In an era of technological advancements, geopolitical tensions, and economic turmoil, standing still is akin to moving backward. As the durability of competitive advantage has dwindled, the average tenure of companies on the S&P 500 index has more than halved since the late 1970s.

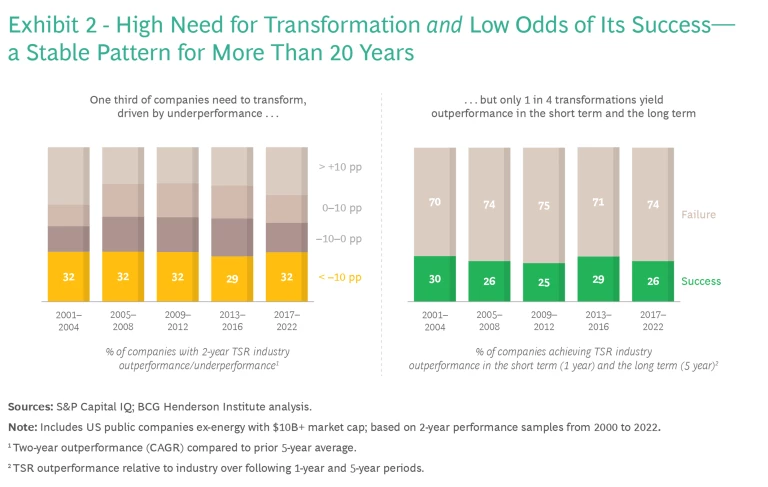

But changing with the times is difficult: A new global BCG study reveals that during the past two decades, only 26% of corporate transformations successfully created value in both the short and long terms. (See “About Our Research.”)

So how can change leaders beat the odds? We use our empirical insights to highlight five truths about corporate transformation—and refute one lie that executives like to tell themselves.

Truth #1: You Can (and Should) Fix Things Before They Break

In transformations, timing matters: Pre-emptive transformations are initiated while total shareholder return (TSR) is in line with or ahead of industry averages. These transformations create significantly more value in the medium and long run (+2.7 percentage point TSR over a three-year horizon) than reactive transformations (initiated after TSR has already dipped below the peer group).

Transforming preemptively—before a performance gap has opened up—means transforming from a position of strength, subject to less pressure and scrutiny: leaders are empowered to focus on identifying options for future advantage, rather than on purely defensive moves, such as divestments.

Consider, for example, Microsoft’s remarkable trajectory over the past decade: After stagnating performance from 2009 to 2012, the company managed to achieve some momentum between 2012 and 2014 (achieving 36% annualized TSR). Not content with this recovery, Microsoft’s then-incoming CEO Satya Nadella made changes to lay the groundwork for future success: He oriented the company toward the new dominance of cloud, even though this trend had not yet damaged the bottom line. This move set Microsoft up to nearly triple its stock price in the first four years of Nadella’s tenure. Nevertheless, he announced yet another restructuring in 2018, setting up an AI division, which was soon bolstered by Microsoft’s early $1 billion investment in OpenAI.

Truth #2: Leadership Will Make or Break Your Transformation

Microsoft’s story also highlights the importance of leadership. The firm’s successful transformations were not only driven by Nadella’s anticipation of future trends, but also his willingness to question and change the mental models and organizational structures that underlay the company’s historic success. For example, since the 2018 restructuring, Microsoft no longer has a division dedicated to its Windows operating system. Contrast this with Blockbuster’s leadership rejecting the opportunity to acquire a fledging Netflix, Swissair continuing to invest in its failing airline, or Kodak not embracing the digital photography technology it pioneered—and the importance of leadership commitment to change becomes crystal clear.

When leaders present an obstacle to change, their removal can improve transformation outcomes.

- Our data shows that a leadership change during a transformation is associated with a 4.1 percentage points higher TSR performance over the five-year time horizon (compared to the previous downturn period).

- The positive TSR impact is even higher (an additional 3.7 percentage points over the five-year period) if the new leadership comes from outside of the company.

However, a change in leadership is not a guaranteed success driver; it is also associated with a high variance in TSR outcomes. As such, this effect is less driven by the leader per se than by their willingness and commitment to making a change—particularly at a time when leadership engagement in transformations is on the decline. Consistent with this, we find that preemptive transformations—in which leaders act to fix things before they break, demonstrating their initiative and commitment—are associated with higher leadership stability than reactive ones (4.7 percentage point lower frequency of CEO change during the transformation period). Moreover, we know from other research that stability in leadership teams can also drive a company’s long-term growth potential.

