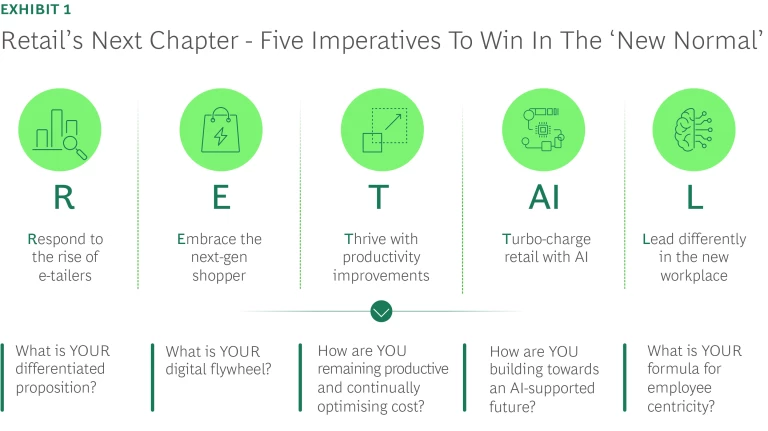

Retailers in Australia today face a fundamentally altered landscape defined by five disruptive forces:

- e-Tailers like Amazon, Temu and Shein, which were not considered sizeable competitors a few years ago, are growing their market share and reshaping consumer expectations

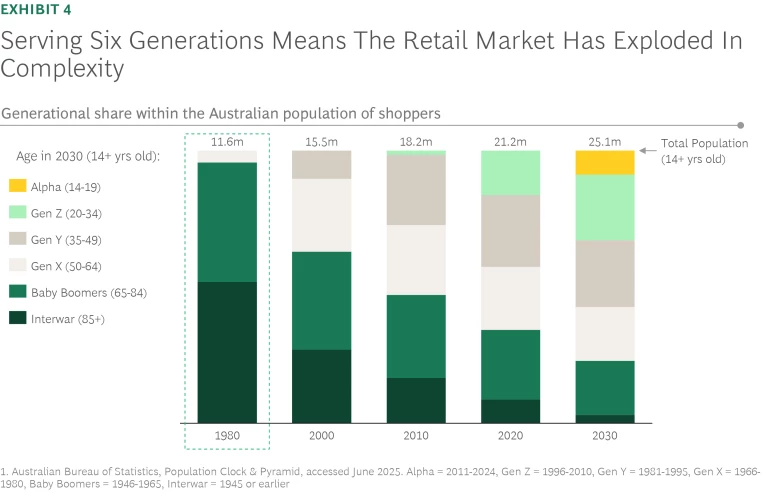

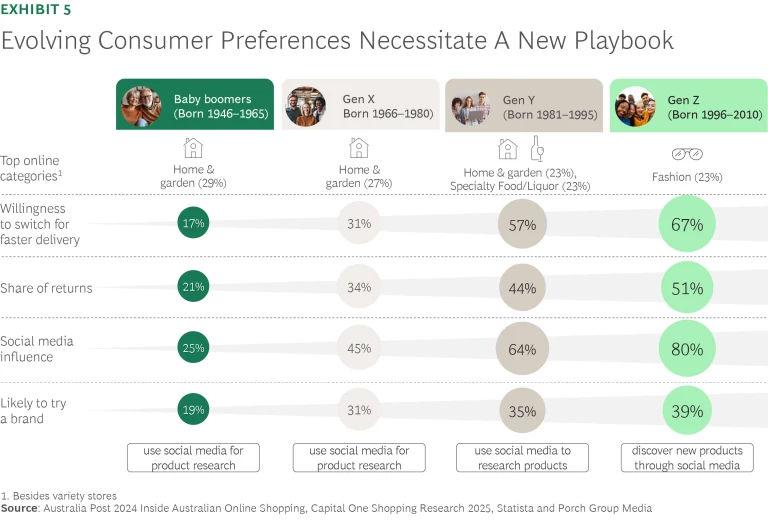

- The Australian shopper base is more diverse than ever, and businesses are still learning about Gen Z and Gen Alpha who are coming online as new shoppers

