In a stable market environment, oil and gas operators with strategic procurement and supply chain capabilities typically achieve a cost advantage of 4% to 8% over their peers. But in today’s volatile environment, the advantages are amplified. We estimate that operators can capture a relative cost advantage of 10% to 15%.

By prioritizing security of supply, adopting new ways of working, and harnessing the power of innovation, companies can transform uncertainty into a source of value. They can build resilience, protect margins, and stand out from the rest at a time when these goals matter more than ever. They can also better anticipate and swiftly respond to changing circumstances.

Uncertainty in Procurement and Supply Chains

The dynamics of supply chain costs in the upstream oil and gas sector are changing. After a decade of relative stability ending in 2020, supply chain costs have accelerated sharply over the last five years, rising by a compound annual growth rate of 5%. This shift is creating new levels of risk for companies.

Stay ahead with BCG insights on energy

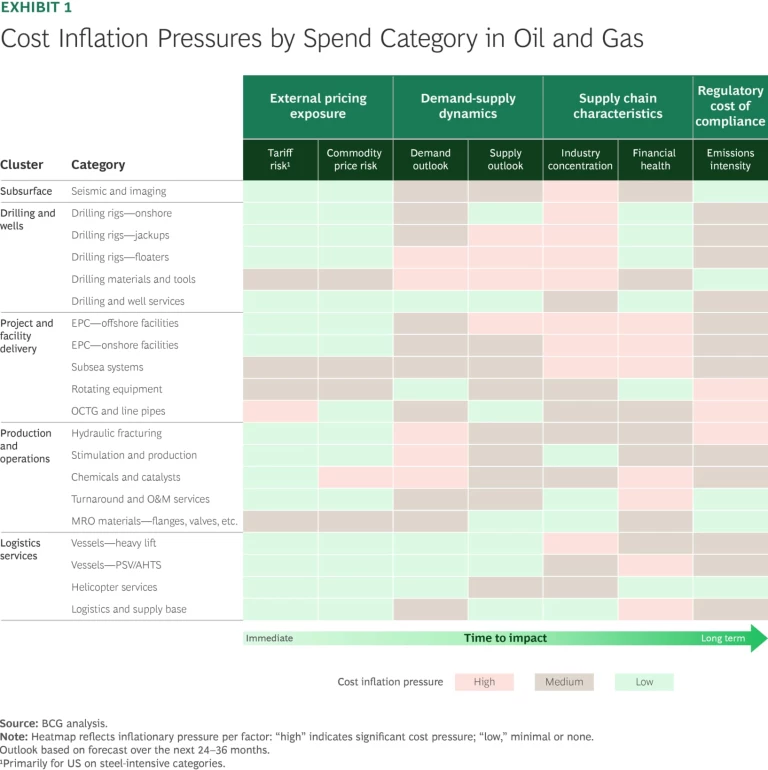

Inflationary pressures remain, fueled by production growth, geopolitical risks, and tight capacity in key categories. Yet, there are some emerging signals of stabilization, including a plateauing of capital expenditure increases, falling commodity input costs, and a rebalancing of regional demand. In this environment, operators must prepare for a range of outcomes. They need to build strategies that take into account the possibility of escalating pressures in some categories and an easing in others. (See Exhibit 1.)

Geopolitical and Trade Uncertainty. Geopolitical tensions and tariff hikes are impacting supply chain costs in key categories. For example, the recent increase in US tariffs on steel has caused the cost of oil country tubular goods (OCTG) used in the oil and gas industry in the US to rise by 25%–35%. Tariff-sensitive steel products, including OCTG goods, valves, and fittings, make up between 15%–25% of drilling costs. Consequently, average drilling costs are expected to increase by 3%–6%. Although the global outlook indicates a decline in commodity steel prices, which may offset the impact of tariffs on steel products, geopolitical tensions and tariff uncertainty could lead to further cost inflation and volatility in oil and gas supply chains. They could also dampen demand and companies’ appetite for investment.

The Outlook for Capex and Opex. Global capex in oil and gas is set to reach an all-time high in the next few years, driven by increased offshore investments in key basins in Africa, Asia-Pacific, Latin America, and the Middle East, before plateauing. The near-term rise in spending will likely lead to both higher prices and shortages in key categories such as drilling and well services, offshore engineering, procurement, and construction (EPC) services, and subsea equipment.

Furthermore, given an even greater increase in investment, annual capex in the offshore wind sector will be only 10% lower than that of offshore oil and gas by 2030. We expect to see competing demand and higher prices for supply chain assets, such as offshore installation vessels, that are used by players in both sectors.

