Retail media is flourishing globally and is expected to grow 15% per year, from $130 billion currently to $230 billion by 2028. US retailers have long been the driver of this growth, representing nearly half of the market, but retailers in the rest of the world are increasingly determined to capture more of that growth. To catch up, however, they need to contend with local market realities that are much different from those in the US. In Europe, for instance, retailers must navigate stricter privacy regulations, a strong emphasis on their own private brands, customers who more regularly visits stores, and customer expectations of omnichannel experiences, all while operating in a highly fragmented market shaped by diverse consumer preferences.

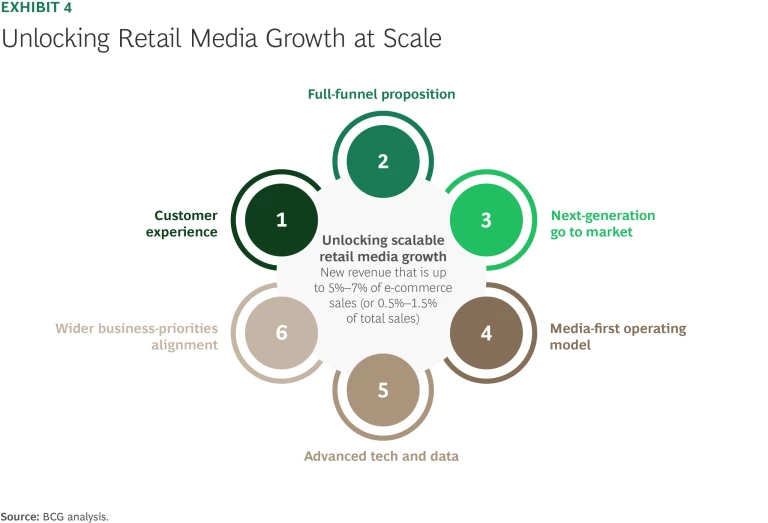

To better understand brands’ advertising needs and the challenges retailers face when trying to launch and scale retail media, BCG conducted a survey involving about 100 retailers and 40 brands across Africa, Europe, the Middle East, and South America. We find that success depends on addressing six critical questions that touch on issues such as how to evolve retail media to a full-funnel marketing channel, how to secure incremental spending from brands, how to mitigate concerns around the customer experience, how to build a scalable operating model, where to focus technology investments, and how to align retail media with broader business priorities. Taking the time to address the six questions is well worth the effort given how quickly brands are increasing their spending on retail media while also focusing their spending with fewer retail media networks.

Stay ahead with BCG insights on marketing and sales

Brands Spend More, Retailers Invest More

The core retail media concept—when a retailer sells advertising placements on proprietary digital platforms or third-party websites using its first-party customer data for more precise targeting and stronger visibility of bottom-line impact—continues to gain momentum. Our recent survey of brands across Africa, Europe, the Middle East, and South America finds that nearly all brands (98%) grew their retail media spending, with 40% of brands increasing it by more than 20% annually during the past three years—and the pace is picking up.