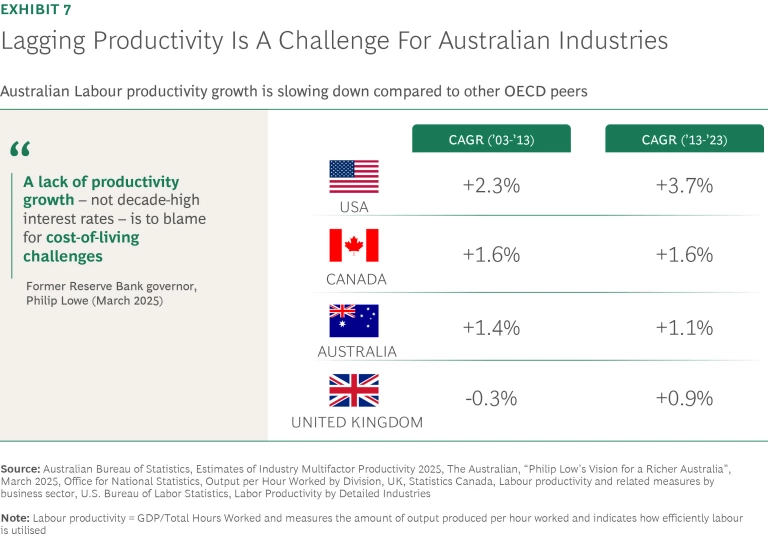

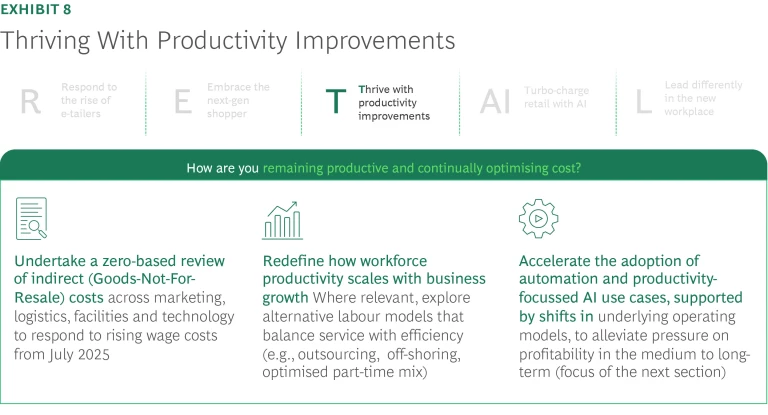

- Stagnating productivity and rising costs in Australia, coupled with the need to go toe-to-toe with eTailers that have ultra-cheap sourcing and operational models, are intensifying the need for operational reinvention

- AI is moving rapidly from pilot and proof-of-concept projects to adoption at scale requiring changes in enterprise operating models to scale rapidly

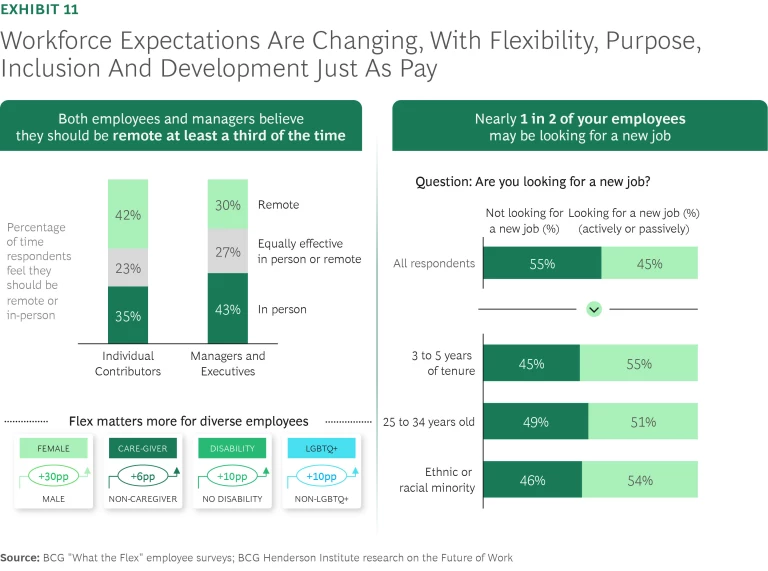

- Employees across industries are seeking flexibility, purpose and meaningful development at work requiring a change in the organisation–employee relationship

These forces have reached an irreversible tipping point, redefining what it takes for retailers to compete. This paper explores five imperatives for retailers and consumer companies to respond and win (see Exhibit 1).

