being implemented to train customs teams in intelligent document processing, keeping track of regulations, and monitoring and managing other contextual data. In the case of one importer, applying AI-based automation to documentation workflows reduced processing time by 50%, freeing up skilled staff for higher-value work.

A cross-functional approach can even support the sharing of critical supply priorities across the extended value chain, which is key to securing a company’s overall performance. If manufacturing, for instance, is running low on essential materials and risking plant shutdowns, the organization must ensure that customs teams will prioritize the clearing of those supplies over less urgent or more abundant materials.

Make customs infrastructure responsive to change. Trade policy is increasingly dynamic. Sanctions, tariffs, and regulatory changes can emerge overnight, forcing rapid shifts in sourcing, route adjustments, and changes in documentation requirements. Static customs operations cannot keep up.

Modular and adaptive customs systems allow companies to respond quickly to these shifts. One technology company shortened lead times by 15% by pre-clearing products through bonded zones and digitizing document flows. In the food and pharmaceutical sectors, real-time IoT tracking is being used to provide evidence of condition, location, and compliance and thus reduce spoilage and inspection rates.

Use AI and automation to scale decisions. The sheer volume and complexity of customs decisions that must be made across thousands of SKUs, jurisdictions, and shipments makes customs an ideal domain for AI and automation. This is especially true given the mix of inconsistent rules; high-volume, frequently unstructured data; and repetitive processes inherent in customs activities. Rather than simply replacing manual work, AI enables more accurate, consistent, and proactive decision making.

The sheer volume and complexity of decisions that must be made across thousands of SKUs, jurisdictions, and shipments makes customs an ideal domain for AI and automation.

Based on an analysis of 1 million customs declarations, AI-powered classification tools now deliver greater than 85% accuracy in assigning customs-related product codes and can flag inconsistencies between product specifications and customs declarations. Some companies are using historical shipment data and AI-based review engines to recover previous duty overpayments. Generative AI is also proving valuable in summarizing trade regulations, drafting declarations from invoice and bill-of-materials data, and bringing to light duty recovery opportunities buried in unstructured text. It can even be used to train frontline staff by providing real-time, context-sensitive guidance.

A further opportunity lies in combining traditional digitization with the use of AI agents to manage edge cases that are hard to digitize. Here, AI agents can take a central role in carrying out customs processes from end to end, gathering relevant data from all parties, validating it, and submitting it in the required systems. Together with more advanced data sharing across the up- and downstream value chain, agentic AI will be able to reduce the considerable effort involved in customs management.

By enabling faster clearance and fewer errors, AI and automation have the potential to enable customs teams to compress time, reduce risk, and scale expertise across their companies’ global operations. Indeed, 42% of respondents in the recent customer survey see innovation as key to increasing efficiency. At the same time, however, 27% worry that AI could pose risks to customs compliance, as well as delays or even fines and reputational damage, emphasizing the ongoing need for human oversight.

Five Near-Term Actions

Customs management transformation requires more than a few process upgrades. Leaders are investing in five core enablers that build lasting capabilities across the organization:

- Make customs a strategic capability. Customs should be treated not as a transactional function but as a lever for business performance. That requires reframing it as a core part of value creation, linked to sourcing, pricing, product design, and supply chain strategy. Senior leadership must champion customs as a capability that protects margins, enables agility, and mitigates risk.

- Create data insight capabilities. Effective customs performance depends on the ability to generate insights, not just process data. Leading organizations invest in data fluency across customs teams, link trade data to commercial and operational KPIs, and embed decision logic where it can shape outcomes. The goal is not simply visibility but actionable intelligence.

- Embed analytics and AI into workflows. Analytics and AI are valuable only when tied to real decisions. High performers integrate predictive tools into core customs workflows, helping teams prioritize risks, assess classification scenarios, and identify opportunities for recovery of duties paid. These capabilities accelerate execution while raising confidence and control.

- Institutionalize cross-functional ownership. Customs is inherently cross-cutting. Top organizations align functions such as tax, legal, logistics, procurement, and IT under shared objectives and clearly defined governance mechanisms. This enables faster alignment on classification policy, broker strategy, and compliance positions. Central teams play a critical role in scaling expertise and enforcing standards.

- Monitor markets continuously. Trade policy will continue to shift, and customs regulations will keep changing. Companies must build the organizational muscle to adapt through scenario planning, modular playbooks, and cross-market coordination. Agility is not just about process flexibility; it’s about developing leaders and teams who can anticipate change, make trade-offs, and act decisively when conditions shift.

In a world of uncertain trade policies and geopolitical disruption, customs management is becoming an increasingly important source of competitive differentiation. Companies that move now to boost their customs capabilities—investing in strategy, structure, and smart tools—will reduce cost, improve responsiveness, and strengthen resilience.

The next operational edge in global trade likely won’t come from faster freight or cheaper suppliers. It will come from smarter customs management.