From a value creation perspective, the global banking industry performed well on average in 2024, with total shareholder return (TSR) outpacing the broader markets over the past year across nearly all geographies—30% TSR for banks globally from June 2023 to June 2024, compared to 19% for the market as a whole. Profitability, too, has recovered since the global financial crisis and is in line with cost of equity across a broad geographical range.

Overall, banking leaders and stakeholders in Europe, the US, and some other markets have every right to enjoy the industry’s strong recent performance. But is this banking performance the result of banks’ having addressed the fundamental challenges they face—rendering the performance sustainable and putting banks on track for long-term value creation—or was it driven largely by external factors? The evidence points to the latter conclusion.

Of course, recent macro developments—including tariff disruptions in April 2025 and the associated macroeconomic volatility—are likely to influence the future of finance, from credit markets and interest rate dynamics to consumer confidence and investment behavior. Although these developments are already sending ripples across financial markets, the specific implications for banks in terms of risks and potential opportunities are not yet entirely clear.

Key Insights on the Future of Finance

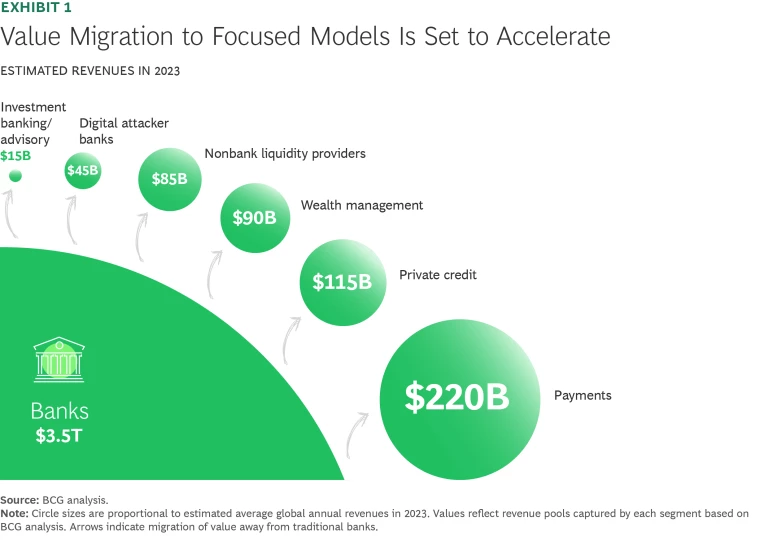

- Financial services revenues are growing—but banks are not capturing their fair share. One of the most prominent banking industry challenges is the fact customers and clients have more options and transparency than ever, and are increasingly choosing alternatives to traditional banks for their financial needs. In the retail space, neobanks and trading platforms have risen rapidly, and the corporate and institutional banking space has seen strong growth by private credit providers. Even more established players such as payments providers are growing at a significantly faster rate than banks. These companies are increasingly eating into the earnings of traditional banks. (See Exhibit 1.)

- What ails banks? A secular decline in fee income, a struggle to lift productivity and scale the business, and underutilization of balance-sheet management as a value driver are combining to challenge the industry. Investors are making their skepticism clear, with low valuations in multiple geographies.

- There are pockets of outperformance. Despite the various banking industry challenges, some institutions consistently outperform their peers through execution excellence and a focus on attractive businesses. These frontrunners are increasing the distance between themselves and followers, particularly in terms of valuation.

- What sets leaders apart? The market tends to reward three strengths in banking: the scale—not size—of domestic market leadership; the ability to generate a superior share of fee income; and market-leading productivity.

- There are four winning stances. Today’s leaders in banking typically pursue one or more of four strategic approaches: front-to-back digitization; customer centricity; focused business models; and M&A champions. Banks can take more than one of these approaches, and mastering the front-to-back digitization is critical to succeeding with the rest.