Imperative 1: Respond to the Rise of E-Tailers

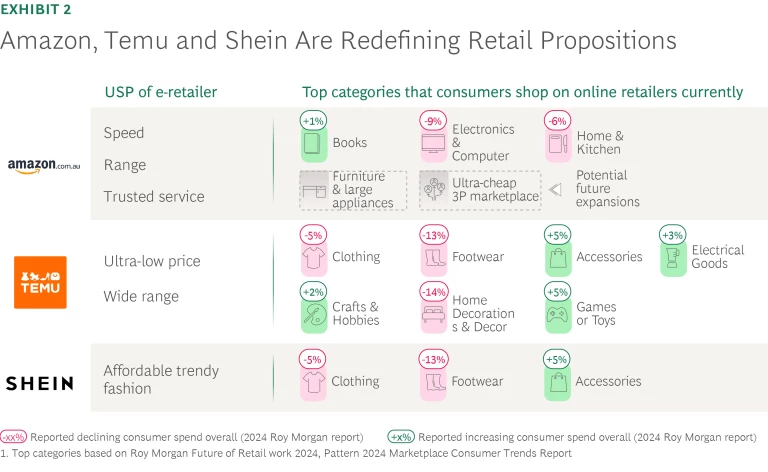

These e-Tailers are winning by delivering clear, compelling value propositions. Amazon is known for speed with same-day delivery in select Australian cities, an incredibly wide range and reliable service. Temu is known for its wide range and ultra-low prices. Shein is known for ultra-low prices and affordable trendy fashion, with thousands of new styles being added to its catalogue every day.

Despite ongoing consumer concerns around the product quality, brand trustworthiness and sustainability standards of platforms like Temu and Shein, purchasing behaviour suggests that these issues are not deterrents. In fact, their ultra-cheap proposition is resonating with cost-conscious consumers during the current cost-of-living crisis. Temu and Shein’s top categories are those in which consumer spend is declining more broadly, which suggests shoppers are actively trading down (see Exhibit 2).

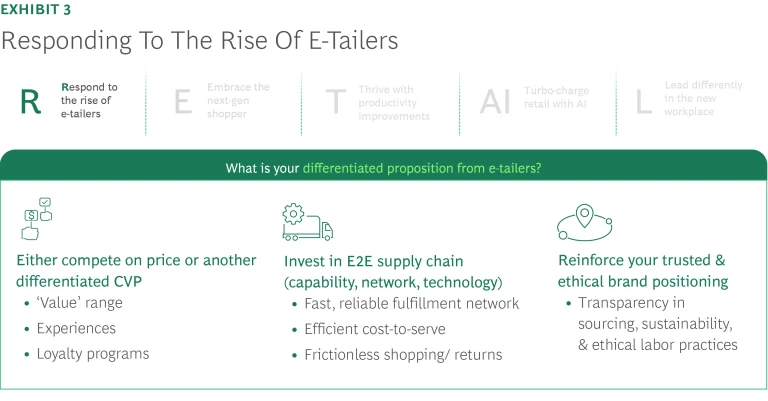

Articulate a differentiated proposition for your core shopper segments: Whether through competitive pricing, differentiated experiences, or trusted brand equity, this must be supported by an efficient supply chain and a fulfillment model that delivers with speed and reliability (see Exhibit 3).

Imperative 2: Embrace the Next-Gen Shopper (Gen Z and Gen Alpha)

Gen Z and Alpha, in particular, are rewriting the rules of discovery, shopping and fulfillment. While fashion was one of the slowest categories to move online owing to the need to trial in store, Gen Z’s largest online category is fashion. These younger cohorts are more willing to switch brands for faster delivery and are more likely to want to return products, reinforcing the need for seamless fulfilment and returns. They are also more likely to use social media to discover new products and are willing to try new brands (see Exhibit 5).

Most businesses that were set up over decades ago were not designed to serve this next gen shopper, which raises three questions:

- Who are your core shopping segment(s)?

- Are you leveraging the immense data available about your core shopper to anticipate and serve their needs with precision? Research indicates three in

four3 3 BCG Publication – What consumers want from personalization, December 2024 customers expect a personalised experience across digital platforms, but few retailers have been able to show success on their data and personalisation strategy with 60% customers saying they felt frustrated when they received irrelevant content oroffer.4 4 Adobe Digital Trends, 2024 - Are you optimising the end-to-end shopping experience, including discovery, to stay relevant to this new next-gen shopper?

