Circularity—that is, minimizing waste and maximizing resource reuse—is rapidly gaining traction in many sectors, driven by economic growth opportunities, stricter regulations, resource scarcity, supply chain resilience, and consumer demand. While circularity initiatives are increasing across industries, many companies struggle to scale and fully industrialize circular models. A common question is whether circularity can truly unlock growth without cannibalizing revenues from the core linear (take-make-waste) business. The answer is yes. Case studies show that circular models, such as rental, repair, and recycling, can drive 15–20% topline growth. Though 30–40% of circular sales may replace linear ones, they also create positive spillovers. To maximize circularity’s potential, it must be embedded in the core business strategy and scaled beyond pilots.

This is the third in a series of articles exploring the opportunities and challenges of circularity. Previous articles have delved into the growth opportunities of circularity and the challenges of and enablers for scaling it profitably.

Driving Growth While Complementing a Linear Business

As consumer and regulatory pressures for sustainable solutions increase, businesses often face the perceived dilemma: sacrifice traditional linear models or profits to embrace circularity. However, this assumption misses the broader opportunity. Circularity does not necessarily mean abandoning linear business. Instead, it provides a pathway to increase resilience, boost customer loyalty, and tap into a €48 billion Nordic value pool by 2030.

This concept has proven successful across multiple industries, including fashion, sporting goods, electronics, and industrial goods. Companies such as Patagonia, Decathlon, Fnac Darty, and Hilti demonstrate how circularity boosts both sustainability and topline growth. By introducing buy-back programs, resale initiatives, and recycling systems, these companies have strengthened customer relationships while driving new revenue streams.

How Circularity Boosts Topline

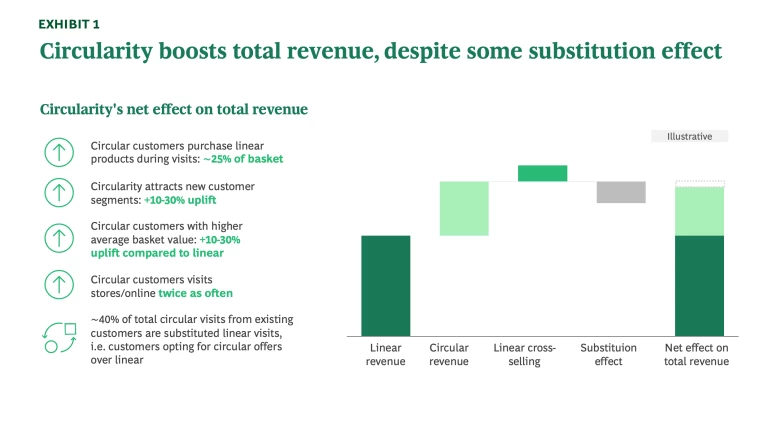

One persistent myth is that circular models are revenue-neutral or even negative, which leads to underinvestment. However, case studies reveal that while substitution does occur, introducing circularity often creates a complementary upside for linear sales.

Circularity unlocks significant growth options through additional value pools by maximizing resource efficiency, extending product lifespans, and creating new revenue streams through recycling, resale, and product-as-a-service models. Some value pools even offer higher margins than product sales, such as product service businesses.

Circular business models add value from several customer angles:

Attracting new customers

Complementary purchasing and larger basket sizes

More frequent customer visits

Retaining higher value customers

The linear cross-selling (corresponding to ~35% of circular sales) and substitution effect (often corresponding to 30-40% of circular sales) balance each other out. Thus, the net impact of circular sales typically is similar to total circular revenue itself. (See Exhibit 1)

Example: B2B electronics

A B2B electronics company introduced a tool subscription model for construction firms. By retaining ownership of the tools, the company could predict component failure and reduce downtime. This allowed the company to provide a broader customer offering and secure higher customer loyalty, effectively closing the market to competitors.

