After a decade of rapid progress, with costs falling more than 60% over the past decade, the industry is now under pressure, as developers face surging project costs (up 30% to 40% in the past two years), higher interest rates, supply chain bottlenecks, and growing geopolitical uncertainty. Meanwhile, governments continue to push ambitious offshore wind targets. The European Union alone increased its target of 300 GW of installed offshore wind capacity to 360 GW by

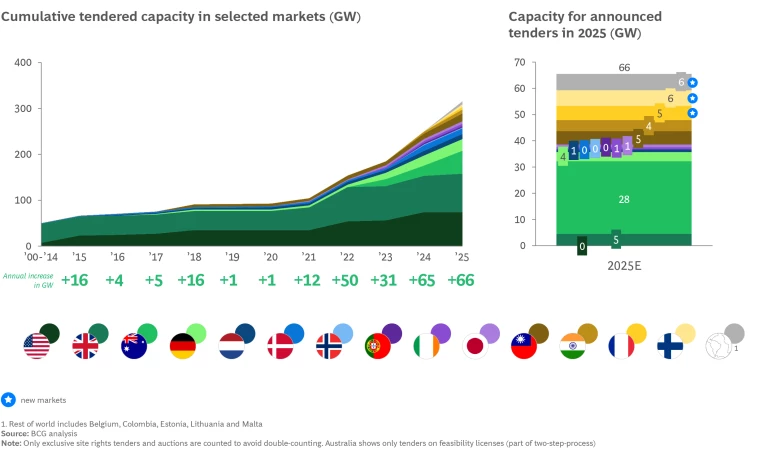

More than 66 GW is expected to be tendered globally in 2025, but competitive intensity is weakening. Developers have become more selective and recent auction failures and delays in Europe highlight the growing gap between ambition and feasibility. Some governments are now actively revising support frameworks accordingly; others risk falling behind.

Meanwhile, the competitive landscape is shifting. Some oil and gas majors are scaling back offshore wind investments, while infrastructure funds and specialized developers are increasingly stepping in. Incumbent developers are refocusing portfolios and deepening partnerships or offloading CAPEX to retain an edge in an increasingly challenging market.

Against this backdrop, 2025 is shaping up to be a defining year. Governments are starting to take action to restore confidence, and developers are increasingly making focused, strategic moves to remain competitive, not only deciding where to play, but how to win and take advantage of the opportunity of the supply-demand imbalance. The big question is whether 2025 will be the turning point year that the industry is hoping for?

This article offers a view of where the offshore wind industry stands today and the strategic choices that will define its next chapter. It explores structural shifts, market responses, and resulting forward-looking priorities for developers.

Stay ahead with BCG insights on energy

Offshore Wind Is Still Navigating a Complex Set of Challenges

Offshore wind has been intensely challenged for the past three-plus years. The following key challenges will remain highly relevant for developers worldwide in 2025 as they rethink strategies and respond to shifting market conditions:

- CAPEX inflation and elevated interest rates

Costs for raw materials, labor, and components have surged by 30% to 50% since 2021, while high interest rates have further strained project economics. This has led to +400 basis point reductions in project margins, and put large pressure on developers to explore major levelized cost of energy (LCOE) savings tactics to compensate for the high cost base. Bottlenecks constraining supply chains

Suppliers across in particular wind turbines, foundations and installation vessel services are facing a combination of low margins, uncertain demand outlooks and long facility expansion lead times. As a result, many are struggling to meet demand for the key services, components, and equipment needed in the coming years, resulting in price increases over the last two years. While we start to observe some normalization of prices to previous levels, the wind turbine costs in particular remain at a high.The build-out of offshore grid connections is behind plan in several countries, creating additional delays.

