This article is the sixth in a series that offers executives practical guidance on business ecosystems. The modular design of this installment allows you to read it in its entirety or jump to the strategic questions that are most relevant to your company.

From media and technology to energy and mining—no major industry is untouched by the rise of business ecosystems. These dynamic groups of largely independent economic players working together to deliver solutions that they couldn’t muster on their own come in two flavors: transaction ecosystems in which a central platform links two sides of a market, such as buyers and sellers on a digital marketplace; and solution ecosystems in which a core firm orchestrates the offerings of several complementors, such as product manufacturers in a smart-home ecosystem. Both types can quickly generate eye-popping valuations; since 2015, more than 300 ecosystem startups have reached unicorn status.

Given the success of this cohort of startups, as well as the Big Tech ecosystem players now numbered among the world’s most valuable companies, it’s no surprise that ecosystems are high on the strategic agendas of incumbent companies. More than half of the S&P Global 100 companies are already engaged in one or more ecosystems, and in a recent BCG survey of 206 executives in multinational companies, 90% indicated that their companies planned to expand their activities in this field.

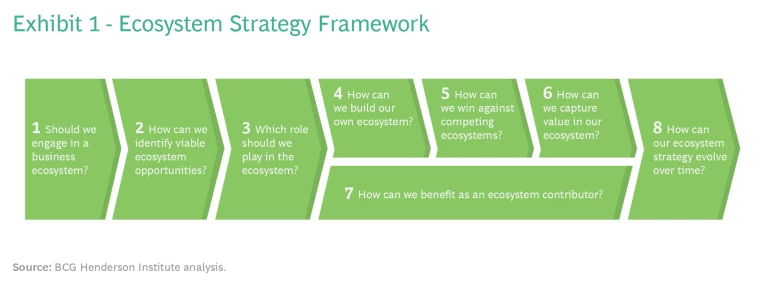

Yet many leaders of incumbent companies are still unsure how to define their ecosystem strategies. This article aims to help them in that pursuit. It is informed by the insights we’ve gleaned from three years of ecosystem research and engagements with large enterprises across industries and geographies. Organized in eight fundamental questions, it offers a step-by-step framework for developing a company’s ecosystem strategy. (See Exhibit 1.)

Ecosystem Strategy Framework

- Should We Engage in a Business Ecosystem?

- How Can We Identify Viable Ecosystem Opportunities?

- Which Role Should We Play in the Ecosystem?

- How Can We Build Our Own Ecosystem?

- How Can We Win Against Competing Ecosystems?

- How Can We Capture Value in Our Ecosystem?

- How Can We Benefit as an Ecosystem Contributor?

- How Can Our Ecosystem Strategy Evolve over Time?

1. Should We Engage in a Business Ecosystem?

Startups and tech companies are not the only kinds of companies that can benefit from ecosystems. Incumbent firms also use ecosystem-based business models to create value.

In financial services, for instance, DBS in Singapore and PingAn in China developed successful ecosystems and were rewarded with outsized shareholder returns, outperforming their local peers by more than a factor of two between 2015 and 2020.

Ecosystems are not a slam dunk, however. They are expensive and risky to launch, and most of them fail. We found that fewer than 15% of ecosystems are sustainable over the long run. Moreover, when we investigated value creation at more than 50 of the largest banks between 2015 and 2020, we found no significant correlation between ecosystem engagement and total shareholder return.

The motivational impetus behind an ecosystem is a foundational element in a successful strategy. Before you embark on an ecosystem adventure, you must be very clear why you want to take the risk and what specifically you want to achieve. We’ve identified five sound motivations for creating or joining an ecosystem:

- Expand market access for existing offerings. Ecosystems can open new sales channels for existing products or services. This is why many appliance manufacturers, for example, joined smart-home ecosystems.

- Strengthen the core business through complements. Ecosystem partners can provide products and services that add value to a company’s core offering. This is why video game console manufacturers established ecosystems of game developers.

- Protect the core business from other ecosystems. Engaging in an ecosystem can be an effective defense against threats from adjacent ecosystems. Several agrochemical companies have engaged in smart-farming ecosystems to defend their seed, fertilizer, and crop protection businesses against the competitive threats posed by precision-farming platforms.