Stay ahead with BCG insights on climate change and sustainability

How To Achieve Similar Net Margin As Linear Models

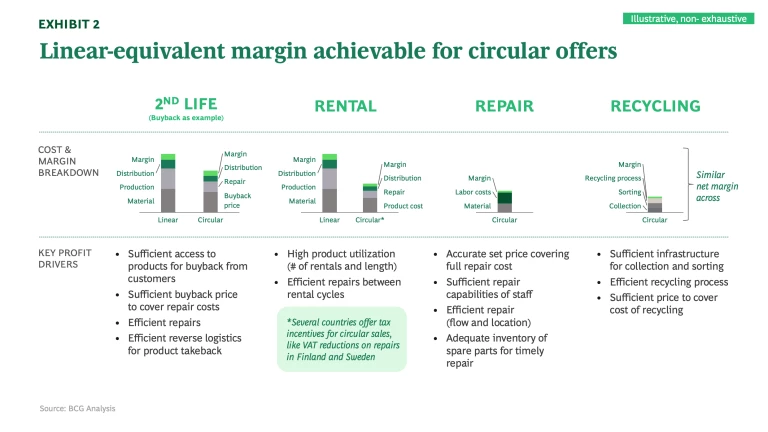

One of the most common criticisms of circularity is that it is not profitable. While it can be challenging to achieve profitability from day one when simply adding a sub-scale circular option to a linear model, it is possible to secure healthy margins for circular offerings by establishing sufficient operations and enablers. Before launching circular offerings, companies should select the right products and categories, build robust business cases by assessing profit drivers and necessary investments, as shown in Exhibit 2, and establish guardrails to protect margins. Accepting low-value or poor-condition items can erode profitability. Key questions to consider include:

- How should product take-back work?

- Can we take back all the products?

- Do we allow all conditions?

- What diagnostics are required?

When growing circular business models and operating them at scale, companies can reach certain "tipping points" where they must carefully balance the speed of growth and profitability. Most circular models depend on securing sufficient feedstock or returned products. When companies scale quickly, they often reach a stage where securing sufficient input means accepting lower-quality or a broader range of products—something that can harm profitability if the necessary enablers are not in place.

For example, when buying back products for secondhand use or recycling, companies typically start with a limited range of their own products in good condition, requiring less processing (e.g., repair). As they scale, they may need to accept products in worse condition, expand the product range, or even accept items from other companies. This places entirely new demands on reverse logistics, pricing systems, repair capabilities, and other enablers that are outlined in the second article of this series "Scaling Circularity into Profitable Business".

Typically, once circularity exceeds 10–15% of revenue, these tipping points emerge, and relying on linear systems is no longer sufficient.

Capturing the Opportunity: Embedding Circularity in the Operating Model

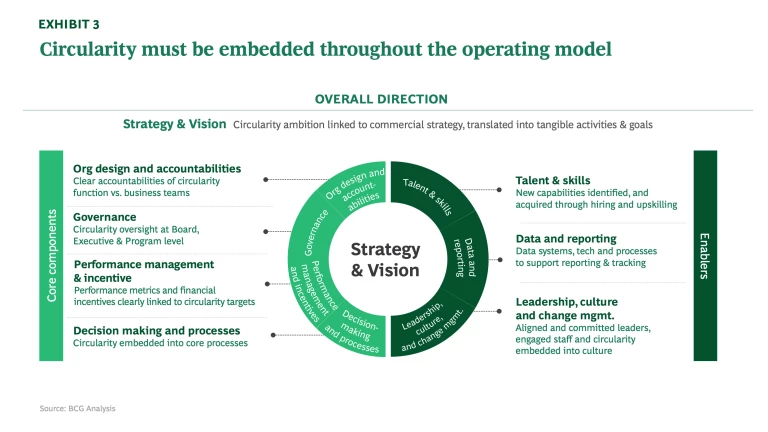

To industrialize and scale circularity, it must be fully embedded in the operating model. This includes defining clear accountabilities, integrating circular KPIs into performance management, and ensuring employees have the right skills. Otherwise, circular efforts risk becoming disconnected side projects. While every element of the operating model matters, four areas are especially critical: performance management and incentives, leadership, talent and skills, and decision making and processes.

1. Performance management and incentives

Circularity must be woven into the entire organization—from R&D and design to sales, finance, and legal. Without integrating circularity into organization-wide KPIs and incentives, it risks being deprioritized when resources and investments are allocated. For example, sales personnel incentives need to factor in new revenue flows for rental models where total sales are split over a longer period.