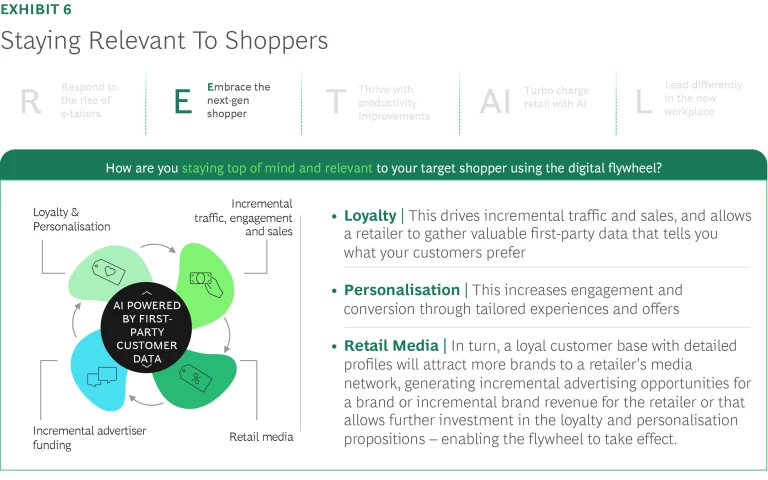

Activate your core shopper segments using a “digital flywheel” of loyalty, personalisation and retail media – all powered by first-party customer data (see Exhibit 6).

Imperative 3: Thrive With Productivity Improvements

However, productivity growth in Australia has stagnated at just 1.1% over the last decade, well behind peers like the US and Canada (see Exhibit 7).

Imperative 4: Turbo-Charge Retail With AI

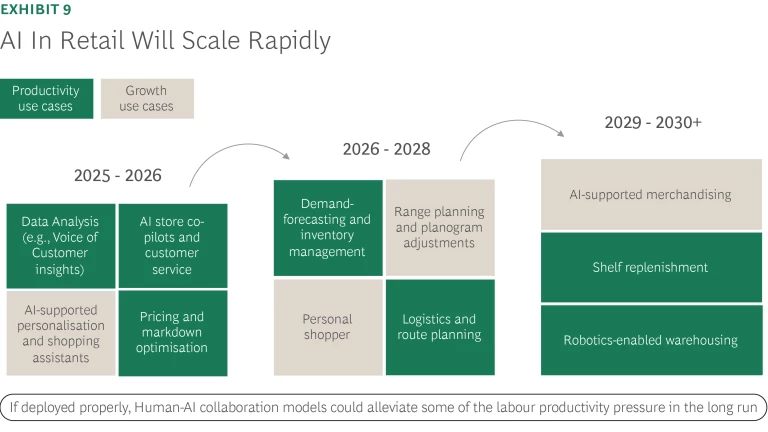

There is no doubt that more AI use cases, such as pricing and markdown support, demand forecasting and inventory management, range planning and logistics & route planning will be rolled out over the next few years (see Exhibit 9).

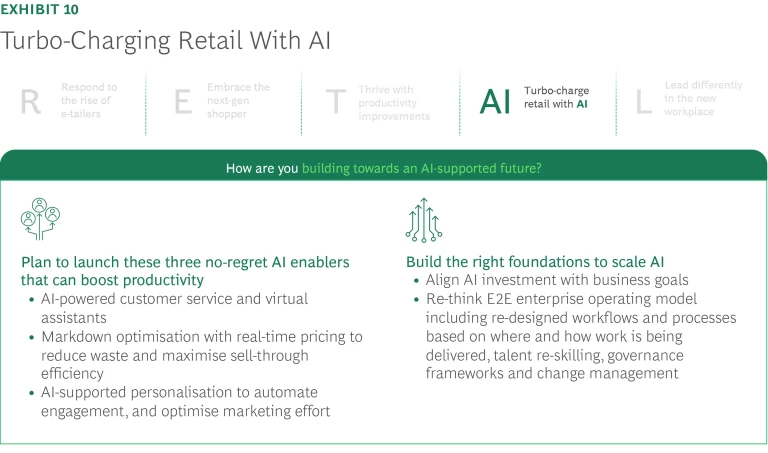

When implemented purposefully, AI can be a force multiplier by freeing up teams for more value-adding tasks and lifting productivity through human-AI collaboration models. However, to unlock AI’s full value, retailers must move beyond isolated pilots and deploy multiple use cases at scale. Doing this involves more than tools and algorithms – it is dependent on evolving the broader organisation operating model. Retailers who build a clear lead in the market will be the ones that scale AI and embed it within a fit-for-purpose operating model with the right organisation structure and roles, talent strategy (for upskilling and performance management), governance and change management.

