AI is fast becoming the most powerful value lever in every link of the insurance value chain. In an industry powered by data, models, and rules-based decision making, insurers are well-positioned to use the technology to improve productivity, personalization, and customer experience. Yet so far the anticipated returns from AI have fallen short of expectations, leaving many insurance executives uncertain about how best to proceed.

The reason for the gap between promise and payoff is clear: contrary to the intuition of many executives—who still see technology as the primary hurdle—the real determinant of AI success lies in the human factors that bring AI-driven strategies to life. BCG’s project experience reveals that while one-third of the transformation challenge is technical, two-thirds hinge on people—how leaders mobilize talent, redesign work, and help employees adopt new ways of thinking.

Over the next three to five years, it will be this human dimension—more than algorithms or tech infrastructure—that separates insurance industry leaders from laggards. CEOs who embed a human-centric AI-first vision in their organizational culture and operational practices today will unlock AI’s transformative potential. This article presents a playbook for making it happen.

Stay ahead with BCG insights on the insurance industry

Why People Determine AI Success

Breakthroughs in reasoning, language, and agentic capabilities have propelled AI from a lab curiosity to a boardroom priority. In insurance, its reach already spans from hyperpersonalized distribution to fully automated claims decisions. Yet many incumbents still focus too heavily on models and infrastructure, underinvesting in adoption, change management, and workforce upskilling.

Many incumbents still focus too heavily on models and infrastructure, underinvesting in adoption, change management, and workforce upskilling.

In the near term, success will hinge on human-in-the-loop systems—accelerating routine tasks so professionals can focus on judgment-rich decisions and deeper client engagement. As capabilities mature, routine underwriting, servicing, and claims handling will be carried out by autonomous agents, while people move higher up the value chain to design, monitor, and steer those systems.

Even then, when basements flood or life-saving treatments await approval, human empathy and accountability will remain decisive. AI’s role will be to equip humans with instant insight at these “moments of truth”—enabling faster, fairer, and more trusted resolutions, not replacing the human touch.

BCG’s field experience underscores a simple truth: value emerges only when employees embrace the new roles, workflows, and mindsets that AI enables. Designing, fine-tuning, using, and sustaining these systems are human endeavors. Yet unlike technology upgrades, which can be rolled out in weeks or months, strengthening an organization’s “AI muscles” requires a long-term investment in people. Critically, insurers who start late give their workforce little opportunity to adapt—while those who build the best-trained AI-ready workforce will set the pace for the industry.

Five CEO Mandates for Human-Centric AI

Leaders must craft a human-first approach that reshapes mindsets, workflows, and incentives. The following five mandates are practical, enterprise-wide moves that turn an AI-first vision into everyday behaviors and measurable results.

Lead by example. Elevate AI to a top-three strategic priority, supported by KPIs tied to value creation. As workflows become increasingly automated, traditional metrics like turnaround time are no longer sufficient to measure customer service. Insurers have shifted to net promoter score or transaction-based NPS, capturing not just speed but also empathy levels and overall experience. In addition, role-model AI usage in your own work—whether drafting communications, analyzing scenarios, or exploring market trends—signaling that adoption starts at the top.

Role-model AI usage in your own work—whether drafting communications, analyzing scenarios, or exploring market trends—signaling that adoption starts at the top.

Rethink processes. Don’t simply deploy AI tools to your employees. Low-value handoffs should be eliminated from workflows, with GenAI automating routine steps so that people can supervise, handle exceptions, and ensure quality, rather than executing repetitive tasks. Insurers are recognizing that traditional digitization strategies—such as rules-based robotic process automation—are becoming obsolete. With GenAI and AI agents taking on routine tasks, it is essential to reassess the value of budgeted IT transformation initiatives and redesign processes around intelligence, not automation.

Design with humans—not just for them. Involve frontline employees, advisors, and claims handlers in codesigning tools. Early engagement embeds usability, relevance, and trust, reducing resistance and surfacing real operational needs. The true breakthrough will come when subject-matter experts embrace creating AI solutions that exceed their own capabilities.

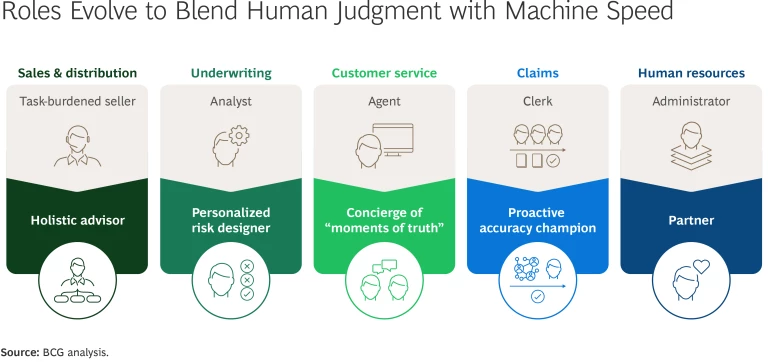

Redefine professional identities. Elevate human roles to focus on judgment, empathy, and complex decision making. (See “Professional Identities in an AI-First Insurer.”) To reduce resistance to change, position AI as a partner that amplifies expertise, not a threat.

