Alternative proteins burst onto the scene a decade ago, promising comparable taste to animal proteins and fewer greenhouse gas (GHG) emissions. But alternative proteins have faced challenges in winning over consumers: today, plant-based meat accounts for only 1% of meat dollar sales in US retail, and many alternative protein startups face tight private capital markets.

And yet, achieving mass adoption of alternative proteins is critical to reducing the impacts of global food production. Animal agriculture accounts for roughly 15% to 20% of GHG emissions—greater than the combined carbon output of cars, motorcycles, and other passenger light vehicles. If alternative proteins could capture half of the global protein market, including dairy, this switch would mitigate 5 gigatons of CO2 equivalents annually.

Achieving mass adoption of alternative proteins is critical to reducing the impacts of global food production.

To realize its full potential, the alternative protein industry should take inspiration from the electric vehicle (EV) sector, whose success has come in large part from addressing the hurdles to consumer adoption that limited potential expansion early on. Private companies tackled these challenges by innovating to narrow the gap in quality and price with gas-powered vehicles, governments helped by providing generous subsidies and policies, and investors contributed by funding the full value chain.

According to the International Energy Agency, governments worldwide provided roughly $40 billion in direct purchase subsidies for EVs in 2022. That dwarfs the $635 million in total government support that the alternative protein industry received that same year. This imbalance is likely even larger if we include all government support for EVs. A longstanding public commitment to EVs has stimulated significant private investment over the past seven years—enabling the EV industry worldwide to grow from less than 0.2% of total new car sales in 2012 to 18% in 2023, according to IEA data.

Key Parallels: EVs and Alternative Proteins

The parallels between the EV and alternative protein industries are striking. Both are disruptive technologies taking on incumbents whose products are rooted in consumer culture and identity. Both are responsible for large slices of global GHG emissions (passenger road transportation for 10%; animal agriculture for

And yet, both have encountered obstacles in gaining consumer trust. EVs have been scrutinized for battery fires, consumer range anxiety, a lack of charging infrastructure, and ecological and ethical issues related to the mining and processing of raw materials. Alternative proteins have faced criticism for the level of processing used to create plant-based substitutions.

The similarities continue on the supply side, where the two industries confronted early challenges in scaling production. Both sectors have encouraged industry incumbents to support and invest in diversifying their product portfolios. For alternative protein companies, that means persuading food and agribusiness firms to invest, just as legacy automakers expanded into EVs.

Alternative proteins are one of the most effective technologies we have to reduce the environmental costs of our food systems. Unfortunately, this area is not moving at the speed necessary to combat climate change and is far behind advances in the energy sector. It’s important to see what can be learned from innovations in energy and transport to accelerate efforts in this space. — Hannah Ritchie, Hannah Ritchie

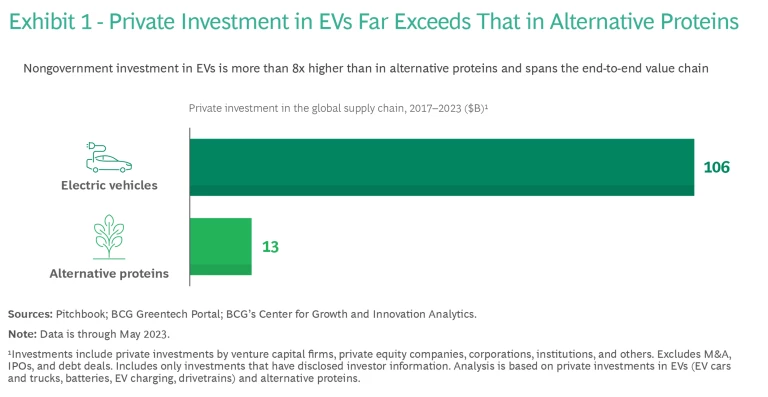

Building institutional support has been challenging for alternative protein companies in recent years. After a flurry of private investment from 2019 to 2021, funding slowed. All told, alternative protein companies raised one-eighth of the private capital of the EV industry from 2017 to 2023. (See Exhibit 1.) This is surprising, given that a previous BCG article showed investing in alternative proteins has the highest CO2 equivalent savings per dollar of invested capital of any sector, four times that of light road transportation. The funding struggles of alternative protein players have been compounded by the ongoing regulatory battles over product labeling and a complicated, patchwork approval process for novel food products.

Still, there are early signs that the alternative protein industry is gaining regulatory support. The US, Denmark, Israel, Singapore, and South Korea created policy frameworks for cultivated meat, and the US, Israel, and Singapore approved a groundbreaking fermentation-derived animal protein. But for the alternative protein industry to achieve its full economic, environmental, and food security benefits, governments need to step up their support.