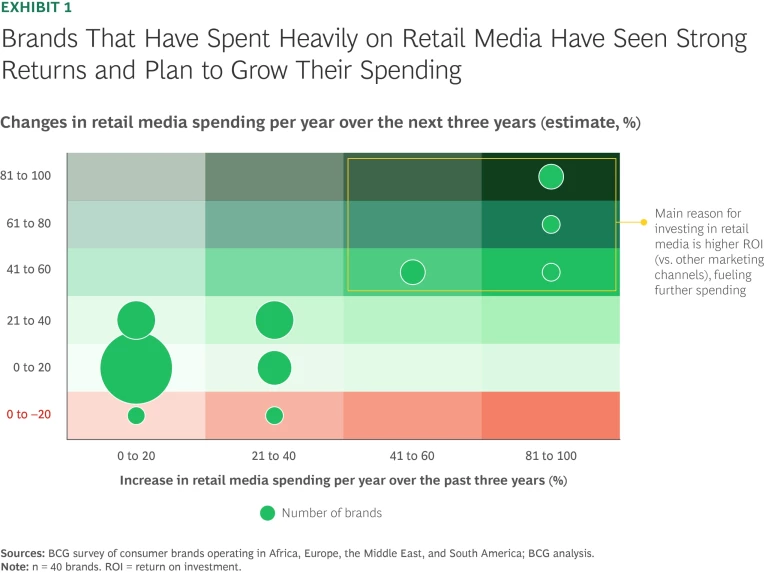

Impressive results from previous spending are driving expectations for continued growth in spending. (See Exhibit 1.) Over the next three years, retail media spending in these regions is anticipated to grow by approximately 25%, on average, year-over-year, outpacing US retail media spending, which is projected to grow by 20% per year.

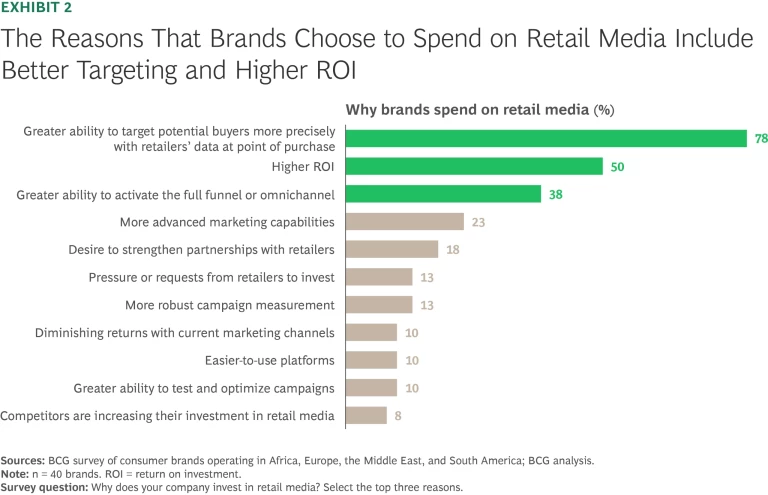

Surveyed brands that spent heavily on retail media in the past three years have seen strong results driven by the ability to more precisely target shoppers using retailers’ first-party data, unlocking a higher ROI than they have in other marketing channels. (See Exhibit 2.)

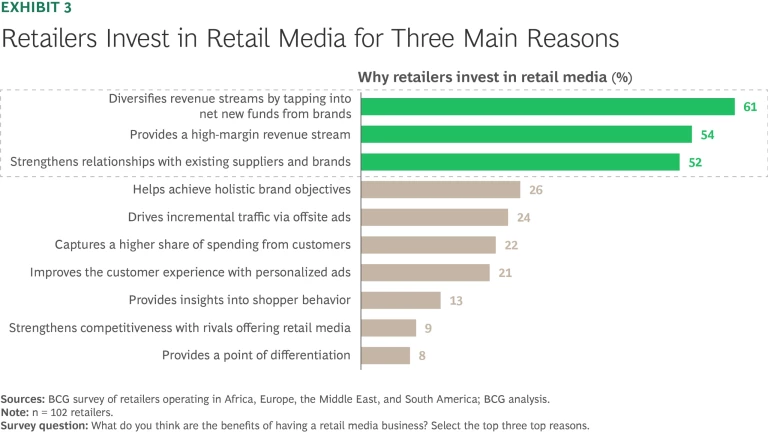

Given the strong brand demand, 49% of surveyed retailers view retail media as a top business priority. It can help them generate new revenue that is equivalent to up to 5% to 7% of e-commerce sales or 0.5% to 1.5% of total sales—with profit margins exceeding 65%. And the appeal extends beyond direct financial gains. (See Exhibit 3.) Retailers identified two additional strategic advantages: diversifying revenue streams by tapping into net new funds from brands (61% of respondents) and strengthening relationships with existing suppliers and brands (52%).

