Successful insurers are turning the current macroeconomic headwinds—which include demographic shifts, changes in customer needs and preferences, and ongoing trends such as inflation and recession—into opportunities to rethink how they attract, nurture, and serve their customers.

They are gaining multiple competitive advantages by augmenting their long-standing distribution models through digitally enabled distribution. This combination of traditional and digital tools and approaches can deepen customer engagement and enhance their access to a broader set of personalized products and services. Straight-through processing and digitally enabled distribution also make the submission and quote process more efficient—while making it easier for the company to do business across product lines, such as property and casualty (P&C), health, and life.

The competitive advantages from digitally enabled distribution have often increased revenue, boosted agent productivity, and lowered customer acquisition costs. Yet implementing this approach requires much more than merely upgrading IT capabilities to meet customers’ diverse needs and support their preferred forms of interaction. Success hinges on the insurer’s willingness and ability to rethink established processes and ways of working from a customer-centric, rather than product-centric, perspective. This obsession with understanding and satisfying customers—end consumers as well as agents and brokers—is the common theme we have observed in our work with insurers who have successfully pursued this new approach.

Customer-Centric Sources of Competitive Advantage

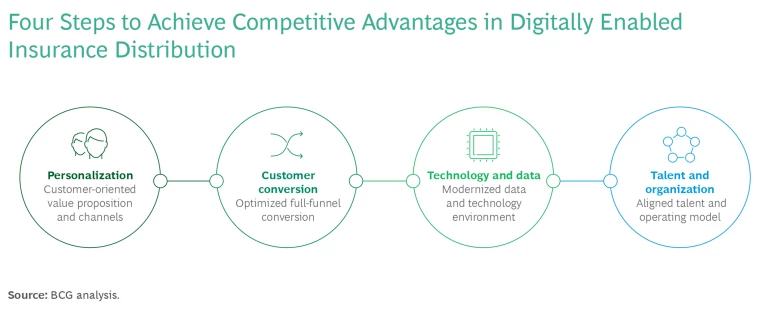

Customer obsession in insurance distribution entails more than understanding the needs of each customer. It also requires a concerted effort to continually remove friction and add flexibility in relationships with customers as well as agents and brokers—from direct interactions to back-office workflows. We have identified four sources of competitive advantage for insurers that apply the commitment to customer centricity to digitally enabled distribution:

Providing tools and support for agents to meet customers where they are in terms of interaction style, channel, and approach.

Many customers want an omnichannel approach, because they have a variety of needs that no single channel necessarily serves optimally. They need to flow seamlessly from one channel to another as they move along the purchase journey. Within the same journey, a customer may shop for coverage online, compare competitors’ rates, and use automated processes for simplicity and convenience. Later, they may still want human touch support, which, for example, can provide confidence that they have not made a mistake or overlooked something. Customers who do their own research often seek validation and assurance that they have made the right final purchase decision with the right coverage.

Enabling agents to customize products and services to customer needs.

Rather than trying to force-fit a customer’s needs to a fixed set of products and services, the insurer aligns solutions flexibly to match the individual’s needs. Customers now expect this level of personalization because they’ve grown accustomed to online retail and financial services companies that have successfully used AI to create modular services—and they are showing greater willingness to share data in exchange for more personalized experiences.

Driving meaningful customer engagement through tailored recommendations.

As customers provide and share more data and information, insurers can offer them more personalized recommendations for related services beyond coverage. This extends to centralized supplementary platforms to manage health, wellness, or financial security. For example, as demand for health and well-being products rises in Asia, several players such as Ping-An and AIA have created health ecosystems that connect new and existing health insurance customers to a curated set of partners. This facilitates access to health information and services such as 24/7 online consultation, chronic disease management, or maternal care.

Enabling faster speed to market.