Opex in oil and gas, meanwhile, shows no signs of flattening out. It is expected to rise at a compound annual growth rate of 2%–3% driven by production increases and higher costs linked to aging assets and a more complex operating environment, placing further demand pressure on key equipment and services.

Structural Supply Chain Underinvestment. Even in categories where cost pressures may moderate due to falling commodity prices, capacity constraints continue to define the supplier landscape. Suppliers have structurally underinvested in new capacity for multiple reasons. These include the high costs of capital (with financing rates 300–500 basis points higher than in the 2000s), a mismatch between long investment payback horizons and short-cycle contracting, and the uncertain outlook for oil in the energy transition. As a result, providers of critical equipment and services, such as drilling rigs, subsea equipment, and fabrication yards, are experiencing high utilization rates and growing order backlogs as demand outstrips supply. (See “The Offshore Rig Shortage.”)

The Offshore Rig Shortage

Despite rising prices, underinvestment in rig newbuilds persists. While analysts estimate that 30 to 40 new units are required to meet projected demand growth through 2030, only 8 to 12 floaters are currently under construction. This is in part due to shipyard capacity being utilized for the construction of wind turbine foundations and liquified natural gas vessels which are in high demand. A similar pattern is evident in subsea equipment, with OEMs reporting substantial backlogs and order lead times of 12–24 months. A global shortage of rigs is already causing operators in India and Indonesia to delay drilling and revise their production targets downward.

Maturing and Marginal Oil Fields. Beyond supply chain cost inflation, oil and gas companies look set to face increased margin pressure from other cost drivers. As the share of mature and marginal oil fields in oil and gas operators’ portfolios increases, the cost of production is likely to rise. About 20% of global production currently comes from marginal or mature fields. But the figure is expected to be over 40% by 2050. The production costs of mature, late-life assets can be up to $15 per barrel higher than those of younger assets, increasing the pressure to manage supply chain costs to avoid margin erosion.

Sustainability and Local Content. As companies align to sustainability objectives and local content requirements, associated compliance investments are anticipated to rise. To meet decarbonization objectives, the integration of solutions for methane abatement and carbon capture and storage (CCS) may contribute an estimated $2–$6 per barrel in extra cost. Additionally, regulatory frameworks in key upstream basins are strengthening the emphasis on local content. Such local content requirements can increase costs by 10% to 20% in regimes where domestic supply chains are underdeveloped or lack cost competitiveness.

Unlocking Value: The Strategic Mandate of Procurement

Upstream oil and gas players need to urgently take three strategic actions in their procurement activities and supply chains if they are to successfully navigate the current challenging environment.

Secure a competitive supply of critical at-risk categories. While the severity of the risk differs by geography, six critical categories stand out as facing a significant risk of being in short supply: drilling rigs, well services, subsea equipment, offshore installation vessels, some offshore support vessels, and EPC fabrication services. (See “Navigating an Uncertain EPC Landscape.”) Procurement functions should rapidly take the following steps:

- Harness intelligence-driven decision-making. A combination of market intelligence and deep category expertise is needed to determine the extent of potential supply shortages in specific geographies. Category managers need to leverage up-to-date market intelligence to assess demand and supply dynamics and the outlook for supply chain costs. Equipped with this understanding, procurement can strategically advise internal stakeholders to optimize demand schedules or to lock in supply and prices in advance of inflationary spikes.

- Secure supply through collaboration. Leverage strong, collaborative long-term relationships with suppliers of these critical categories to help secure supply in a constrained environment. Building strong relationships will require greater dialogue between the leadership teams of upstream operators and their suppliers as well as collaborative initiatives and agreements, such as joint capacity planning, collaborative design optimization initiatives, and the operators’ right of first refusal or call options on critical supply chain assets like rigs and vessels.

- Consider vertical integration and alliances. Operators are increasingly exploring new ways to overcome shortages and achieve long-term security of supply. For example, a Middle Eastern operator has pursued a strategy of vertical integration by establishing a separate drilling business while also ramping up rig acquisitions to support its 2030 production target. Its approach has simultaneously secured rig supply in a constrained market while enabling long-term investment into AI and other technologies that can optimize drilling operations and reduce costs. In the North Sea, meanwhile, operators are collaborating with their supply chains to boost the adoption of rigless technologies for well interventions and plug and abandonment activities. Smaller independent oil and gas producers are also exploring geographically based “buyer clubs” to secure limited rigs and optimize drilling schedules for efficiency and cost reduction.