How to Address Challenges and Scale Retail Media

Launching and scaling a retail media operation is not easy or straightforward. Of the retailers surveyed, more than 90% have a retail media business, and more than 80% of those cited three or more major challenges—challenges often magnified by the distinctive market environment in their country or region. These challenges include concerns around customer experience and privacy, difficulties in designing the right full-funnel proposition, trouble securing incremental brand funding, the lack of the right internal ways of working and talent, the lack of advanced tech and data capabilities, and misalignment with broader business priorities.

The good news is that these challenges are all solvable, evidenced by what successful retailers have done to optimize and scale their retail media. We have developed a retail media scalability framework that can help a retailer organize how it addresses these challenges and unlock meaningful growth. (See Exhibit 4.) There are six critical questions, one for each framework component, that retailers should ask themselves.

Customer Experience: How should we ensure that retail media benefits the customer?

Compared with their US counterparts, consumers in other parts of the world are more privacy-conscious, less willing to share data, and accustomed to a more straightforward shopping journey. There are also tightening privacy regulations across many markets that limit data collection and usage.

All of which makes scaling retail media a delicate balancing act that retailers take seriously. In our survey, more than half the retailers said a primary barrier to scaling retail media operations is the potentially negative impact on the customer experience and customer privacy. But the two need not be at odds. Retail media can enhance shopping journeys by inspiring customers, facilitating product discovery, and making shopping easier by using relevant, personalized advertising.

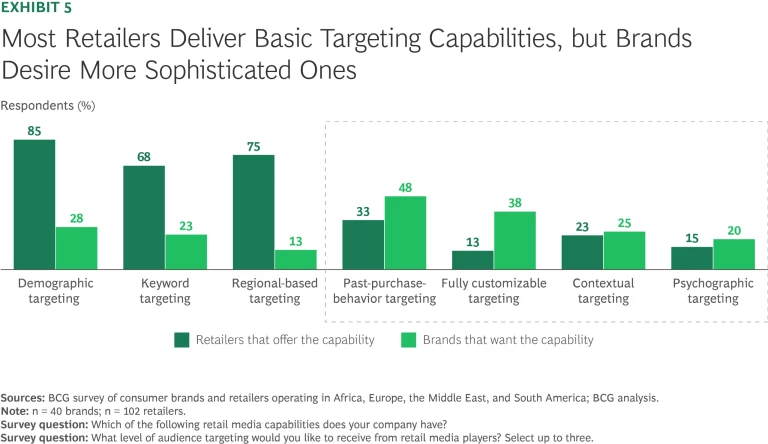

The key is to move beyond basic ad-targeting techniques (using keyword searches, for example) that can disrupt the customer journey. While the most mature retail media players have advanced targeting capabilities in place, our survey finds that 68% still have only have the basics. There is a clear desire to improve, however, with 55% of brands expressing an interest in investing in AI to optimize ad placements.

By tailoring their retail media approach using category dynamics, a channel strategy, and their customer engagement model, retailers can do the following:

- Make ads feel seamless and relevant. Present highly targeted ads that feel “native” to the shopping experience, thus facilitating discovery at the best advertising touch points. To this end, retailers should develop atomic content capabilities to customize ad content and frequency on the basis of each customer’s browsing behavior and likelihood of engaging with the ad.

- Offer value beyond the cart. Leverage well-placed nonendemic advertising to promote products or services not sold by the retailer. This adds value for customers who are interested in adjacent products and services or in end-to-end solutions. For example, nonendemic advertising can be particularly effective in the home improvement space.

- Avoid ad overload and disruption. Prevent ad fatigue by leveraging first-party customer data and intelligence to adjust and optimize ad frequency given each customer’s propensity to engage with ads.

- Constantly improve what customers see and experience. Embrace a rapid test-learn-and-scale approach and develop an always-on AI-driven experimentation capability. By constantly refining media offerings, retailers can maintain the fine balance between monetization and customer value to build customer trust. We find that 35% of brands want campaign experimentation capabilities, but less than one in three retailers offer it.

Full-Funnel Proposition: How should we deliver an attractive proposition for brands across channels?