- Tap revenue pools adjacent to the core business. Ecosystem partners can help a company expand its existing business into adjacent markets. Some banks, for example, build ecosystems to expand their mortgage business into broader real estate services.

- Launch new ventures separate from the core business. Companies can also benefit from ecosystem opportunities by launching new ventures separate from the core business, for the purposes of learning, financial returns, or diversification. Allianz X, the German insurance giant’s investment arm, has built up a portfolio of companies, over two-thirds of which rely on ecosystem business models.

If one of these motivations resonates with the priorities of your company, and if you are ready to invest for the long run, experiment, fail, and learn, you should seriously investigate the ecosystem opportunity. If multiple motivations apply, choose the one that is associated with your highest priorities, because your primary objective will shape your answers to subsequent strategic questions and decisions.

2. How Can We Identify Viable Ecosystem Opportunities?

Every successful ecosystem is based on a compelling value proposition—it solves a concrete business problem. Thus, the proper starting point in the search for ecosystem opportunities is an outside-in market perspective, not an inside-out view dictated by a company’s existing assets and capabilities.

The most effective way to identify a viable ecosystem opportunity is to examine the customer journey and identify market frictions—frustrations, unmet needs, and unfulfilled desires—that are too big or complex to be solved by one company alone. It is important to focus on frictions that represent substantial problems for customers or suppliers and correspondingly large opportunities to justify the investment and effort required to build a successful ecosystem. Frictions that are indicative of such opportunities include:

- Fragmented Demand. Ecosystem platforms are well suited to aggregate the demand of many small customers and make them accessible to suppliers in an economically viable way. For example, online food delivery platforms provide restaurants with easy access to a highly fragmented base of potential customers.

- Fragmented Supply. Platforms can aggregate the offerings of a large number of small-scale suppliers to facilitate the search and transaction process for potential buyers. Alibaba’s initial success came from providing large companies with access to small and medium-size Chinese suppliers that had previously been difficult to identify and contact.

- Matching Problem. Platforms can enable real-time matching of the two sides of a market and ensure a deal. Ride-hailing platforms address this friction by identifying the driver best positioned to serve a given rider and facilitating the transaction.

- Lack of Trust. Business ecosystems can establish the transactional trust required when partners don’t know each other and are vulnerable to fraud or misbehavior. By vetting guests and securing payments, Airbnb creates the trust necessary for owners to invite perfect strangers into their homes.

- Lack of Supplier Coordination. Ecosystems can enable the delivery of coherent customer solutions that require the intricate coordination of various independent suppliers of products or services. John Deere’s smart farming platform coordinates suppliers of seeds, fertilizers, crop protection, equipment, and agronomic and weather data to help farmers become more productive.

- Lack of Co-Innovation. Sometimes the resolution of a friction requires multiple innovations by companies from different domains that must be closely aligned to achieve their full impact. For example, Intel removed performance bottlenecks in the personal computer industry by orchestrating an ecosystem of PC component developers and their innovations through the Intel Architecture Lab.

Once you identify an attractive market opportunity and value proposition, ask yourself whether an ecosystem is the best way to deliver the solution. Typically, ecosystems work best when solutions feature high levels of modularity with easily and flexibly combined components and require high levels of coordination to identify and match partners, align innovation activities, or manage interfaces. Otherwise, other business models, such as vertically integrated organizations, hierarchical supply chains, or open-market models, may be better choices.

If the opportunity is attractive and suitable for an ecosystem solution, consider if your company has a right to play and to win. What can you contribute to the solution? Do you have essential assets and capabilities that can serve as a jump-off point for building an ecosystem? Do you own underutilized assets (such as data) that could be of value in someone else’s ecosystem? But don’t let your existing capabilities fully dictate your strategic choices. If the opportunity is right, it may justify building or acquiring the required capabilities, or finding partners to close the gaps. As Hannah and Eisenhardt observed, “Perhaps in complex strategic settings like ecosystems, strategy is more consequential than initial

3. Which Role Should We Play in the Ecosystem?

Too often, when large incumbent players see an ecosystem opportunity, they automatically assume that they should lead the ecosystem as its orchestrator. When unexamined, this assumption can blind companies to two realities: first, there are other ecosystem roles that may be more desirable and profitable than orchestrator; and second, a company can play different roles in different ecosystems.

