For the CEO

A message from our editor on this critical topic.

After a decade of economic stagnation and underwhelming returns, Europe looks poised for a new era of growth and innovation. The momentum that started with the Draghi report’s call to slash red tape, spur competitiveness, and create a more business-friendly environment has accelerated this year in response to shifts in US policy. Public investment is set to surge across the continent. Talent and capital that once flowed from the EU to America is looking at Europe with fresh eyes.

For Europe’s CEOs, this is a defining moment. Will they seize it—or squander it?

“Based on the conversations I’m having, CEOs are prepared to do their part to move Europe towards a more competitive future,” says Matthias Tauber, a BCG managing director and senior partner and leader of its operations in Europe, the Middle East, South America, and Africa. “It's not just finger-pointing at bureaucrats to do something, which is a good sign.”

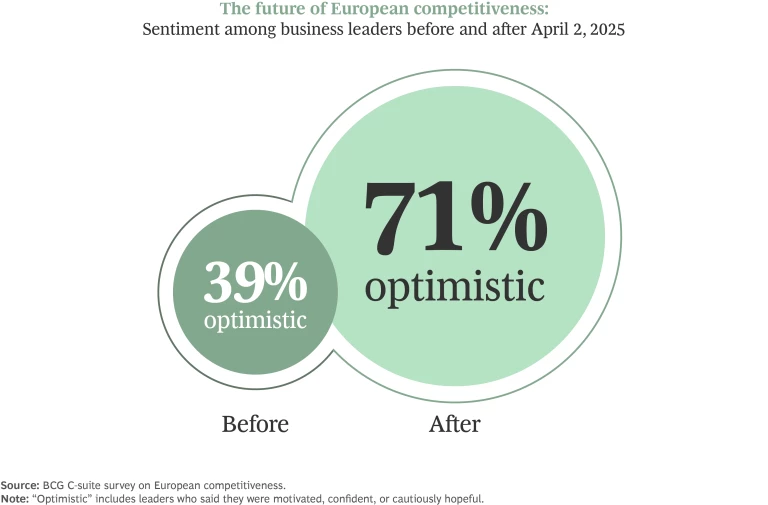

Across Europe, CEOs are galvanized for growth. And the evidence isn’t just anecdotal. More than 70% of C-Suite executives surveyed by BCG in the week after April 2, 2025—the day the Trump administration unveiled its sweeping new global tariff policy—say they are optimistic about the continent’s future competitiveness. By contrast, less than 40% felt that way in the week before April

But CEOs will need more than optimism to secure a prosperous future for their companies. Even if European policymakers enact envisioned reforms, structural challenges stemming from excessive bureaucracy and fragmented markets are likely to persist for years. To overcome these barriers, CEOs will need to make innovation a top priority.

“Innovators succeed,” says Justin Manly, a BCG managing director and senior partner who leads the firm’s growth and innovation work globally. “And [they succeed] with an order of magnitude more when a CEO is behind an innovation pursuit.”

Europe’s chief executives can make the most of this legacy-defining opportunity by spending more on R&D and developing capabilities that leverage disruption to gain a first-mover advantage. They can accelerate AI adoption to improve productivity, drive efficiencies, surmount structural barriers, and carve a competitive advantage. And they can lean into Europe’s strengths while working with policymakers to shape a more business-friendly landscape that honors European values while enabling growth and innovation to thrive.

Featured Insights: Explore the ideas shaping the future of business

Headwinds Old and New

European companies have been lagging in global competitiveness for nearly two decades. An analysis of BCG Global Innovation Survey data from 2005 to 2024 reveals that Europe has been home to only 17% of the world’s most innovative technology firms over the past twenty years. During that timeframe, only four European companies could be called serial innovators, having made our rankings ten times or more.

BCG’s latest Value Creators rankings show the consequences of Europe's less competitive innovation approach. Only three of the global top 100 companies measured by TSR are Europe-based. And only two of the global top 30 companies measured by TSR and vitality—a firm’s ability to turn positional strategic advantage into profitable growth—are European. The US, by comparison, has 17 firms on list, while 11 are from the Asia-Pacific, including six from India alone.