Imperative 5: Lead Differently in the New Workplace

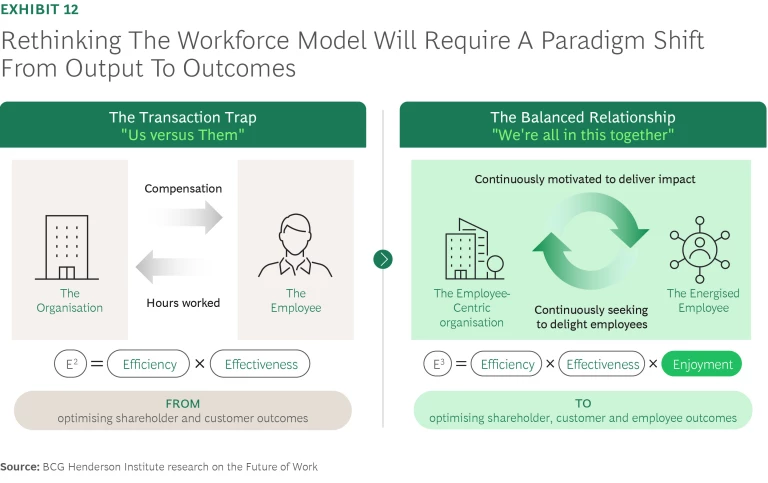

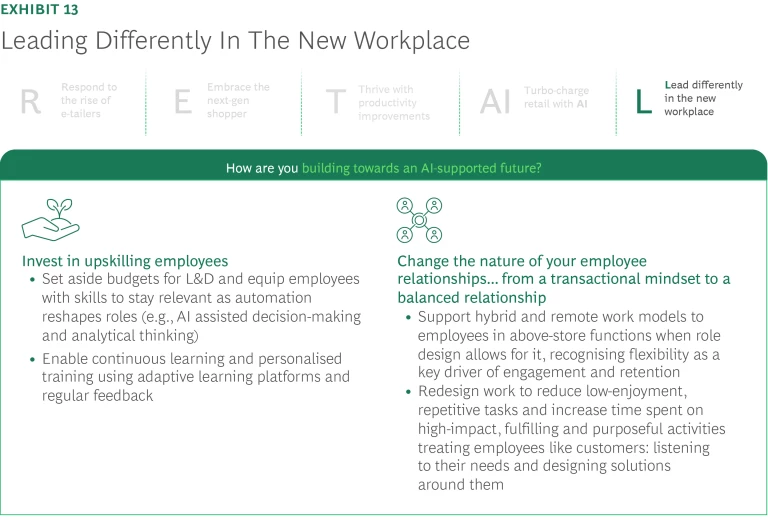

Organisations that remain anchored in output-focused models are losing ground on employee engagement. Leading players are moving towards a more balanced relationships, where employee outcomes matter, along with shareholder and customer outcomes (see Exhibit 12). This means adopting workforce models that elevate flexibility, purpose and inclusion which yields stronger retention, unlocks discretionary effort, and makes consumers want to engage with the retail brand more.

Winning in the next half-decade will not be a linear extension of past strategies. Retailers must go beyond incremental change and directly address the disruptive forces reshaping the sector:

- Respond to the rise of e-Tailers by crafting a differentiated proposition that can stand up to Amazon’s service leadership and the ultra-low-cost models of Temu and Shein; retailers must double down on experiences, speedy fulfillment and returns, trusted brands and value-added services that foster loyalty.

- Embrace the next-gen shopper by defining a core shopper segment(s) and build a high-performance digital flywheel to activate them. This means leveraging advanced loyalty programs, hyper-personalised offers, and retail media platforms that resonate with target customers and drive repeat engagement.

- Thrive with productivity improvements by launching zero-based reviews of indirect costs and targeted automation and AI deployments.

- Turbo-charge value-led AI deployment-at-scale that supports productivity and growth underpinned with the right operating model.

- Lead differently by adopting a new organisation paradigm that optimises for shareholder, customer and employee outcomes to energise workforces.

These five imperatives that re-shape R.E.T.AI.L. are both a challenge and an opportunity. Retailers who move decisively, combining bold transformation, innovation, and organisational agility will purposefully accelerate their next chapter of growth and long-term relevance.