Besides orchestrators, there are two types of ecosystem contributors: complementors and suppliers. Complementors directly provide customers with products or services that enhance the value of other components of an ecosystem. Suppliers operate upstream (and at arm’s length from customers) by providing products or services to orchestrators and complementors.

If strong and attractive existing ecosystems are already present in the domain you’ve identified, consider whether you can achieve your strategic objectives by joining one or more of them as a contributor. But don’t stop there. Also consider the tradeoffs among ecosystem roles.

Orchestrators are in a position of power as the rule maker, gatekeeper, allocator of profits, and judge and jury of the ecosystem, but they also must shoulder the high upfront investment and the risk entailed in launching it. Contributors are exposed to risks, too. There are the uncertainties associated with a lack of control over the orchestrator related to the scope, composition, operations, and governance of the ecosystem, as well as risks related to sharing critical data and access to customers. But contributors typically have lower upfront costs than orchestrators and can choose among competing ecosystems, or even limit their exposure and increase their strategic flexibility by participating in more than one ecosystem at the same time. Our research shows that the contributor role can be as financially rewarding as the orchestrator role, or even more so. Startup companies and their investors seem to have realized this already. For many years, the share of ecosystem contributors among new unicorns has been on the rise, and in 2019 they surpassed the number of ecosystem orchestrators for the first time.

If you decide to go for the orchestrator role, confirm that you are properly positioned and have the capabilities needed to succeed. There are four qualification requirements for ecosystem orchestrators. First, the orchestrator needs to be an essential member of the ecosystem and have control over critical resources, such as a strong brand, customer access, or key skills. Second, the orchestrator should occupy a central position in the ecosystem network and have linkages to many players and the ability to coordinate them effectively. Third, the orchestrator must be able to shoulder the generally large upfront investments and risk required to realize high net financial benefits from the ecosystem. Finally, the orchestrator should be perceived by the system contributors as a fair partner, not a competitive threat. You cannot unilaterally choose to be the orchestrator; you must be accepted by the other players in the ecosystem.

If your analysis suggests that your company is not fully qualified for the orchestrator role, you can consider co-orchestrating the ecosystem with other companies, including direct competitors. The Here geolocation platform is owned by a consortium of major German auto manufacturers, among other investors. Alternatively, you can orchestrate an ecosystem as a cooperative with other contributors, such as the artist-owned stock photography and video platform Stocksy United. (But don’t underestimate the challenges of managing the additional layer of governance in a consortium, which can be a material burden when fast decisions and flexible adaptation are needed.)

4. How Can We Build Our Own Ecosystem?

If building a traditional business is like constructing a single-family home, building an ecosystem is akin to constructing a mixed-use development, with all the additional complexity, coordination, interaction, and emergent outcomes that implies.

Our research revealed six critical success factors that you need to get right in the design of your ecosystem to increase your odds of being among the 15% of ecosystems that survive in the long run.

Ensure that essential partners join. You cannot force partners to join your ecosystem. Instead, you must convince them to join by offering them a compelling set of benefits and incentives. In addition to a clear customer value proposition, this demands an appealing value proposition for contributors to the ecosystem. Better Place, which launched an innovative ecosystem solution to battery rental and replacement for electric vehicles, learned this lesson the hard way. It shut down after six years and $900 million of funding because it was unable to convince leading car manufacturers to

Establish the right governance model. Our analysis of 110 failed ecosystems found that weaknesses in governance are the single most common cause of failure, accounting for more than a third of the cases. The governance model must establish the proper level of openness by balancing open elements (which attract partners, stimulate growth, and enable innovation) and closed elements (which ensure consistent quality and alignment). Publishers refused to join Sony’s e-reader platform because they believed that its openness did not sufficiently protect their copyrights. Instead, they opted for Amazon’s Kindle and its very closed platform that loaded content only from Amazon and precluded users from transferring books to other devices, printers, and readers. On the other hand, overly closed governance may choke an ecosystem’s growth, as experienced by the BlackBerry in its competition with the iPhone.