- Policy misalignment and uncertainty

Geopolitical tensions are driving regionalization of supply chains, but domestic manufacturing build-out has proven to be both slow and capital-intensive. Ongoing trade frictions across the world have led to uncertainty around future sourcing options and resulted in hesitation by OEMs in carrying out needed investments. Meanwhile, misaligned grid, port, and regulatory planning, combined with support mechanisms that are not adjusted for recent challenges, are contributing to auction failures and stalled development. - Revenue compression and value erosion in a buyer’s market

Developers can no longer rely on farm-downs to decrease the CAPEX burden, quickly improve returns, or unload unwanted assets. Oversupply of projects and hesitant buyers are pushing down valuations and complicating financing and exit options - for distressed projects, e.g. in the US you might not find a buyer at all. Additionally, the value of power assets is declining with decreasing capture prices and increasing cannibalization and wake effects, especially in mature markets. - Green Power Demand Lag

Slow industrial and heat electrification, delayed hydrogen infrastructure buildout, weak e-fuel uptake, and stagnating EV adoption in Europe cause slower than anticipated increase of Green Power demand, deteriorating revenue projections for offshore wind farms. Especially energy projects that rely on power-to-molecule conversion, like electrolysers connected to offshore wind farms, face delays.

The Tables Have Turned — Governments Now Compete for Interest

Because of current industry challenges, developer interest in offshore wind auctions has cooled noticeably in recent years. In some cases, this has led to outright auction failures. In the UK, the 2023 auction (Allocation Round 5) failed to attract a single bid. Developers argued that the £44/MWh strike price offered under the Contracts for Difference scheme was no longer viable under current cost conditions. The UK government responded by raising the price ceiling by 66% for the 2024 allocation round, which subsequently awarded 5.3 GW in new offshore wind contracts.

Denmark experienced a similar outcome in 2024, when a tender round for +3 GW of subsidy-free offshore wind received no bids. Developers pointed to several issues, including limited flexibility on project timelines and uncertainty around future power prices, worsened by unclear Danish offshore wind build-out timelines and delays in the ability to export power-to-X products to Germany. In response, Danish authorities paused the tender and committed to redesigning it with more flexible terms to revive investor interest; it later announced a re-launch of the tender with a more flexible timeline and a CfD.

In the first week of August 2025, Germany experienced another failed auction, when the tender for 2.5 GW of centrally pre-investigated sites did not attract any bidder.

These examples mark a reversal from just a few years ago, when developers would compete intensively in a limited number of auctions. Today, developers are becoming more selective, enabled by a global surplus of auctioned capacity and a heightened capital discipline among developers. The tables have turned; it is now increasingly governments that must compete for developer interest, not the other way around.

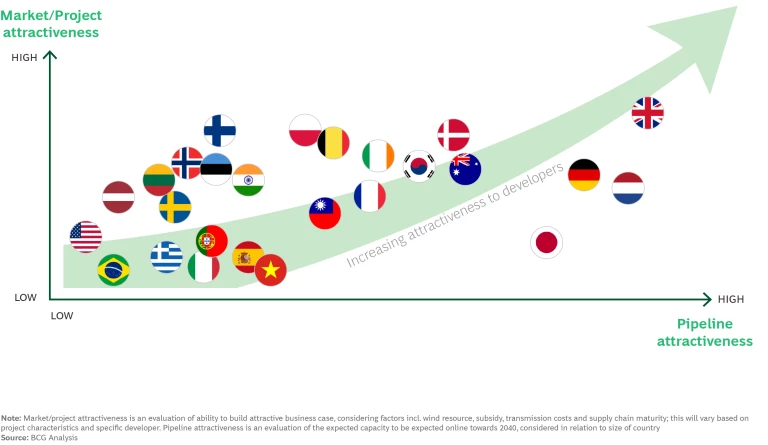

When observing offshore wind markets around the world, there is a wide span in how attractive markets have become to developers. To attract developer interest, markets must both be able to provide clear project capacity outlooks to developers and ensure that the projects themselves are attractive. As project attractiveness is increasingly driven by regulatorily influenceable conditions such as offtake risk protection, transmission payment scope, and general regulatory stability, some markets have been able to re-position themselves as more attractive overall. At the same time, other markets may have been able to mobilize attractive capacity outlooks but have yet to reflect the market reality in making the projects sufficiently attractive. These are facing a major risk of undersubscribed auctions.

