The US government’s steep new tariffs—and the retaliation by key trading partners—stand to disrupt most consumer product categories. While a few industries have received lower tariffs or exemptions, there’s no similar relief in sight for others, including the US beauty industry. The 145% tariffs imposed on most imports from China are exerting pressure on beauty brands, which also face additional 10% tariffs on imports from the rest of the world. Like companies in other industries, beauty players are also bracing for higher tariffs from dozens more countries, depending on the outcome of negotiations.

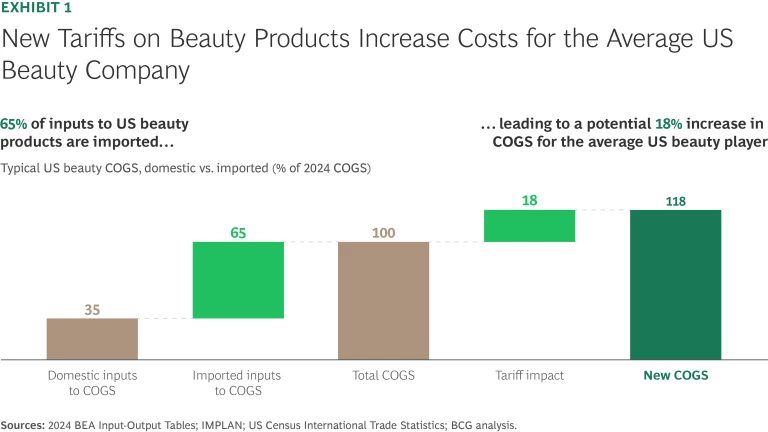

With imports representing two-thirds of the beauty industry’s product costs, the tenfold surge in the US tariff rate for beauty products, weighted by trade volume—to 30% versus the 2.4% average in 2024—has abruptly reshaped consumer dynamics and the competitive landscape. (See Exhibit 1.) Beauty brands must navigate the highest tariff rates in a century just as consumers are showing less confidence in the economic outlook and uncertainty is growing.

The industry has shown resilience during past downturns and has maintained positive growth over the past year even as categories like apparel, jewelry, and luggage turned negative. While the industry’s resilience is being tested, this also presents opportunities for brands that can adapt strategically.

The degree of disruption will vary significantly. Large companies with negotiating leverage, pricing power, and ample cash reserves will be better able to absorb these costs than smaller brands that lack this kind of scale. The largest companies, with their own factories and vast networks of suppliers, also have the ability to shift production as needed to lower-tariff countries. More vulnerable are the young upstart brands that have poured significant resources into building their market share. Many of these smaller brands rely on just one or two contract manufacturers, making it harder to shift production quickly. Without this flexibility, the new tariffs threaten to wipe out their already narrow margins.