Focus on scale before scope. In the traditional approach to innovation, a new product or service is developed to its full scope, tested in a pilot market, and subsequently rolled out to full scale. Successful business ecosystems follow a different path. They start with a clear value proposition of limited scope and focus on building scale before expanding the scope of the offering. LinkedIn started as a pure-play social network aimed at connecting professionals through simple profiles. It didn’t add online recruiting, advanced messaging features, and a publishing platform until it had established a broad network of active users. In contrast, General Electric struggled to establish Predix as a leading IoT platform partly because it lacked focus and tried to be everything to everyone at once.

Solve the chicken-or-egg problem. One of the biggest conundrums that companies face when launching ecosystems is the chicken-or-egg problem of securing sufficient participation of both customers and contributors. The key to solving it is to identify and subsidize whichever side of the market must be developed in order to achieve critical mass. Several early restaurant reservation platforms failed because they tried to attract restaurants by charging them little or no fees and, instead, charged diners for the service. Diners balked, and when the platforms couldn’t fill seats, so did the restaurants. OpenTable succeeded by attracting a critical mass of diners with no fee and charging restaurants for filling seats.

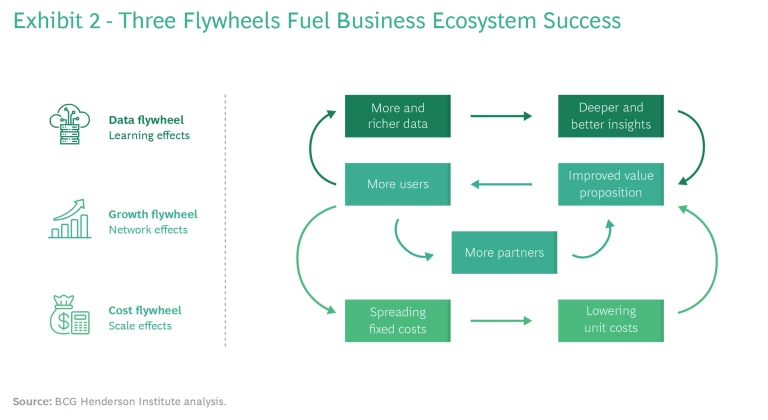

Create three flywheels. The secret sauce in the design of many successful business ecosystems is three mutually reinforcing flywheels. (See Exhibit 2.) The growth flywheel is based on indirect network effects and bolsters the value of the ecosystem to orchestrators and contributors as the number of customers grows, and vice versa. The data flywheel is based on learning effects and taps user growth to generate more and richer data, which in turn is used to improve the value proposition and attract more users. The cost flywheel is based on economies of scale and uses ecosystem growth to spread fixed costs and lower unit costs to generate more growth. All three flywheels are essential; consider the many ride-hailing platforms that created effective growth and data flywheels but struggled to activate the cost flywheel and thus accumulated losses.

Ensure social acceptance. A number of successful ecosystem players have recently experienced substantial backlash from consumers, partners, competitors, and regulators. In order to build social capital and secure social legitimacy, orchestrators must establish an ecosystem governance model that is consistent and fair. Consistency means that the mechanisms of governance are transparent and easy to understand, comprehensive, internally consistent, and stable over time. Fairness means that governance complies with local laws and norms, avoids biases (for example, in data algorithms and access), and engenders trust among participants. An ecosystem can only prosper in the long run if it creates tangible value and distributes it in a fair manner among its participants.

5. How Can We Win Against Competing Ecosystems?

Ecosystem competition differs from conventional market competition in three ways.