One in three surveyed brands is interested in full-funnel activation, meaning they are looking to drive awareness, discovery, consideration, and conversion via their retail media networks of choice. Further, 45% of brands are specifically interested in innovative, awareness-focused retail media formats. Yet most retail media networks in Africa, Europe, the Middle East, and South America remain concentrated on traditional formats such as sponsored search and display ads, which together account for approximately 50% of brand spending. This investment is highly focused, with 53% of brands allocating spending across just four or fewer retail media platforms per market.

To compete for brand budgets across the full funnel, retailers should expand into high-impact formats, strengthen core money-making products, and cross-sell ads.

To compete for brand budgets targeted across the full funnel, retailers must offer a more complete media proposition and end-to-end packages that address each major advertiser’s objective (such as promoting a new brand or product or re-engaging lapsed customers). This means expanding into high-impact formats, such as innovative onsite formats (homepage takeovers, shoppable video, and user-generated content, for example). At the same time, retailers should continue to strengthen core money-making products (such as in-aisle activations) and cross-sell ads. Further, retailers need to build strong offsite propositions that target customers across four key behaviors: streaming, scrolling, searching, and shopping.

But enabling full-funnel activation requires more than a wide array of formats. Retailers also need to prove that they can reach an advertiser’s desired audience with the right messages and cadence—and deliver value at each stage of the funnel. Metrics need to capture not only conversion data and ROI but also awareness, engagement, consideration, and brand lift data. Doing so is vital to build credibility with brand marketers and unlock larger, more strategic media partnerships.

Historically, 30% or more of retail media in Africa, Europe, the Middle East, and South America has been focused on in-store activations. Considering that 40% of brands in those non-US markets are looking for innovative in-store advertising solutions to further their full-funnel objectives, it behooves retailers to invest in innovative retail media formats in store. These can include digital screens in storefronts, aisles, and parking lots, as well as augmented-reality mirrors and apps that detect when a customer is in or near a store and push relevant content.

Retailers should also focus on building scalability, transitioning away from one-off physical advertisements to digitally enabled ads that are more conducive to quick expansion, linking online discovery with in-store conversions and measurable impact. (See the sidebar “Case Study: Tesco Media’s Omnichannel Success.”)

Case Study: Tesco Media’s Omnichannel Success

Tesco is a leader in retail media innovation, integrating in-store, digital, and offsite formats to create a high-impact, full-funnel activation offering for brands. By leveraging its vast physical footprint, first-party data, wide set of Clubcard and other partners, and omnichannel capabilities, Tesco has built the largest retail media network in the UK after Amazon and one of the largest in Europe.

Tesco is innovating across channels. It aims to transform stores from pure point-of-sale venues to dynamic engagement hubs that connect brands with shoppers at every touch point. For example, it’s expanding the in-store digital screen network so brands can maximize exposure and capture shopper attention. (Tesco found that two digital screens double dwell time and lift brand recall 3.5 times.) Other innovations—including store wraps (where whole outside walls of stores become billboards) and ads on in-store scan-as-you-shop devices—help brands build awareness, support new-product launches, and boost conversions and share of wallet.

Tesco is also increasing the number of offsite partnerships (including ITV, Channel Four Television, Meta, Pinterest, and The Trade Desk) and helping brands extend their audience reach, target look-alike audiences, retarget specific customer groups, and demonstrate retail media’s bottom-line impact.

The company has expanded beyond traditional ad formats, introducing short-form video ads and homepage activations. Further, Tesco is blurring the lines between personalization, trade, and retail media by offering brand-funded personalized discounts and gamified experiences to drive loyalty, larger shopping baskets, and repeat purchases.

Mondelēz partnered with Tesco for Cadbury’s 200-year anniversary using exclusive activations, such as full-store wraps, innovative store-within-a-store concepts, and Secret Santa grottos at select Tesco stores to reinforce brand heritage, an emotional connection, and shopper engagement. The campaign was a commercial success for Cadbury, delivering more than an 80% year-over-year sales increase in the selected period.

