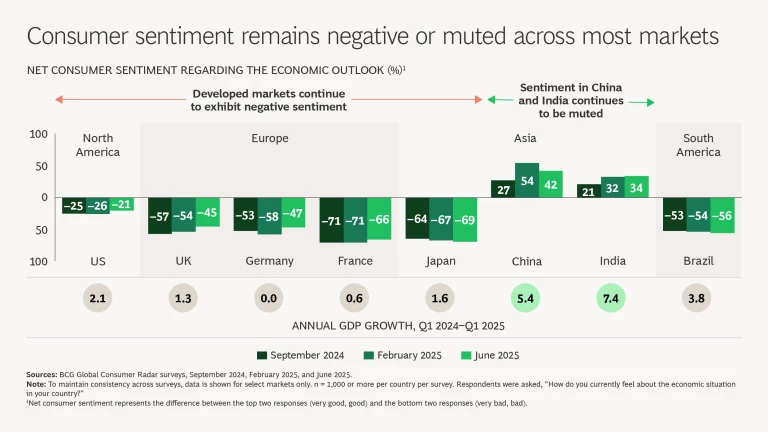

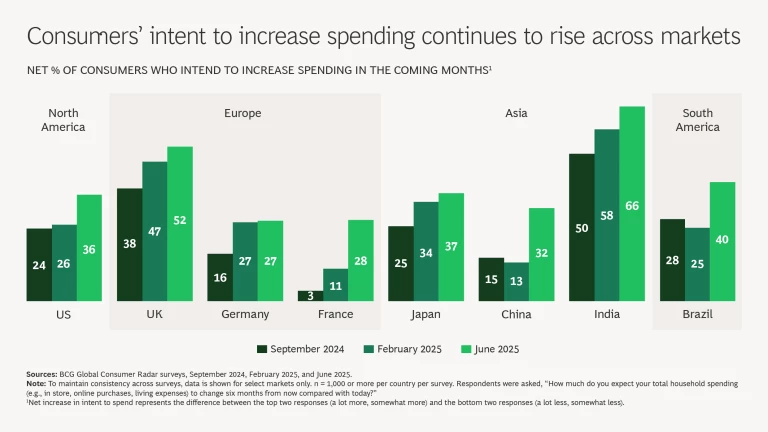

Ask consumers about the general economic outlook in their country, and their response is muted—at best. Ask them if they will continue to increase their spending, and their response is loud and clear: in each country we cover, the intent to increase spending has held steady or increased. (We did ask; see “About Our Research” for more information.)

BCG’s Global Consumer Radar surveys, as well as the company’s Center for Macroeconomics, have explored this apparent dichotomy—persistent economic pessimism alongside strong and consistent spending intent. Both teams have concluded that consumer sentiment can’t be used to gauge macroeconomic trends. Consumers typically don’t predict broad economic trends realistically; consequently, their predicted responses to those trends are not realistic.

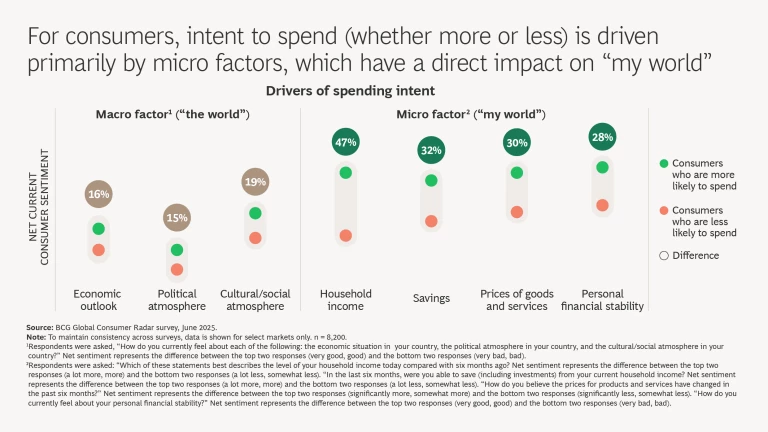

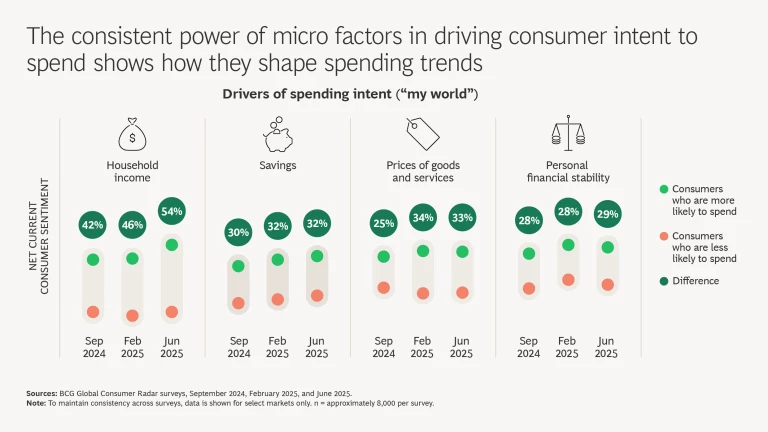

At the same time, consumers have a well-calibrated and consistent sense of their own personal financial comfort, and they adjust their spending patterns accordingly. So, while we can’t use their feelings about macroeconomics to predict changes in the economy at large, we can understand and monitor their feelings about microeconomics and spending patterns. These insights have significant value for brands.