First, boundaries are fuzzier with ecosystems. Market borders become fluid as expanding ecosystems follow customer needs. Automakers find themselves competing with tech players for mobility solutions, and banks find themselves competing with e-commerce retailers for payment services. Corporate borders become less relevant as the competitive context shifts from products and companies to the broader context of ecosystems. As CEO Stephen Elop rightly observed in a 2011 speech to Nokia’s employees: “Our competitors aren’t taking our market share with devices; they are taking our market share with an entire

Second, ecosystems must compete for contributors as well as customers. In addition to a compelling customer value proposition, they need a powerful contributor value proposition, as well as the ability to strike a nuanced balance between collaboration (to grow the pie) and competition (to divide the pie). Also required is the willingness to give up full strategic control and accept that ecosystem strategies, even more than traditional competitive strategies, are to some extent emergent and may pivot from time to time.

Third, ecosystem competition is frequently winner-takes-all or winner-takes-most. Network, learning, and scale effects bolster the competitive advantage of the leading ecosystems and make it ever more difficult for other ecosystems to catch up. This suggests that there is a first-mover advantage that is less about being the first in the market and more about being the first with a complete solution. Apple’s iPod was not the first digital music player, but it was the first to offer a comprehensive solution by combining the hardware product with the iTunes music management software.

While some aspects of competition are different in an ecosystem context, others are the same. Ecosystems still need to differentiate themselves from their competitors. Orchestrators can use the architecture and technology of their platforms, data analytics frameworks and algorithms, and their governance model to differentiate along three dimensions: the scope of the ecosystem, its customer value proposition, and its contributor value proposition.

The scope of the ecosystem answers the timeless strategic question of where to play. Which market segments and geographies will you target? Niche plays can succeed when some customers have divergent needs that are not fully served by mass solutions or when they develop a yen for more sophisticated solutions. Thus, we see Uber and Lyft competing head-on in the mass market for ride-hailing, while their competitors Wingz, HopSkipDrive, and Veyo focus on airport transfers, small children, and non-emergency medical transports, respectively. Geographically focused models can succeed when local network effects or network density is more important than network size, as it is for platforms that focus on well-defined neighborhoods.

The customer value proposition is part of the answer to the strategic question of how to play. In ecosystems, one of the major tradeoffs in the customer value proposition is between an emphasis on the scale and breadth of the offering and an emphasis on the quality of the customer experience. The used-fashion platform Poshmark focuses on expanding its offering by setting very few boundaries for sellers and driving engagement and social interaction among platform participants. By contrast, its competitor ThredUp focuses on customer experience and quality by actively curating and positioning products on the platform.

A strong focus on customer experience typically requires a higher investment in areas such as enhanced platform functionality, curation processes, and additional services. Ecosystems that pursue this strategy can compete in ways that can be difficult for competitors to match without jeopardizing their core business model. When Google launched Google Maps on Android, TomTom, the leading location technology provider at that time, managed to avoid head-to-head competition by refocusing its customer value proposition, emphasizing transparency of data usage, which enhanced its appeal to major car manufacturers, ride-hailing service providers, and mobile operating systems. Google could not follow without jeopardizing its core business model of data

The contributor value proposition, which defines the ecosystem’s desired contributors and what they will receive in return for their participation, provides the second part of the answer to the question of how to play. The governance model of the ecosystem is an important source of competitive advantage here. An open model makes it easy for contributors to join and offers them greater freedom, while a closed model limits internal competition and enables strong alignment among contributors. Both approaches can be successful, as seen in the video game industry where Nintendo adopted rather strict quality controls and quantity limitations for externally developed games and Microsoft Xbox offered external game developers a good deal more freedom.

We’ve seen that the development of an ecosystem is strongly path dependent and that early governance decisions can significantly change its trajectory and future position. Thus, many successful ecosystems started with rather closed governance (to control quality and behavior and avoid a vacuum that contributors could fill) and became more open over time. However, new entrants to ecosystem competition are frequently forced to start with a more open governance model to quickly gain scale and catch up with their more established competitors.

Of course, positioning an ecosystem on the three dimensions of competitive differentiation does not represent dichotomous choices—the dimensions are more like spectrums that contain many potential positions. Moreover, the combination of the dimensions and the way they reinforce each other offer additional opportunities for differentiation. HopSkipDrive focuses its ride-hailing platform on the narrow customer segment of small children. Correspondingly, it emphasizes trust, transparency, and safety in the customer experience (for instance, by publishing regular safety reports and offering real-time tracking of rides). This positioning is further reinforced by a very strict governance model that requires drivers to prove their qualifications and pass a detailed background check.