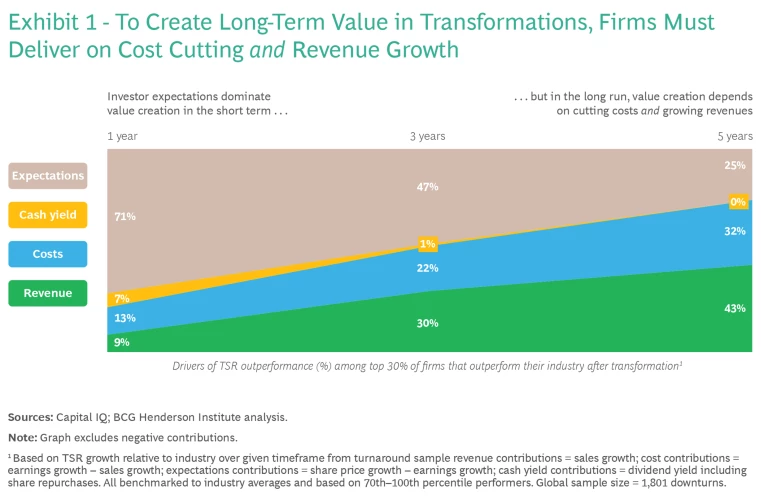

Truth #3: You Cannot Cut Your Way to Greatness

Our analysis shows that, in the short term, investor expectations are the most significant driver of value creation in a transformation contributing more than two thirds of TSR outperformance over industry peers in the first year after a transformation is initiated. (See Exhibit 1). Efficiency improvements drive 13% of the outperformance, while the remaining factors (revenue growth and margin improvements) play even smaller roles.

As such, it is crucial for companies to craft a compelling transformation plan and narrative at the outset of their journey, and to define a clear communication agenda toward their shareholders. Moreover, firms must signal discipline and momentum by executing on quick wins for cost reductions.

In the long term (five years), value creation drivers are flipped, such that the lion’s share of TSR outperformance is driven by successful cost reductions (32%) and revenue growth (43%), while investor expectations play a smaller role (25%). This indicates that, in the long-term, execution is key, as investors will keep executives to their promises. Moreover, it shows that you cannot cut your way to greatness: differential growth is critical to sustained value creation.

Truth #4: Transformations Require a Long-Term Orientation

Achieving sustainable growth and a future-proof operating model requires entering transformations with a long-term orientation, rather than merely focusing on addressing performance woes or catching up to peers in terms of technology stack or organizational best practices.

Our data shows that having a long-term strategic orientation exhibits a strong positive impact on transformation performance, being associated with a 12.5 percentage points higher TSR impact over a five-year horizon.

Beyond mindset, culture, and metrics, a long-term orientation also means investing in the exploration of new ideas that could be the basis of future advantage: above industry-average R&D spending is associated with a 2.9 percentage point improvement in TSR performance over the course of a transformation.

Above industry-average capital expenditures are also linked to better transformation outcomes—to the tune of 3.7 percentage point TSR over a five-year horizon. This indicates that leaders must find the right balance between identifying new sources of growth and improving their existing model, for example, by upgrading production machinery. It also underlines that operational effectiveness needs to be tied not only to cuts, but also to selective investments.

Truth #5: You Cannot Make Things Up as You Go

Transformations are complex and require simultaneously delivering on several objectives—usually under immense pressure from the outside and inside. As a result, companies cannot make transformation up as they go.

Putting a formal transformation program in place—which we identify based on a combined analysis of corporate announcements and restructuring spend—has a positive impact (5.9 percentage points) on long-run TSR during transformation periods. Moreover, the scale of the program and the willingness to invest in change matter, with our results further showing a strong, positive correlation between above industry-average restructuring spend and TSR outcomes (+5.7 percentage points over five years).

Formalizing the transformation entails defining a clear governance and process—or setting up a dedicated transformation office—for coordinating and tracking progress on change initiatives, as well as regularly communicating it to the executive leadership team so that roadblocks can be addressed promptly. Moreover, it may mean putting in place a chief transformation officer to helm an ambitious change effort, which our prior research shows can improve transformation odds significantly. However, simply having a CTO on staff is not a panacea. The role must be designed appropriately and filled by someone who is persistent, vigilant, and flexible—and who is trained for the job.

A Lie: You Are Special—and These Insights Don’t Apply to You

The empirical patterns of transformation are quite stable: At any point in the past 20 years, roughly 30% of companies significantly underperformed their sector for a period of multiple years, making transformation a necessity for performance reasons.

Just as crucially, these patterns are remarkably universal, with our data showing that no region, sector, or size group is an outlier on transformation need and success rates. The success factors of transformations discussed throughout this article also have directionally similar effects across all subgroups of our sample.

Put briefly: When it comes to transformations, no one is special. Change leaders have no reason to be overconfident, given that only half of the companies we studied employed more than two of the key success factors we identified. Sustainable value creation through transformation remains so rare.

About Our Research

Our empirical study covers the period 2001 to 2022, with the sample including nearly 2,000 public companies from around the globe that generated at least $10 billion in revenue in 2022 or had a market capitalization of $10 billion at the end of that year.

To identify transformations, we assess firms’ total shareholder returns (TSR) relative to their industry peers, as transformations are regularly initiated in reaction to performance downturns. We combine this with a predictive model, which leverages information from corporate announcements and data on restructuring spend to identify whether a formal transformation program has been set up.

Depending on data availability across variables in a given analysis, our study covers between 1,000 and 2,000 transformations.

In an increasingly turbulent world, changing with the times is crucial—but the odds of success are slim. To beat them, change leaders must heed these truths about corporate transformations.