Despite these auction challenges and setbacks, tendered offshore wind capacity remains strong in 2025. Governments, e.g., Germany and the UK, have largely maintained their deployment targets, continuing to release large capacity volumes into the market. At the same time, 2025 is seeing a considerable amount of capacity from newer markets such as Australia and India. Announced tenders for 2025 total over 66 GW, with more than 60% of this volume coming from newer markets outside Europe.

Developers Take Distinct Value-Creation Approaches

Developers, in turn, are adapting their strategies to these changing market dynamics. We observe four distinct value-creation approaches emerging among offshore wind developers. Each of these archetypes has contributed to lower auction activity. While all are responding to the same market challenges, their reasons differ based on risk appetite, revenue model, and investment strategy.

- Relentless LCOE focus by scale and efficiency (the “utility approach”)

Traditional utilities and pure-play renewable developers tend to focus on minimizing LCOE. They achieve this in particular through optimization of the technical project setup, with some increasingly moving towards standardized design, shared operations, and repeatable installation methods. This model thrives in markets offering long-term contracts (for example, contracts for difference) or feed-in tariffs, allowing developers to focus on cost reduction while enjoying revenue security. Utilities typically aim to offload electricity price risk to the offtaker, reducing volatility and enabling higher debt levels. As a result, they usually can accept lower project IRRs, supported by their structurally lower cost of capital and limited merchant exposure. Without increased support mechanisms or sufficient demand from large industrial offtakers, utilities’ low risk appetite tends to make them considerably more selective in auctions, especially after the rise in LCOE and interest rates. - Revenue sophistication and CAPEX offloading (the “oil and gas approach”)

Developers with oil and gas backgrounds often focus on maximizing revenues and de-risking upfront investments by pursuing partnerships that allow for substantial CAPEX offloading. These players are frequently willing to carry considerable merchant price risk, supported by sophisticated trading capabilities and their ability to optimize production with integrated energy systems (for example, power-to-X). However, they tend to require higher IRRs, in particular for high complexity projects. Currently, a delayed or immature hydrogen infrastructure and limited system integration opportunities mean that this advantage is narrowing, leading to a partial retreat and limited interest in auctions where value stacking remains unviable. - Optionality through delayed DEVEX and decision-making (the “newcomer approach”)

New entrants and financial investors often adopt a more cautious strategy of optionality, emphasizing flexibility and delaying significant expenditures. Without an existing offshore portfolio or large balance sheet, they secure rights to promising sites (often in a light manner through minority stakes in joint ventures) with minimal upfront costs and defer major decisions, allowing adaptation to evolving market conditions. By front-loading optionality and back-loading commitments, they limit capital at risk in the early stages and preserve the flexibility to adapt or even exit during unfavorable times. This cautious stance can deter these players from participating in the current environment, reducing auction competitiveness. - Hibernation and strategic pause

Some developers have been halting investments and stepping away from previous committed target investments for renewable energy sources. Driven by deteriorated business cases, unpredictable political environments, and even alternatives with the potential for higher IRRs in their core business segments, these developers are pausing or selling off current projects, to either exit or wait for conditions to turn again.

Offshore Wind Recovery Will Require Major Change

We firmly believe in the strong potential of the offshore wind industry. Electrification is accelerating globally, driven by growing demand from transport, industry, and, increasingly, data centers and AI. This demand is not only due to decarbonization targets, but also increasingly superior economics. Offshore wind today provides scalable solutions for this, close to demand centers.