Professional Identities in an AI-First Insurer

- Sales and Distribution: From Task-Burdened Seller to Holistic Advisor. Sales professionals transition from performing burdensome tasks, such as lead generation, note taking, and meeting preparation, to delivering value as holistic advisors. Predictive lead scoring and hyperpersonalized outreach combined with real-time quoting capabilities enhance advisors’ ability to deliver tailored client solutions. This shift enables advisors to increase face-to-face client time by 30%, improving conversion rates by 10 to 15 percentage points.

- Underwriting: From Analyst to Personalized Risk Designer. Underwriters evolve from analysts focused on data entry and preliminary assessments to actively engaging with brokers and clients to structure personalized insurance solutions. AI triages submissions, retrieves precedents, and drafts initial pricing, empowering underwriters to apply nuanced judgment and strengthen relationships. This shift frees up approximately 20% of underwriters' capacity, allowing them to focus on high-value tasks and accelerating quote turnaround times by up to 60%.

- Customer Service: From Agent to Concierge of “Moments of Truth.” Customer service agents shift from routine inquiry handlers to strategic concierges, focusing their efforts on pivotal interactions. Voice bots resolve routine inquiries, while AI-driven copilots provide comprehensive context and recommend actions. Consequently, agents can channel their skills toward empathetic interactions, cross-selling, and customer retention efforts. This shift has resulted in 50% of agent capacity rechanneled into revenue-generating conversations.

- Claims: From Clerk to Proactive Accuracy Champion. Claims professionals move beyond routine paperwork, becoming champions of accuracy and proactive customer care. GenAI pre-validates documentation, identifies fraudulent activities, and recommends appropriate payouts. This allows claims handlers to engage more effectively in nuanced cases and reassure customers during critical interactions. The adoption of AI in this area has reduced average cycle times from five days to under 24 hours and improved productivity by 30%.

- Human Resources: From Administrator to Partner. HR professionals move from administrative tasks toward strategic partnership roles driven by AI-enabled automation. Chatbots handle routine employee inquiries efficiently. GenAI dashboards identify attrition risks and skill gaps, facilitating targeted interventions. As a result, HR teams have shifted approximately 25% of their capacity toward strategic initiatives, reducing voluntary attrition by 2 to 3 percentage points.

Start now, scale fast. Launch targeted pilots and immersive academies to give employees hands-on experience. Demonstrating tangible benefits early builds confidence, accelerates cultural change, and sets the stage for scale-up.

Architecting the AI-First Operating Model

To embed AI into daily practice and help employees adopt new professional identities, insurers must rewire their organizational DNA so the technology is integrated into every decision, workflow, and incentive. An AI-first operating model realizes that vision through clear governance, future-ready talent pathways, agile structures, aligned incentives, and a modular tech backbone. Only when these elements work in concert can human–machine collaboration scale beyond pilots and deliver enterprise-wide advantage.

Leading CEOs drive a coordinated transformation across the following mutually reinforcing dimensions:

Leaner, Flatter Structures. As more AI agents execute end-to-end workflows and fewer humans are required for oversight and edge-case management, organizational structures will become leaner and flatter. With information codified and readily available, the relevance of experts with highly specialized domain knowledge will diminish. Instead, human capability to oversee entire processes and ensure outcomes will become more critical.

Cross-Functional Operating Model. With technology at the center of every business activity, insurers must transition from teams that are business-led and tech-supported to a truly cross-functional operating model. Tech and data skills must be embedded in every team that drives change. Even in operational functions, AI solutions will require constant fine-tuning and adjustment.

Redesigned Workflows. Processes designed around people must give way to workflows designed around AI agents, with human roles focused on oversight and intervention at critical points. This agent-centric approach clarifies where humans add unique value and ensures outcomes are both efficient and trusted.

New Evaluation Criteria and Incentive Schemes. As roles and work content change, so too must evaluation criteria and incentives. Employees building AI solutions should be rewarded for the accuracy and reliability of the systems they manage. Those using AI solutions and handling edge cases should be recognized for the unique human value they add.

Continuous Upskilling and Reskilling. The systematic monitoring and closing of skill gaps becomes mission-critical as AI capabilities evolve and the division of work between humans and agents changes. Success will require cultivating open mindsets and a commitment to lifelong learning across the workforce.

Responsible AI for Risk Management. Decentralized AI decision-making increases the need to embed strong safeguards in the centrally deployed building blocks used to develop AI solutions. Responsible AI principles must also be ingrained into daily oversight of risk management, approval, and governance processes.

At an AI-first insurer, technology handles routine tasks with precision, while people focus their judgment and empathy where it matters most: the moments that shape trust and loyalty. Catching up on technology deployments is relatively easy. But developing the human skills, mindsets, and leadership to use AI effectively takes years, leaving late movers little opportunity to close the gap. It is this human dimension that will separate insurers that merely deploy AI from those that build an enduring advantage. Insurers that begin strengthening these capabilities today will secure tomorrow’s true competitive edge.