The ongoing interactions and deeper customer relationships can expose new customer needs. Insurers can enhance the customer experience further by broadening their offerings with new products to meet these needs. The efficiency gains from reducing friction and increasing flexibility can decrease the time needed to launch these new products. A lead generation engine, for example, can help an insurer identify and evaluate customer preferences, the relevant events that trigger purchases, and the potential opportunities for retention, upselling, and cross-selling. Having this detailed customer information could potentially shorten launch cycles.

To quickly establish and benefit from these competitive advantages, insurers need to develop a deep understanding of their target customers and integrate this knowledge into their strategic roadmap—working “from the customer back” to access, sell to, and serve them effectively, efficiently, and profitably. They build relationships with customers and enhance their experience by adding new products, digital features, and tools.

A Framework for Customer-Focused, Digitally Enabled Distribution

We’ve developed a step-by-step framework that will help insurers use digital interactions to serve changing customer needs, meet customers where they are, and grow existing and emerging segments. It will also help insurers weave digital enablement into all aspects of their business, rather than treat it as a side business managed separately. From the outset, an insurer must establish a set of clear objectives on the role of digital enablement in the context of its overall business ambition.

The framework focuses on deeper customer obsession and optimized customer conversion as well as the longer-term enablers of technology, data and analytics, and talent/organization. (See exhibit.)

Personalization

Insurers must develop an integrated and seamless end-to-end digital experience for customers. This ranges from information on product features and modules on the company website, to 100% dynamic digital applications, to customer onboarding and demand-based digital services. Ultimately, what customers find must meet their needs. This requires micro-segmented risk profiling and customized pricing, as well as more tailored protection specific to unique customer circumstances. When an insurer creates segment-specific value propositions that enhance the importance of quality digital experiences and emphasize the combination of tech and human touch, customers can willingly find their way to and through this experience.

Automating some functions and increasing back-office efficiency also elevates the role of insurance sales professionals, who can focus on improving the quality of human support within the seamless experience. Even with the best self-service digital tools, customers will still seek advice on products to manage their unique risks. This is especially true for individuals who acquire several assets, purchase complex long-term life products, or seek coverage for unique risks in commercial P&C. Human support may also be necessary to help customers understand key differences in policy options. For example, for life products, illustrations usually include several pages due to regulatory requirements. Lengthy P&C policy documents full of legal terms make it hard for the average customer to understand the details of coverage they are getting or judge whether they are receiving the right amount of appropriate coverage.

To better serve customers and more effectively draw meaningful insights from ample available data, insurers are looking to increase investment in data analytics and rapidly explore generative AI (GenAI) capabilities. While insurers have deployed traditional data analytics and predictive AI models for years, GenAI enables them to draw real-time insights both from structured data, such as telematics and elasticity, and unstructured data, such as notes and phone calls. For example, trained GenAI models can provide meaningful and personalized advice about a specific situation to a customer via chatbot in real time.

Customer Conversion

Recently, a large pan-Asian insurer established a new partner distribution model to increase customer conversions. It optimized the entire client journey by applying marketing technology and advanced analytics on its partner data set. The use of tools such as in-app triggers and messages, combined with a better user experience, led to cycle times on campaigns that were two to four times faster and doubled the quotes’ start-to-submission. As a result, new policies grew by 109% and policy quotes by 56%, leading to a margin increase of 15%.

Success stories like this have several components, starting with demand generation. To maximize return on marketing spend, insurers must define where they want to play, and then use a continual test-and-learn approach to quickly identify the digital marketing channels and the needs-based value propositions that will attract digital-first buyers. Chief Marketing Officers need to maintain an investor mindset, which means they treat marketing as a disciplined investment—with an expected return—rather than as an expenditure. The deeper the insurer’s understanding of these prospects, the better it can use combinations of social media, search, and affiliate marketing to target specific audiences and build a productive pipeline.

GenAI can rapidly generate personalized marketing content as well as automated nurture campaigns. Eye-catching content drives the clicks and visits, but the insurer then needs to convert this traffic into leads. By using analytics to qualify leads, insurers can enable agents or systems to work on the best lead at any given time, not simply the next lead in the queue.