6. How Can We Capture Value in Our Ecosystem?

Numerous platform-based businesses—many of them fueled by cheap venture capital—have achieved impressive revenue growth, market positions, and valuations but are still far from earning profits.

And they may be right not to focus too much on profit because in an ecosystem world the question of value appropriation should not come first. The best way to benefit from an ecosystem is to focus on creating value for the customer. This will increase the total size of the pie and thus the size of your slice. An ecosystem where all participants focus on their own advantage will find it hard to establish the level of cooperation that is required to create some value to distribute in the first place.

Nevertheless, at some point, boards and investors will want to know how the platform owner is going to capture a fair share of the value that is created by and for the ecosystem. For this, it is important to understand the peculiar economics of the ecosystem business model. Most traditional businesses experience diminishing returns; as the number of customers grows, the value per customer declines, naturally limiting the economically viable size of the business. In contrast, most business ecosystems enjoy increasing returns; driven by network and learning effects, the value per customer increases as additional customers join the ecosystem. This enables many ecosystems to benefit from exponential growth and winner-takes-all or winner-takes-most dynamics.

There is a dark side to the story, however. An exponential growth profile also implies that it may take a long time before the ecosystem reaches the tipping point and really takes off. Accordingly, platform owners tend to wait and hope that they will eventually reach the tipping point, so if they fail, they fail late, after spending substantial amounts of money. This makes ecosystems an investment with potentially high returns, but also with high risks. Many venture capitalists are attracted by this profile, but it is much harder for most incumbent firms.

For the orchestrators, this economic profile is even more pronounced than it is for contributors. The orchestrator is the residual-claim holder of the ecosystem. While it has a big influence on the distribution of the value created, it must also make sure that all players earn enough to keep them on board. In return, the orchestrator can retain the residual profit, which may eventually be very high but is negative for an extended period. By comparison, a contributor role offers lower upside potential at a lower risk.

Orchestrators must consider two levels of value capture. They must monetize the benefits that the ecosystem creates for its participants (ecosystem monetization), and they must distribute the value among its participants (value distribution).

In terms of ecosystem monetization, the orchestrator must balance three competing objectives: maximizing the size of the pie; enabling essential contributors to earn enough profit to ensure their ongoing participation; and capturing its own fair share of the value. To achieve this, the orchestrator must decide whom to charge and what to charge for from a wide range of options. For example, it could charge all participants or charge only one side of the market while subsidizing the other side, or it could offer reduced charges for particularly price-sensitive customers. Similarly, the orchestrator could demand an access fee, licensing fee, transaction fee, or revenue share, or it could monetize the ecosystem through the sale of supplementary products or services, or through advertising revenues.

In general, ecosystem monetization should not stifle the growth of the ecosystem; it should encourage and incentivize participation. This can be achieved, for example, by charging for transactions versus access, subsidizing the side of the market that is less willing to participate, and/or offering rebates for increased usage and rewards for recruiting new participants. Moreover, monetization efforts should be directed at overcoming bottlenecks in the ecosystem and encouraging innovation by, for example, subsidizing bottleneck players and/or lowering prices on new products.

Value distribution, which is regulated by the ecosystem’s governance model, can include access to customers, data, and intellectual property, as well as money. The orchestrator can secure its share of the value by harnessing its role as a gatekeeper and occupying critical control points, such as access to customers, essential products or services, and bottlenecks in the system.

Orchestrators can use a variety of strategies to increase their value share. Some improve and extend their offering by integrating their own versions of successful applications developed by complementors, a strategy called

Orchestrators should take care not to reach beyond their grasp in the quest for value appropriation or to misuse their power. They must manage the risks of losing the support of their contributors as expressed by increased multihoming (when contributors participate in multiple competing ecosystems), disintermediation (when participants bypass the platform and connect directly), or forking (when contributors exploit the resources of the ecosystem to become direct competitors). Toward this end, orchestrators should continuously monitor the health of their ecosystems and look for red flags, such as declining engagement levels, complaints about predatory behavior, negative coverage in social media, or increases in the number of legal actions filed against the platform.