A sustained recovery in the offshore wind sector will not happen on its own; it will require action to structurally change the approach by developers and improve project economics as well as governments stepping in to adjust support mechanisms to the new reality. While the precise trajectory remains uncertain, there are several key signposts to watch for that could indicate a turning point toward renewed market momentum. These indicators may first emerge in select markets before shaping global industry dynamics:

- Improved revenue certainty. Recovery is likely to be driven in markets that introduce stronger support mechanisms that enable developers to recover elevated input costs and lock in viable returns. This can be observed in Europe, with recent examples in Denmark and the UK, while other countries are contemplating action.

- Lower LCOE. There are signs of a reduction in the supply chain cost base as material costs are stabilizing and interest rates have generally fallen. From there, a reset in supply chain pricing, either through recovery of the supplier base reducing price or the expansion of new suppliers into Western markets, can drive down LCOE and increase project viability and attractiveness.

- Further industry consolidation. The market is likely to undergo a pullback and rationalization among players that previously pursued overly aggressive bidding or expansion strategies. Portfolio divestments and a slowdown in new entrants are expected to ease competitive intensity. At the same time, greater portfolio focus and strategic repositioning will enable developers to prioritize higher-quality projects, driving stronger bids and ultimately leading to more successful project delivery.

While the first signs of recovery are starting to show, we anticipate that the needed industry reset will take several years to complete. We expect a gradual and slow recovery, from a low-point in 2025.

Five Forward-Looking Priorities for Offshore Wind Developers

Change will not come on its own. Success will require difficult choices, cross-functional coordination, and a willingness to rethink established ways of working. We see five priorities for developers today to remain competitive and play a critical role in shaping a resilient, scalable, and mature offshore wind market:

- Redefine portfolio development strategy: Reassess attractiveness and relevance of markets, auctions, and projects to ensure cost discipline without compromising long-term market competitiveness.

- Reduce DEVEX while safeguarding development quality: Further prioritize market presence, deploy development teams smartly, utilize low-commitment bids, and postpone investments until clear value to save DEVEX.

- Pursue strategic M&A for scale and capabilities: Closely monitor markets for opportunities to grow through acquisitions of projects or even platforms/developers to secure new value-accretive capacity.

- Fine-tune operating model for flexibility: Adopt a more cost-light, flexible operating model, e.g., by offloading DEVEX and CAPEX via joint ventures or partnerships with financial investors.

- Use step-change approach for LCOE reduction: Set bold, top-down LCOE ambitions, translate into concrete LCOE targets per unit, and drive bottom-up effects with business units to identify additional value.

About BCG’s Offshore Wind Team

BCG is a trusted thought partner to offshore wind developers, investors, and policymakers and has been on the industry’s forefront since its early days. Our global offshore wind team combines deep sector expertise with a proven track record and capabilities in cost optimization, supply chain, capital projects, and competitive auctions. We’ve supported clients responsible for a significant share of global installed capacity and advised on landmark tenders across Europe, Asia-Pacific, and the Americas.

BCG’s offshore wind practice’s key capabilities include:

- Strategy and market entry, where we assist companies in assessing where and how to compete (for example, which emerging markets or technologies to invest in).

- LCOE and cost-out programs, driving design-to-cost and operational excellence to deliver competitive projects.

- Supply chain and partnership development, helping clients secure critical supply agreements, local content strategies, and alliances that de-risk execution.

- Digital and advanced analytics, applying tools like probabilistic simulation and AI-driven design optimization to improve project planning and performance.

- Concept and revenue optimization, assessing optimal configurations and offtake strategies to improve project value and long-term revenue capture.

- Tender and auction advisory, leveraging BCG’s Global Center for High-Stakes Auctions to craft winning bid strategies and maximize chances of success.

- Transaction support, advising clients on farm-downs, asset sales, and acquisitions, helping clients with high-stakes investment decisions.

BCG’s work in offshore wind is rooted in our commitment to innovation and impact; we see the sector as a vital lever in the climate transition. That’s why we develop methodologies like the win-cost approach and actively collaborate with governments, regulators, and financiers across the ecosystem. We work side by side with client teams to deliver solutions that are practical, cross-functional, and implementable.