Insurers must enhance lead-to-sale conversion by ensuring seamless hand-offs from initial engagement to application and then to enrollment and onboarding.

Insurers must enhance lead-to-sale conversion by ensuring seamless hand-offs from initial engagement to application and then to enrollment and onboarding. This journey must be tailored because customers expect personalization, simplicity, and speed. Additionally, insurers need to streamline their rate/quote/bind processes to reduce friction in the purchase process and improve the underwriting timeline. They can achieve this in several ways, such as limiting required data inputs to those that will impact pricing, using third-party data sources to pre-populate data, and reducing manual work and paper.

Technology and Data

One of the UK’s leading insurance, wealth, and retirement businesses reduced asset outflow by a third when it deployed a personalized engagement engine to prevent churn and convert customers to financial advice. Because they had the ability to better engage customers via multiple outreach channels and direct them to relevant products through targeted engagement, their success rate in signing customers for financial advice increased by a factor of three compared to earlier campaigns.

This improvement would not have occurred if the insurer had simply added a “direct” channel to an existing data and technology footprint. Creating a truly modernized technology environment often requires a significant overhaul that addresses several areas. For sales and marketing, this starts with a technology stack that can support tools like CRM, email, and SMS that grow and nurture the customer base. These tools are evolving rapidly as companies find innovative ways to incorporate capabilities such as AI and recommendation engines. These systems also need a feedback loop integrated across channels as well as robust funnel reporting to support optimal responsiveness to customer signals.

Investing as an organization in data analytics and GenAI helps accelerate both content development and customer insight generation. These advanced analytics capabilities work most effectively when embedded alongside agile teams and product owners, which also reinforces a mindset of customer obsession.

Finally, all these systems must communicate with each other. The new lead generation engine would pre-populate application forms, which would automatically feed into illustrations and eventually to policy administration systems. This improves the timeline from quote to binding, which produces a better customer experience and potentially higher conversion.

Talent and Organization

Success in digital distribution hinges on the right people, processes, and governance. The organization and operating model could take one of many forms—from a virtual agency integrated into the distribution business to a full-stack carrier designed to be a digital disruptor against other legacy businesses. In any case, the insurer must tightly link the business, product, design, sales, and marketing functions to enable the rapid translation of customer-centric learnings into coordinated actions across all aspects of the business.

One international insurer has implemented AI-driven agent recruiting to identify profiles of high-potential agents. The company has collected extensive profile data of over 20,000 candidates and new hires. Predictive modeling and AI algorithms determine factors that best forecast success at hiring; they also highlight signals of failure/success once an agent is in the role. So far, the system has 80% accuracy in predicting a new hire’s 12-month success and 78% accuracy in predicting 24-month success based on six-month performance. The system also uses a multi-layer algorithmic model to generate personalized training plans with target dates, timing, and methodologies aligned with the agent’s availability and preferences. The insurer has experienced 15% to 20% gains in productivity per agent in the first two years after adapting the AI-driven recruiting agent.

In addition to the four components of this framework, successful organizations should have other elements in place as well, including:

- Agile ways of working that enable efficient, collaborative decision-making processes across multiple functions and support a test-and-learn approach to innovation.

- Clarified decision authority through objectives and key results (OKRs). This helps teams better prioritize and link actions to business results.

- Updated compensation models to ensure alignment of incentives to meet their digital ambitions.

- Partner ecosystems to expand their ability to access additional customers and deliver on more customer needs.

Starting the Journey

Integrating digital distribution is a lucrative, long-term opportunity for insurers—although success depends on their conviction to think and act differently. Customer obsession is the central pillar, and this governs all aspects of digital distribution, with tighter collaboration across functions needed more than ever before.

Insurers implementing this approach effectively are creating competitive advantage by providing tailored solutions to customers and by enabling agents and brokers with personalized products and services in real time. With ongoing advances in technology, particularly the way GenAI is changing how companies engage with customers, insurers will need to act urgently to serve evolving customer needs and gain competitive advantages.