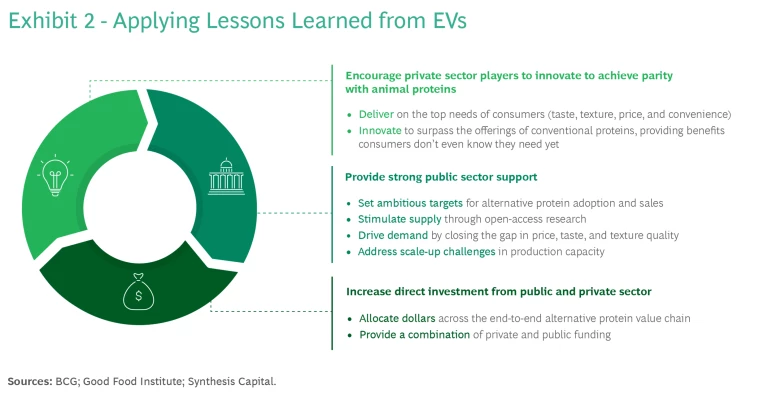

And to successfully expand this sector, governments and alternative protein companies should learn from the lessons that jump-started the growth of the EV industry. (See Exhibit 2.)

Lesson 1: Innovate to Achieve Parity with Animal Proteins

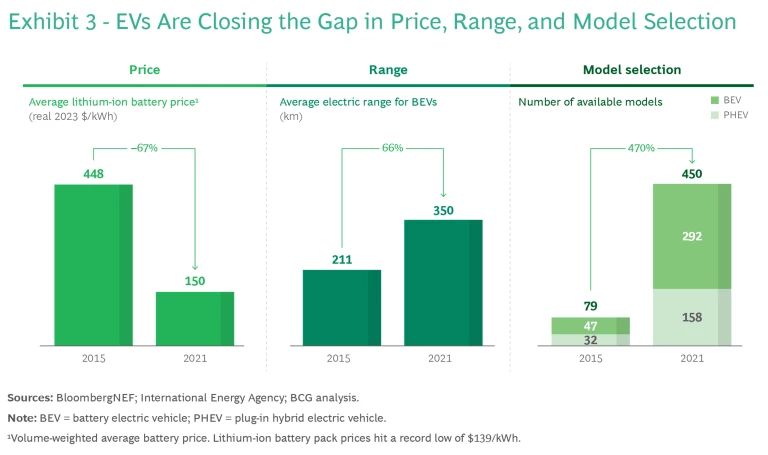

To compete with gas-powered vehicles, EV makers have used the public and private investments they received to innovate on vehicle quality and cost. Over time, they’ve significantly closed the gap with traditional vehicles on price, range, and model selection. (See Exhibit 3.) What’s more, they have delivered capabilities that traditional autos lacked, including cutting-edge operating systems and superior acceleration. Suddenly, sustainability is no longer a tradeoff—but a bonus.

That said, EVs are one of the highest-cost investments that many customers make. Car shoppers often purchase vehicles after brief test drives and live with their decision for several years.

By contrast, consumers have hundreds of opportunities each year to choose their preferred protein products at a grocery store or restaurant. Food choices are studded with cultural ritual and novelty, fulfilling a distinct need for consumers. Those differences impact how alternative protein companies design and market their products.

Deliver on Consumers’ Needs

By making their vehicles competitive with gas-powered cars on price, range, and model selection, the most successful EV makers have given consumers choice and trust in product quality. This has helped sell sustainability as an “and,” not an “or.”

For the alternative protein industry to achieve similar success, companies must innovate to create products that mimic the best properties of animal proteins. Consumer adoption of alternative proteins won’t take off until they match animal proteins in taste, texture, price, and convenience.

The alternative protein industry needs to deliver products that do more than appeal to consumers’ better nature regarding climate change, water pollution, and other ethical concerns. Companies must also appeal to their customers’ core food needs. This requires producers to take a holistic approach that prioritizes taste and texture alongside considerations such as price and convenience. The goal is to make alternative proteins a choice rather than a compromise. This way, sustainability becomes a sweetener, not a sacrifice.

Develop Products That Surpass Conventional Proteins

The evolution of most successful EV players such as Tesla reflects a broader vision to meet and exceed consumer expectations for lightweight vehicles writ large, not just EVs. Instead of concentrating only on sustainability, successful EV makers have focused on delivering great cars with innovative features not often found in traditional cars. This means producing EVs with a low cost of ownership, active safety features, self-driving technology, and advanced software.