Copious red tape is one reason for Europe’s relatively lackluster rankings. Germany’s Ifo Institute found last year that excessive bureaucracy costs the EU’s biggest economy €146 billion a year in lost output. Perhaps not surprisingly, the labor productivity gap between Europe and the US has widened in recent years, according to the European Central Bank.

The regulatory burden that both big companies, but also startups, need to comply with hampers their ability to compete. — Cristián Rodríguez-Chiffelle, BCG Partner & Director

“The regulatory burden that both big companies, but also startups, need to comply with hampers their ability to compete,” says Cristián Rodríguez-Chiffelle, a BCG partner and director who focuses on trade, foreign investment, and geopolitics.

EU regulations can also vary widely between member states. Manly cites the example of how rules concerning the labeling of products across the region can erect barriers to growth.

“If you're a consumer products company [in the US], you’re dealing with one label when you put products on shelves, which drives quite a bit of scale to your innovation endeavors,” he notes. “The fragmentation of different requirements across the EU can make labeling overwhelming and substantially reduce the desire by companies to take on any sort of change initiative.”

The very nature of the EU, comprising 27 sovereign countries with a diverse set of cultures, languages, and consumer preferences, can also lead companies to think locally rather than regionally and globally.

“If you create a company in Italy, you start thinking, ‘Okay, I’m happy if I can make a company for the Italian market. I mean, it’s 60 million people’,” says Roberto Verganti, a professor at the House of Innovation of the Stockholm School of Economics and an ambassador of the European Innovation Council. “But then if you get there, the next step is so difficult, because you’re so shaped around a local market that you need to redesign to the details of other local languages.”

These issues are reflected in Europe’s relatively poor track record in scaling world-class firms and a preference for incremental as opposed to disruptive innovation. Europe has long boasted plenty of research—yet as the Draghi report noted, over the last 50 years no European company with a market capitalization over €100 billion has launched from scratch. By comparison, six US companies with a valuation above €1 trillion have been launched and scaled in the same timeframe.

“Companies seek to disproportionately innovate where the growth is,” says Manly, “and the growth has disproportionately been in places—depending on sector—outside of Europe.”

The failure to grow tech giants means Europe misses out on their multiplier effect.

The failure to grow tech giants means Europe misses out on their multiplier effect. Tech powerhouses spawn high-tech hubs, where a higher risk tolerance ensures that disruptive innovation continues to flourish and new platforms take shape.

“With a few exceptions—for example in Sweden, which has a strong capacity to create new digital startups—we [Europe] are weak in the digital space,” says Verganti. “So we are missing big digital platforms that drive growth.”

Against this backdrop of deeply entrenched challenges, European CEOs are now grappling with almost-daily shifts in US policy, particularly around trade, making it harder to invest with conviction in long-term growth and innovation strategies.

“People essentially are very cautious with investments on the R&D side and elsewhere, simply because they don't know where things are going from a regulatory perspective,” says Tauber.

Tailwinds New and Longstanding

While changes to US policy—both domestic and foreign—are creating some headwinds for Europe, they are also generating tailwinds.

“Because of geopolitical pressures—forcing new industrial policies and capital allocation—Europe could be entering a period of renewed strength, from investments to innovation,” says Rodríguez-Chiffelle. “CEOs should move quickly to turn today’s potential advantages into tomorrow’s competitiveness.”

Public funding for defense and infrastructure is poised to climb sharply, with Germany passing an historic bill exempting defense spending from its strict debt brake.

“Defense spending is often a proving ground for innovations that often translate to the private sector,” Manly notes.

Policymakers have made clear they want Europe to be a leader in future-proof industries, including AI, quantum computing, genomics, and biotech.

Policymakers have also made clear they want Europe to be a leader in future-proof industries, including AI, quantum computing, genomics, and biotech.

Meanwhile, changing US policies toward universities may result in more talent moving to Europe. In May, European Commission President Ursula von der Leyen launched a €500 million package to “make Europe a magnet for researchers” in key high-tech sectors.

“The classic path in Europe for creating new companies is you start in Europe, get maybe a little bit of first round of financing, and then you need to move to California,” says Verganti. “Now, there is a chance for Europe to retain talent that would have gone to the US in the past.”