Looking ahead, Tesco is committed to enhancing its capabilities. Priorities include incrementality measurement and full-funnel activation across channels, strengthening its first-party data through clean rooms and AI-powered audience segmentation (leveraging 23 million Clubcard customers and the retailer’s ability to track 80% of its transactions across channels back to the customer). Tesco is also expanding its nonendemic offering after a strong Vauxhall Motors campaign, which delivered a 16% uplift in brand positivity and a 21-point rise in electric vehicle purchase intent among exposed shoppers.

Next-Generation Go to Market: How should we ensure that retail media wins incremental marketing budgets?

In the past, commercial teams offered retail media as a sweetener in commercial negotiations, a practice that has made winning incremental revenue from brands more difficult. But there is a stark difference between retail laggards and leaders. Among retailer’s with less advanced offerings, the revenue generated by their media offering mostly just cannibalizes existing spending by brands. As little as 20% is actually incremental revenue. Meanwhile, the leading retailers we surveyed reported 95% incremental retail media revenue, and they accomplished this by adopting three main best practices: separating retail media discussions from commercial discussions (64% of respondents), providing detailed advice and insights on how retail media can drive impact (51%), and offering full-funnel solutions to meet specific brand objectives (45%).

Retailers need a dedicated retail media team with specialized media expertise that can meaningfully engage media agencies and brand marketing teams. Further, they need to develop a differentiated go-to-market approach and pitch materials and to supplement them with case studies that demonstrate strong incremental ROI. Our survey finds that retailers with dedicated retail media teams that communicate directly to agencies and brands are almost twice as likely to have scaled their retail media business compared with retailers that are relying on commercial teams.

This success reflects the brand operating model. On the basis of the 40 global brands we surveyed, brand marketing teams make more than 90% of retail media decisions, and brand sales teams are involved only about 30% of the time. Meanwhile, most retailers still rely on their commercial teams (36% of those surveyed) and struggle to scale retail media. The barriers they cited include unclear roles and responsibilities between retail media and other teams, a lack of media expertise, and a lack of defined media KPIs and resource constraints.

Media-First Operating Model: How should we build a scalable operating model for retail media?

Scaling a retail media business demands a fundamental shift in mindset, talent, and ways of working. Retailers are no longer just buyers negotiating with suppliers; they are sellers competing for brand investment alongside digital advertising giants, such as Amazon, Meta, and Google. That shift requires a purpose-built retail media organization and operating model to meet the expectations of brand marketers and agencies. But we find that 58% of retailers struggle to scale retail media due to challenges in setting up the right ways of working with wider teams and a lack of the right internal talent.

To unlock scalability, retailers need to stand up a dedicated team with specialist expertise—and the right mix of internal and external talent. They need to stand up or enhance six core teams: sales and lead generation, account management, ad operations, data and analytics, ad measurement and insight, and adtech. Each of those teams must be structured in a relevant way to reflect the priorities of the business. For example, the sales and account management teams need to offer a differentiated experience depending on each brand’s size and strategic importance, whether brands are endemic or nonendemic, and whether they conduct their business via an agency or not.

The challenges retailers face when attempting to scale their retail media business change as their offering matures.

Our survey also finds that the challenges retailers face when attempting to scale their retail media business change as their offering matures. Half of the retailers that are starting out said that teams need to do a better job assigning roles and responsibilities, setting clear rules for who is responsible, accountable, consulted, and informed (RACI). And 45% of retailers said an entrenched corporate culture can create roadblocks, such as continuing to see supplier relationships as purely transactional and not viewing them as advertising customers.

Meanwhile, 48% of more mature retail media businesses cited a lack of the right talent as an impediment to scale, 38% said they need more autonomy from the core business, and 33% said they need greater operational agility and automation. These more mature companies also need to focus on RACI rules to streamline governance and agree on rules-based guardrails with commercial, digital, and customer experience teams. To this end, they could set up nimble business planning processes at annual and quarterly levels, allow responsive “speed lanes” for in-season brand and business needs, and align KPIs and incentive structures across relevant teams (such as commercial, retail media, and marketing). The result will be faster decision making, execution, and growth.

Advanced Tech and Data: Where should we focus our technology investment to drive scale?