Additionally, ensuring that employee KPIs are tied to circularity, even for roles not directly involved, helps ensure that all teams contribute to a unified direction. Successful companies measure sales staff on circular growth but expand this KPI to critical enabling functions such as logistics, operations, and digital. As the circular offering is scaled, productivity and profitability should be included, too.

Company example: Renault

Renault has created a dedicated entity named The Future Is NEUTRAL, which includes the Gaia subsidiary for repairing batteries and the Flins factory for retrofitting vehicles. Their ambition is to bring recycling into a new era and become the European leader in the automotive circular

Reusing high-value materials in car production aligns circular efforts with existing efficiency goals—without cannibalizing linear revenue.

2. Leadership, talent and skills

To achieve long-term success, circularity must be embedded across every level of the organization, from leadership to workforce capabilities. This ensures a unified approach that aligns the organization’s vision and operations with the principles of circularity. Key focus areas include:

Champion leadership: Full leadership buy-in is essential to drive the transformation toward a shared vision of circularity. Circularity could be integrated into leadership remuneration, and senior leaders could be measured on, e.g., circular sales as share of total.

Build circularity capabilities through hiring and upskilling: Identify and develop new capabilities needed for circularity, such as designing for repairability, creating tailored customer journeys, marketing and selling circular solutions, and managing repairs for emerging product types. Additionally, expertise in logistics, including take-back systems for products in a buyback scheme or for recycling, is essential. These capabilities can be built through strategic hiring or by upskilling the existing workforce.

Company example: Decathlon

When Decathlon decided to double down on circularity, they reassessed their skill sets across teams to ensure they had the right capabilities. Key circular capabilities were identified, including expertise in e-commerce, circular value chains, and operations. Efforts like these provide a solid foundation for advancing circularity within the organization.

To achieve sufficient speed and scale, many companies look for partnerships that provide specialized capabilities. These include reverse logistics flows, digital solutions for pricing and stock management, and repair networks for larger or specialized repairs.

3. Decision-making and processes

Circularity needs to be integrated into all processes, including procurement, production, design, and innovation. Linear systems often provide a solid foundation for circular initiatives to achieve initial circular growth. For example, initial growth can be generated through in-store-only offerings without full omnichannel integration, which would require larger digital and logistics investments. Companies can, for example:

a. Utilize existing assets: Support circular operations by using existing logistics networks (e.g., underutilized trucks) and utilizing existing distribution networks (e.g., same sales channels to minimize need for entirely new infrastructure).

b. Leverage existing customer relationships and channels: Offer discounts or credits for customers returning used products to enhance loyalty and feed the circular system. Also, companies can utilize existing customer communication and sales channels to promote awareness of circular programs and their benefits.

Company example: Patagonia

Patagonia’s "Worn Wear" initiative encourages customers to trade in used clothing as input to Patagonia's circular business models in exchange for store credit applicable to both used and new

Company example: Houdini

Houdini has come a long way in integrating circularity into their business, enabling each consumer to tailor a circular consumption model to their needs. As for product design, 85% of products have fully circular

Integrate With Linear To Turn Circularity Into a Success

In conclusion, circularity offers promising opportunities for incremental sales growth alongside linear models and can be made profitable with the right approach. Success requires thorough business case creation, securing sufficient investments, selecting the right models for each category, understanding their interactions with linear offerings, and managing profitability tipping points carefully. To ensure viability, circularity must be fully integrated into the operating model and commercial strategy. Most importantly, circular offerings must deliver superior value to consumers—not just rely on sustainability arguments—to drive meaningful adoption and growth.

This article is written by the Nordic Circularity Team, a group of professionals dedicated to advancing circular economy solutions in the region. The team includes: Nanna Gelebo (Managing Director and Partner, Stockholm), Peter Jameson (Managing Director and Partner, Stockholm, Copenhagen), Davide Urani (Managing Director and Partner, Stockholm, Milan), Elina Ibounig (Partner, Helsinki), Trine Filtenborg de Nully (Principal, Copenhagen), Marcus Bruns (Project Leader, Oslo), Marie Holtorf (Consultant, Copenhagen) and Johanna Ihrfelt (Associate, Stockholm).