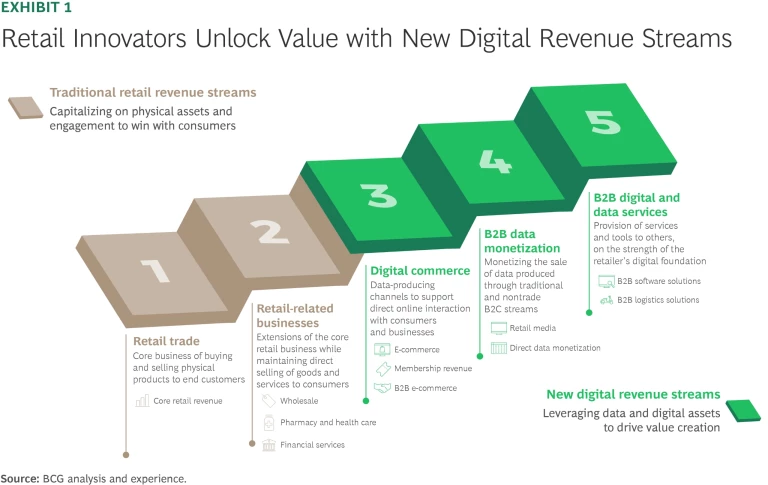

Leading traditional retailers have been reinventing themselves as data-driven business platforms by integrating online marketplaces, retail media, data monetization, and B2B digital services. (See Exhibit 1.) Investments in these new platforms and their associated revenue streams not only enhance the consumer experience, but have also become a material driver of sustainable growth, competitive advantage, and strong financial performance.

The gap between leaders and laggards is already substantial. Reviewing the TSR of retailers between 2019 and 2024, BCG found that:

- The top quartile of global retailers by revenue materially outperformed total five-year TSR of total retail—16% for top quartile versus 9% for overall retail industry.

- Approximately one third of this outperformance came from new revenue streams.

The imperative to invest in revenue streams is clear. Retailers that underinvest in these areas or take a siloed approach risk shortchanging consumers and investors and falling further behind.

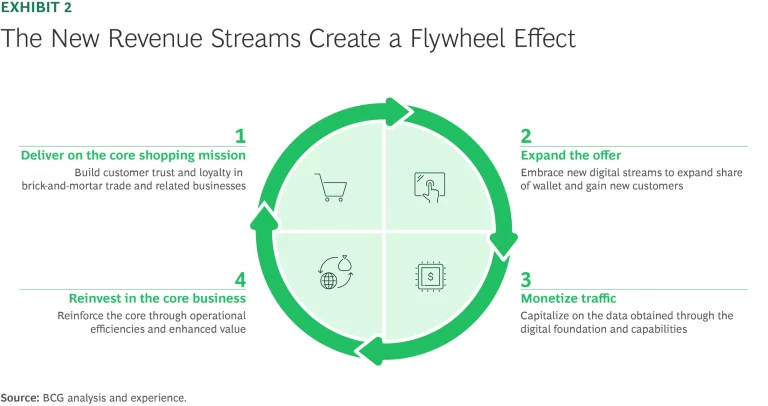

The Flywheel That Powers the Transformation

The combination of new revenue streams—if done right—creates a powerful new business flywheel in which each element reinforces the others. (See Exhibit 2.) This virtuous cycle enables further growth in the core retail business, increased profitability, and lasting competitive advantage. By building out new revenue streams, traditional retailers are positioning themselves not only to compete with digital natives like Amazon and Alibaba, but to generate sustained value creation that reinforces the core.

Deliver on the core shopping mission. At the highest level, retail leaders excel by fulfilling the fundamental needs of consumers and providing reliable, convenient, and value-oriented shopping experiences. This builds consumer trust and loyalty and establishes the critical data and relationship foundations that enable growth from new revenue streams. New revenue ultimately derives value from the retailer’s direct ownership of the consumer relationship, which they must defend aggressively.

Expand the offer. E-commerce and third-party marketplaces, combined with loyalty programs, enable innovative retailers to expand their share of wallet by attracting new customers and drawing more traffic and frequency to their digital platforms. By broadening their assortment into logical adjacencies beyond traditional retail boundaries, retailers can serve more diverse shopping missions, generate high-value data, and deepen consumer relationships. Implementing an effective loyalty program is critical to ensure data capture to power the new revenue flywheel.

Stay ahead with BCG insights on the consumer products industry

Monetize traffic. By collecting and analyzing data on consumer behavior, preferences, and purchasing patterns, retailers can translate traffic into advertisement inventory that they can monetize through ads for the mass market as well as for targeted, high-intent audiences. In addition to these retail media programs, leading retailers are also monetizing customer data directly by developing insights dashboards, benchmarking tools, and anonymized audience segments for their partners. Revenue from these high-margin, scalable monetization channels significantly enhances the overall profitability of the business.

Reinvest in the core business. Leading retailers are channeling profits from new revenue streams back into the core business through pricing, store experiences, and operational efficiencies. These retailers are also gaining leverage in supplier negotiations, which supports cost reductions. Investments in digital and omnichannel capabilities further accelerate growth, creating a cycle of continuous improvement and sustained customer value. (See “Walmart’s Transformation.”)

Walmart’s Transformation

The Key to Getting Started . . . Is to Start

Retailers that are confident in their core customer experience must overcome inertia, set the flywheel in motion, and assign a C-level executive to lead new revenue initiatives as a high priority.

Jumpstart the flywheel. Setting the flywheel in motion can start with a first-party e-commerce offering, a third-party marketplace, or a loyalty app, but there is no prescriptive starting point. Regardless of a retailer’s size or ambition, success depends on fostering a culture of experimentation and rapid iteration, where minimum viable products are tested with real customers.

We recommend that larger retailers start broadly, place several smaller bets, and double down on early winners that look likely to pay off as the capabilities mature. They should also invest in a range of initiatives instead of expecting the flywheel to be predominantly self-funding.

Retail media is an attractive starting point for mid-sized retailers, who can use turnkey solutions to get the tools they need and should seek out partners to offset their relative lack of scale.

Smaller retailers or ones with a predominant focus on brick-and-mortar retail can set their flywheel by accelerating their online operations to keep pace with consumers. In addition, they can sell online, in-store, or loyalty program data to a larger network and then reinvest profits in their core.

Increase the flywheel’s momentum. To increase the flywheel’s momentum, retailers must invest in a centralized data pool and strong foundational tech stack that they can optimize and scale as their digital strategy evolves. They will also need to recruit and retain top-tier technical talent with the appropriate skills and knowledge to run and expand the new revenue streams. Ensuring that digital leadership roles are represented at the executive level is crucial, as is supporting these leaders with skilled technology teams. The retailers should also promote leaders who understand how to apply data and insights for informed decision making and innovation.

Developing in-house capabilities for all aspects of the value flywheel may be challenging, especially for small and medium-sized retailers. That is why we recommend that retailers embrace partnerships, strategic alliances, and external support to bridge capability gaps. Collaborating with third-party providers and technology partners allows retailers to access the tools and expertise they need to compete without the heavy capital investments required to build these capabilities from scratch.

Retailers no longer have reasons to delay investing in high-margin new revenue streams. The potential for further value creation remains significant, but the path forward will require bold action, strategic investments, and a commitment to continuous innovation.