- AI, a game changer if implemented boldly with focus, may not be enough. If AI has not yet delivered for all banks, that may be due more to challenges in scaling and a lack of holistic adoption by employees and customers than to issues with the technology. As agentic AI and machine voice emerge as even greater productivity levers, winners will take a bold but focused approach to incorporating them. AI alone may not be sufficient, however. Much of the potential value could be captured by nonbank players that are currently better positioned to benefit from its applications.

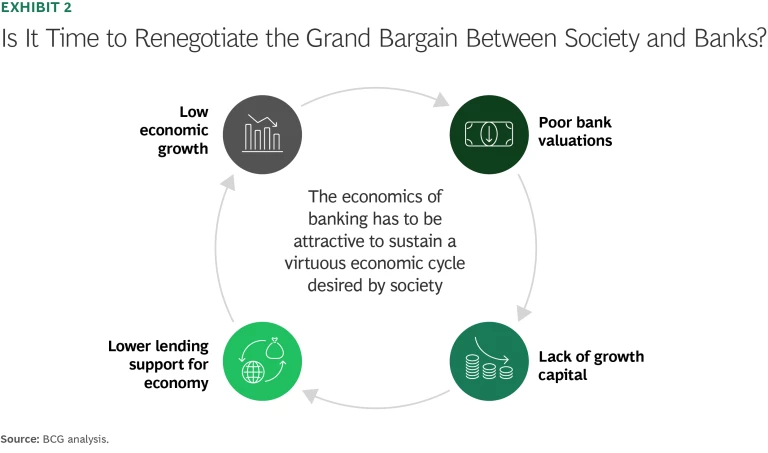

- Regulations must reflect a new grand bargain. If banks are to continue to fulfill the crucial role that they play in society, we believe that policymakers need to articulate a framework for ensuring that banking remains a profitable business while maintaining strong risk controls and oversight. (See Exhibit 2.) This is not a call for less regulation. It is a call for simplification, harmonization, and more modernization—recognizing that a rapidly changing world demands updated thinking across a range of banking issues, including innovation, distribution, connected commerce, synthetic scale, and digital assets. Our discussions at this year’s IIF and IMF/World Bank spring meetings showed a broad awareness of the challenge. Global regulation must deal with two competing paradigms: fostering economic competitiveness and efficient regulation, while pushing for common global standards. The moment calls for a redefinition of the role that banks should play in the future of finance.

As the global economy endures a period of volatility and disruption, it presents banks with both a challenge and an opportunity. They must adapt to a shifting macro environment, but they must also reaffirm their roles as valuable guides and advisors to customers and clients that are navigating the uncertainties.

To succeed, banks must address the industry’s long-term structural challenges, irrespective of macroeconomic developments. Only by ensuring their economic sustainability and value creation potential for growth and profitability will banks attract capital and fulfill their critical role in the future of finance, and support economies and society more broadly.

To give this important work the priority it requires, we recommend that bank leaders consider and debate a number of strategic questions, including:

- What is the actual shareholder value generated by each business/segment?

- Do we have the right to win in our priority businesses in the medium term?

- Are we bold enough to rethink our entire portfolio and business mix, divesting or turning around challenged businesses?

- Do we offer distinctive customer value versus our peers, based on unique assets or capabilities? And do we not shy away from pricing our services in line with their value?

- Are we organized to deliver value efficiently front to back (with functions aligned to business purpose) to address customers’ future needs?

- Do we have an AI strategy that focuses on a few, high-impact areas and financial goals across the bank?

- Are we attracting top-quality talent in critical domains, including tech, digital, and AI?

- Are we actively engaging with regulators and policymakers to expand our perimeter of permitted activities to generate additional fees?

Although most of these questions are intuitively important, too many banks initiate large-scale change programs without first achieving clarity on these topics. Bank leaders should question their existing models head-on and in a structured groupwide process, rather than through individual decision making across business units and horizontals. The future of finance will be led by those that make tough decisions and commit to thorough execution of priorities.