The Drivers of Consumer Spending

Consumer spending is influenced by a complex mix of factors, each contributing uniquely to decisions about spending.

Macro Versus Micro. For consumers, macroeconomic trends tend to be somewhat distant. The closer-to-home, microeconomic factors and other motivational factors really influence spending.

- The World: Macro Sentiment and the Nature of Spending. While overall economic sentiment does not directly correlate with consumer spending, it does seem to shape the type of spending. In markets including India and China, where economic sentiment is the most optimistic among the countries we cover here, 68% and 67% of consumers, respectively, plan to engage in deliberate spending—stocking up, gift purchases, and so on. In markets with weaker sentiment, spending is more restrained and increases are likely driven by necessity, reflecting rising prices. The intent to spend deliberately ranges from 30% to 47% in the other countries covered.

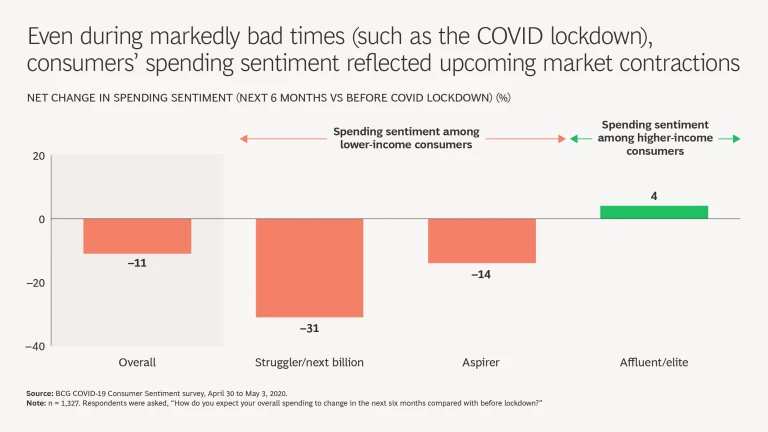

- My World: Personal Financial Sentiment and the Extent of Spending. Personal economic conditions—such as income levels and savings—are more tangible and have a stronger correlation with how much consumers spend. Low-income cohorts remain more cautious relative to consumers in higher-income cohorts. This behavior—consumer spending sentiment that is strongly associated with consumers’ personal situations—has been consistent over time.

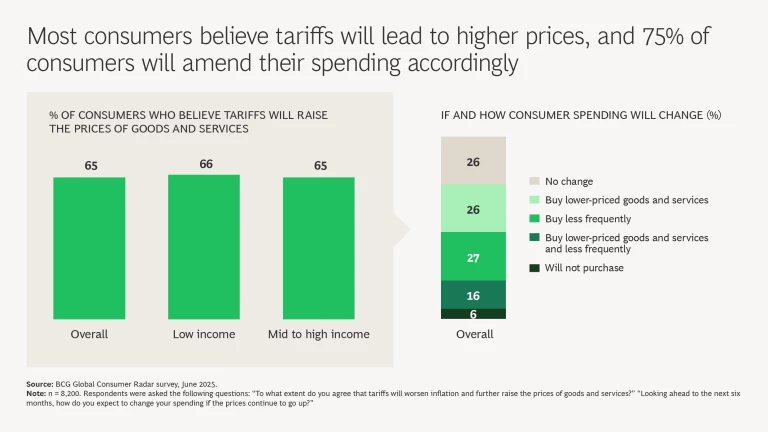

Even Times Versus Event Times. Specific events can cause notable adjustments in spending patterns, especially events with direct financial impact, like anticipated price hikes from tariffs. Previous reports showed early signs of this shift, and the trend continues: 75% of consumers say they plan to rationalize their spending in response to rising prices.

Even during the worst times for consumers (for example, the COVID lockdown), data shows that consumer sentiment reflects upcoming market contraction. (See the exhibit below for an example of how this played out and how sentiment differed markedly by income cohort.)

This consistent trend in reactions to market forces with personal impact reinforces the need for a disaggregated view of consumer sentiment.