7. How Can We Benefit as an Ecosystem Contributor?

Not every company is ready, willing, and able to be an ecosystem orchestrator. Indeed, given the vastly greater demand for contributors, it is far more likely that your company will fill that role.

Fortunately, being a contributor can offer as many opportunities as being the orchestrator. Many incumbent firms have successfully followed this path and shared in the success of large ecosystems. Axa launched a first-of-its-kind ridesharing insurance product on the BlaBlaCar platform, and Philips executed on its strategy of becoming the leading lighting expert in the smart-home market by first partnering with Apple and then joining most other smart-home ecosystems as a complementor.

There are five key success factors that contributors need to get right.

Join the right ecosystem. Contributors should identify ecosystems that are aligned with their strategic priorities. They should assess the competitive position of potential ecosystems to find the one with the highest likelihood of success. Then, they should scrutinize its governance model, paying particular attention to transparency and decision rights, rules that limit access to customers and the freedom to operate, required commitments and investments that may restrict future flexibility, and the design of the data and value sharing plan.

Define the right level of engagement. The right level of engagement can be determined by asking two questions:

- Should we commit to just one ecosystem or multihome in several ecosystems?

- Should we bring the full breadth of our offering to the ecosystem or limit it to specific products and services?

A high level of commitment to one ecosystem allows a contributor to strategically focus its efforts, limit the complexity of its operating model, and realize economies of scale. On the other hand, it can maximize exposure to and dependency on the ecosystem and reduce strategic flexibility and bargaining power.

Stand out from other contributors. Competition within an ecosystem is different from competition in an open market because the rules of ecosystem competition are largely defined by the orchestrator and can change over time. A contributor can stand out from its internal competitors and improve its bargaining position by occupying control points within an ecosystem, such as essential components, customer access points, and bottlenecks. It also can stand out by enhancing the value it adds to an ecosystem—becoming a category leader, dominating a niche, creating a new category, closely collaborating within a subset of contributors, or finding creative ways to exploit the mechanics of the ecosystem.

Avoid being commoditized by the orchestrator. Contributors can avoid commoditization using preventive and defensive measures. To mitigate the chances of such a threat materializing, contributors need to stay innovative and deliver value that orchestrators cannot. They also should secure direct access to customers and their granular data whenever possible. And, if the orchestrator begins to act in ways that commoditize contributors’ offerings, the contributors should be ready to resist through lobbying, mobilizing public support, and, if necessary, legal action.

Know when it is time to leave. Contributors should regularly review their decision to participate in an ecosystem and be open to reversing it. Indicators that it may be time to seriously consider leaving an ecosystem include a rising risk of brand damage, competitive discrimination, erosion of trust, the decline of the ecosystem, and the emergence of better alternatives. Leaving an ecosystem should not be an unmindful decision—joining an ecosystem should entail a commitment to support and fight for it. But in the end, one of the benefits of being a contributor is not having to go down with the ship.

8. How Can Our Ecosystem Strategy Evolve over Time?

The evolutionary development of ecosystems cannot be predicted. It is an emergent process that is influenced by many factors, such as competition, regulation, the evolving needs of customers, and your resources, underutilized assets, and appetite for risk.

Many of the successful ecosystems we studied have pivoted multiple times and in unexpected ways. Indeed, adaptability is one of the major strengths of ecosystems.

