The C-suite needs a new toolkit.

In response to new US bilateral tariffs, domestic and international companies subject to material tariff impacts have stood up dedicated response units. These cross-functional teams assess their companies’ strengths and vulnerabilities in the face of tariffs and then orchestrate targeted adjustments to product designs, pricing, manufacturing, and supply chain networks. They act as centralized hubs for real-time competitive intelligence, operational coordination, and strategic responses to tariff shocks and regulatory uncertainty.

But in a complex and fast-changing environment, these teams often lack the necessary tools. It is not uncommon for a global company to manage more than 10,000 SKUs, thousands of suppliers, and trade flows across as many as 70 countries. Meanwhile, US tariff rates now vary widely, with the majority anywhere between 0% and 50%. Big swings have occurred within single news cycles. Since January, the White House has issued more than 40 executive orders and 120 social media posts about trade and tariffs, affecting more than 19,000 tariff subheadings.

Manual calculations cannot keep up, and a single miscalculation can cost millions. Without real-time digital tools, decision making is reactive, fragmented, and risky. Companies struggle to coordinate across units, products, and markets.

The answer lies in real-time analytics platforms that automate complex classifications, simulate supply shifts, capture indirect exposures, and forecast margin impacts. These tools are available, but they can vary significantly. Each has distinct capabilities and limits, and rapid policy changes can render them obsolete. Companies need to think through questions such as tool functionality, data access and availability, and regulatory risk.

Below we explore the tools companies need to address the tariff-related issues that they face. (Full disclosure: BCG offers its own AI-enabled tariff response toolkit that can help analyze new developments and their financial and operational impact, which our clients are using to good effect. But we also believe that companies should choose the best tools for their own circumstances.)

Taking Charge of Tariffs

It’s clear that in addition to tariffs, increased uncertainty will remain a factor to deal with for the next few years. Not only can costs vary if tariff rates change, but tariff levels can change both absolutely and relative to other companies, countries, and products depending on bilateral negotiations, including those that are not just about trade. Tariff response units should be more than ad hoc teams; they need to evolve into advanced, always-on, AI-enabled capabilities that are integrated into the business.

Companies need both the right operating model and advanced tools that combine automation, advanced analytics, and AI-driven insights to enable faster, smarter decision making. These tools can give a company measurable advantages across such performance indicators as cost avoidance, reconfiguration speed, trade compliance, margin protection, supply chain resilience, and mitigation and supplier negotiation. They also make possible complex strategic scenario modeling and simulation.

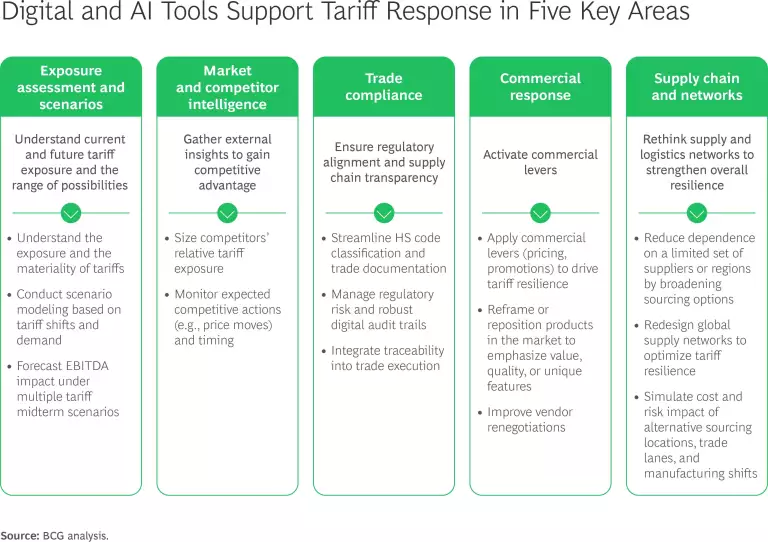

In our experience, the right tools can make a big difference in these five essential areas (see the exhibit):

- Exposure assessment and scenarios

- Market and competitor intelligence

- Trade compliance

- Commercial response

- Supply chain and networks

Exposure Assessment and Scenarios. Tariff response units must be able to quickly size the potential impact of tariffs and tariff changes on the business. Digital and AI tools can help assess not only the direct impact of a new development but also exposure across the full supply chain, including pass-through or indirect exposure, even for companies that source domestically. By breaking down the individual components and sources of second-tier products, companies can gain a better sense of upstream costs, allowing them to more effectively renegotiate contracts or find alternative suppliers.

These tools, which update almost instantly as tariff rates change, also enable iterative scenario planning, which likewise leads to more informed contract negotiations with suppliers. AI-driven scenario planning tools allow companies to simulate the effects of geopolitical shifts and different tariff developments and test sourcing options.

The right technology makes it easy to quantify tariff-driven cost increases and forecast EBITDA impact under multiple tariff scenarios. For example, AI-derived trade intelligence helped a large retailer discover that its indirect pass-through costs were more than twice its direct exposure. Mapping these tier 2 inputs resulted in vendor negotiations and supplier shifts that have produced valuable cost savings.