Similarly, the most successful alternative protein producers will be those that first deliver on consumers’ needs—which include closing the gap in taste and price—and then out-innovate existing food companies. Technology gives alternative protein makers unbounded creativity to innovate in ways that the makers of animal meats can’t. This could mean developing products with additional benefits, such as enhanced nutrition or wellness-promoting functional ingredients.

Alternative protein producers can also use technology to provide novel tastes and flavors currently unavailable to consumers. Over time, the ability of alternative protein makers to personalize and customize their products to address consumer allergies, health conditions, and other dietary needs and preferences may give them an edge over conventional proteins.

The unique properties of plant-based ingredients—such as fiber—can be leveraged to help fill nutritional gaps in diets, which is an attractive proposition to important demographics such as parents. — Stephanie Banham-Eichner, Stephanie Banham-Eichner, CEO and Co-Founder of Kiddiwinks

Lesson 2: Build a Supportive Public Sector

Public sector support has been critical to the growth of novel technologies, from semiconductors and the internet to biotechnology. (The US biotech industry alone now receives more than $9 billion in annual funding just from the National Institutes of Health.) This, too, was the case with the EV industry, which has benefited from government subsidies and incentives that have helped underwrite the costs of R&D, tooling, manufacturing, and the growing national network of charging stations.

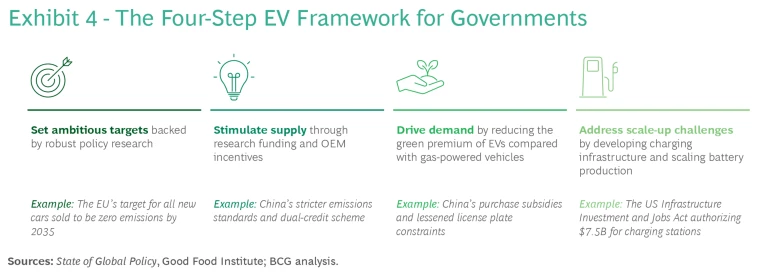

Ambitious demand-, supply- and ecosystem-side policies—such as the Inflation Reduction Act (IRA) and Infrastructure Investment and Jobs Act (IIJA) in the US, the dual-credit system for new-energy vehicles in China, and the European Union’s Green Deal—have accelerated EV adoption. These pieces of legislation follow a similar four-step framework: government investment and support primarily include setting ambitious targets, stimulating supply, driving demand, and proactively addressing scale-up challenges. (See Exhibit 4.)

Set Ambitious Targets

The European Union’s stair-step approach to reducing auto emissions is an example of ambitious target setting. The EU’s new CO2 standards require average emissions from new cars to fall 55% by 2030 versus 1990 levels and for new models to be zero-emissions as of 2035. While governments have created a few goals supporting alternative proteins, they need to make much larger commitments to establishing ambitious targets for carbon reduction in the food system.

Stimulate Supply

The catalysts for China’s production of EVs were stricter emissions standards and a dual-credit policy that financially rewarded carmakers that met their EV quotas. In contrast, government support for alternative proteins has been more modest. According to the Good Food Institute, governments around the world invested roughly $180 million in alternative protein R&D in 2022, with much of that funding allocated to publicly accessible research grants.

While governments also provide financing to support domestic market development and the infrastructure for cultivated and fermented foods, more funding is needed to develop and scale up the full spectrum of alternative proteins. Because startups are conducting much of the research, the breakthroughs they achieve tend to be treated as proprietary. Governments can play a role by funding open-access research that helps alternative protein makers collectively achieve scale.

Drive Demand

Governments can also stimulate demand by enacting regulations that aid companies in bringing innovative proteins to market. For instance, Chinese policymakers helped reignite EV demand during the pandemic with generous purchase credits on the national and local levels, as well as streamlined license plate registration processes for EVs (compared with internal combustion vehicles). While governments have implemented programs to lower the prices of EVs—stoking consumer adoption—many alternative protein companies are still navigating the path to market. But as the industry grows and applications for market approval increase, governments must be prepared to evaluate alternative products quickly.

Most alternative protein research has focused on improving taste, price, and texture—all areas where conventional animal products still enjoy an advantage. More work must be done to address other areas important to food choices, including factors such as health and variety. The European Union, led by Germany, is funding research to improve the availability, sensory properties, and nutritional benefits of alternative proteins.

Address Scale-Up Challenges and Labor Concerns

One main challenge for any emerging industry is to create the public infrastructure that may be needed to support its products. In early 2023, US policymakers gave the EV industry a boost by providing up to $7.5 billion in public (IIJA) funding to build more EV charging stations. In addition to its own charging-station initiative, the Chinese government also helped EV manufacturers address shortages of skilled workers by developing a German-style vocational education system.