Though its light has dimmed somewhat in recent years, German engineering remains world class. The continent also has plenty of financial talent to draw upon in London, which continues to be an important center for raising capital in Europe.

“There’s been a skill set that’s been built over many years, and a set of approaches and disciplines that still and will always matter,” says Manly. “Building on those sources of advantage to innovate, which they [European leaders] are doing now, will continue to matter.”

Manly also points to Europe’s long game on regulation as a source of competitive strength. While the EU’s tough standards for food safety, environmental protection, responsible AI, and antitrust matters may seem onerous in the short term, they can be hugely advantageous down the road.

Innovating for green is not just innovating for green. It’s also profitable. — Justin Manly, BCG Managing Director and Senior Partner

“There are many cases where environmental investments, for example, and profitability and consumer demand for those offerings are moving in the same direction,” says Manly, “meaning innovating for green is not just innovating for green. It’s also profitable.”

Europe’s business culture, which emphasizes collaboration and respect for workers’ rights, can be harnessed to scale and accelerate AI adoption and unlock genuine value even sooner.

Finally, Europe also has many existing trade agreements to leverage.

“Europe’s firms can also harness benefits from its open trade environment beyond the US, taking advantage of the multiple free trade agreements and economic partnerships that holds globally, such as the new EU-Mercosur FTA,” says Rodríguez-Chiffelle.

Five Moves to Jump-Start European Innovation and Growth

CEOs across Europe can leverage the current momentum with five key actions to jump-start growth and innovation and lay the foundations for continued strength.

Invest more in R&D and make it matter. Innovation intensity is a measure of a company’s vitality—a key indicator of its ability to deliver future growth. Relatively speaking, Europe’s innovation vitality is not as robust as it could be, even when accounting for structural barriers.

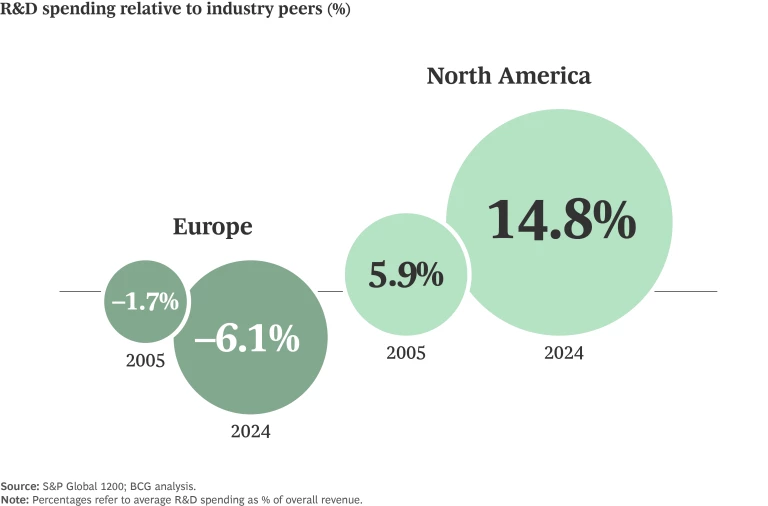

Between 2005 and 2024, North American firms increased R&D investment as a percentage of sales by nearly 9% relative to their industry peers, while European companies scaled back by more than 4%, BCG research finds. When companies headquartered on the continent did crack BCG’s 50 most innovative companies list, 82% of them did not rank in the top 20, while 36% were one-hit wonders.

“More investment is needed—right now,” says Tauber. “And it must go towards future-proof sectors: AI, health care, energy. That’s where investment can make a huge difference.”

When it comes to innovation, Europe’s CEOs need to invest with conviction. R&D anchored to a clear goal—improving efficiencies and customer experiences, developing new products that create competitive advantage—is more likely to drive value. Corporate chiefs also need to move boldly. CEOs who wait and see what their competitors are doing with AI and other disruptive tech risk falling permanently behind.

“If you decide to wait it out and follow others, you will be less prepared to embrace the next wave of global innovation technologically,” says Manly.