Market and Competitor Intelligence. External perspectives provide real-time competitive advantage. Users of digital tools can gain insights into the relative tariff exposure of competitors by checking news feeds, mining competitor earnings calls and financial filings, and reviewing company shipping records and product information on websites. They can also monitor competitive actions, such as price moves, supply chain reconfigurations, and market shifts. Intelligence tools don’t just highlight where companies are advantaged or exposed versus competitors, they also allow for decisive action. Companies can determine whether to raise or lower prices, when to move, and whether to defend or capture share. A global medtech diagnostics player used agentic AI to track competitor moves in near-real time, quantifying EBIT exposure and spotlighting areas of advantage in product lines and markets.

Competitor and market insights can also inform the redesign of companies’ own supply chains and the reconfiguration of networks. Firms stay ahead of market shifts by turning raw data into insights they can act on in an environment that changes by the day.

Trade Compliance. A wide selection of trade compliance systems and platforms helps response teams in at least two ways. They can streamline trade documentation and the classification of harmonized system (HS) tariff codes, as well as monitor tariff and regulatory updates, helping companies stay compliant and avoid potential penalties, which can be substantial. As a result, response teams can more easily gain transparency into supply chains, manage regulatory risk, and integrate traceability into trade execution with robust digital audit trails. A major US retailer used machine learning to infer metals content at the SKU/BOM level and support supplier attestations and documentation collection, minimizing its exposure to Section 232 steel and aluminum tariffs and avoiding penalties.

Compliance tools add further value by helping to assess ways in which compliance levers can be used more routinely and effectively to reduce tariff impacts. Examples include redesigning products to reclassify their HS codes or using the first-sale rule to achieve lower customs values. For example, if a product imported into the US from Canada or Mexico complies with the provisions of the US–Mexico–Canada Agreement, it could be subject to zero duties as opposed to 25% or 35%.

Commercial Response. Companies strengthen their commercial response and tariff resilience by deploying targeted levers—such as segmented pricing, smart promotions, and strategic positioning—to safeguard margins without undermining competitiveness. These tools provide clarity on suppliers’ exposure and—by making clear what is truly at stake—turn that insight into informed negotiations and decision making.

AI-powered platforms, dynamic pricing engines, and scenario modeling equip businesses with real-time, data-driven insights that anticipate cost shocks and precisely adjust pricing, promotions, and assortments—while also uncovering new demand opportunities. These capabilities deliver immediate margin relief through agile pricing tactics and simultaneously build long-term advantage via supply chain diversification and resilient decision making. In addition, they help companies track competitor behavior, such as pricing patterns and promotional timing, enabling them to anticipate moves and calibrate responses. A global medtech company’s tariff task force used tariff and pricing data analytics to reprice SKUs, reset terms, and re-source selectively, which has so far enabled it to offset most of the 2025 tariff impact.

Supply Chain and Networks. In the short term, firms have employed resilience measures such as stockpiling. For the medium term, though, they will need to look at redesigning global networks for efficiency and resilience and factoring in rules of origin considerations. Digital tools and AI can support both: improving demand forecasting and inventory management today, while simulating network alternatives and rules of origin impacts to guide sourcing and manufacturing locations in the future.

Redesigning global supply networks involves optimizing tariff resilience for both manufacturers and suppliers. For the former, companies can leverage alternative strategies, such as reshoring. Digital tools can help simulate the costs and risks of different sourcing locations, trade lanes, and manufacturing sites. For the supply chain, AI enables smarter supplier diversification, helping firms explore near-shore and offshore alternatives quickly and negotiate better terms. AI can simulate costs, risks, shipping delays, and regulatory compliance in seconds, facilitating decision making based on facts rather than intuition. One apparel manufacturer used data-driven trade intelligence to identify alternative sourcing and rebalance production away from high-tariff lanes, reducing its tariff exposure by more than 25%—and fully mitigating the impact under some modeled scenarios.

Stay in Command

As with anything involving AI, active supervision by skilled staff, rules of use, and guardrails are important. Tools are useless unless you have the operating model to leverage them and the skills to understand what they reveal. Expert review is essential. AI can hallucinate, and digital tools may have limitations in handling borderline classifications, subtle exemptions, and case-specific rulings.

AI is only as good as the data it has access to—and staying agile when managing tariffs demands real‑time, highly detailed information. This means tracking thousands—often millions—of SKUs and mapping each to standardized trade codes. In the US alone, the HS system spans more than 19,000 tariff lines, with different schedules for each country of import. Without the right access and complete integration with internal and external data sources, algorithms won't know how many factories are sold out, the benefits of shifting production to a new country, or whether it’s a good idea to forge new vendor relationships.

Human judgment remains essential to interpreting ambiguous rules, lobbying for exceptions, and dealing with live enforcement. Strategic decisions, such as whether to absorb tariffs, pass them on to customers, or shift production, require cross-functional consideration of the tradeoffs. Tools can inform, but ultimately humans need to make the decisions.

Tariffs will almost certainly evolve, but they are unlikely to go away. They have quickly become a source of revenue for the US Treasury. And history shows that tariffs can be sticky. For example, the Biden Administration mostly maintained the duties levied by the first Trump Administration.

Tariff monitoring, management, and response are now everyday requirements. Moreover, tariff response units are starting to evolve into policy response centers that monitor regulatory changes at the international, national, and state levels, as well as geopolitical events and important policy fields, such as climate and sustainability, public health, tax, and investment incentives. All of this puts well-equipped response teams front and center for the C-suite. Superior capabilities are a source of competitive advantage that can be continuously reused and may grow in importance over time. Having the right digital tools is essential.