As brands consolidate their spending to just a few retail media platforms, retailers need more than plug-and-play technology to compete. Seventy-six percent of retailers in our survey reported having the core adtech capability fully or partly in place—yet, as many as 56% lack advanced tech and data capabilities. More than two-thirds of retailers that have failed to invest beyond the bare minimum of core ad technology have also failed to scale their retail media business. Success requires investing in scalable advanced tech to differentiate and attract advertisers. Retailers should double down on three critical areas.

Advanced Audience Targeting. Advanced audience targeting involves resurfacing the most relevant ads to the right customers to support their shopping journey and not disrupt it, thus driving higher engagement, conversion, and sales. We find that 86% of brands see retail media as the channel with the strongest potential to deliver the most effective customer targeting, and they are willing to pay a markup of 30% or more for improved targeting. Yet, most retailers are failing to meet brands’ expectations. Brands want to leverage machine learning and behavior insights to more precisely target consumers. (See Exhibit 5.) To meet these expectations, retailers need a robust audience-management solution that delivers:

- Unified Customer Data. Create a 360° view of each customer by integrating data across channels. This requires investing in a customer data platform, identity resolution tools, and clean room technologies.

- AI- and Machine Learning-Driven Audience Segmentation. Leverage artificial intelligence and machine learning to analyze shopping patterns and build predictive audience segments.

- Privacy-Compliant Data Collaboration. Establish secure integrations with offsite partners’ data systems through clean room environments to share data privately and safely.

Reliable, Transparent Measurement and Actionable Insights. Basic metrics such as clicks and impressions are table stakes; 76% of the retailers surveyed offer these. To differentiate, retailers need to offer real-time, campaign-specific performance tracking (desired by 53% of surveyed brands), incrementality measurement to understand the true value of the ad campaign (43% of brands), and campaign-performance scenario planning using actionable insights, category performance, and peer benchmarking (40% of brands). Currently, only 15% of nascent retail media players offer incrementality measurement, compared with about 50% of more mature players. Proving impact is critical to unlock the next rounds of retail media investment.

Easy-to-Use, Omnichannel Self-Serve Platforms. Such platforms are critical to deliver a tiered-service proposition to brands based on their size, importance, and maturity in their space. They enable media at scale for smaller brands, while also providing larger brands and agencies with advanced media-planning capabilities and direct control over campaign management. Yet, more than half of the surveyed retailers said that they lack sufficient self-serve platform capabilities. A self-serve platform can reduce the operational burden on retailers, help them capture the demand from smaller brands, and empower them to scale the business faster.

Wider Business-Priorities Alignment: How should we balance retail media and private-label priorities?

Even as retailers expand their ambitions, 34% worry that retail media will overshadow the visibility and strategic importance of their private brands. With this in mind, retailers need to tailor the approach for each private brand. Differentiation is key. Not all private brands are the same—some operate in highly competitive categories where increased media investment may be needed, while others dominate a particular category and may require less support.

The goal is to give private brands the visibility they need—on the basis of strategic priorities, category dynamics, and customer insights—without sacrificing retail media revenue. In our survey, 60% of retailers said that they are exploring a mix of approaches to integrate their private brands into retail media. For example, 35% dedicate some of their media placements to private brands, 27% allocate internal funds that their private brands can use to bid for retail media space, and 18% provide advertising subsidies and preferential rules for their private brands.

Yet, roughly 40% of surveyed retailers do not offer their private brands preferential treatment (this group generally has relatively lower private-brand sales). Additionally, we find that 13% have their private brands compete on equal footing with branded suppliers through competitive bidding for ad space, while 26% do not allow their private brands to advertise via retail media at all.

Move Fast to Capture the Retail Media Opportunity

Retailers that have scaled their retail media offering are enjoying media margins north of 65%, and they are reinvesting to build advanced capabilities, create innovative ad offerings, and improve the customer experience. Because most brands are likely to prioritize four retail media networks in each region, these retailers understand that these investments are necessary to secure an early-mover advantage. Given the speed with which retail media is developing and brands are adopting it, retailers need to act quickly to launch and advance their offerings—or they risk falling behind as others move to capture the opportunity.