- Enable data-driven vendor development programs (VDPs). Given the structural underinvestment in supply chains and increasing local content pressures, oil and gas operators that invest in shaping their supply chains for the long term stand to create competitive advantage. Based on category-specific needs, operators can strengthen visibility on the long-term demand outlook, optimized contract durations, baseload demand certainty, and support to secure capital for large investments depending on the specific needs of suppliers within a category. Merit-based vendor development programs that aim to secure long-term security of supply for operators and enhance supplier competitiveness do so by ensuring that local suppliers achieve a minimum efficient scale of operations, benefit from technology transfer, and invest in workforce capabilities to drive productivity. Successful VDP efforts have reduced costs by 5% to 8% by avoiding supply shortages, introducing competition, and increasing local supplier cost competitiveness. (See “Creating Resilience in Local Supply Chains.”)

- Establish differentiated agile procurement processes. In volatile markets, procurement pace and agility can be critical sources of competitive advantage in securing cost competitive supply. Procurement can become more agile by adopting distinct sourcing processes tailored to different scenarios, such as a standard process focused on cost savings, a fast-tracked process prioritizing speed, or an innovation-driven process allowing greater scope and budget flexibility. Each sourcing scenario should have defined governance and turnaround times, enabling teams to select the most effective approach based on strategic priorities. For example, an operator facing supply shortages in drilling rigs used a fast-tracked procurement process that focused on upfront alignment on contracting strategies, established a robust cost model to identify a “strike price” for purchase, and reduced the number of approval stage gates in order to move quickly.

Navigating an Uncertain EPC Landscape

To navigate this uncertain landscape, operators must act decisively—and chief procurement officers should lead the way. They must proactively deploy strategic levers to address near-term constraints while building a more resilient supply chain for the future. These include moving toward long-term agreements as well as technology alliances. These alliances should be governed by a competitive tender process while building trust, collaboration, empowerment, and transparency between partners. Likewise, financial incentives should align interests on common goals such as HSE, cost, schedule, productivity and quality, while improving performance through shared risks and rewards. A guaranteed maximum price and lump-sum models are increasingly used to avoid unexpected price escalations. Such measures will not only help mitigate immediate market pressures but also lay the groundwork for partnerships that can endure across market cycles.

Creating Resilience in Local Supply Chains

The first step is building a robust fact base. This means going beyond surface-level mapping and developing a deep understanding of the outlook for each category, the current state of the local supplier landscape, critical capability gaps, and underlying drivers of competitiveness—from access to skilled labor and capital to quality systems and scalability. This understanding enables operators to prioritize action in those categories where local supplier development can move the needle the most: categories with high value-add potential, supply vulnerabilities, or opportunities for economies of scale.

Insights on their own are not enough, however. Operators must also proactively shape their local supply chains to meet future demands. They must move away from traditional transactional sourcing and build local supply ecosystems that not only allow operators to meet local content rules but are also competitive globally. To achieve this, operators need to provide greater long-term demand visibility and deploy enablers such as contracting commitments, co-investment, and structured vendor development programs. Using these tools, they can future-proof their supply chains by helping suppliers to scale efficiently, improve productivity, adopt technology, and deliver to global standards.

Reframe value creation through value engineering. Most procurement functions focus on creating value by using commercial levers, such as bundling parts and services, to drive economies of scale and competition. However, this accounts for only 20% of value creation. The remaining 80% depends upon the optimization of demand and the use of technical levers. Procurement functions must deepen their capabilities and change their ways of working to unlock this often-untapped source of value. Here are three ways they can do that.

- Foster business partnering for demand management. Procurement functions must become strategic thought partners to the business. They need to have a seat at the table and be involved early so they can help shape business demand and requirements. But to earn the right to play, procurement must first invest in deep category expertise, enhance market intelligence, and understand value creation levers. Among leading oil and gas operators, procurement personnel are embedded in the work planning and budgetary processes of the business. In some cases, they have achieved cost savings of up to 15% to 20% by using levers such as joint optimization of demand schedules to avoid price inflation at peak periods.

- Create value from design. Procurement can help unlock technical levers such as avoiding gold plating, adopting greater standardization, and using more of a lifecycle approach to cost through design-to-value techniques. For example, one oil and gas major found that the weight of its offshore platforms had increased by 20% over the last five years, without any material gains in performance. The extra weight stemmed from technical teams adding equipment. A design-to-value study helped to eliminate such “gold-plated” specs and simplify the design of the platform, unlocking 10% to 15% in cost savings.

- Harness supply chain innovation. Category managers are in the unique position of being supplier-facing with key supply companies that are constantly innovating and investing in technology. Category managers should encourage supplier innovation to further unlock value. For example, instead of providing prescriptive design specifications of individual offshore support vessels, a major operator gave its suppliers details of its offshore logistics requirements so they could develop innovative solutions. The suppliers then suggested holistic solutions with an optimal combination of vessel types that met the requirements of the operator while offering cost savings.