The alternative protein industry can take a page from the US and Chinese EV industries by helping startups build more labs and add demonstration-scale capacity. The EU has taken that step by funding Bio Base Europe in Belgium, a pilot manufacturing facility for innovative bio-based products and processes. Proactive measures like this will help Western economies remain competitive in the transition to alternative proteins. The government of Singapore offers valuable support to the industry as well. (See “Singapore’s Alternative Protein Policies Serve as an Inspiration for Governments Worldwide.”)

Singapore’s Alternative Protein Policies Serve as an Inspiration for Governments Worldwide

Set ambitious targets. Alternative proteins can play a role in helping Singapore achieve its ambitious “30 by 30” goal—producing at least 30% of its nutritional needs domestically by 2030—and making its food supply chain more resilient.

Stimulate supply. Singapore has dedicated $107 million to fund R&D for alternative proteins, including projects to improve the nutrition, taste, and texture of plant-based proteins produced domestically.

Drive demand. The Singapore Food Agency (SFA) has pioneered a regulatory framework for cultivated and microorganism-based meats. The SFA changed the approval process, requiring alternative protein makers to seek premarket approval of products that do not have a history of being consumed as food. Companies must submit test results addressing potential risks such as toxicity and allergenicity, as well as details of their manufacturing processes. This preapproval process is designed to give consumers confidence in the safety of alternative proteins.

Address scale-up challenges. Singapore is building its production capacity by helping startups fund the construction of shared laboratory and production spaces. This includes a $21 million investment in the Food Tech Innovation Centre, which will provide up to 10,000 liters of capacity for microbial fermentation. In addition, academic institutions in Singapore have been working with industry partners to develop short courses to train adult learners and career switchers for jobs in the plant-based meat industry.

Lesson 3: Boost Public and Private Investment

The record $635 million that governments invested in 2022 to support research, development, and production of alternative proteins is still a fraction of what the industry needs to thrive. A 2021 BCG analysis found that nearly $30 billion and $11 billion, respectively, are required worldwide just to build the critical bioreactors and extrusion capacity to produce sausage links, patties, and other products affordably. The industry’s public funding levels stand in contrast to the EV sector: the US bipartisan IIJA enacted in late 2021 included $7.5 billion to help subsidize the buildout of a national EV charging network.

Similarly, private capital for alternative proteins lags other sectors. According to the venture capital firm AgFunder, VC funding for the “innovative foods” category fell 51%, to $1.6 billion in 2023—bringing funding down to pre-COVID levels. (This gap is likely even larger when considering non-VC funding.)

The success of electric vehicles shows how fast public and private investment can catalyze green innovation. Forward-thinking governments and food companies now have the opportunity to replicate that success for alternative proteins. — Lewis Bollard, Lewis Bollard, Program Director for Open Philanthropy

Like EVs, alternative proteins require a lot of capital to research and produce at scale. Just as EV makers needed to invest heavily in tooling, software development, and emerging battery technologies to succeed, alternative protein companies require funding to continue researching new food technologies, including cell cultures and precision fermentation. They also need support to identify, develop, and build industrial-scale manufacturing processes and facilities for texturizing, extruding, and, in some cases, 3D printing proteins.

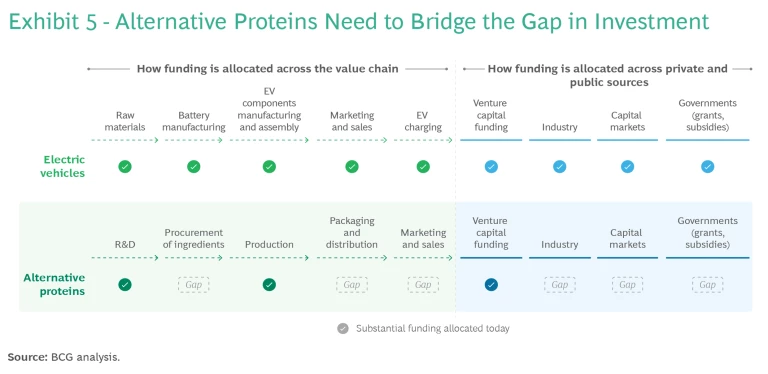

Public and private EV funding is allocated across the end-to-end value chain—from raw material mining to EV charging. By comparison, the funding landscape for alternative proteins is characterized by investment whitespace. (See Exhibit 5.) Still, as alternative protein companies seek to secure funding, they can apply lessons learned from the earlier experience of the EV industry.