Five Strategies to Combat Margin Erosion

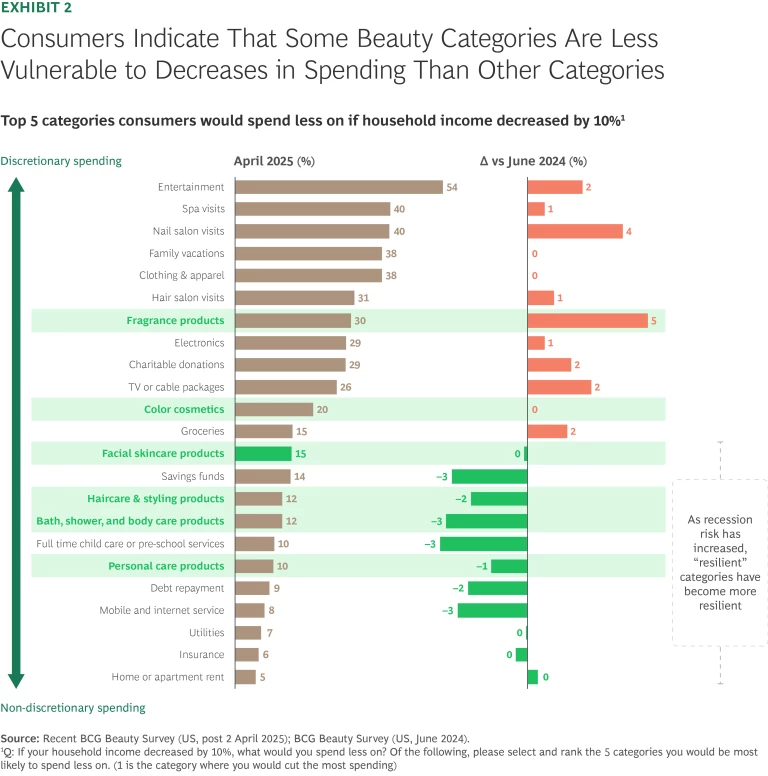

In past recessions, US beauty fared better than other industries: For example, when the COVID-19 pandemic spread in the second quarter of 2020, sales of beauty and personal care products stayed flat, while cosmetics, clothing, and jewelry fell 7%, 16%, and 19%, respectively. This resilience is driven by strong customer loyalty, as shown in the latest BCG Beauty Survey of 2,000 consumers. While categories like fragrance and color cosmetics—typically purchased for nights out and special occasions—could face reduced demand, daily essentials like shampoo and other personal care products are likely to remain resilient, mirroring trends from the global financial crisis and pandemic. (See Exhibit 2.) This demonstrated customer loyalty may cushion the impact on US beauty brands compared with companies in sectors like travel and apparel.

However, loyalty alone cannot fully insulate companies from the impact of tariffs. Beauty brands are scrambling to adapt, trying to mount a short-term response while factoring the risks of ongoing trade negotiations into longer-term strategy. Success requires a coordinated approach on both fronts—crafting a tactical response for the next six to 12 months and building long-term resilience. These five short-term moves can help companies maintain positive margins in the tariff-driven economy.

Establish a Cross-Functional Command Center. Beauty companies should create dedicated teams that can provide real-time insights and respond quickly to tariff changes and other market forces. These command centers should include representatives from the supply chain, finance, and marketing function to ensure decisions are made quickly and transparently.

Gameplan Supply Chain Impacts. Beauty brands can use predictive analytics to map out potential disruptions and adjust their procurement strategies. Given the industry's reliance on ingredients from around the world, companies should prioritize securing raw materials critical to their biggest money-makers. For luxury brands, this might involve safeguarding access to rare ingredients, while mass-market brands may focus on ensuring the availability of high-demand staples.

Adjust Your Supplier Mix. Diversifying suppliers and negotiating shared costs can help companies reduce their exposure to tariffs. Prioritizing vendors in lower-tariff regions can further minimize cost increases while maintaining flexibility in supply chains.

Leverage Tariff Exceptions. Exploring compliance strategies and tariff exemptions can help lower costs. Consulting trade experts could uncover eligibility for duty drawbacks or the use of special economic zones to further reduce the burdens of the new tariffs.

Strengthen Financial Resilience. Proactively managing cash flow is critical as tariff-induced price hikes squeeze margins. Luxury brands, with their higher pricing power, can focus on strategic price adjustments, while mass-market players may need to implement cost controls across operations to maintain affordability for price-conscious consumers.

Stay ahead with BCG insights on the consumer products industry

Long-Term Moves to Build Resilience

While short-term actions can help stabilize margins, beauty brands must also prepare for the possibility that higher tariffs could remain in place for years. This requires a secondary focus on long-term strategies that reinforce brand loyalty, capitalize on scale or any other advantages, and create innovative products to fit the new order.

Optimize Design to Value. For luxury brands, this might mean enhancing signature products to justify premium pricing, such as sustainable packaging or all-in-one formulations. Mass-market players can reduce costs by streamlining product lines to focus on high-demand staples that align with customer priorities.

Diversify the Supplier Base. Investing in shorter lead times and flexible supplier arrangements can reduce future risks. Large companies, with their scale, can negotiate more favorable terms, while smaller brands should focus on deepening relationships with regional suppliers that are highly reliable.

Pursue M&A Opportunities. Shifting market dynamics may create opportunities for mergers and acquisitions, particularly in underperforming segments. By acquiring niche brands—particularly those with cutting-edge products or loyal followings—companies can strengthen their portfolio while hedging against future economic shifts.

Invest in AI-Powered Marketing. Advanced analytics can help beauty brands identify growth markets and target consumers effectively. The new AI tools can be valuable in creating personalized marketing campaigns—raising engagement and conversion rates across a range of customer segments.

The Future of Beauty in a Tariff Economy

Despite the latest challenges, the US beauty industry remains a symbol of resilience. While tariffs and inflation have reshaped the outlook, beauty brands have an opportunity to innovate and adapt. By addressing the new cost pressures and leveraging consumer loyalty, the industry can maintain its strong relationships with customers.