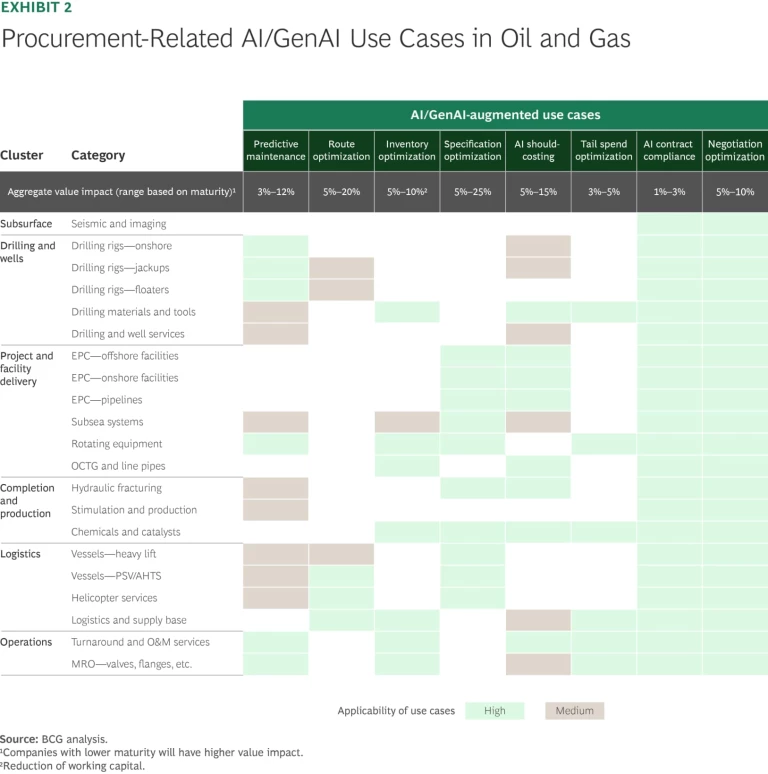

Leverage the transformative power of AI and GenAI. AI offers an opportunity to identify significant value creation opportunities in procurement and supply chain activities. Here are three ways companies can leverage this technology.

- Unlock productivity gains. Around three-quarters of procurement and supply chain activities can be automated or enhanced using AI and GenAI technology. AI co-pilots that act as tender assistants are halving the time needed to produce a request for proposal (RfP) document while improving its quality by incorporating past learnings and industry best practices. GenAI is also being used by leading procurement functions to support supplier engagements, analyze RfP responses and bid comparisons, and propose negotiation strategies. Overall, we estimate there is potential to free up 50%–75% of procurement resources, enabling procurement functions to focus on more strategic activities and unlocking 10%–15% in productivity cost savings on core workflows.

- Drive savings across total spend. Beyond productivity gains, operators are leveraging GenAI to systematically unlock savings among medium-sized and long-tail suppliers. (See Exhibit 2). These suppliers typically contribute 80% of procurement volumes but only 20% of procurement spend. The use of should-cost models, cost indices, and optimized pricing based on shifts in supplier cost structures have been shown to achieve savings of between 15% and 20% on addressable spend. For critical high-spend categories, GenAI is supporting category managers with in-depth category analysis by helping to triangulate and structure different sources of market intelligence, thereby improving decision making.

- Deploy control towers to enhance agility. Leading oil and gas operators are investing in AI-enabled supply chain control towers which dramatically improve the breadth and depth of monitoring of supply chain and supplier risks. As well as providing real-time risk tracking, control towers also offer early warning systems that allow operators to respond quickly and with agility to emerging risks. In addition, companies are using AI to better understand the complex connections between supply chains, including how a single event can have a snowball effect through the supply chain and lead to multiple delays. In today’s volatile environment, this is an important source of competitive advantage.

Faced with significant margin pressures and an uncertain inflationary outlook, oil and gas operators need to prioritize building strategic procurement and supply chain capabilities. Due to the long-term nature of supply arrangements, such capabilities can have a substantial impact on operators’ cost competitiveness lasting over several years. By focusing on the highest impact actions involving the highest at-risk categories, companies can successfully navigate the challenging near-term environment that lies ahead.

The authors thank BCG colleagues Magno Guidote, Stefanie Khaw, Shiva Kant, Pietro Romanin, Martha Vasquez, and Borja Jimenez for all of their contributions to this article. They are also grateful for the contributions of Inverto’s Mohamad Kaivan and Stefan Benett.