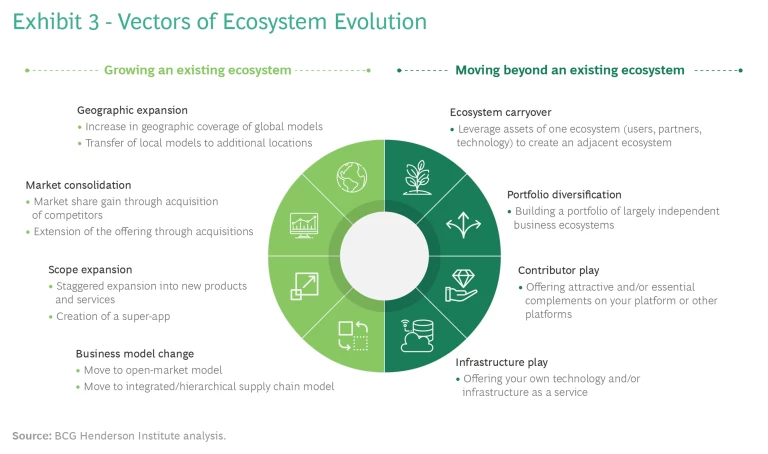

Would-be orchestrators should consider the evolutionary possibilities when planning ecosystems because those possibilities can inform the initial design and guide future strategic decision making. In addition, the orchestrators of existing ecosystems should consider their future possibilities as they seek to build and expand. We’ve identified eight vectors of ecosystem evolution in two categories. The vectors can be pursued individually or in various combinations. (See Exhibit 3.)

The first set of vectors offers options for growing an existing ecosystem:

- Geographic Expansion. An ecosystem with a global business model can grow by gradually increasing its geographic coverage, as did Airbnb, which, as of June 2021, was active in more than 220 countries and regions. Local business models can also be transferred to additional locations, as did Uber, which started in San Francisco and expanded into 100 new cities within three years.

- Market Consolidation. Ecosystems can expand their offering and gain market share through acquisitions. Roll-up strategies aimed at acquiring multiple smaller competitors and consolidating the market are an effective way to compete in a winner-takes-all environment, as we’ve seen in the online food delivery sector.

- Scope Expansion. The scope of an ecosystem can be expanded by adding new products or services (as LinkedIn did by offering publishing and recruiting services); by transitioning from a pure-play solution or transaction ecosystem to a hybrid (as Airbnb did by inviting providers of supplementary services, such as tour guides and cooking instructors, onto its platform); or by becoming an all-encompassing super-app (such as WeChat, which started as a messenger service and developed into the Chinese “app for everything” with more than 1 billion monthly active users).

- Business Model Change. In some instances, the next stage of development can best be achieved by giving up the ecosystem model. For example, smart-home ecosystems may slowly develop into open-market models by establishing Matter as an interoperable home automation connectivity standard, and ride-hailing companies could use self-driving cars to move their business model away from a gig-economy matching platform toward a more integrated organization with its own fleet.

The second set of vectors offers options for moving beyond an existing ecosystem:

- Ecosystem Carryover. Leveraging the success of one ecosystem to construct a new one can be an effective pathway to growth. Apple used its strong position in the music player ecosystem to conquer the smartphone ecosystem by positioning the iPhone as the next-generation iPod, while Uber leveraged the large base of drivers and passengers on its ride-hailing platform to build the Uber Eats food delivery ecosystem.

- Portfolio Diversification. A shift in emphasis from synergies to experimentation and diversification yields a portfolio approach to ecosystem growth. The Allianz Group exemplifies this vector with its digital investment unit Allianz X and its broad portfolio of ecosystem investments.

- Contributor Play. Some ecosystem orchestrators grow by contributing products and services they offer in their own ecosystem to other ecosystems. For example, Alipay was initially launched on Alibaba’s Taobao platform, but it has developed into a leading provider of mobile and online payment services and a contributor in many ecosystems worldwide.

- Infrastructure Play. Finally, some successful ecosystem operators grow by offering their technology and infrastructure as a service to outside partners. AWS, which was developed to support Amazon’s e-commerce ecosystem, now powers other major ecosystems, including Airbnb, Twitch, and Twitter, and has become the company’s most profitable division.

Business ecosystems are not a panacea for every market opportunity, but neither are they a fleeting fad. Although they have gained an enormous boost from digital technologies, they have been around for centuries. Accordingly, every company, including industry incumbents, should master the ways and means of ecosystems.

Currently, many incumbent firms are playing catch-up in this arena, but they are fast learners. As the technology for building and running digital platforms becomes increasingly commoditized and the success factors for managing them become clearer, more and more incumbents will be well positioned to unlock the rich opportunities for innovation and value creation offered by ecosystem models. We hope this step-by-step framework for developing an ecosystem strategy will support them on the journey.