Allocate Dollars Across the Value Chain

Building resilient supply chains requires companies to invest in the value chain from end to end. By supporting the full spectrum of activities—from early research and infrastructure support to ingredient sourcing and consumer sales—stakeholders can create efficiencies, avoid bottlenecks, and cut costs enough to ensure that alternative proteins are accessible to a wider audience.

Deliver Public and Private Funding to Jump-Start R&D

Securing both public and private funding is critical to conduct high-risk, early-stage research. Public funding such as grants and subsidies can help support foundational research and pilot projects. According to a 2023 article in MIT Technology Review, the $29 billion that the Chinese government poured into relevant credits and tax breaks from 2009 to 2022 enabled its nascent EV industry to become the global leader.

This type of government support attracts private investment to fund production, distribution, marketing, and other core business functions. A dual public-private funding approach could also help build market confidence in alternative protein companies. Initiatives could include government-backed research institutions collaborating with startups on R&D projects or public-private partnerships to fund infrastructure that supports alternative protein production and distribution.

The Road Ahead

Alternative proteins offer a sustainable and ethical substitute for industrial livestock farming, with fewer carbon emissions, less threat to biodiversity, and no contribution to antibiotic resistance and pandemic risk. With the increasing threat of climate change, it’s more crucial than ever to prioritize reducing the agricultural sector’s carbon footprint and lowering its environmental impact. And as climate change disrupts traditional agriculture and as growing global populations consume more meat, a robust alternative protein industry could increase countries’ food security.

While the alternative protein space, especially with regard to cultivated meats, has seen heavy criticism over the past few months, it is worth noting that the field has seen more technological advancements and cost reductions than most other disruptive technologies over the same duration of time. As such, though the initial projects from companies were over-zealous, the actual impact of the industry should not be sidelined. — Dr. Viknish Krishnan-Kutty, Founder and CEO of Cellivate Technologies

Governments, investors, incumbent food companies, and alternative protein companies should embrace and accelerate the transformation by taking these actions.

Governments

Build supportive public policy that leverages the four-step framework to act as a catalyst for alternative protein innovation. Policymakers can help companies fund R&D, secure raw materials, and build production processes and infrastructure; this will help the industry achieve the scale it needs to reach price parity with animal proteins. (See “Key Challenges for Alternative Proteins.”)

Key Challenges for Alternative Proteins

Producers will need to work through ongoing

These constraints may affect many alternative protein companies, though the impact for each depends on the underlying technologies, production efficiencies, and market penetration for different types of alternative proteins. For example, price is a primary challenge for cultivated meat production owing to cell media ingredient costs and the difficulties of scaling production, while meeting consumer expectations on taste and texture is a more critical concern for plant-based meat.

A combination of technology breakthroughs, state and federal funding to stimulate research, and the buildout of infrastructure has helped EVs achieve critical mass. A similar approach could help alternative proteins achieve their own economies of scale. For example, BCG identified three keys to using

Investors

Channel investment dollars across the value chain to increase adoption. Encourage companies to devote sufficient resources to innovation in R&D that narrows the gap with conventional proteins and positions products for sustained consumer uptake.

Incumbent Food Companies

Innovate early to gain a significant competitive edge by setting alternative protein industry standards—and resetting customer expectations for alternative proteins.

Alternative Protein Companies

Unveil products that appeal to core consumer needs with excellent taste, desirable texture, competitive prices, and utmost convenience. Out-innovate traditional proteins by providing additional health benefits and customizing alternative proteins to consumers’ dietary needs, allergies, and taste preferences.

Scaling up to offer products that are competitive with conventional proteins on taste, texture, price, and convenience is a sizable challenge for the alternative protein industry. But with continued investment, innovation, and collaboration across the alternative protein ecosystem, companies can lay the foundation for a more sustainable and secure food system.

This article was a collaboration between BCG, the Good Food Institute, and Synthesis Capital.

The Good Food Institute is a nonprofit think tank working to make the global food system better for the planet, people, and animals. Alongside scientists, businesses, and policymakers, GFI’s teams focus on making plant-based and cultivated meat delicious, affordable, and accessible. Powered by philanthropy, GFI is an international network of organizations advancing alternative proteins as an essential solution needed to meet the world’s climate, global health, food security, and biodiversity goals.

Synthesis Capital is an investment manager based in London (UK) and investing globally in transformative food technology innovations, with a focus on the alternative protein ecosystem. Synthesis is currently investing out of a $300M venture fund, the world’s largest dedicated to food technologies.