Use scenario planning to gain a first-mover advantage. Scenario planning is how CEOs turn disruption into strategic advantage. Especially when powered by AI, scenario planning capabilities such as a tariff command center can become a CEO superpower, enabling them to identify opportunities before their competitors, hedge risk, and allocate capital with greater confidence.

“In two or three years’ time, the people who did make the bold moves on things like big R&D investment bets or M&A are likely to look stronger,” says Tauber.

European CEOs can start by mapping near-term and emerging headwinds and tailwinds to develop a set of broad but plausible scenarios for how the business landscape could evolve. They can then develop a set of signposts to monitor to alert them when change is afoot and proactively plan how to alter course quickly to mitigate risks and unlock new opportunities.

Scenario planning can also inform and stress-test their strategic and annual plans. For example, it can help them determine whether they are over-indexed on legacy bets, what kind of acquisitions, partnerships or business lines can help them win in different scenarios, and how they can move faster than their peers if a new scenario unfolds.

Scale GenAI and embrace AI agents now. It’s obvious to most CEOs that the rapidly evolving AI revolution, from GenAI to AI agents, needs to be central to innovation and growth strategies. But for European CEOs especially, it’s imperative to scale GenAI pilots now and start incorporating AI agents.

“Europe’s CEOs need to push to ensure rapid AI adoption because it will be a key for boosting productivity,” says Tauber.

It can also help CEOs better navigate changing regulatory regimes and overcome headwinds that are likely to persist, such as fragmentation.

“Emerging technologies such as AI can be used to combat the structural challenges of scale and coordination complexity across a very diverse network of countries in Europe,” says Manly.

To make the most informed decisions about where to place AI bets and how to unlock real value from them, Europe’s CEOs should also get hands-on with AI and use it every day.

Lean into Europe’s strengths. Though Europe has considerable structural issues to address, it also has a deep well of strengths that can serve as a powerful launchpad for future, sustainable growth.

For example, Europe has a reputation for producing high quality products and is a global first mover on responsible AI governance and digital trust frameworks. That sets the conditions for CEOs in Europe to build AI and digital solutions that meet global trust standards from day one.

“Europe should start by relying on its strengths, both cultural and commercial,” says Rodríguez-Chiffelle. “Its values and talent, but also precision manufacturing culture, are all strategic assets. CEOs can use them to build innovation that is both trusted and scalable.”

To power innovation, Europe can draw on its current pool of STEM talent fed by world-class universities, while its quality-of-life proposition and vocal commitment to boost research spending can attract STEM talent from other parts of the globe.

Many corporate structures in Europe also give workers a voice, which could prove advantageous for scaling AI successfully. Because AI fundamentally transforms how people work.

“The deployment of AI calls for a new seat for [knowledge worker] labor at the table,” says Tauber. “If done well, organizations could achieve a higher degree of adoption.”

Finally, the EU is also built on collaboration. Some 89% of business leaders surveyed by BCG see value in a CEO working group to catalyze cross-sector momentum and scale.

Engage with policymakers. CEOs cannot wait for policymakers to catch up with their innovation and growth ambitions. But they can help them shape a more competitive future for Europe to unlock billions in untapped growth.

“When education, government, venture capital, and corporations and entrepreneurs come together, that creates a spark,” says Manly. ”CEOs should collaborate with the public sector to ensure that (a) the right investments are happening and being driven by policymakers and (b) that the right corridors or networks of communities are being invested in to support them.”

Some CEOs are already taking the initiative. The heads of around 200 European tech firms signed an open letter in March 2025 urging policymakers to “become more technologically independent,” an acknowledgement that many of the assumptions they have been operating under no longer apply.

Verganti says most rulemaking in the EU happens in isolation from industry. “And so the rules often don’t make business sense,” he says. “If we engage in cooperation and dialog with the government, in defining rules that are impactful, we achieve what leaders claim they want to do. A more meaningful society.”

Momentum is an asset not to be taken for granted—and right now it’s moving in Europe’s favor. But that won’t always be the case. CEOs can make the most of this moment by initiating actions now to write a new chapter on growth and innovation. Those that do will not only revive European competitiveness. They will also redefine it for the next generation.