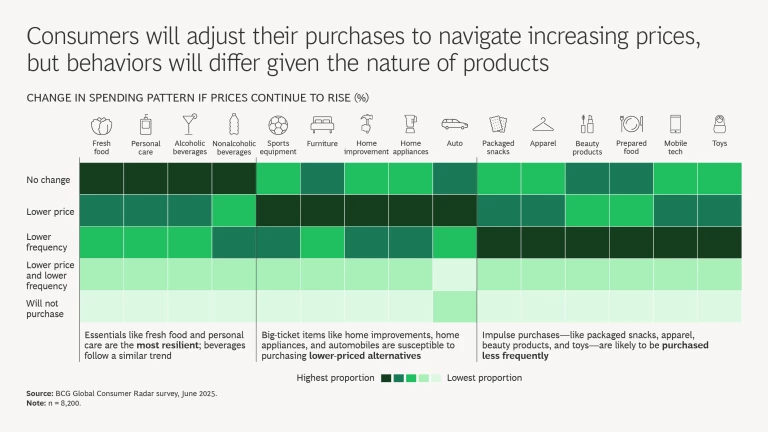

Category Versus Category. Spending adjustments are not evenly distributed across categories. Essentials such as fresh food and personal care tend to remain resilient. When it comes to discretionary categories, like home improvements and home appliances, consumers will continue to spend but might trade down to lower-priced brands. Impulse purchases may occur less frequently. This behavior is not merely reactive—it is deliberate and strategic: consumers will prioritize, making intentional decisions about where to maintain spending and where to adjust it.

Additionally, we consistently see that context drives needs and purchases.

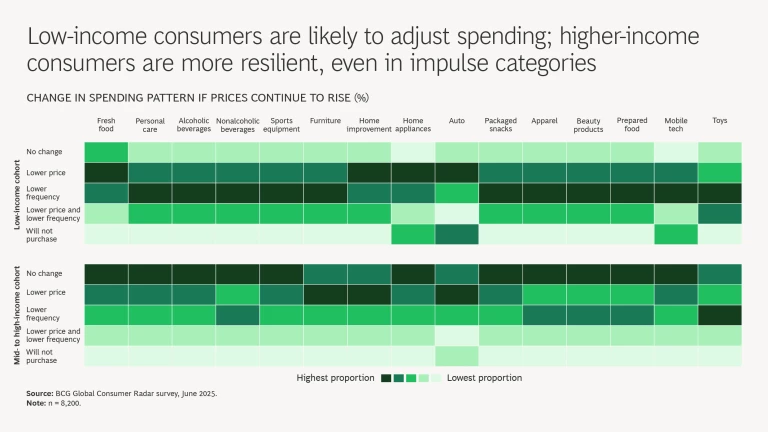

Income Cohort Versus Income Cohort. A rationalization mindset will continue to be more prominent among lower-income cohorts across various categories. In contrast, higher-income cohorts are expected to make spending choices that vary by category; they are likely to continue spending, including spending on impulse-driven purchases.

How Brands Can Shape Strategies Around a Disaggregated View

Remember the dichotomies. Understand the underlying drivers and root causes of spending shifts across markets, categories, and cohorts to shape targeted propositions, drive activation, and unlock growth opportunities.

Consider category dynamics. Align portfolio strategy with changing economic conditions and consumer behavior to identify parts of the portfolio that are at increased or reduced risk.

Know your customers. Adapt strategies—swiftly—to reflect changing consumer sentiment. For example, consider new pricing models and flexibility as price sensitivity and category dynamics evolve.

While aggregated consumer sentiment can indicate the general direction of “my world” for consumers, meaningful insight is gleaned by taking a closer look at the micro level: by market, category, cohort, and purchase occasion. Understanding future demand—and the reasons behind it—requires a granular view. Brands must dig deeper than surface-level sentiment to uncover the real tradeoffs shaping consumer behavior.

The authors thank Aparna Bharadwaj, Kanika Sanghi, Tejsvi Tannan, Ishita Joshi, Yizhou Chen, and Sofia Aguilar, as well as Tomas Andor and Oliver Toman from NativeResearch, for their contributions.

About Our Research

- Brazil

- China

- Egypt

- Ethiopia

- France

- Germany

- India

- Indonesia

- Japan

- Kenya

- Malaysia

- Mexico

- Morocco

- Nigeria

- Philippines

- Saudi Arabia

- Singapore

- South Africa

- Switzerland

- Thailand

- United Arab Emirates

- UK

- US

- Vietnam

To facilitate longitudinal comparisons with our prior surveys in September 2024 and February 2025, we have focused our coverage in this publication to the following eight markets, comprising 8,200 respondents: Brazil, China, France, Germany, India, Japan, the UK, and the US.

These countries represent approximately 46% of the total global population. The survey was representative of global consumers, with a demographic balance across age, income, gender, regional, and ethnicity groups (where relevant). In this edition, we covered 15 categories that are of broad commercial interest:

- Apparel

- Alcoholic beverages

- Auto

- Beauty products

- Fresh food

- Furniture

- Home appliances

- Home improvement

- Mobile tech

- Nonalcoholic beverages

- Packaged snacks

- Personal care

- Prepared food

- Sports equipment

- Toys